Gold Price Hits Record High as Investors Anticipate US Rate Cuts Amid Nasdaq and Nvidia Volatility

By Daniel M.

March 11, 2024 • Fact checked by Dumb Little Man

Remarks made last week by Federal Reserve Chairman Jerome Powell and European Central Bank President Christine Lagarde stoked rumors of upcoming rate cuts from both central banks. Powell has hinted at lowered interest rates, but only if the economy performed as expected, according to his testimony before the Senate Banking Committee.

As for the ECB, Lagarde suggested that rate cuts might be on the table by the middle of the year, stressing the need for additional data to support the credibility of inflation targets.

If the ongoing wage discussions yield positive outcomes, Bank of Japan representatives in Japan may raise interest rates. Due to this outlook, the market is pricing in a rate hike this month, with odds approaching 60%.

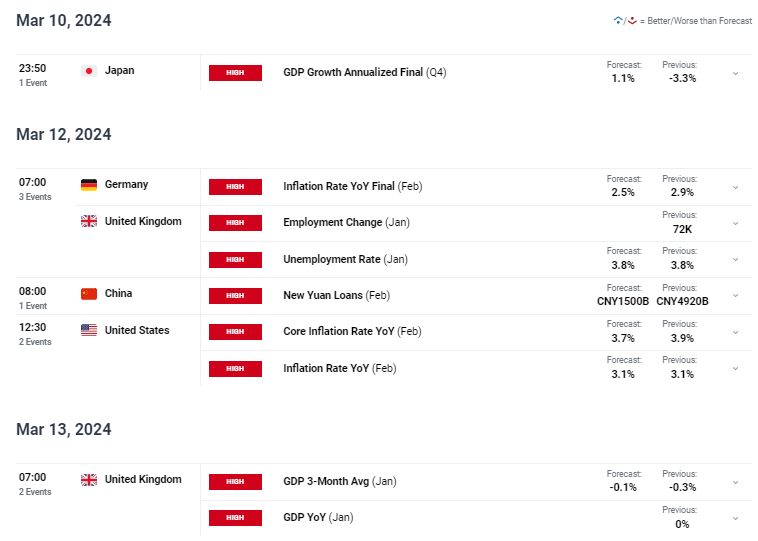

Key Economic Events Ahead

Important economic announcements are scheduled for next week, which might cause volatility in several asset groups. The US inflation report comes first among these releases, then key employment and growth figures from the UK.

