Hunt Favors National Insurance Reduction Over Tax Cuts, Triggering Highest Tax Burden Since WWII

By Daniel M.

March 6, 2024 • Fact checked by Dumb Little Man

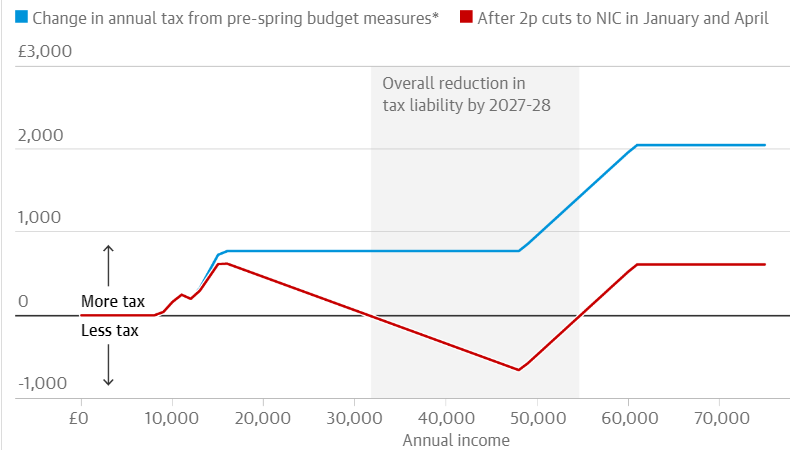

In a contentious pre-election budget, Chancellor Jeremy Hunt took a bold stand, choosing to forgo the much-anticipated tax cuts in favor of a 2 percent reduction in National Insurance (NI) contributions. In light of bleak economic predictions, Hunt's move was an attempt to achieve a precarious balance between voter appeal and fiscal sustainability.

Budget Constraints and Taxation Measures

Hunt conceded that projections “have gone against us,” which limited the Chancellor's flexibility and forced the cancellation of the tax cuts. Instead, Hunt unveiled a plethora of policies, such as higher taxes on vaping and non-economy class airfare, as well as the elimination of tax benefits for vacation rentals.

Furthermore, the child benefit threshold was raised and the higher rate of capital gains tax was reduced from 28% to 24%.

