Gold Nears Record Peaks as US Dollar Strengthens, AUD/USD and NZD/USD Dip

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Market psychology is important in financial trading because it steers retail traders toward common patterns. However, seasoned traders recognize the benefits of contrarian techniques, which capitalize on market mood changes.

Using metrics such as IG customer sentiment, they identify excessive bullishness or bearishness as potential turning points and then combine these insights with technical and fundamental studies to make better-informed trading decisions.

Market Outlook: Gold, AUD/USD, and NZD/USD

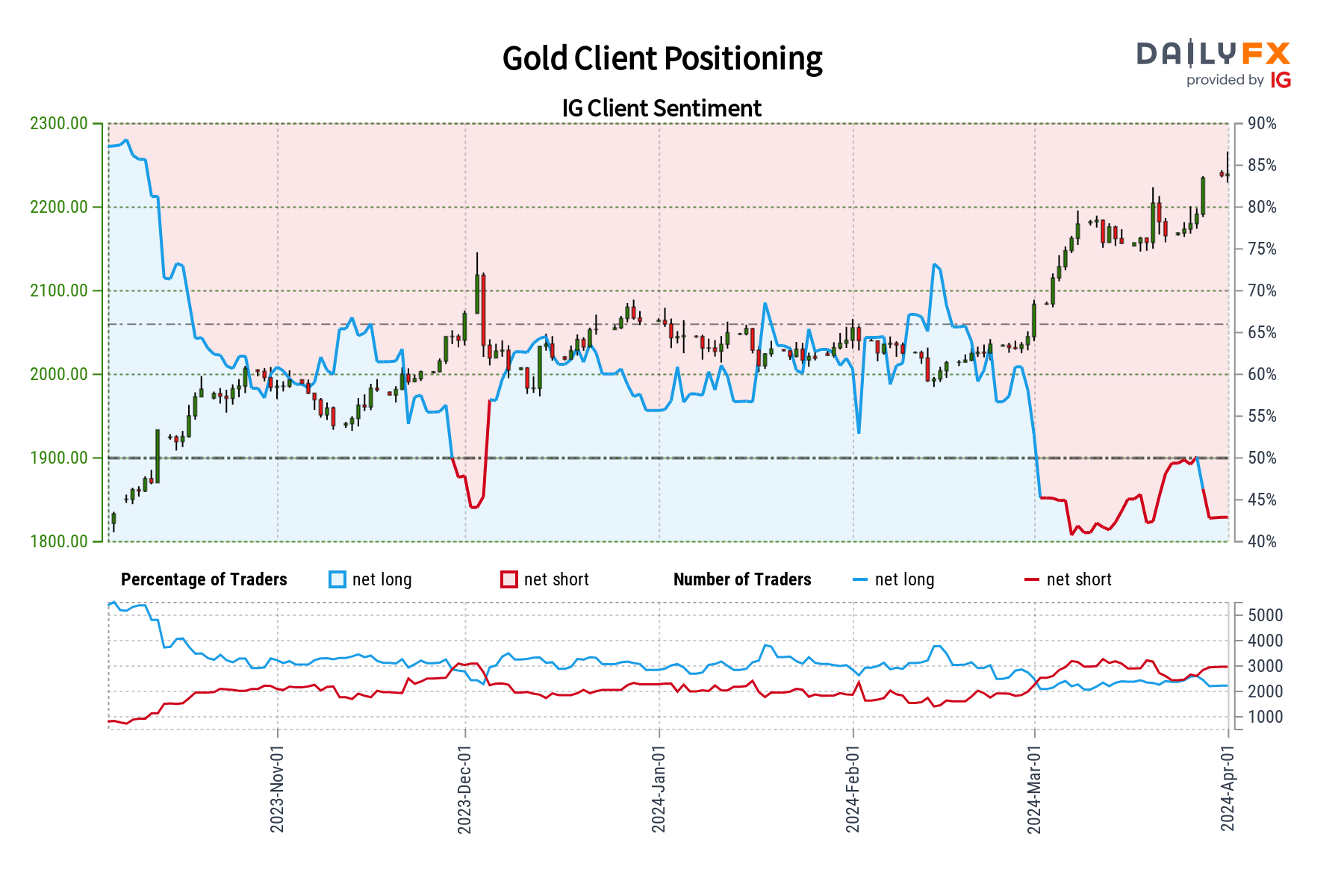

Despite the current retail attitude, gold's price prediction anticipates more upward movement.

According to IG customer statistics, 55.46% of traders are net-short, implying a contrarian indicator of gold's continued run, potentially reaching new highs beyond the current all-time high before any drop.

