Further Upside for FTSE 100, DAX 40, and Dow

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

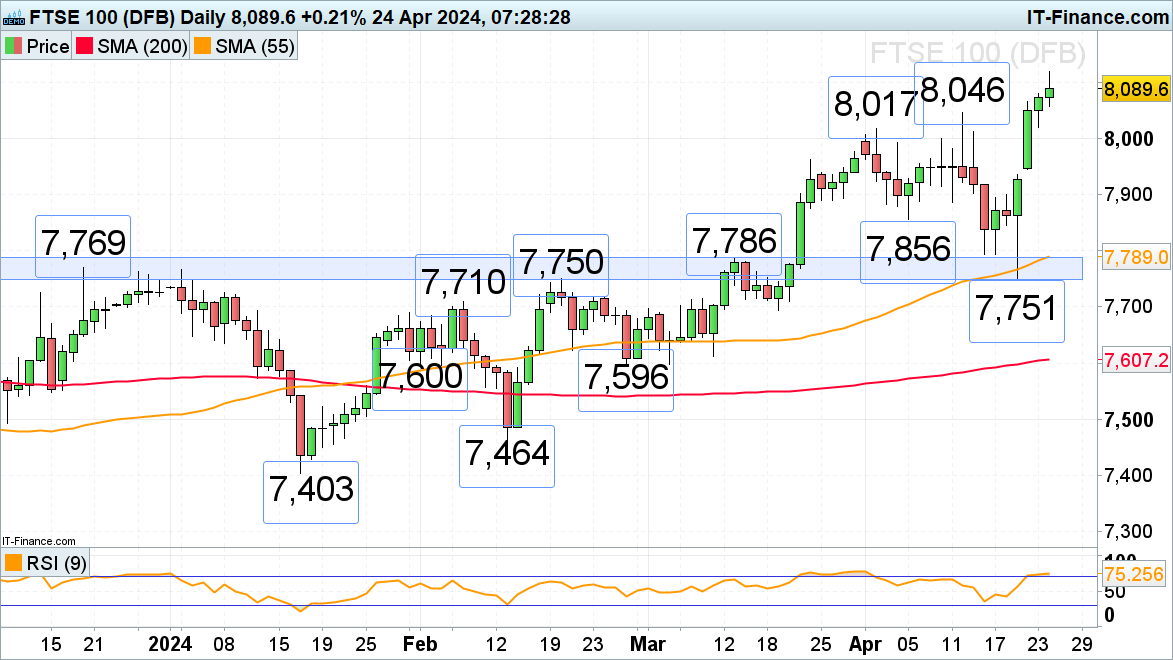

FTSE 100 Hits New Record Highs

The combination of a weaker pound sterling and foreign investor purchasing has pushed the FTSE 100 to another record high on Monday.

Despite the pound’s recovery after hawkish comments from BoE chief economist Huw Pill, the FTSE 100 maintained its upward trajectory, marking its fourth consecutive day of gains.

Minor support is identified between 8,046 to 8,017 from early-to-mid-April highs. Looking ahead, the 161.8% Fibonacci extension from the March-to-June 2020 rise, starting at the October 2020 low, suggests a potential upside target near 8,300.

