Gold Dips, Silver Edges Up Before US Inflation Data

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Gold fell sharply at the start of the trading week, owing mostly to the anticipated release of the United States Consumer Price Index (CPI) data and Federal Reserve Chairman Jerome Powell's planned statements.

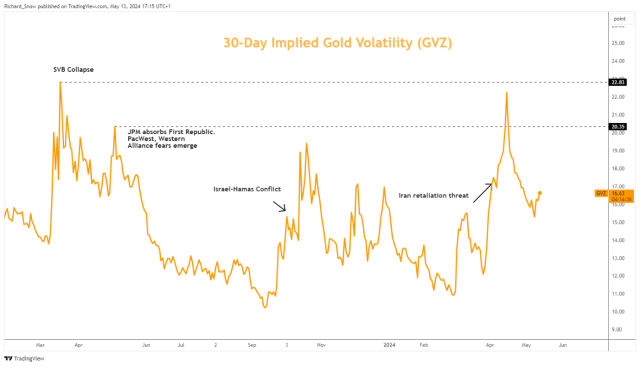

Gold's volatility, as measured by the Gold Volatility Index (GVZ), spiked before last weekend but has since dropped.

This indicates a cautious market mentality, fueled in part by geopolitical tensions, such as the Israeli Defense Force's incursion into Rafah, which initially bolstered precious metals investments.

Despite recent jumps, current volatility levels are significantly lower than those witnessed during the March 2023 crisis at US regional banks.

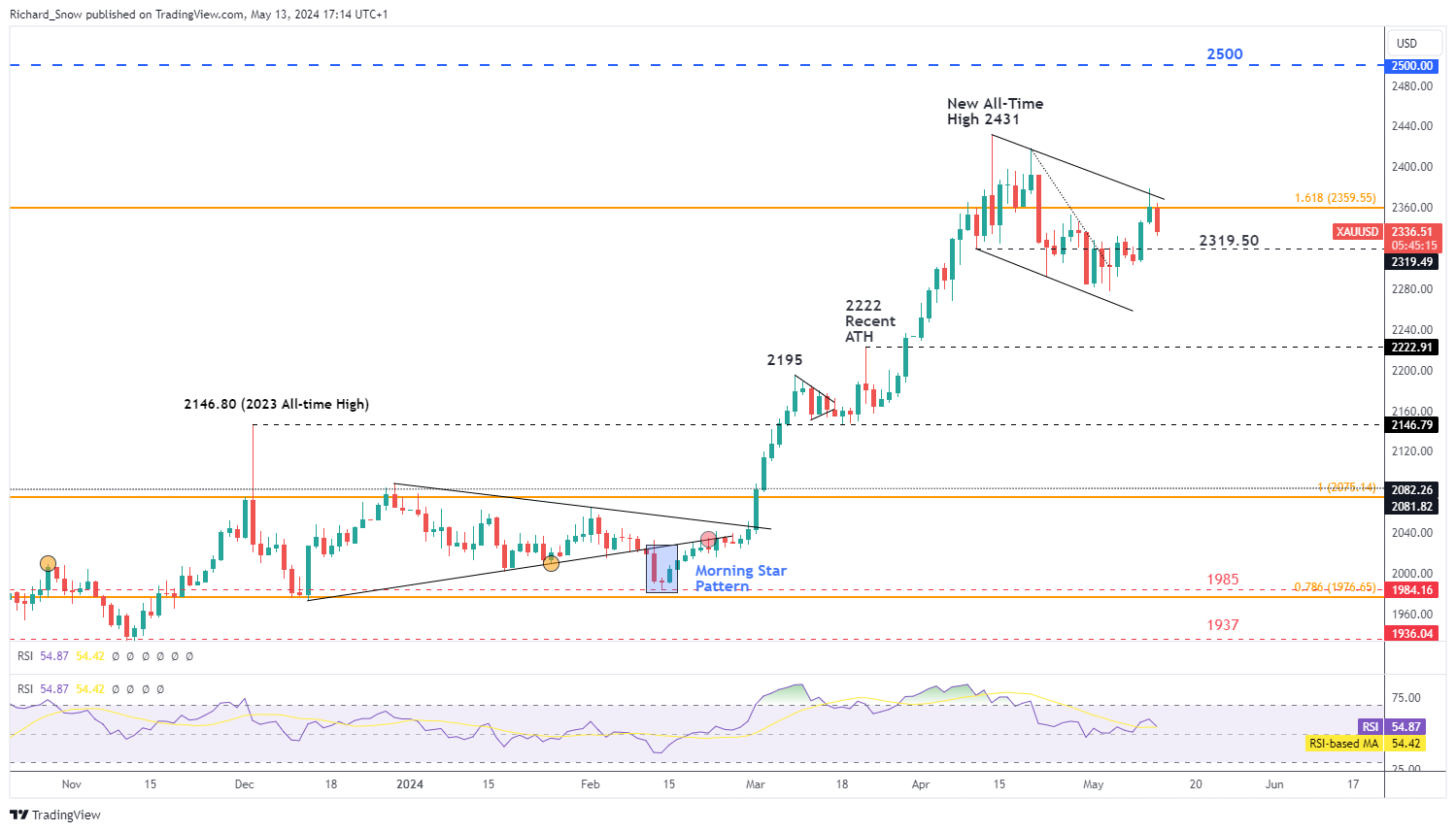

Gold's Technical and Economic Indicators

Gold's price fell to $2,344.53 per ounce by 1204 GMT on Monday, a major fall from Friday's record, the highest since April 22, putting it on track for its biggest daily drop in nearly two weeks.

