Gold Rallies Amid US Rate Cut Hopes, Mideast Peace Talks

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Gold prices have risen significantly, aided by the combined effects of expected US interest rate cuts and ongoing Middle East peace talks. The US jobs data for April highlighted a slowing in new job growth, with only 175,000 positions added—far less than the predicted 243,000.

This slowdown has changed market expectations, with financial markets now pricing in a possible 25 basis point rate decrease from the Federal Reserve in September, followed by another in December.

Meanwhile, the geopolitical environment has a significant impact on gold's valuation. Israel and Hamas are holding cease-fire talks in Cairo, which are being mediated by Egypt and Qatar.

Although Hamas has accepted the ceasefire parameters, Israel has raised doubts, claiming that they do not match its basic needs. The ongoing military operations in regions such as Rafah illustrate the fragility of these debates.

Market Dynamics and Technical Analysis

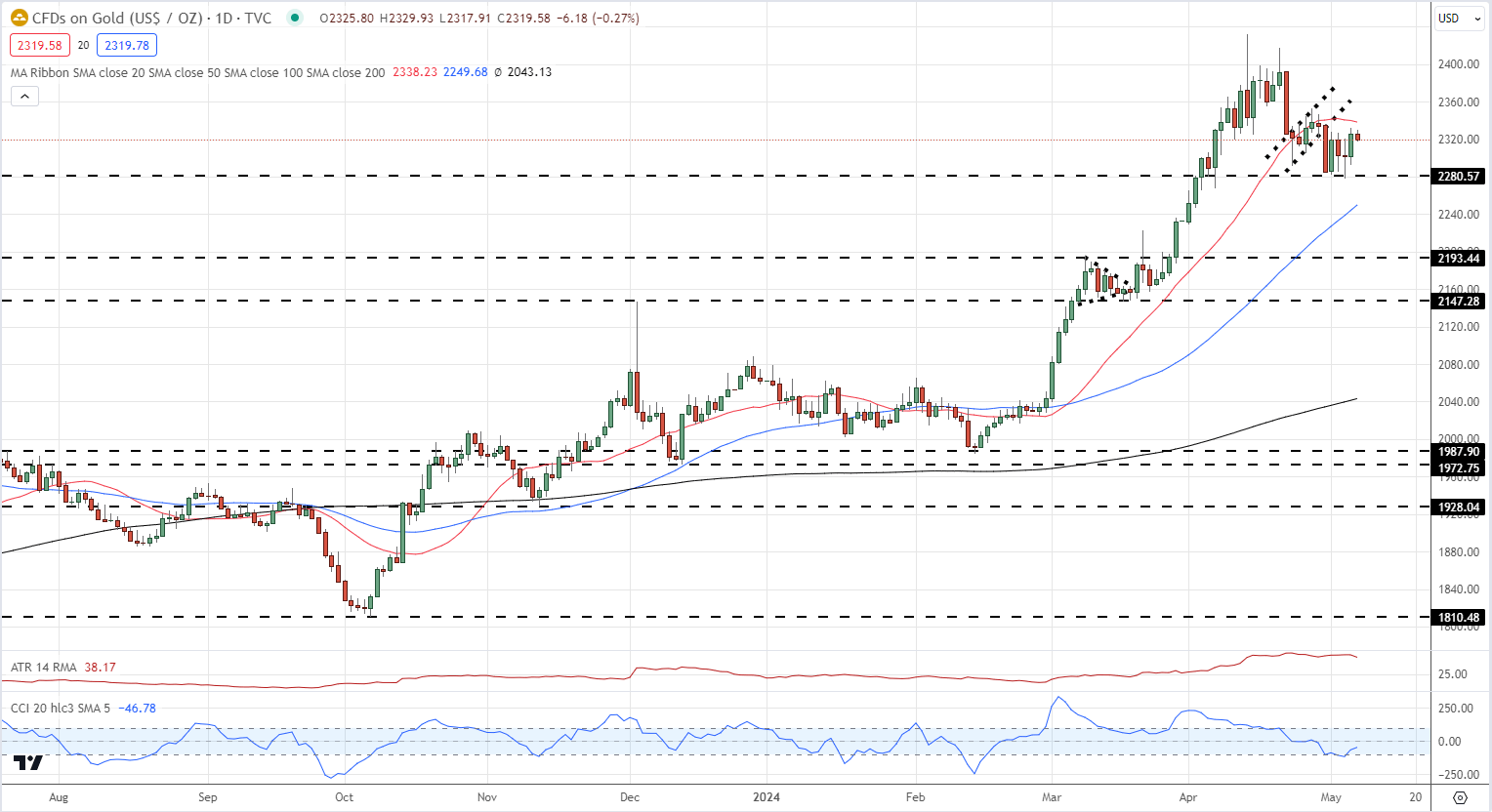

Technically, gold has defied a downward trend, consistently finding support at $2,280 per ounce. Resistance is currently forming around $2,340. The outcome of the cease-fire talks could have a huge impact on the next major movement in gold prices.

Retail trader data shows that 55.20% of traders are net-long on gold, with both long and short positions up from last week. This sentiment is an important indication since a contrary attitude to public opinion usually indicates probable price changes.

Federal Reserve's Stance and Market Reaction

Recent comments by Federal Reserve officials have fanned speculation. Richmond Fed President Thomas Barkin remarked that there have been no convincing indicators of inflation easing, implying that the current restrictive monetary policy will continue.

In contrast, John Williams of the New York Fed acknowledged a slowing job market and hinted at a future rate cut.

The weakening labor market, together with impending inflation reports, will be key in shaping the Fed's interest rate choices in the coming months. The market has responded to these events by increasing trade volumes in gold, driving prices closer to $2,320 per ounce.

Final Thoughts

As traders and investors monitor the unfolding economic and geopolitical developments, the path of gold prices remains unknown but tilted toward prospective rises.

Success in cease-fire talks could reduce gold's safe-haven appeal, whereas additional economic weakness in the United States could confirm the bullish trend for gold.

Traders should keep an eye on important resistance levels at $2,352 and $2,400, which, if overcome, might pave the door for additional rises. A breakdown below $2,300, on the other hand, may result in a corrective downturn.

To summarize, gold remains a focal point for traders, balancing geopolitical resolutions with economic indicators. The coming weeks will be critical in determining the long-term trajectory for this precious metal.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.