Gold’s Rally Gains Momentum Amid Anticipation of US Rate Cuts

By Daniel M.

March 11, 2024 • Fact checked by Dumb Little Man

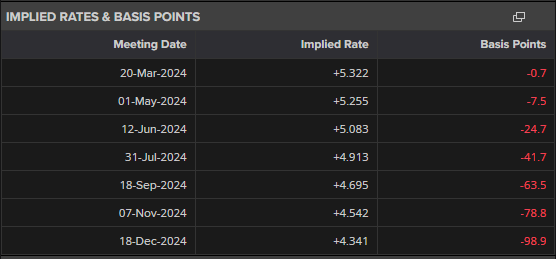

With the financial markets fully anticipating a 25 basis point rate cut at the upcoming June 12th FOMC meeting, the gold market is poised for continued growth. The Fed's recent statements have solidified expectations for up to three quarter-point reductions in 2024, with a fourth cut also on the horizon, signaling a pivotal moment for the US central bank to transition from planning to action.

Key US Economic Updates to Watch

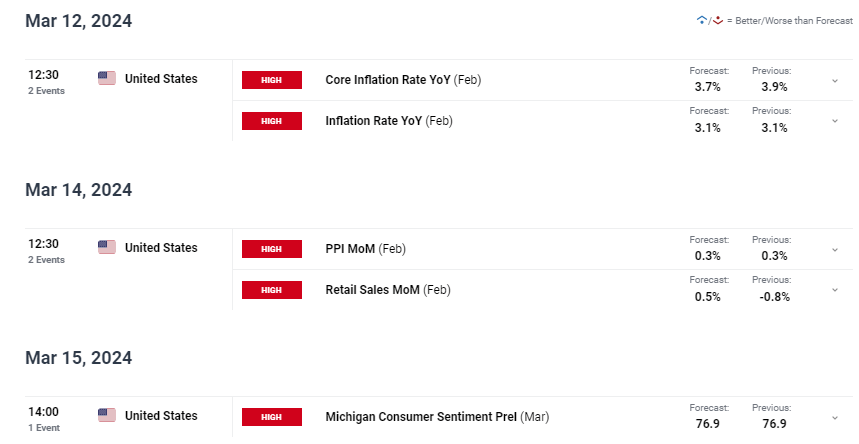

Next week's economic calendar highlights crucial US data releases, notably Tuesday's inflation report. This update is particularly significant, given the Fed's satisfaction with the current disinflationary trend.

It would require a significant deviation from year-over-year inflation figures to alter the Fed's rate cut schedule.

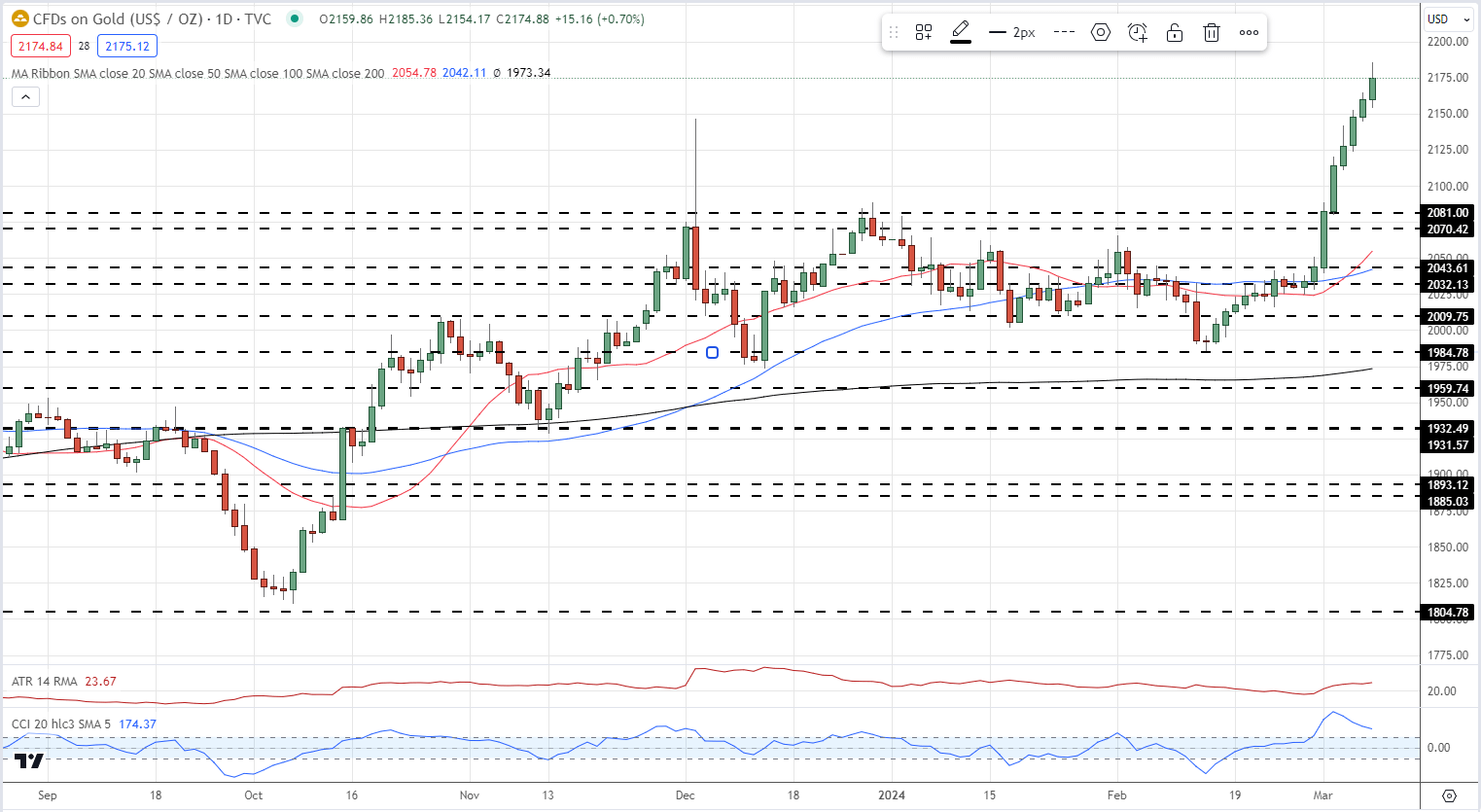

As the gold price chart reveals a continued ascent into uncharted territory, indicators such as the CCI suggest an overbought condition, yet the daily candlestick pattern remains decidedly bullish. Gold's performance over the past six sessions illustrates a consistent upward trajectory, challenging bullish traders seeking entry points during potential short-term retractions.

Support levels at $2,100/oz. and $2,081/oz. offer stability, but the overarching trend suggests gold prices may climb higher in the weeks ahead.

Analysis of retail trader data indicates a bearish sentiment among traders, yet the broader outlook for gold remains robust. With a decrease in net-long positions compared to the previous day and week, contrasted with a significant increase in net-short positions, the market's dynamics underscore a cautious optimism for gold's near-term prospects.

In Summary: Gold's Bright Horizon on Rate Cut Expectations

The anticipation of US interest rate cuts has set a bullish backdrop for gold, reinforced by upcoming economic indicators and trader sentiment. As the Fed aligns its actions with market expectations, gold's trajectory remains upward, marked by solid support levels and a compelling narrative for continued rally.

Investors and traders alike should closely monitor these developments, poised to navigate the opportunities presented by this precious metal's promising outlook.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.