The metal's immediate support is at $2,319.50, with resistance possible near $2,360 and along the current trendline. Gold futures in the United States fell by approximately 1%, mirroring this negative trend.

This week's focus on the Federal Reserve's prospective rate hikes, exacerbated by upcoming CPI and Producer Price Index (PPI) data releases, continues to dominate market strategy.

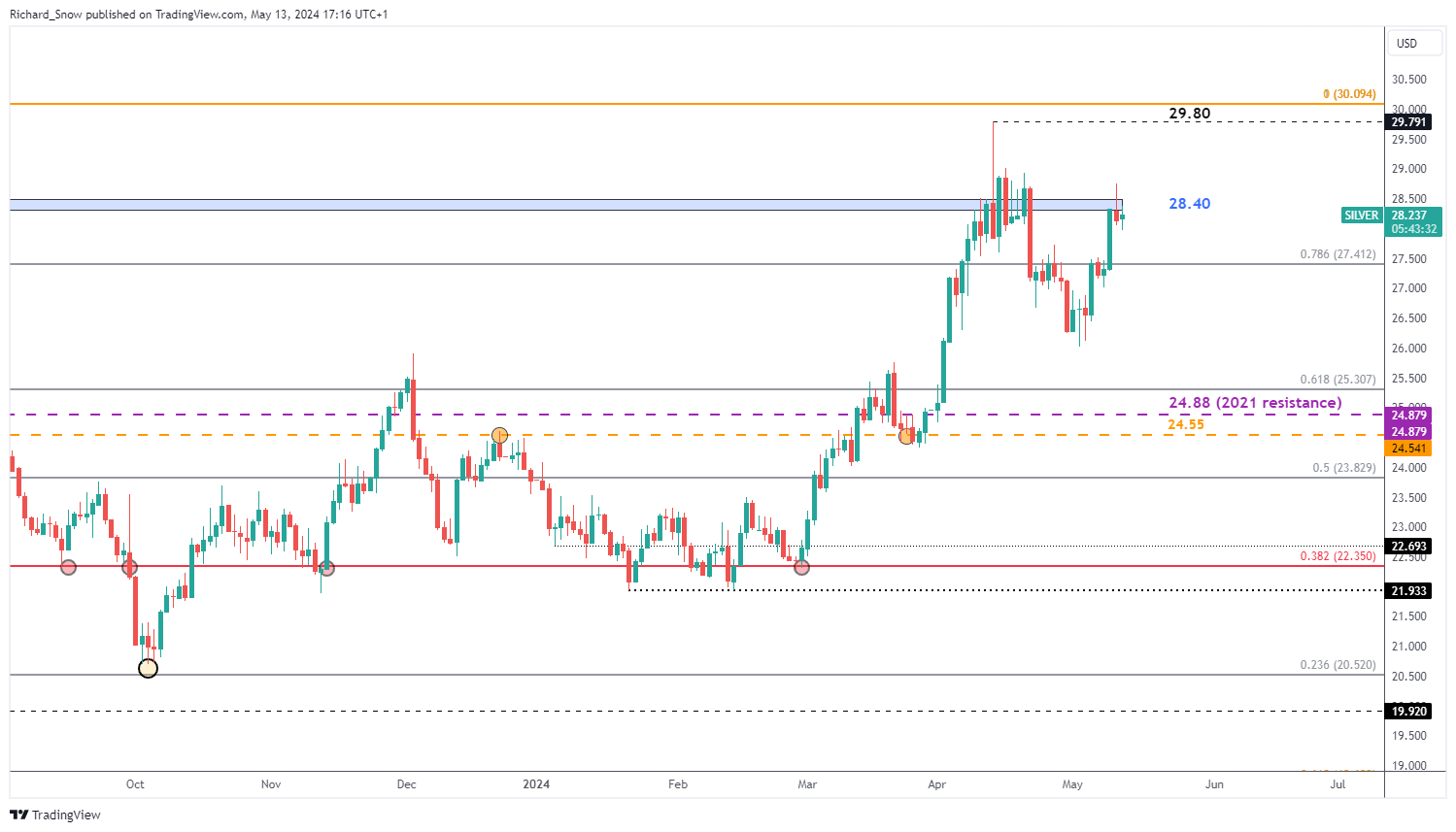

Silver's Price Movement and Resistance Challenges

Silver, on the other hand, made minor increases but struggled to overcome resistance around $28.40, which was formed during the tumultuous years of 2020-2021.

Silver's price behavior indicates a cautious approach among traders as they await any new economic data that may show shifts in inflationary pressure. Silver's next important support level is the 78.6% Fibonacci retracement of $27.41, with a further downside barrier at $26.00.

Economic Data Influence on Precious Metals

Recent economic statistics in the United States, such as poor Non-Farm Payrolls (NFP) and a spike in initial unemployment claims, have tempered expectations for an aggressively hawkish monetary policy.

This has resulted in a dovish outlook for the dollar, which is normally good for gold, albeit recent trends indicate gold prices moving in tandem with the dollar rather than inversely.

Investors are also taking in larger economic signals and Federal Reserve officials' remarks, which complicates market forecasts.

Final Thoughts

With important U.S. inflation figures due soon, traders and investors are on high alert, altering their tactics to reflect anticipated economic movements. Signs of decreasing inflation may raise prospects for a quicker rate cut, perhaps boosting precious metal prices.

On the other hand, higher-than-expected inflation figures may delay rate reduction, putting downward pressure on gold and silver.

As market investors await these key data points, the picture remains unpredictable, underscoring the importance of being cautious when making financial decisions.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.