Gold Price Forecast; XAU/USD Retreats from Record Highs, Trades Near $2,160, US Jobs Data to Influence

By Daniel M.

March 8, 2024 • Fact checked by Dumb Little Man

This week, gold prices broke beyond $2,150, driven by the depreciating value of the US dollar and falling Treasury yields amid expectations of an early rate decrease by the Federal Reserve. The market is still skeptical about rate decreases, despite Fed Chair Powell's cautious approach, which is partially due to worries over a regional financial crisis.

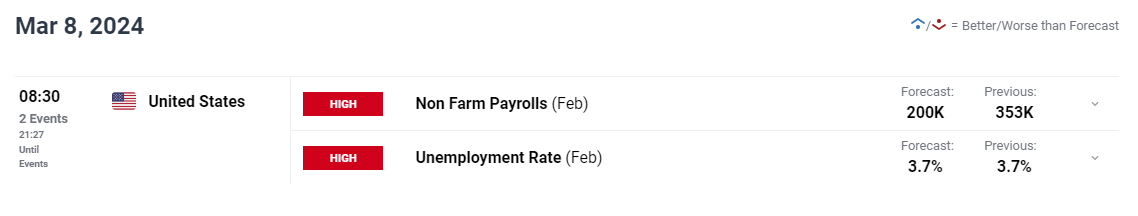

Bond yields are pushed down by Powell's attitude in contrast to market expectations, which increases the appeal of gold as an alternative investment. Economists predict a gain of 200,000 jobs in February, thus Friday's non-farm payrolls report in the United States is highly anticipated.

A positive surprise might support Powell's hawkish outlook, however, causing traders to unwind dovish bets and possibly putting pressure on gold prices. In contrast, weak employment growth would support early rate-cutting forecasts and drive up the price of gold.

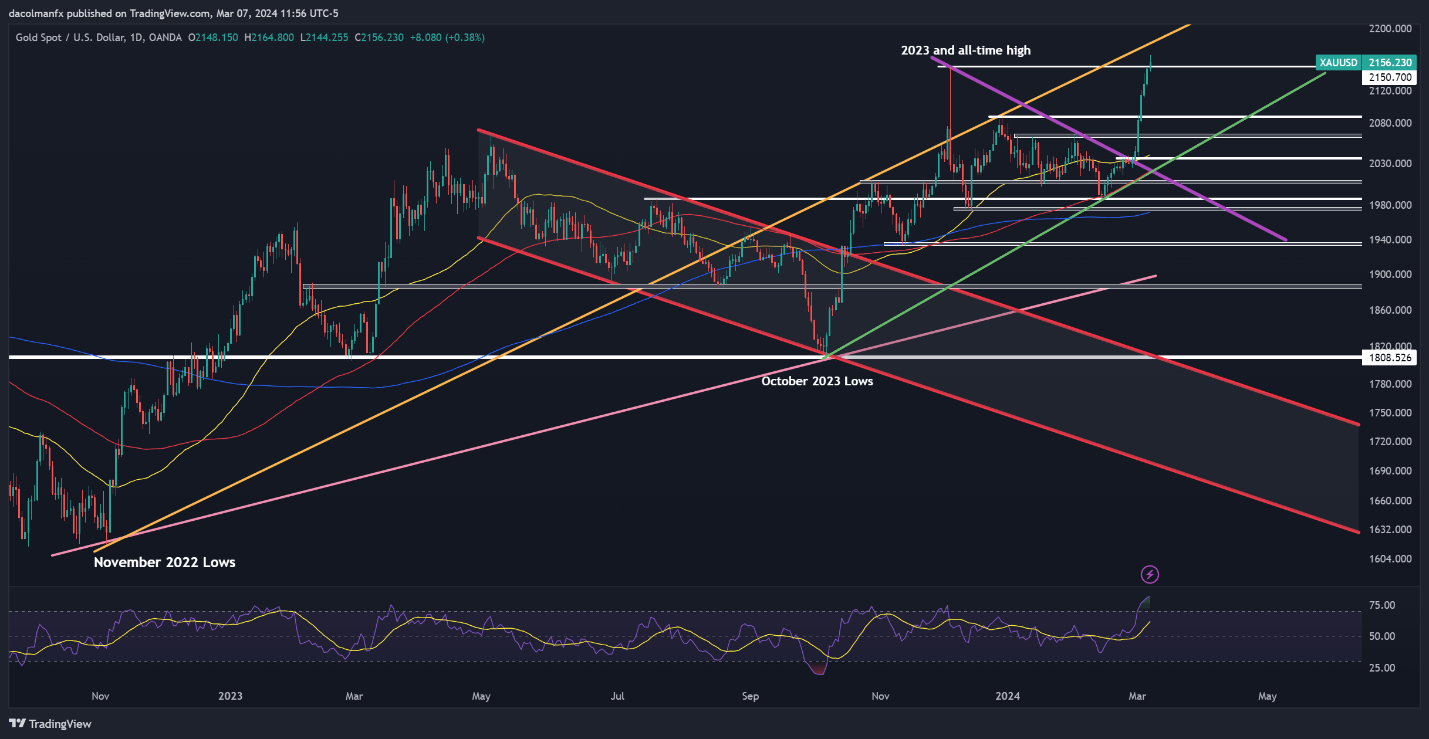

Technical Analysis: Gold Price Outlook

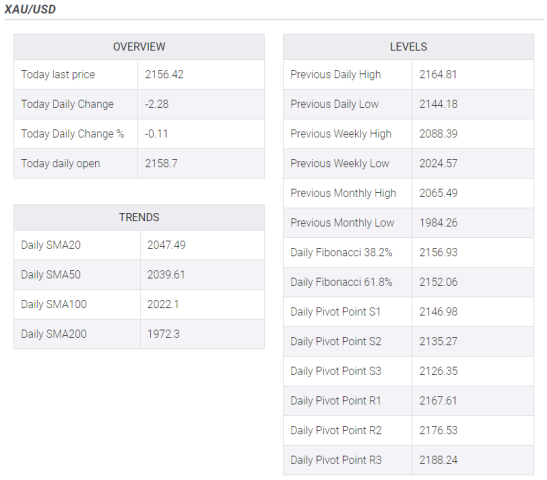

Gold prices (XAU/USD) just broke through the record set in December and rose past $2,150 to a new all-time high. Bulls may be encouraged to seek the $2,185 trendline barrier due to the bullish momentum.

Prices did, however, correct to approximately $2,160 as a result of market expectations of future rate reductions. Rate cut rumors have been further stoked by remarks made by Fed officials, such as Powell and Cleveland Fed President Mester.

All eyes are on Friday's employment numbers for further insights into the U.S. economy, even though indicators like consistent initial jobless claims and steady nonfarm productivity growth offer some stability.

Final Thoughts

Although the technical outlook on gold is promising, caution is warranted because of the possibility of market reversals brought on by abnormally overbought conditions. Key support levels are found at $2,150, $2,090, and $2,065, and a breach of these levels could lead to a more severe decline.

Moreover, the U.S. jobs report is going to be closely monitored by traders, as the results could either support the current advance or cause a reversal, which would determine the direction of gold prices shortly.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.