Gold, Nasdaq 100, and Nvidia

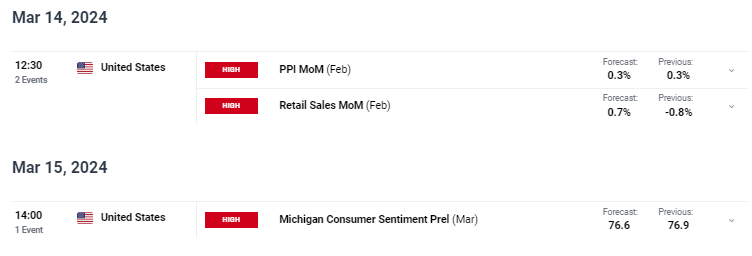

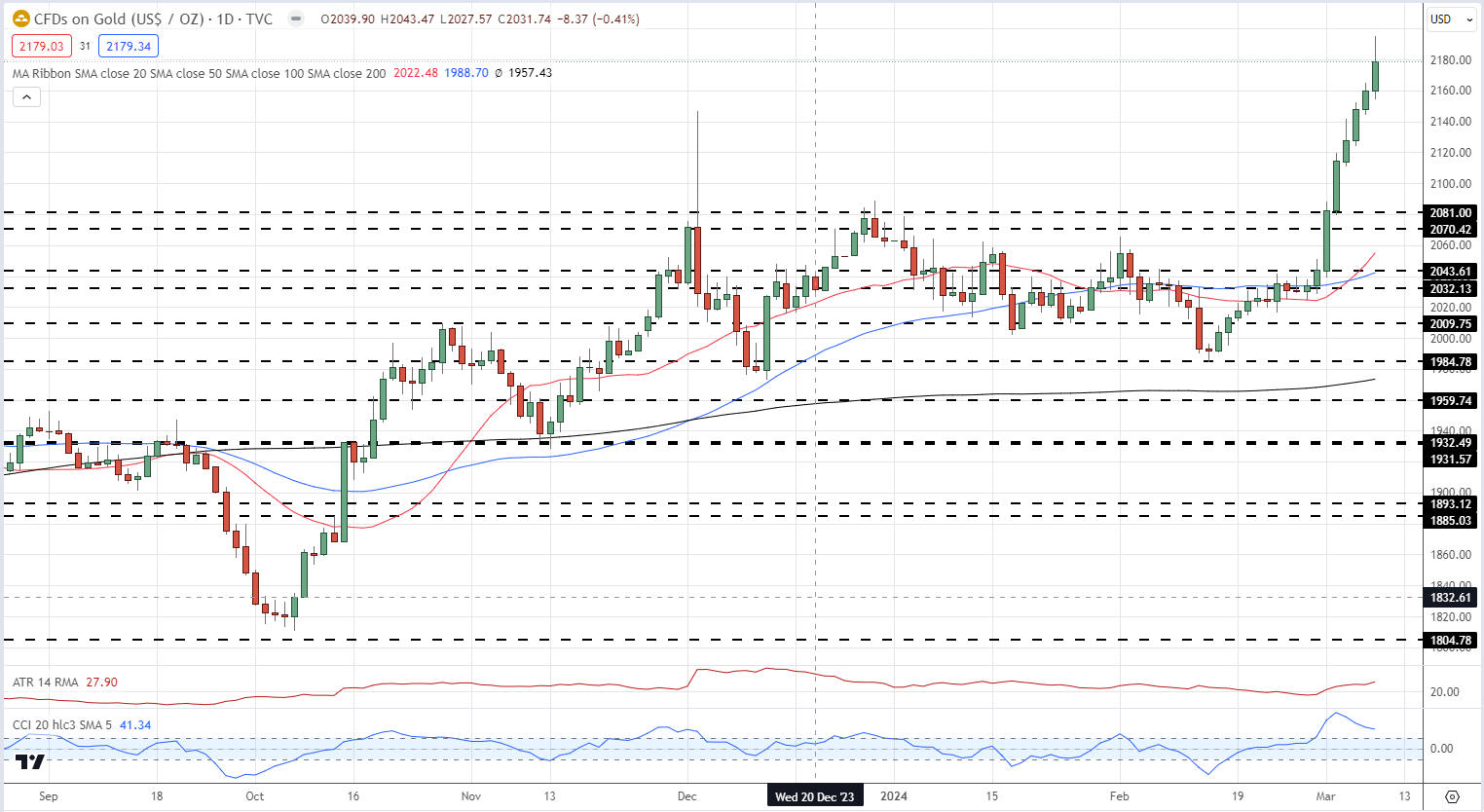

Gold prices kept rising, reaching new all-time highs as safe-haven purchases, strong Chinese demand, and mounting anticipation of rate cuts all played a part. Even while US indices saw slight gains all week, Friday's sell-off—especially in the Nasdaq—caused some alarm.

