Gold Price Trends: Precious Metals Retreat After Peaking

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

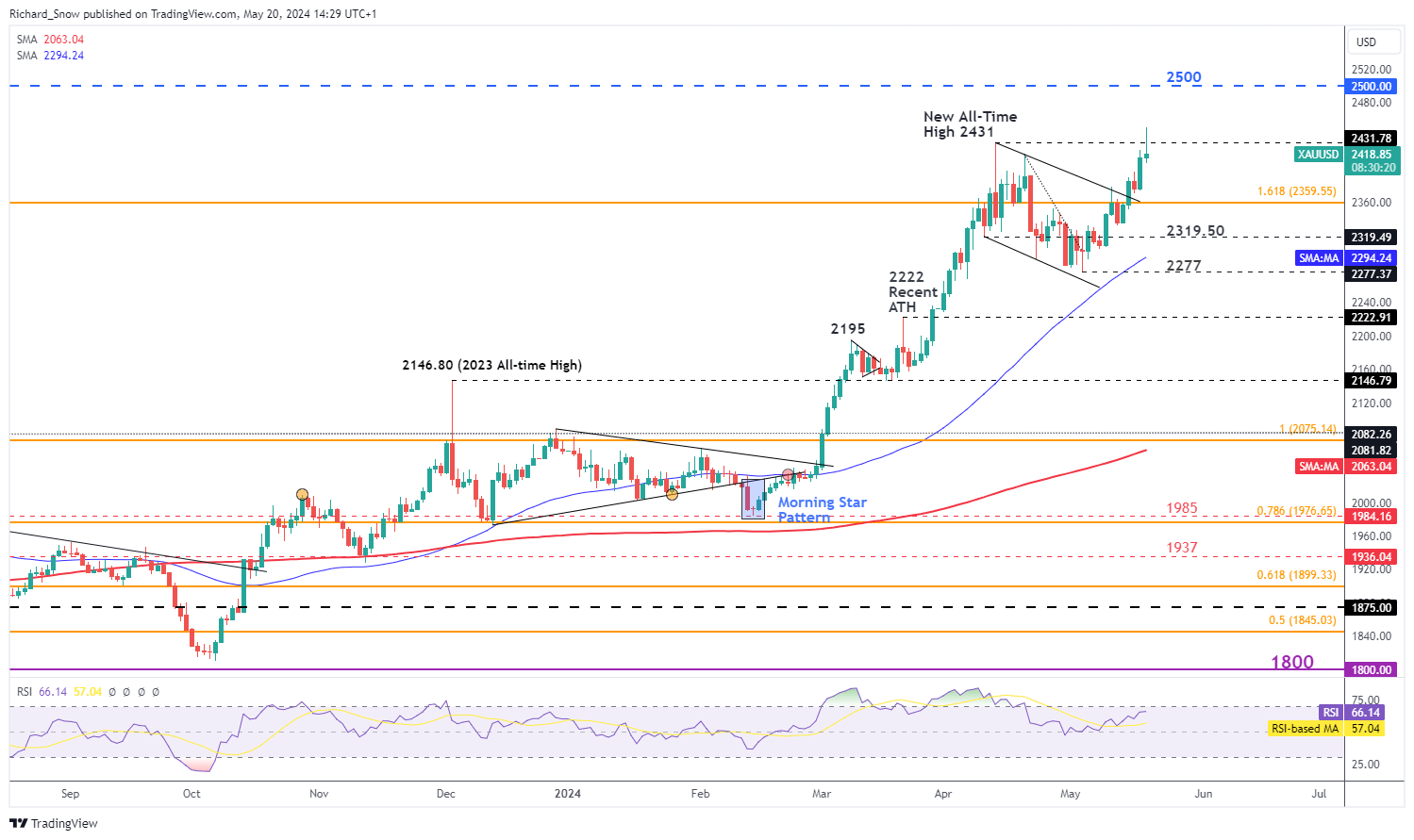

Gold Retreats Following Record Highs Amid Federal Reserve Remarks

Gold surpassed previous records, reaching over $2431, only to fall back under as Federal Reserve speakers suggested that interest rate cuts are not imminent. Atlanta Fed President Raphael Bostic highlighted persistent inflationary pressures, indicating ongoing economic challenges, though he anticipates a gradual easing of inflation into 2025. Fed Governors Michael Barr and Philip Jefferson echoed the sentiment, suggesting a cautious approach to lowering rates until inflation targets are met.

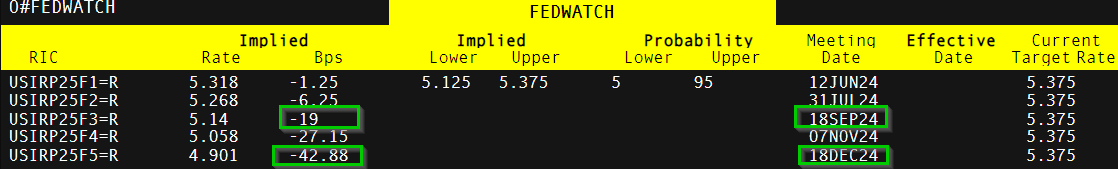

The market has adjusted expectations, shifting from anticipating two rate cuts this year to possibly one in November, particularly as the Fed is unlikely to alter policies during a presidential election year. The next potential policy adjustments are anticipated for September, December, or even 2025.

