Global Stock Market Rebound: FTSE 100, DAX 40, and S&P 500

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

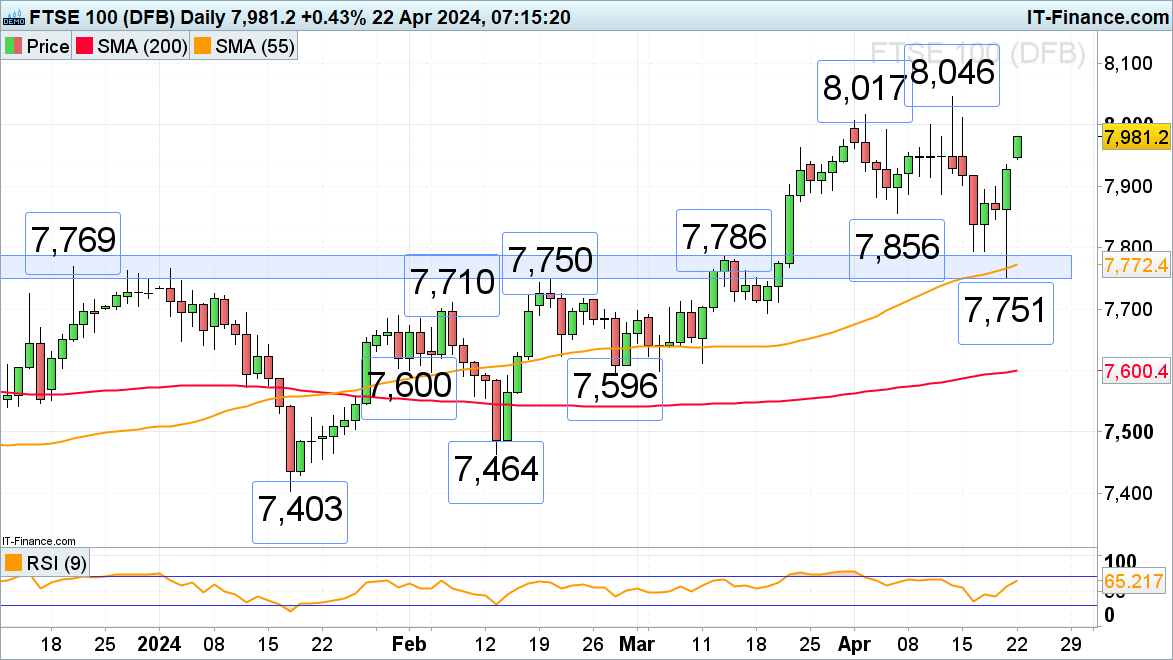

FTSE 100 Sees Uplift Amid Easing Tensions

After a sharp decline on Friday due to military actions in the Middle East, the FTSE 100 made a notable recovery. The index dipped to 7,751 after reports of Israel's missile strikes on Iran but rebounded to close slightly higher as Iran indicated no interest in escalating the conflict.

By Monday, the FTSE 100 had surged, nearing the critical 8,000 level, potentially facing resistance at the early April high of 8,017. The depreciation of the Pound Sterling also contributed to this recovery. A drop below Monday’s low of 7,944 to Friday’s high of 7,935 would be required to fill the gap.

