Gold Prices Rise Amid Slowing Inflation and Uncertain Economic Indicators

By Peter Vanderbuild

February 29, 2024 • Fact checked by Dumb Little Man

Gold prices rose on Thursday, following traders' reactions to a series of confusing economic data from the United States, particularly Personal Consumption Expenditures (PCE), a key inflation index closely followed by the Federal Reserve. The January PCE report showed a decrease in inflation, which was consistent with market expectations and fuelled speculation about possible interest rate cuts, though not in the near future.

The headline PCE index rose by 2.4% year on year in January, a tiny dip from 2.6% in December, while the core PCE, excluding food and energy, rose by 2.8%, down from 2.9%. This progressive decrease in inflation rates raises the prospect of future rate cuts, despite the fact that the total price index and core measurements show a month-on-month increase.

At the same time, jobless claims data showed a modest increase over expectations, adding to the larger economic picture and perhaps influencing the Federal Reserve's monetary policy. Despite these numbers, the market consensus currently expects the first interest rate decrease in June, with potential early rate cuts in the latter half of 2024.

Gold's appeal as a non-yielding asset generally rises in response to forecasts of reduced interest rates and yields, as evidenced by the nearly $10 per ounce gain in gold prices following the data release.

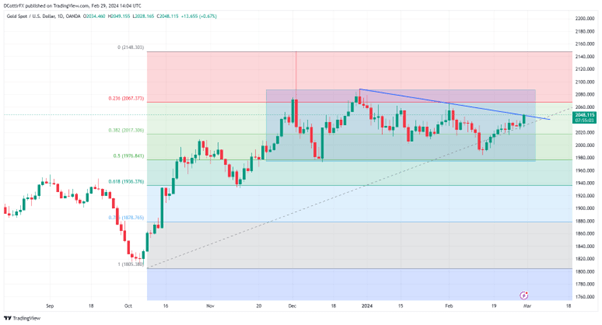

Gold Prices Technical Analysis

Technical analysis shows that gold is currently range-trading below its recent highs, with a strong downturn since late December's peaks. Resistance is seen at $2046.76, with near-term support at $2017.31. Market mood, as measured by IG's indicator, shows a moderately positive tilt among traders, pointing to potential fluctuations within gold's existing range.

The core PCE Price Index's consistency with projections reinforced the current disinflationary trend, resulting in lower US Treasury bond yields and an increase in gold prices, with XAU/USD trading around $2,046. The larger economic panorama, which includes the announcement of jobless claims, pending home sales, and the Chicago PMI, as well as comments from many Federal Reserve officials, paints a confusing picture for traders. Fed officials' remarks ranged from a willingness to lower rates depending on facts to a cautious approach given the ongoing inflation worries.

Final Thoughts

This complex blend of economic data and Federal Reserve comments emphasizes the continuous problems of handling monetary policy in the face of shifting inflation and economic indicators. As traders evaluate these developments, the outlook for gold prices remains dependent on changes in interest rate forecasts and broader economic trends.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.