GBP/USD, EUR/GBP: Sterling Falls Post-BoE Comments

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

The Bank of England (BoE) has indicated that UK inflation could decline more swiftly towards the target than previously anticipated. This week, Governor Bailey highlighted a positive trend in inflation reduction, pointing towards a potential rate cut. He noted the UK’s achievement of “disinflation at full employment,” signifying that the economic strategy is effectively influencing the inflation rates.

Bank of England’s Optimistic Outlook

On a similar note, BoE Deputy Governor Dave Ramsden expressed increased confidence that the persistence of domestic inflation is diminishing, supported by improved economic dynamics. According to Ramsden, the latest data suggests that risks to inflation are now skewed to the downside, making it plausible for inflation to hover around the 2% target over the projected period.

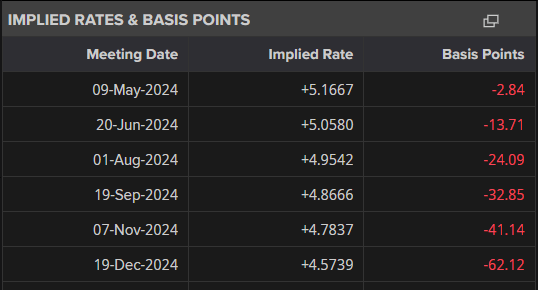

Shift in UK Rate Cut Expectations

Recent developments have led to an adjustment in expectations for UK rate cuts, with the market now anticipating a 25 basis point reduction as early as the central bank meeting on August 1st.

GBP/USD Exchange Rate Dynamics

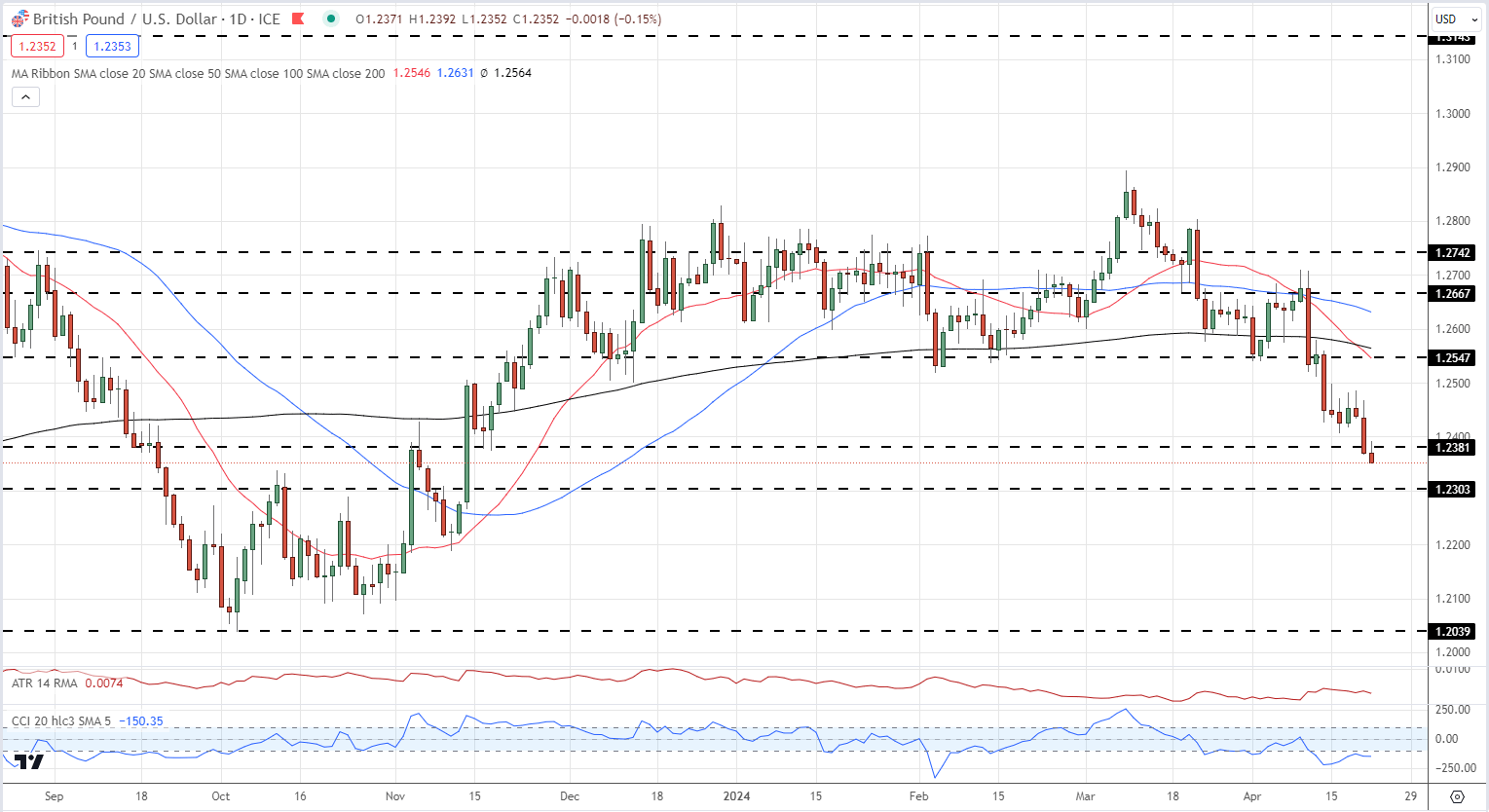

The anticipation of earlier rate cuts has weakened the British Pound across various currencies. In the forex market, the GBP/USD pair has breached the 1.2400 mark, eyeing further declines toward key support levels, including the significant Fibonacci retracement markers.

