FTSE 100 Hits Record High; Dow, Nasdaq Also Advance

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

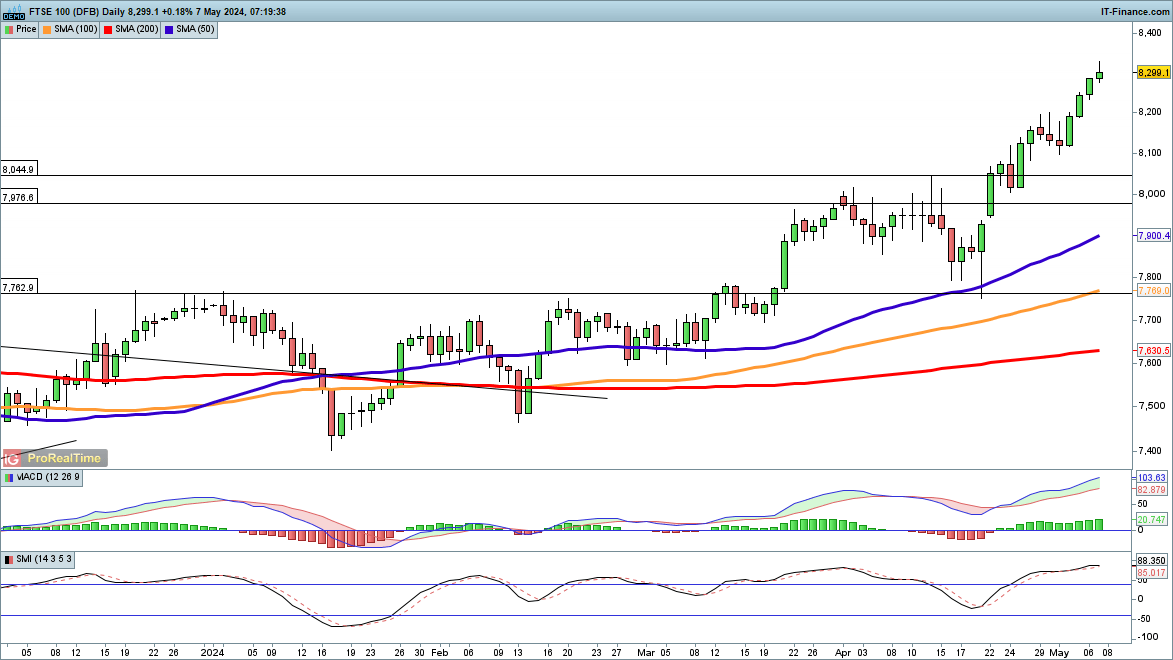

FTSE 100 Daily Overview

The FTSE 100 index has been on an excellent upward trend, posting significant gains and reaching new records. Last week, the index outperformed expectations by breaking the 8,300 barrier and reaching a new high of 8,335.68.

This is the 11th advance in the last 14 sessions, with the market closing 1.2% higher. However, the index is presently highly overextended, about 5% above the 50-day SMA, which could indicate a near-term decline. A drop below 8,100 could signal the beginning of a pullback.

