Global Economic Dynamics: Analyzing Japan’s Inflation Shift and Market Resilience

By John V

February 28, 2024 • Fact checked by Dumb Little Man

Recent changes in Japan’s inflation rate point to a minor decline, which would mean the country is getting closer to the central bank’s 2% target. This change may raise the possibility of a rate hike in Japan, which would complicate global economic dynamics. In the meantime, the potential influence of US and German economic indicators on changes in the market is constantly watched. These indicators include statistics on durable goods and consumer confidence.

Technical and Fundamental Effects

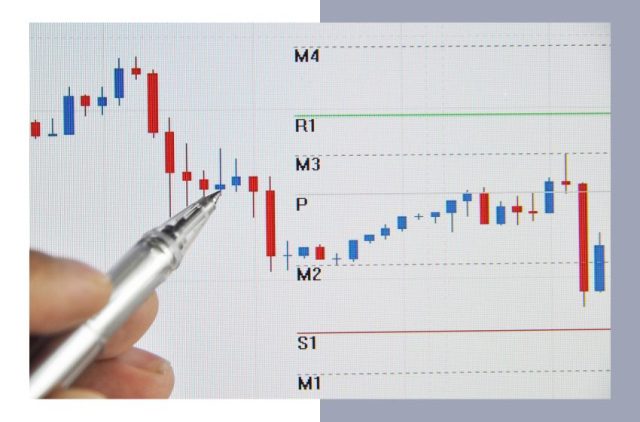

The euro and pound have strengthened against the US dollar in recent weeks, which contrasts with the US currency’s declining trend. All things considered, market activity has been very steady generally, with little volatility and few swings.

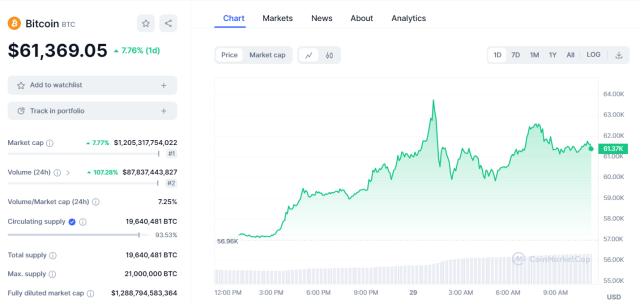

Notably, the market for cryptocurrencies, which includes Bitcoin and Ethereum, has demonstrated resilience and upward momentum, and there is anticipation for future developments that may have an impact on their value. However, because digital currencies are inherently unpredictable, caution is advised.

Attention turns to impending economic releases and speeches that could provide insights into future trends as traders wait for more information and events that could impact market mood. Although things are calm right now, there could be potential for significant shifts in market dynamics at some point, emphasizing how critical it is to be aware of the risks and opportunities that could arise.

Market Outlook

Asian markets exhibit mixed performance, with US stocks near record levels amidst subdued trading. Due to regional concerns, Hong Kong and Shanghai are experiencing decreases despite budgetary efforts. As Australia’s inflation rate steadies and influences Reserve Bank decisions, China’s real estate market comes under investigation. Positive earnings results help US equities keep their momentum.

Bitcoin and Ethereum lead the spike in cryptocurrency prices. The focus shifts to economic data releases amid conflicting signals, such as consumer confidence and inflation forecasts. While the US dollar performs differently against other major currencies, oil prices somewhat decline. Vigilance and adaptability are still essential for managing changing market situations.

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.