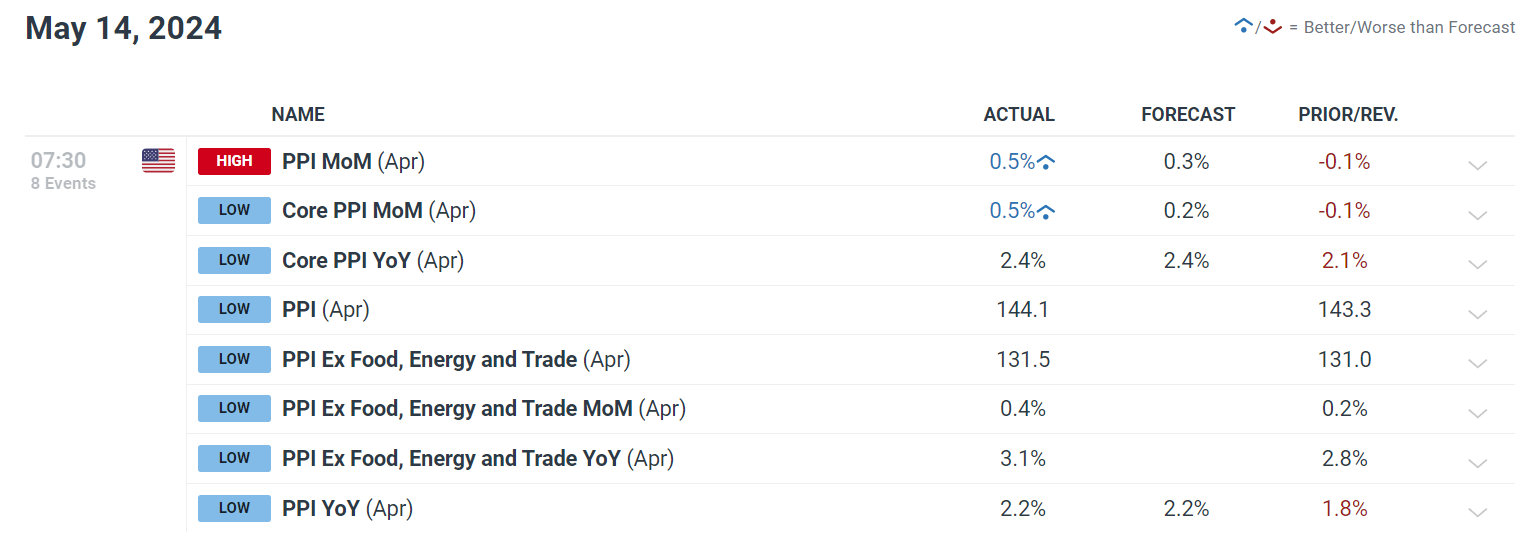

Gold Price Rises Amid Mixed US PPI Data, Inflation Uncertainty

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Following the previous day's dramatic dip, gold prices rebounded significantly on Tuesday, rising over 0.8% to reach the $2,350 barrier.

This increase was spurred by a weaker US currency and lower Treasury yields, which coincided with the release of mixed US Producer Price Index (PPI) figures.

Despite April's PPI statistics exceeding expectations, revisions for the previous month mitigated the impact, leaving investors cautiously optimistic about the overall economic landscape.

Federal Reserve Chair Jerome Powell stated that, while inflation is likely to fall, the rate of disinflation is unpredictable. This view was echoed in the minimal volatility following the PPI announcement, indicating a cautious approach by traders.