Market Rate Cut Expectations for 2025

The reduced likelihood of rate cuts supports the dollar, dampening gold's appeal as yields rise, making the non-interest-bearing asset less attractive. Despite this, gold remains on a strong upward trajectory, though significant inflation resurgence could drive prices down.

The key support level for gold now stands at $2360, marked by the 161.8% Fibonacci extension, with further support from the upper trendline of the previous channel.

For further insights, download our free sentiment guide to understand how shifts in gold positioning might signal future price movements.

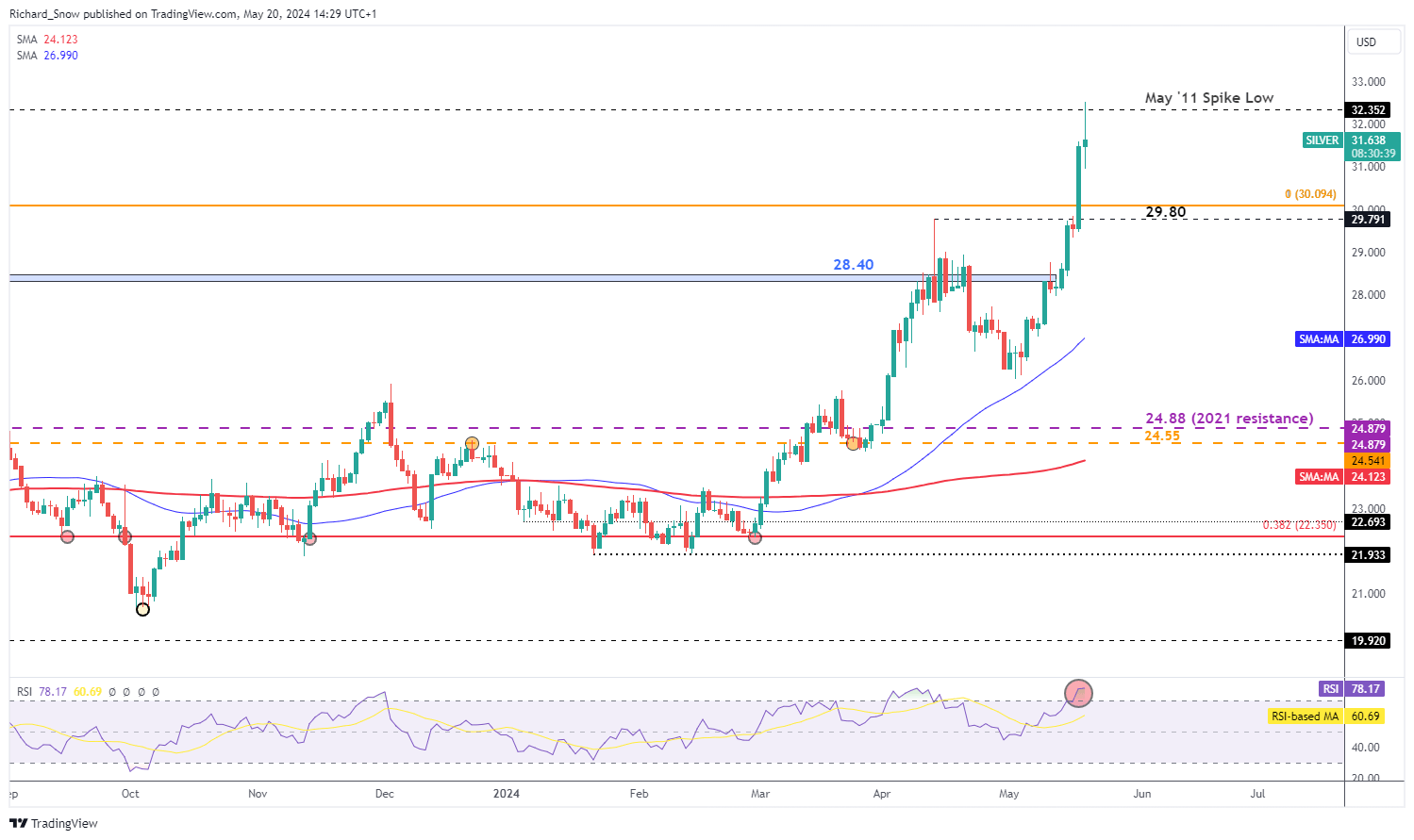

Silver's Performance Dips After Reaching Annual High

Silver showcased its dual appeal as both a precious and industrial metal, initially hitting an 11-year peak before pulling back. It remains steady, with significant support at the $30 mark, a pivotal point derived from the top of its 2020-2021 rise.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.