Political Landscape and Economic Impact

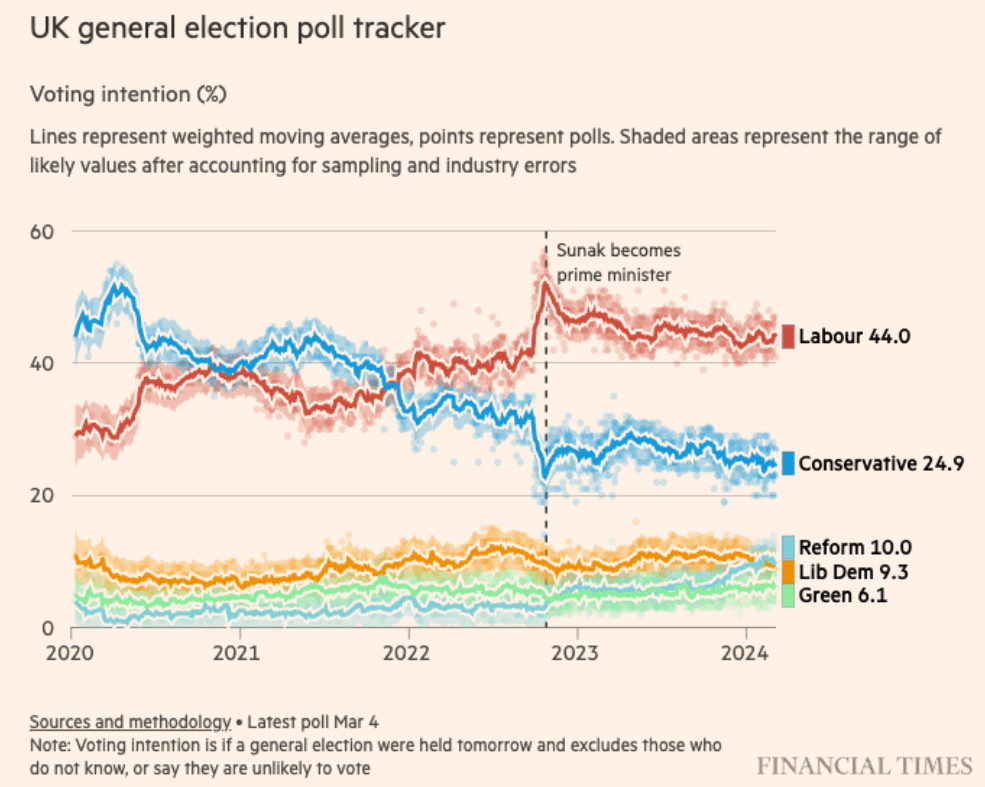

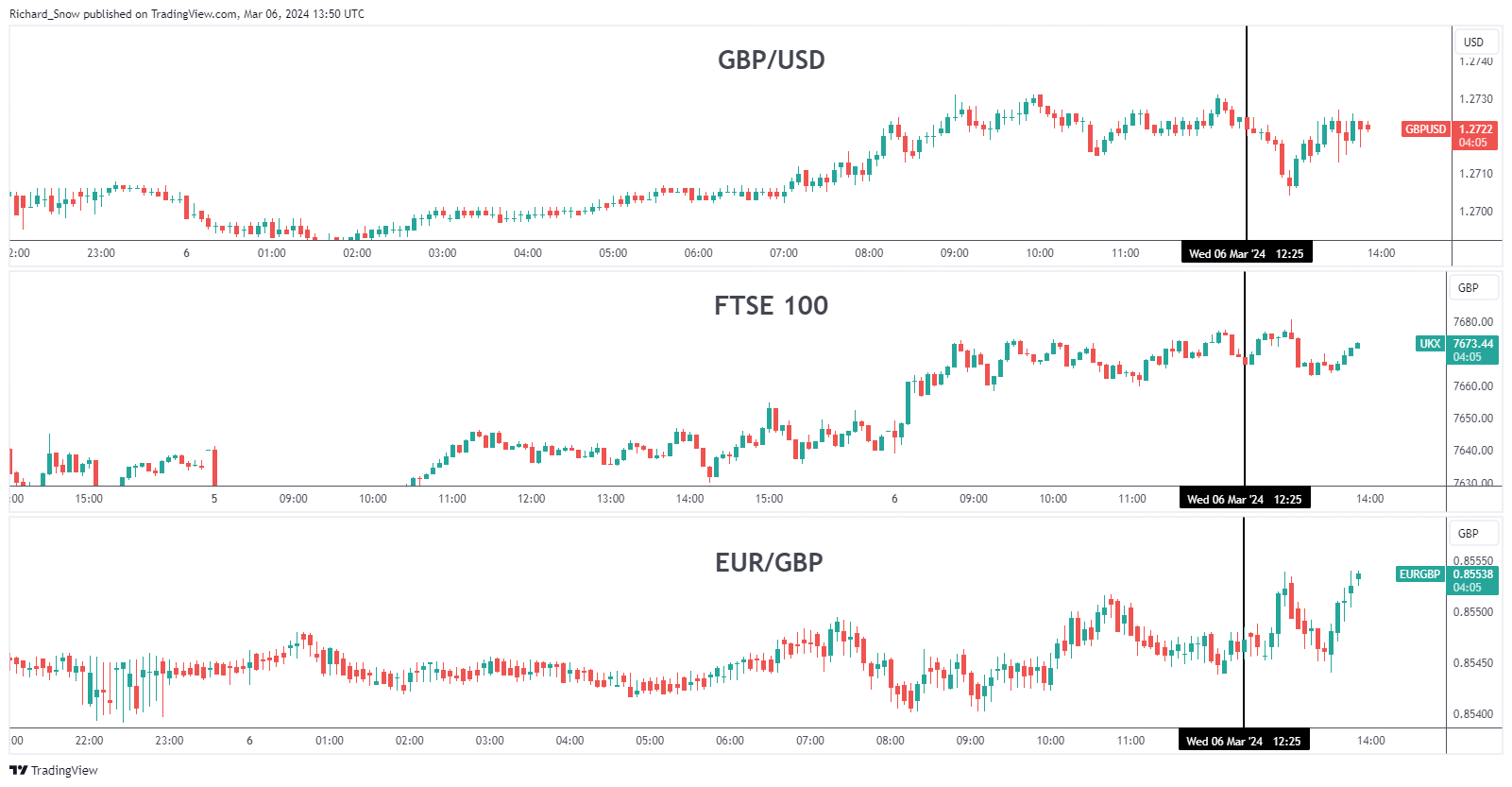

Hunt's budget decisions were heavily influenced by the Tory party's slide in the polls, especially during the short Liz Truss government. UK assets showed a degree of stability during the budget speech, despite minor fluctuations, indicating market confidence.