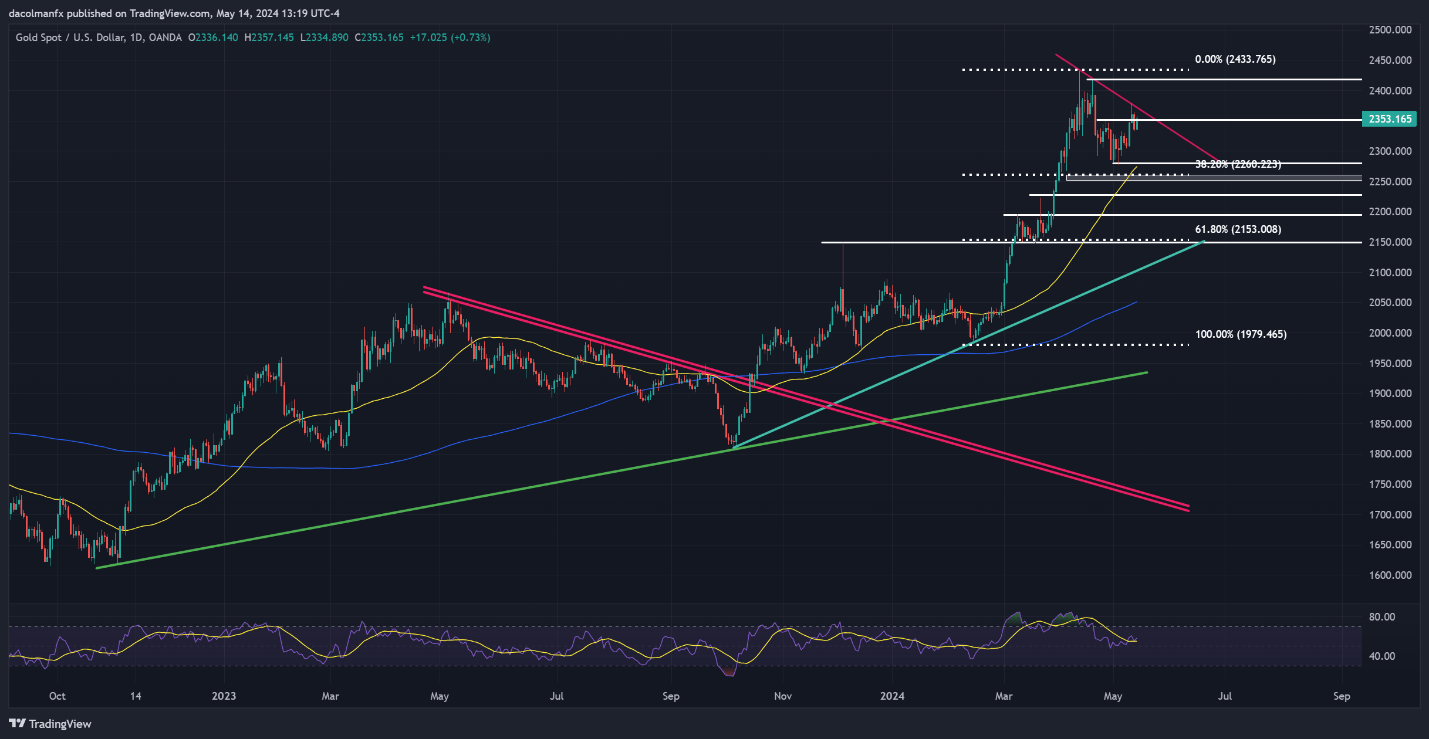

Technical Analysis and Market Movements

Technically, gold prices demonstrated strength by recovering the $2,350 mark. If this bullish trend continues, resistance near $2,370 may be tested soon, perhaps opening the way for a rally to the $2,420 to $2,430 range.

However, a reversal below $2,350 might trigger a drop toward the $2,280 support, with further losses potentially exposing the $2,260 level, which corresponds to the 38.2% Fibonacci retracement of the 2025 advance.

Upcoming CPI Report: A Key Driver for Market Sentiments

Investors are now focusing on the next Consumer Price Index (CPI) report, which is projected to show a monthly increase of 0.3% in both headline and core categories.

These data are expected to push annual inflation rates down modestly, potentially influencing Federal Reserve policy.

A weaker-than-expected CPI report may increase gold prices further by raising prospects of an early rate drop, whilst a higher report could strengthen the dollar and put pressure on gold prices.

Dollar and Treasury Yields: The Broader Economic Impact

The US currency and Treasury yields have been volatile in response to the inflation report. Treasury rates surged to a daily high following the PPI report before recovering, indicating the market's mixed reaction to inflation concerns.

The US dollar index dipped marginally, reflecting a lower stance against a basket of currencies. This shift creates a sense of uncertainty in currency markets, influencing commodities prices, particularly gold.

Further Economic Indicators and Market Sentiments

Additional economic statistics, such as Retail Sales, Initial Jobless Claims, and Industrial Production, are scheduled to be released later this week, perhaps providing further light on economic trends.

The New York Federal Reserve's Survey of Consumer Expectations and the University of Michigan Consumer Sentiment poll both revealed rising inflation expectations, complicating market estimates.

Final Thoughts

Inflation and economic indices continue to have a significant impact on the relationship between gold prices, the dollar, and Treasury yields.

As traders anticipate the CPI report, the market is on a knife-edge, balancing optimism about sustained economic recovery with caution about future inflationary pressures.

The impending statistics will most certainly play a critical role in setting market trends, particularly for commodities like gold, which are still vulnerable to changes in US economic policy and global economic conditions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.