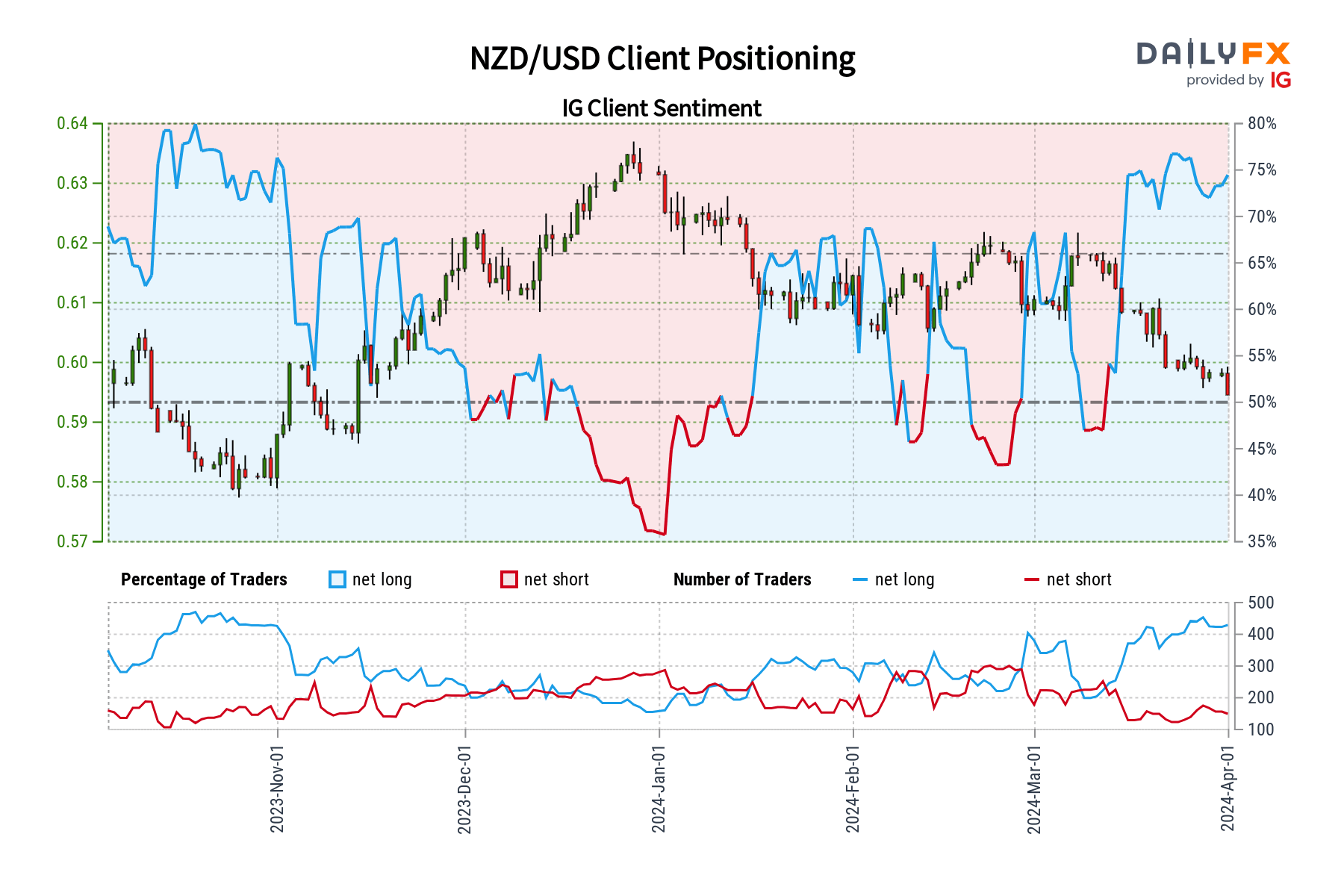

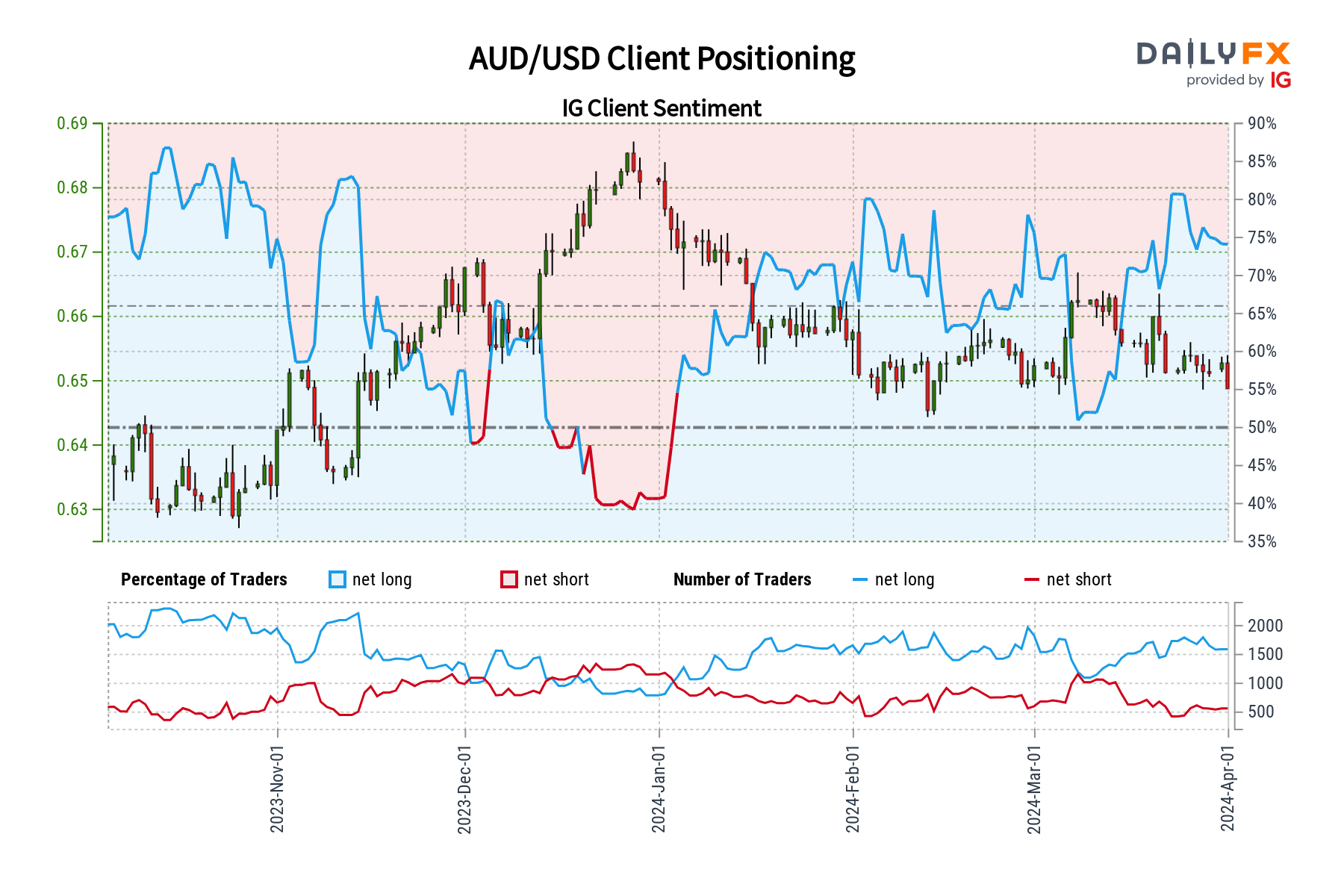

In contrast, the AUD/USD and NZD/USD pairings show a majority of bullish sentiment among traders, with 75.92% and 72.74% holding net-long positions, respectively.

This one-sided euphoria, along with an increase in net-long positions, signals the possibility of more declines, which is consistent with our contrarian view that these currencies will fall.

Daily Digest & Technical Analysis

Gold's performance remains strong, with prices increasing but still just below the record top of $2,265. XAU/USD currently trades around $2,240, up 0.30%.

This movement comes against the backdrop of a stronger US dollar and higher Treasury bond yields, fueled by good US economic indicators such as the ISM Manufacturing PMI's expansion and S&P Global's Manufacturing PMI reports showing growth.

Despite recent increases, technical analysis suggests that gold's rally has been overextended, with a negative divergence in the Relative Strength Index (RSI) indicating caution.

However, the route for gold remains optimistic, with probable retreat levels indicated at $2,200, which will lead to more support levels.

For traders, the juxtaposition of bullish sentiment in currency pairs against a backdrop of good US economic performance provides a complex environment.

With the Federal Reserve's cautious stance on interest rates, as indicated in Chair Jerome Powell's recent remarks, traders should combine contrarian indications with extensive market analyses.

Key Takeaways and Final Thoughts

Trading, particularly with gold's continued run and the varying dynamics of AUD/USD and NZD/USD, demonstrates the importance of reconciling market sentiment with economic fundamentals.

The current market conditions serve as a clear reminder to traders of the importance of implementing a comprehensive strategy that combines sentiment analysis, technical insights, and a good understanding of market fundamentals.

This comprehensive approach is critical, especially in cases when retail sentiment is substantially biased in one direction, showing the potential benefits of taking a contrarian approach to uncover trade opportunities that go counter to popular opinion.

Looking ahead, the importance of paying attention to economic data and monetary policy moves cannot be overstated, since these factors can cause major market volatility.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.