FTSE 100, S&P 500, and Nasdaq 100 Rise on Rate Cut Hopes

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Investors eye the FTSE 100, S&P 500, and Nasdaq 100 as they navigate through a landscape shaped by rate cut expectations and market optimism. These indices are in the spotlight, showcasing significant movements influenced by global economic signals.

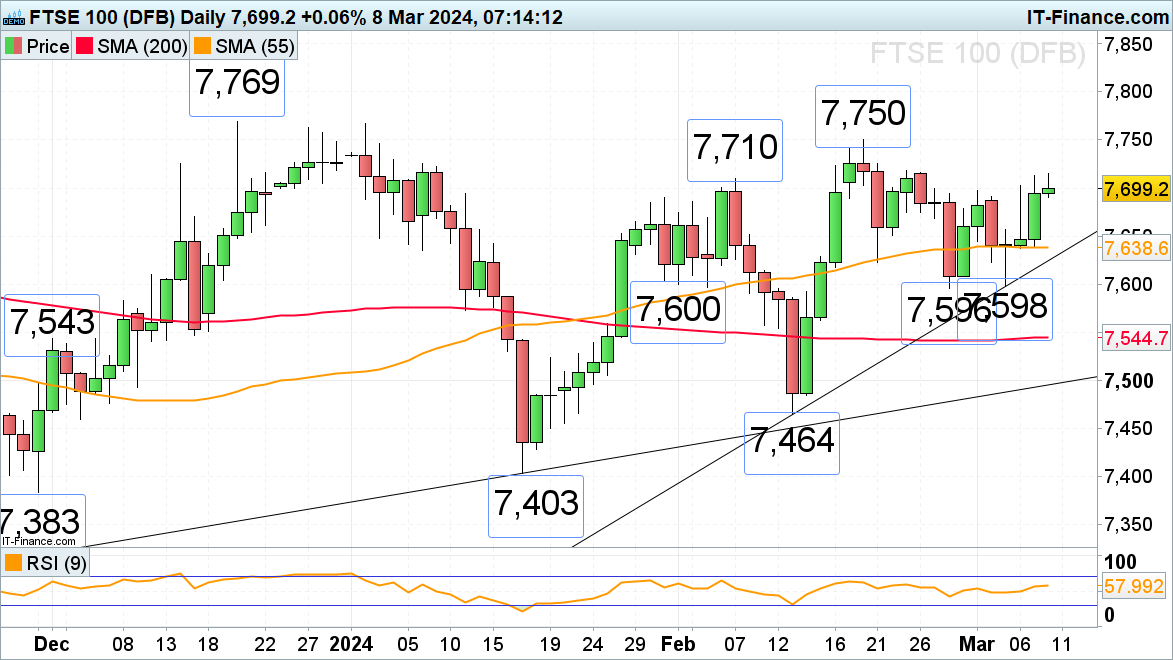

FTSE 100 probes the 7,700 to 7,710 resistance area

The FTSE 100 navigates through the 7,700 to 7,710 challenge zone. This index is riding the wave of optimism, powered by M&A activities, strong performance, and the anticipation of rate cuts in the summer. It is currently testing the resistance area between 7,700 and 7,710, which echoes the early February peak.

Breaching this could set the stage for aiming at the December and February ceiling of 7,750 to 7,769. The 55-day simple moving average (SMA) at 7,639 offers solid support.