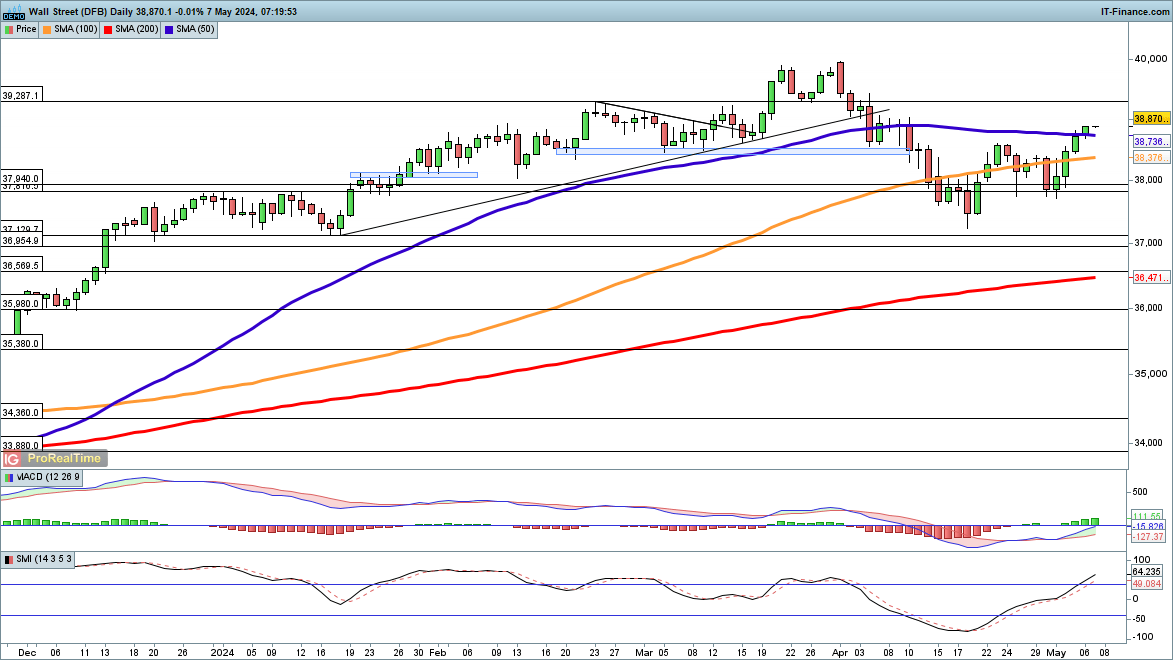

Dow Jones Industrial Average Insights

The Dow Jones Industrial Average is making a strong recovery, opening above the 50-day SMA for the first time since April 4. Since its three-month low in mid-April, the index has risen around 1,500 points, with the most recent close above 38,600 signaling additional upward momentum.

The next targets are 39,287 and possibly a new record around 40,000.

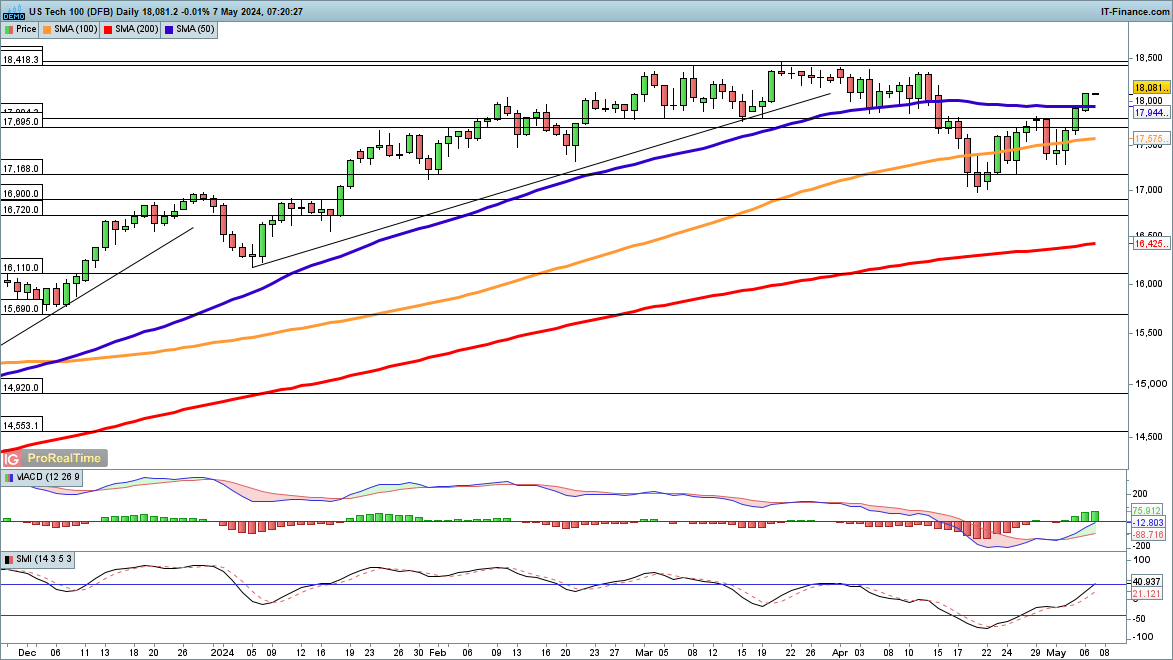

Nasdaq 100 Performance

The Nasdaq 100, like the Dow, has recovered impressively, lately closing above the 50-day SMA and reaching its mid-April high of 16,700. With major tech results out, removing a significant risk element, the index is positioned to retest its previous record high of 18,420.

However, a decline below 17,500 would reverse this bullish picture, potentially resulting in a repeat of the April low of $17,000.

UK Economic Factors and FTSE 100

The UK’s economic situation has an impact on the FTSE 100’s performance. The Bank of England’s projected interest rate cuts, which began in August, have devalued sterling, benefiting exporter-heavy equities in the index.

A survey indicating the fastest rise in British construction activity in more than a year added to the positive vibe.

Despite these encouraging signs, the UK confronts major hurdles, including political uncertainty from the impending general election and economic pressures from high national debt and sticky inflation.

Sectoral and Company Highlights

Precious metal miners and industrial support services were among the sector’s top gainers, up 2.3% and 2.6%, respectively. In contrast, BP’s shares slid 1.3% due to disappointing earnings, which were hurt by decreased oil prices and operational concerns.

Shell, on the other hand, gained 1.3% on reports of probable asset sales in Malaysia. The airline sector was under pressure as Easyjet and Wizz Air shares fell sharply following Ryanair’s CEO’s concerns about lower summer travel prices.

Market Outlook

Looking ahead, market trends indicate continued volatility, with a combination of growth potential and imminent threats. Traders should keep an eye out for Bank of England policy announcements and other macroeconomic factors that may influence market movements.

The next general election, and its results, will be critical in defining future economic policies and potentially influencing market sentiment.

Overall, while the indices are now on an upward trend, traders should be cautious, taking into account both technical positions and larger economic data when making selections.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.