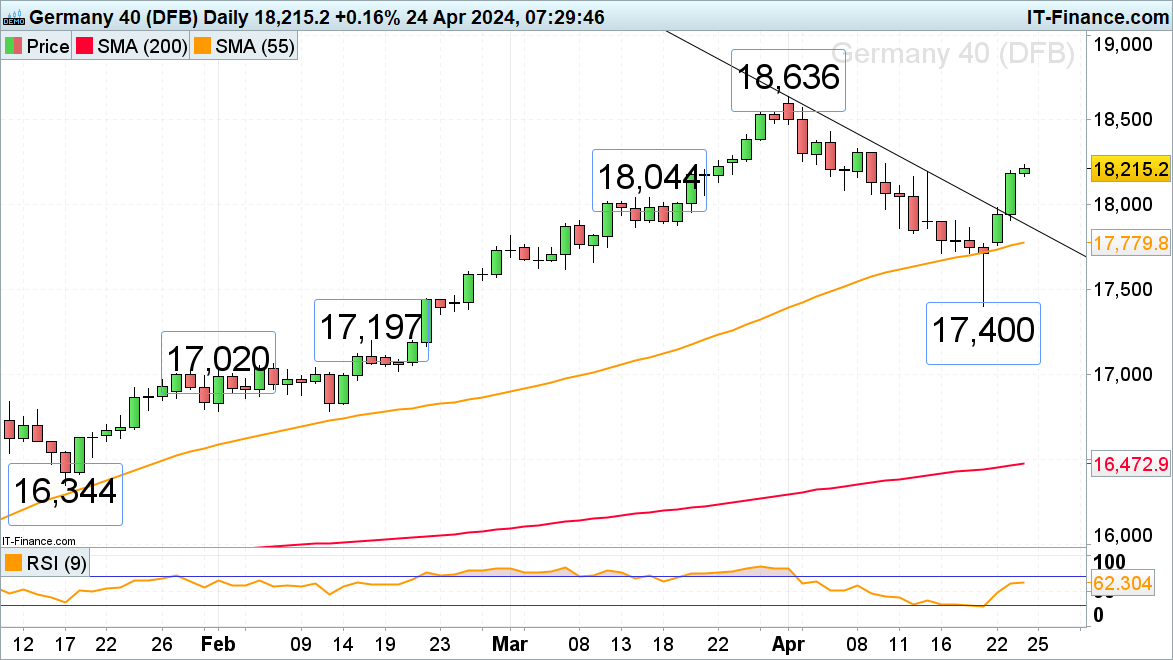

DAX 40 Rebounds Strongly

After rebounding from last week's low of 17,400, the DAX 40 has mounted a significant rally, attempting to surpass last week's high of 18,195.

If it closes above this on a daily basis, the April 8 high at 18,329 and the April 4 high at 18,429 will be the next targets.

Minor support is noted at the April 5 low at 18,085 and the 18,000 psychological level.

Retail data indicates that 21.75% of traders are net-long, with the long-to-short ratio at 3.60 to 1. The number of net-long traders is 10.60% lower than yesterday and 28.67% lower than last week, while net-short positions have increased by 10.60% since yesterday and 15.38% from last week.

Given our contrarian view on crowd sentiment, the prevailing net-short stance suggests the DAX 40 may continue its ascent.

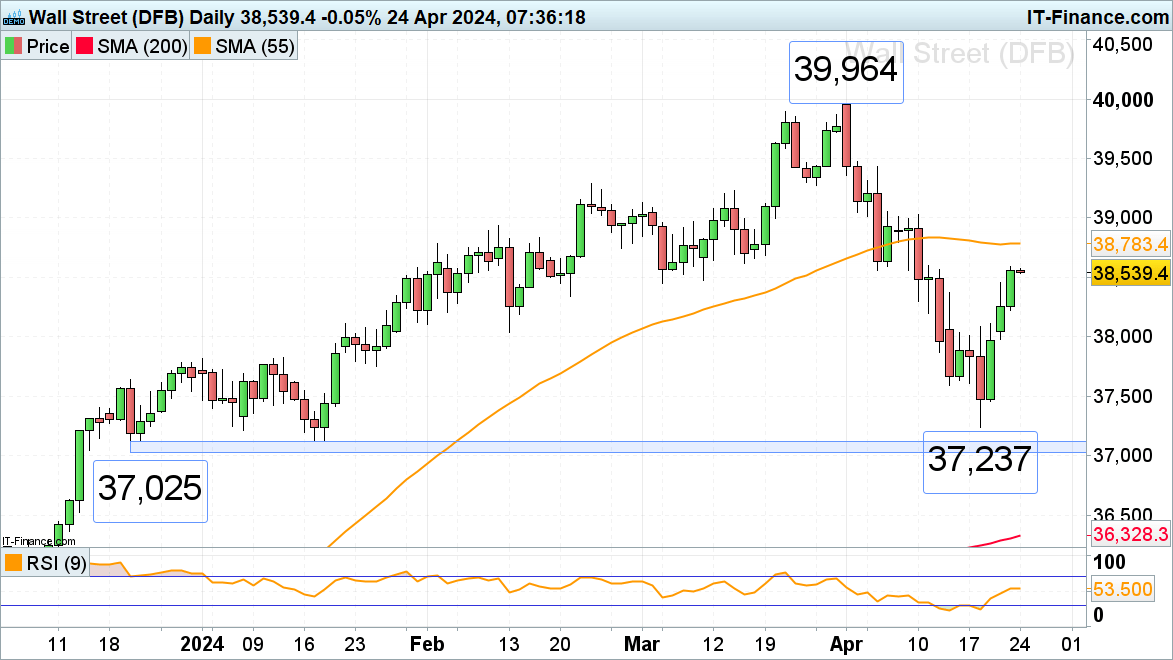

Dow Jones: Continued Rally

The Dow Jones has recovered well since last week, posting a 3% increase. The 55-day SMA at 38,783 is now a likely upward target, followed by the April 10 high at 39,029.

Potential dips might find support near the March low at 38,452 or the late February low around 38,336.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.