GBP/USD Dynamics and Economic Outlook

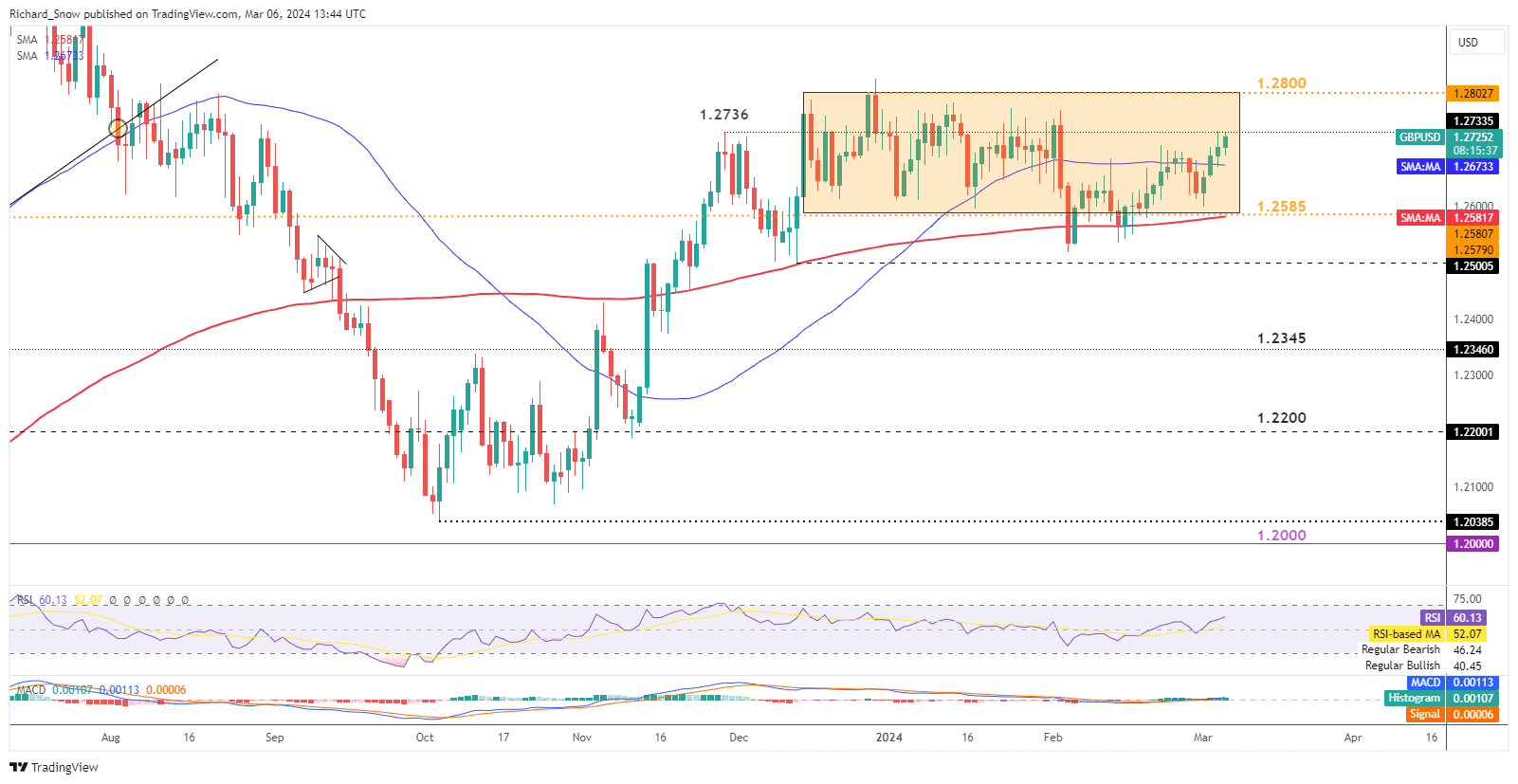

This year, the value of the British Pound has slightly decreased in relation to the US dollar, however, it did witness a little increase in value before the Spring Statement, which was mostly explained by the poorer US data.

Concerns raised by earlier manufacturing data were reinforced by recent services PMI data, which indicated a little weakening. The pound has been one of the best performers against the dollar so far this year, even with a slight decline of -0.2%.

Despite expectations that the Bank of England would keep interest rates unchanged until August, the GBP/USD pair showed tenacity, reaching November highs above 1.2736. Still, Jerome Powell's testimony and US jobs statistics will determine the course of the currency pair, and market sentiment may cause changes.

Hunt's Fiscal Approach and Criticisms

Hunt faced both criticism and praise for his bold decision to enact a £10 billion NI cut that would be paid for by revenue-raising initiatives. Although welcomed as a relief for struggling families, detractors, such as Labour leader Keir Starmer, attacked the Conservatives' economic track record, pointing to years of stagnation.

Impact on Taxation and Government Expenditure

Despite the NI drop, taxes as a percentage of GDP are expected to rise to levels not seen since 1948. Debates on budgetary objectives and economic management were triggered by Hunt's decision to keep the income tax threshold freeze in place and enact revenue-raising measures.

Final Thoughts

The budget will influence both the political and economic spheres as Chancellor Jeremy Hunt's budgetary policy is implemented. After all, there was no denying the political impact of the budget, with many seeing Hunt's proposals as game-changers capable of cutting into Labour's advantage in the polls.

The emphasis on tax reduction, however, might result in a harsher approach toward austerity following the election, which would affect government agencies and facilities. Ultimately, the delicate balance between taxation, public spending, and voter sentiment will determine the direction of the UK's economic trajectory with the upcoming election.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.