Gold Halts Surge as Risk Appetite Returns, US Economic Focus Looms

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Gold Retreats Amid Risk Appetite Recovery

The recent easing of tensions in the Israel-Iran conflict has provided a boost to risk assets, diverting attention from safe-haven assets like gold. With the Passover (Pesach) religious holiday fostering a temporary calm between the two nations, gold has relinquished some of its recent gains amidst a shift towards riskier investments.

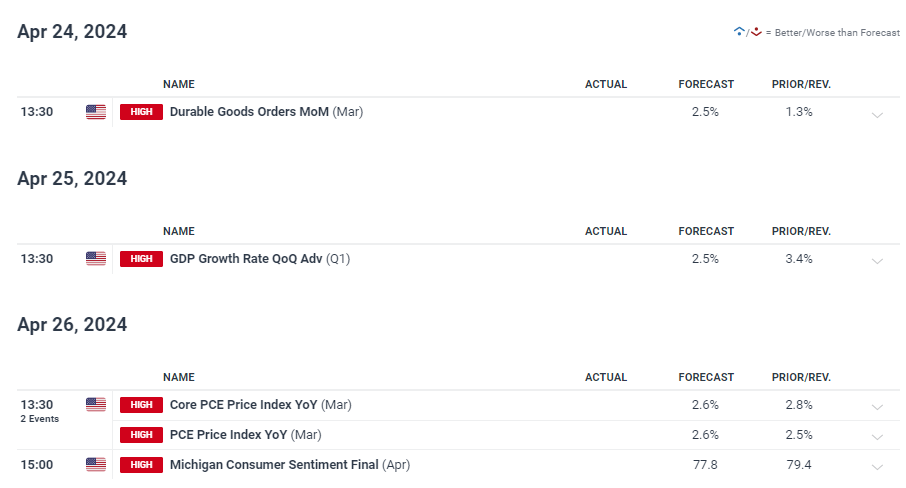

US Economic Data Takes Center Stage

Attention now turns to three pivotal US economic data releases poised to influence market dynamics. Alongside the perennially significant US Durable Goods report, this week’s agenda includes heavyweight releases: the initial glimpse of Q1 GDP and the Fed's preferred inflation gauge, Core PCE. While Q1 GDP is anticipated to dip to 2.5% from the preceding quarter’s robust 3.4%, any deviation could sway the Fed’s stance on rate adjustments. Meanwhile, Core PCE is expected to indicate a further descent towards the inflation target, potentially altering short-term rate expectations.

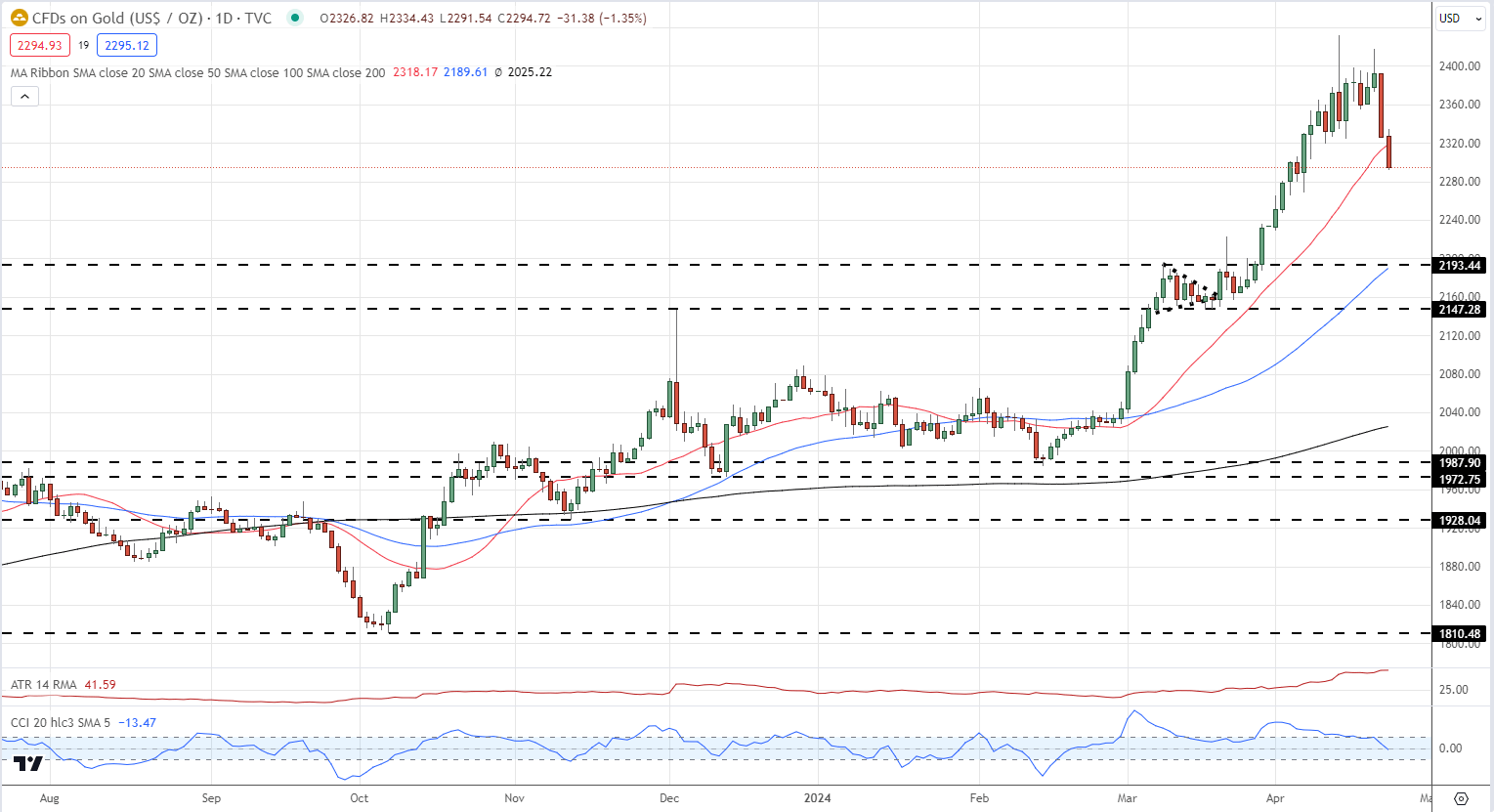

Gold’s Technical Position

Gold is presently trading below $2,300/oz. and is testing the 20-day simple moving average. A breach below this marker could expose gold to additional declines, although recent rally strength suggests support levels at $2,800/oz. and $2,300/oz. should hold. Further downside may target $2,193, contingent upon a further easing of Middle Eastern tensions.

Retail Trader Sentiment and Gold Price

Retail trader data reveals that 54.89% of traders are net-long, with a long-to-short ratio of 1.22 to 1. While net-long positions have increased compared to yesterday and last week, a contrarian interpretation suggests a potential downside for gold prices amidst prevailing sentiment.

By closely monitoring US economic data and geopolitical developments, investors can navigate gold’s current trajectory amid shifting market dynamics.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.