GBP/USD Daily Price Chart

IG Retail data indicates a predominance of net-long positions among traders, with a notable long-to-short ratio. This sentiment often serves as a counter-indicator, suggesting potential further depreciation in the GBP/USD rate.

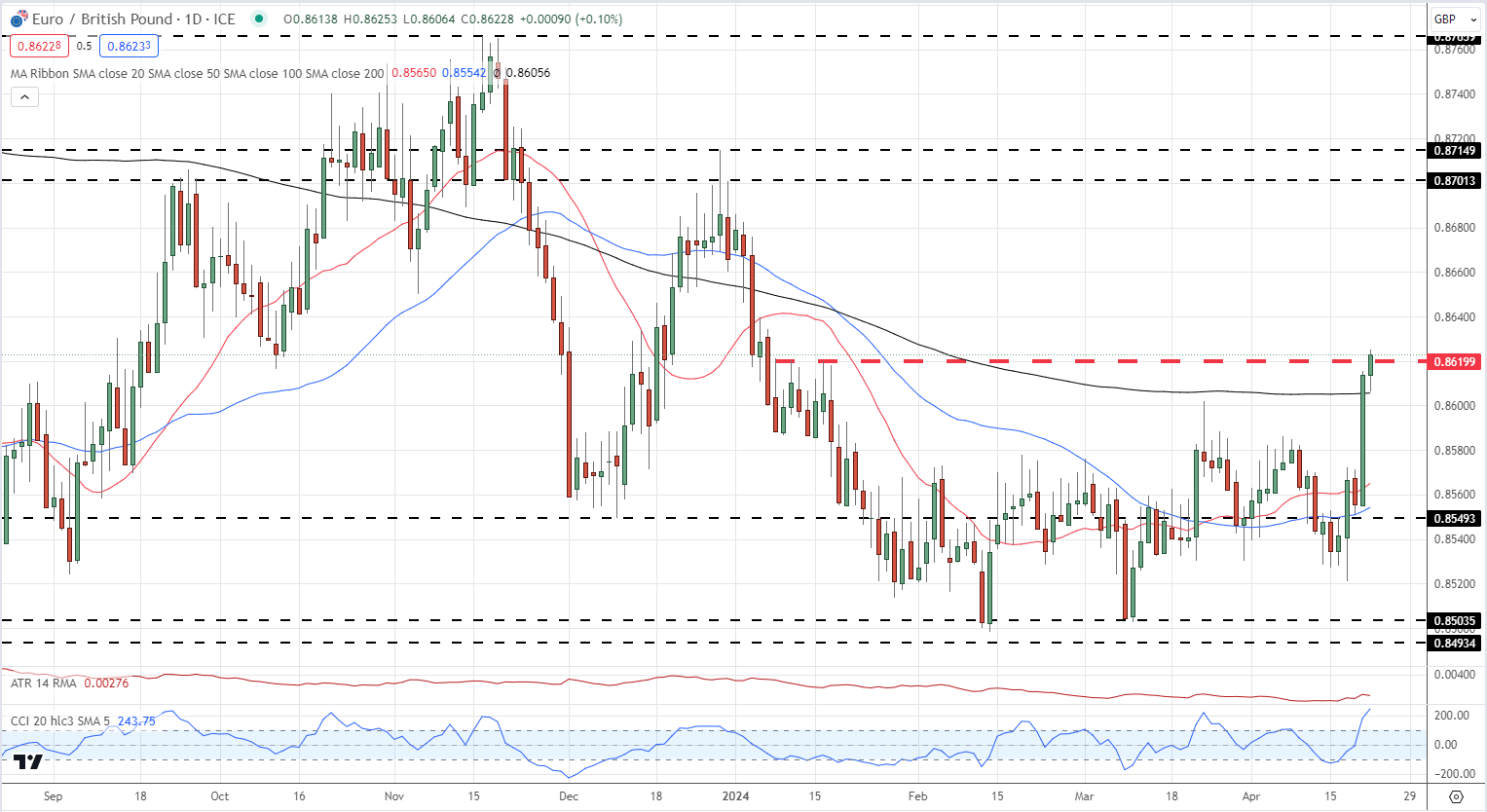

EUR/GBP Exchange Rate Trends

Contrasting with the GBP, the Euro exhibits relative strength, particularly noticeable in the EUR/GBP pairing. The European Central Bank (ECB) is poised to cut rates sooner than the BoE, reinforcing the Euro’s advantage. A decisive break above 0.8620 could open the path to higher resistance levels.

EUR/GBP Daily Price Chart

The current dynamics between the British Pound and the Euro illustrate a significant shift in investor expectations, influenced by the central banks’ policies and economic indicators.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.