Gold Price Rebounds Above $2,170 Amid Weaker Dollar, Eyes New Peak Despite Recent Dip

By Daniel M.

March 25, 2024 • Fact checked by Dumb Little Man

Gold Price and Analysis

Last week's trading sessions experienced a highly unpredictable gold market, as prices surged to reach a new record high before undergoing a notable decline, ultimately resulting in the metal's value remaining relatively stable for the week.

This volatile movement was mainly driven by the Federal Reserve's indication of a possible 75 basis-point reduction in the Fed Fund rate for this year, reiterating their previous remarks. After Fed Chair Powell's optimistic remarks, gold briefly surged to new levels.

However, the rally quickly fizzled out as the US dollar strengthened, especially following the Bank of England's policy meeting. This caused the Euro and British Pound to weaken, putting downward pressure on gold prices.

In light of the stronger USD, US bond yields have been steadily declining due to anticipated adjustments in the Fed Fund rate.

Given the recent decrease in yields, specifically for the US 2-year and 10-year notes, which saw declines of 14 and 11 basis points respectively, there is a possibility that gold prices could increase, potentially reaching last Thursday's all-time high.

Market Technicals and Trader Sentiment

The gold market is showing indications of a bullish setup after a bullish pennant pattern was formed last week.

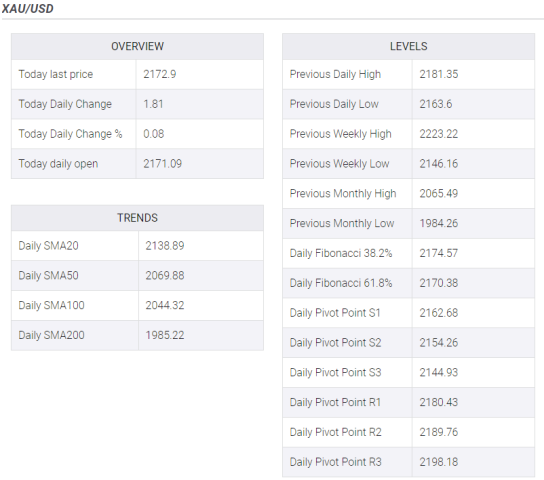

The current sideways trading could potentially transition into a bullish flag pattern, to surpass $2,200/oz. and potentially testing the all-time high of around $2,225/oz. There seems to be some initial support just below the $2,150/oz mark.

According to retail trader data, most traders currently hold net-long positions, indicating a generally optimistic sentiment. Since March 1, when gold was trading near $2,082.75, its price has experienced a 4.24% increase.

There has been a noticeable rise in net-long positions in comparison to net-short positions.

Recent Gold Price Movements

The price of gold continued to rise, surpassing $2,150 during early Asian trading hours on Tuesday. This increase was driven by the anticipation of interest rate cuts and the dovish remarks made by Federal Reserve officials.

At present, the price of gold stands at $2,171, indicating a modest uptick. This increase occurs as the US Dollar Index (DXY) declines and there are small improvements in US Treasury bond yields, specifically the 10-year yield at 4.25%.

Investors are closely monitoring upcoming economic indicators, including the US Personal Consumption Expenditures Price Index (PCE) for February, to gain insights into the potential timing of rate cuts.

It seems that the market has already factored in a rate cut by June, especially after the Fed's March meeting.

Geopolitical Tensions

Given the current geopolitical landscape, with Russia's increased aggression towards Ukraine and ongoing tensions in the Middle East, it is likely that investors will turn to gold as a safe-haven investment.

These recent developments, along with important US economic reports scheduled for this week such as Consumer Confidence, Durable Goods Orders, and GDP data, are expected to have an impact on the short-term trajectory of gold.

Final Thoughts

The gold market is currently at a critical point, as multiple factors are exerting conflicting influences on it. On one hand, the adjustments in Federal Reserve policy and geopolitical tensions offer significant support for prices.

However, the US dollar's strength and the constantly evolving global economic landscape present some challenges.

As traders navigate this complex environment, the possibility of reaching a new all-time high still exists, depending on the unfolding economic data and geopolitical developments.

Given the current state of the market, individuals must stay well-informed and attentive to make the most of the potential changes in gold's value.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.