Impact of Rising Rates on Stock Market Rally

By Daniel M.

May 21, 2024 • Fact checked by Dumb Little Man

Yesterday, the S&P 500 closed flat as it awaited Nvidia’s (NASDAQ:NVDA) earnings, set for release on Wednesday afternoon. The calm market conditions reflect low implied volatility levels, suggesting that investors are not expecting major surprises from Nvidia.

In contrast to Nvidia’s stability, JPMorgan (NYSE:JPM) experienced a sharp 4% decline following Jamie Dimon’s hint at an earlier retirement. Despite this drop, JPM shares have gained over 50% since their October lows, approaching a critical resistance trendline.

The S&P 500 has encountered resistance near the 5,300 level in recent days, highlighting a key technical barrier for the index.

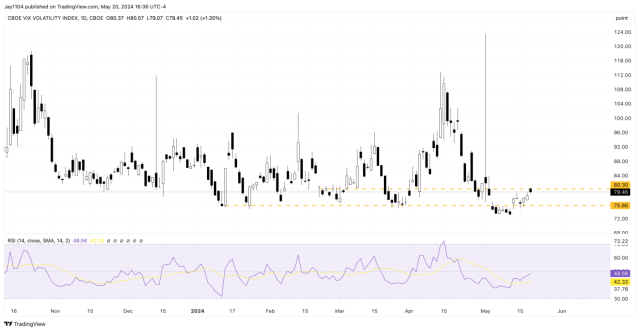

Wednesday’s VIX options expiration could influence market dynamics. With the VIX stabilizing around the 12 and 13 strike prices, there’s potential for increased volatility.

Currently, the VIX appears to be maintaining its level due to accumulated put gamma at these strikes.

The VVIX has risen for three consecutive days, nearing the 80 mark. This trend could serve as a precursor to VIX movements, offering insights into future volatility.

With rising VIX levels, the implied correlation index has also increased, a trend that warrants ongoing attention.

10-year rates have rebounded following the recent CPI data, influenced by higher copper prices, Federal Reserve discussions on the neutral rate, and increasing rates in Japan. Japan’s 10-year government bonds reached their highest levels since 2012, indicating a potential global shift in interest rates.

The market has adjusted its expectations for a November rate cut, now forecasting fewer cuts than anticipated on CPI day. This adjustment underscores the importance of not reacting hastily to CPI reports as the market needs time to fully absorb such news.

Overall, investors should monitor these evolving dynamics carefully to navigate the complexities of the current financial landscape effectively.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.