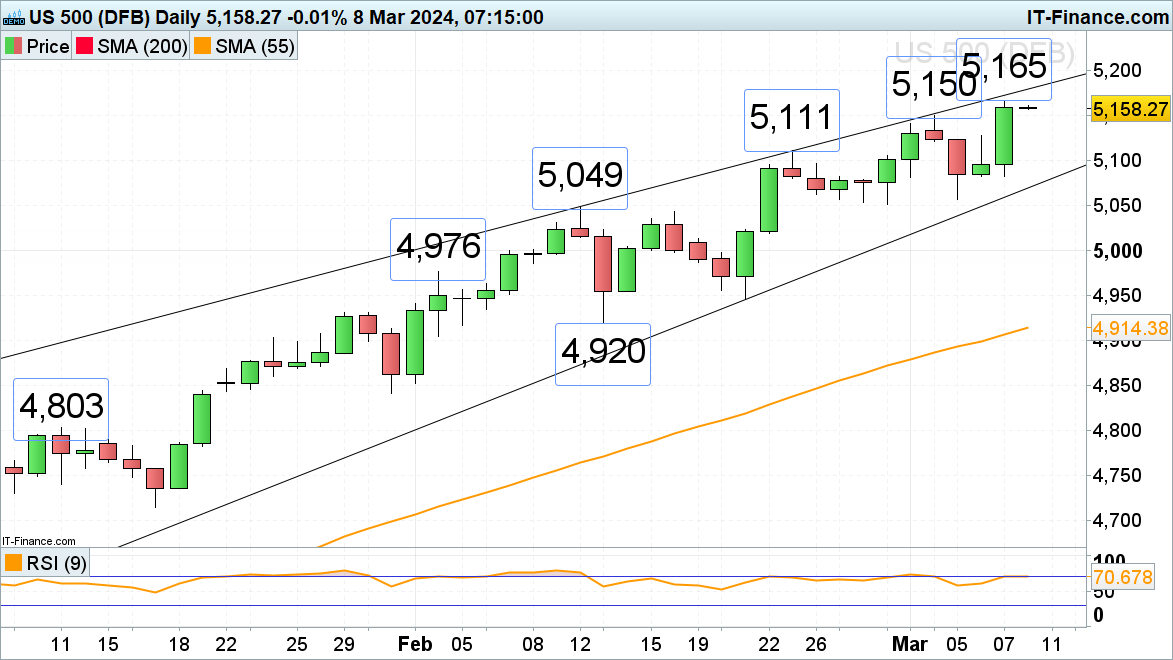

S&P 500 Reaches New Summit

The S&P 500 climbs to unprecedented heights, fueled by the hopes for rate reductions and positive market sentiment, marking a new record at 5,165. The next milestone is set at the 5,200 threshold. Support resides in the gap between the recent peak of 5,128 and the high of February 23 at 5,111.

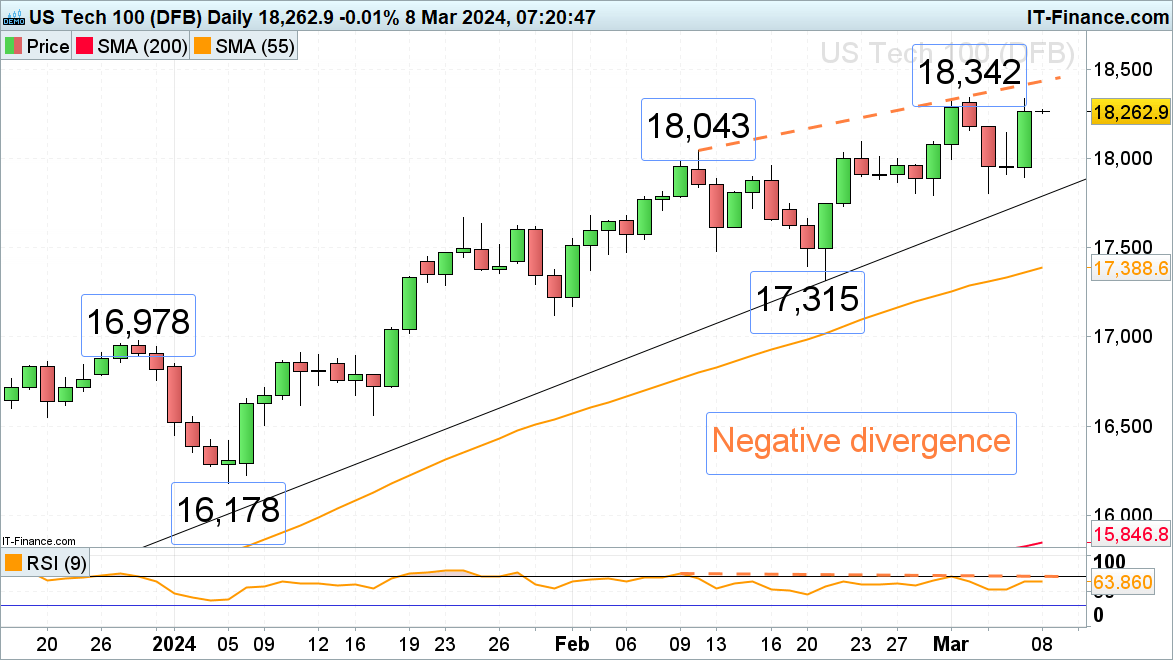

Nasdaq 100 Aims for Record Heights Again

Following a significant fall from Monday's peak of 18,342 to a low of 17,805 on Tuesday, the Nasdaq 100 rebounds, targeting the 18,400 area, especially with the anticipation of the US Non-Farm Payrolls announcement.

Despite the temporary setback indicated by the daily RSI's negative divergence, the trend remains bullish as long as the 17,805 support holds firm.

This analysis highlights the potential for further gains in these indices, driven by market optimism and speculative rate cuts, offering a detailed perspective for investors looking to navigate these trends.

Final Thoughts

In conclusion, the trajectory of the FTSE 100, S&P 500, and Nasdaq 100 underscores the intricate relationship between monetary policy expectations and market dynamics. The resilience of these indices, amid shifting economic forecasts, points to a potentially bullish outlook for investors willing to navigate the complexities of global finance.

As markets react to the anticipation of rate cuts, investors should remain vigilant, analyzing trends and positioning themselves to capitalize on opportunities that arise from these economic indicators.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.