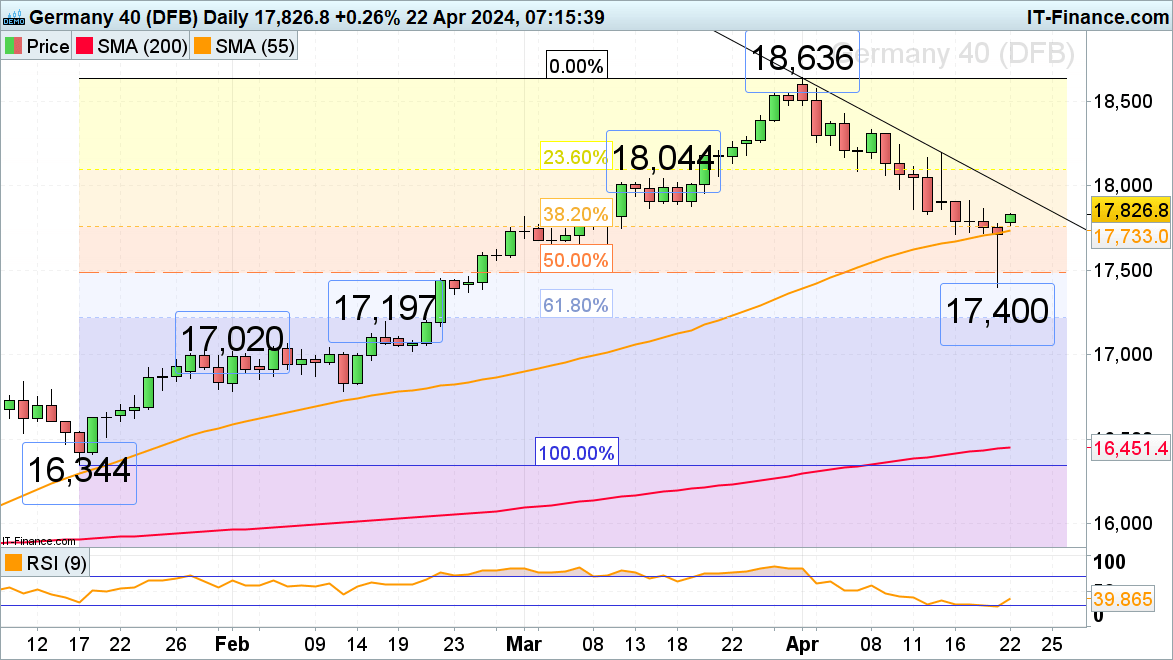

DAX 40 Begins Recovery

The DAX 40 experienced a similar decline, reaching lows last seen in late February at 17,400 following the regional tensions. A Hammer pattern on Friday's chart preceded a rebound above the 17,773 mark by Monday, targeting the April downtrend line at 17,976 and nearing the 18,000 level.

A close above Friday's high would confirm a bullish reversal at least in the short term. Should there be a dip, the 55-day SMA at 17,733 could provide support, with further cushions at the 7 March low of 17,619 and the mid-January to April 50% retracement level at 17,490.

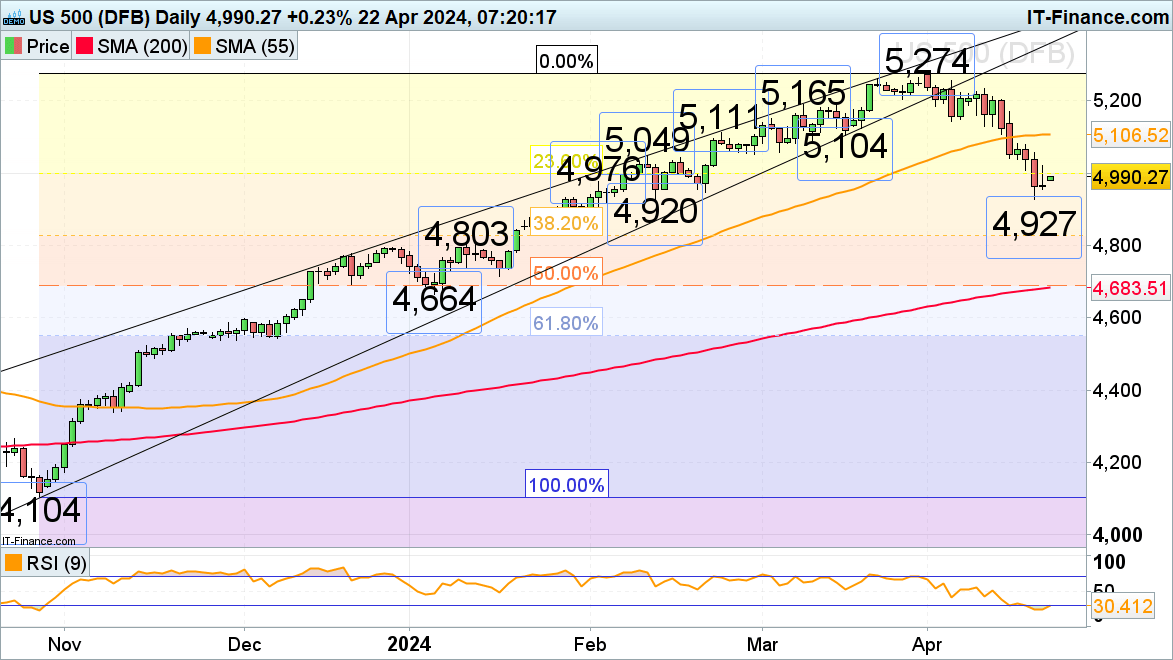

S&P 500 Edges Towards Recovery

The S&P 500 is working to reclaim positions lost over three consecutive weeks of declines, which brought it to a two-month low of 4,927 amid heightened Middle East tensions and firm Federal Reserve policies. With tensions appearing to ease, the index is pushing towards the psychological barrier of 5,000, which may serve as resistance.

The next significant resistance could be at the mid-February peak of 5,049. Support is likely near the low of the previous Friday's Harami pattern at 4,954, with additional support just below at the 4,927 and 4,920 levels.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.