Gold Price Outlook: Fed May Shake Up Markets, Sparking Pullback or Rally in Store

By Daniel M.

March 19, 2024 • Fact checked by Dumb Little Man

Monday saw gold prices edge higher as investors remained cautious ahead of significant events, most notably the Federal Open Market Committee (FOMC) announcement on Wednesday. In early afternoon New York trading, XAU/USD increased by about 0.2%, finding support at $2,150.

Fed Meeting Anticipation and Potential Policy Shift

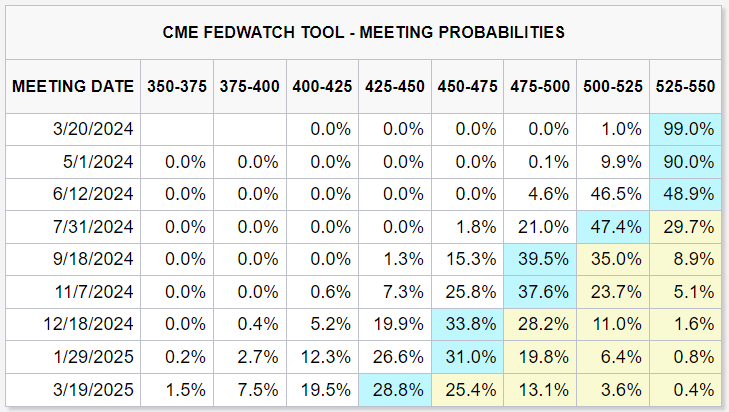

The Federal Reserve will hold its March meeting this week. The central bank is expected to keep its existing policy settings in place, but given the worrying developments in inflation, it is anticipated that it may modify its forward guidance and economic projections.

Unexpected spikes in recent inflation figures point to a possible pause or reversal in the trend of disinflation. As a result, the Fed may take a more cautious approach, postponing rate reductions and cutting back on other easing measures.

Market Impact Scenarios

The Fed's position may cause the dollar and U.S. Treasury yields to rise, which might stifle the current precious metals boom. On the other hand, gold may gain traction if the Fed sticks to its dovish outlook, despite recent inflation data suggesting otherwise.

Technical Analysis

Gold prices steadied on Monday, rebounding from support at $2,150. Support levels are $2,150 and $2,085, and resistance is at $2,175 and $2,195.

Gold prices held stable on Tuesday as traders focused on central bank decisions from the Reserve Bank of Australia (RBA) and the Bank of Japan (BoJ).

Central Bank Decisions Impact

The BoJ's potential withdrawal from the negative interest rate policy (NIRP) could trigger volatility, which would impact the price of gold as well as the USD/JPY pair. With little effect on the market, the RBA is anticipated to keep its interest rate where it is.

Upcoming Fed Decision

With the crucial Fed decision on Wednesday approaching, traders are ready. The short-term technical picture for gold suggests a possible bullish continuation if it breaks through resistance levels at $2,164 and $2,190.

Final Thoughts

As the world's markets anxiously await the FOMC statement, gold prices are still susceptible to changes in Fed policy and the state of the world economy. It is recommended that traders keep a watchful eye on critical levels of support and resistance if there is any future market volatility.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.