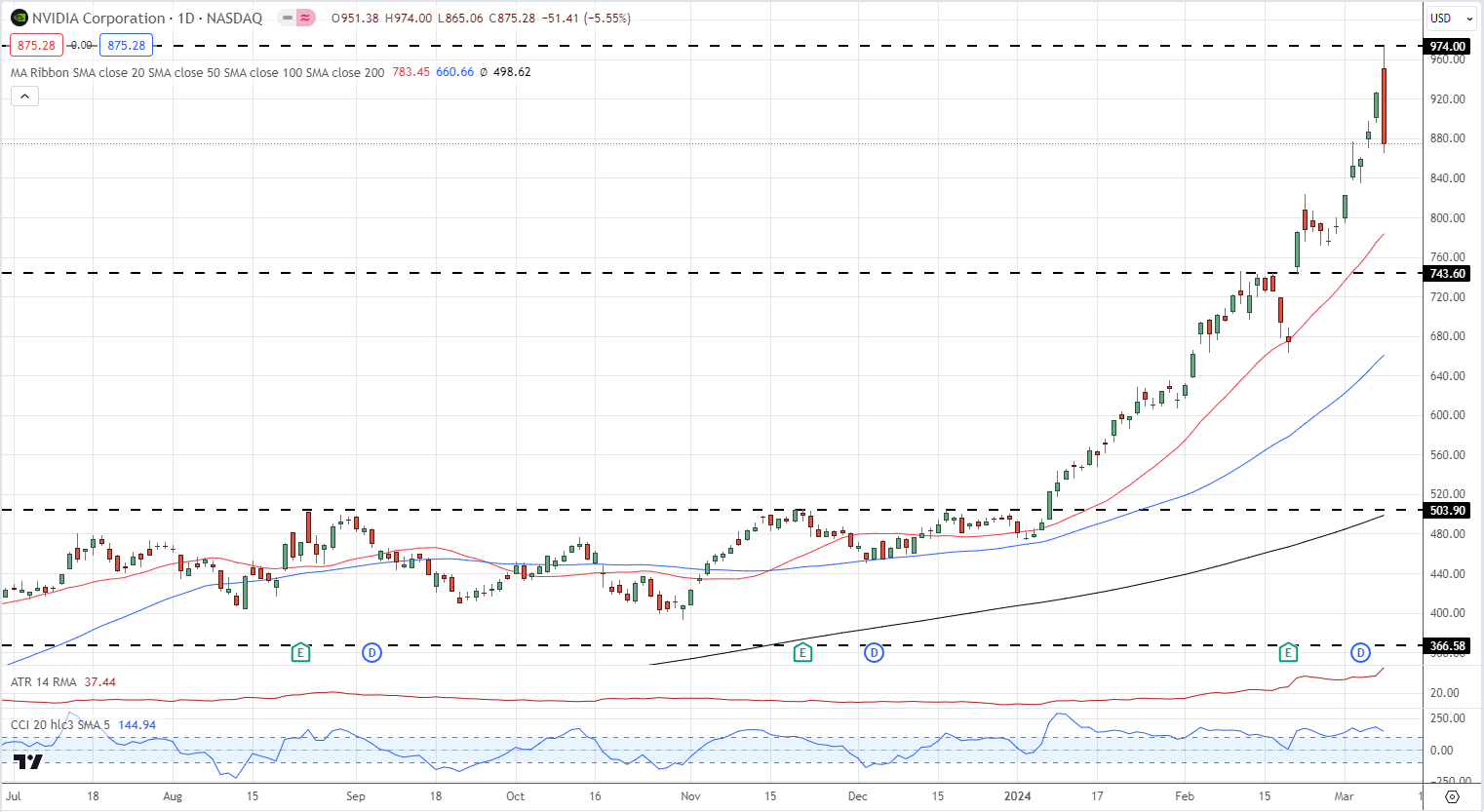

Meanwhile, Nvidia, a prominent participant in the semiconductor sector and an important constituent of multiple US indices, had a notable decrease on Friday, departing from its previous upward trajectory.

Market Outlook

Early on Monday in the Asian session, gold prices represented by XAU/USD, jumped above $2,180 and approached $2,200. Demand for the precious metal was boosted by the possibility of rate cuts by the Federal Reserve this year as well as geopolitical unrest.

Although he alluded to possible rate cuts in the near future, Fed Chair Jerome Powell expressed confidence in the economy in his most recent testimony. US job growth that was greater than anticipated combined with a rising unemployment rate raised hopes for rate cuts in the employment sector.

China's inflation report indicated a return to average consumption levels, which helped to reinforce the price of gold. Although the Producer Price Index (PPI) fell more than expected, the Chinese Consumer Price Index (CPI) increased year over year in February, exceeding expectations.

Awaiting new market cues later this week, traders are looking forward to the publication of US CPI and Retail Sales statistics. Within the same time frame, retail sales are predicted to improve each month, while the CPI is predicted to show a monthly increase and an annual rise in February.

Final Thoughts

One may argue that investor reaction to key economic data releases and central bank signals about interest rate policy would likely result in increased market volatility during the coming week. The rising price of gold highlights the changing landscape for investors looking for safe-haven assets, as it is expected to rise due to geopolitical uncertainties and rate cuts.

Monitoring market sentiment and company-specific events is important, as the IT sector—represented by the Nasdaq and powerful businesses like Nvidia—faces difficulties amid Friday's sell-off.

In order to predict the course of the economic recovery and the activities of the central bank in the coming weeks, traders will be closely monitoring announcements from the US CPI and Retail Sales statistics.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.