France 40 Sentiment Analysis: Traders Net-Long for First Time Since November

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

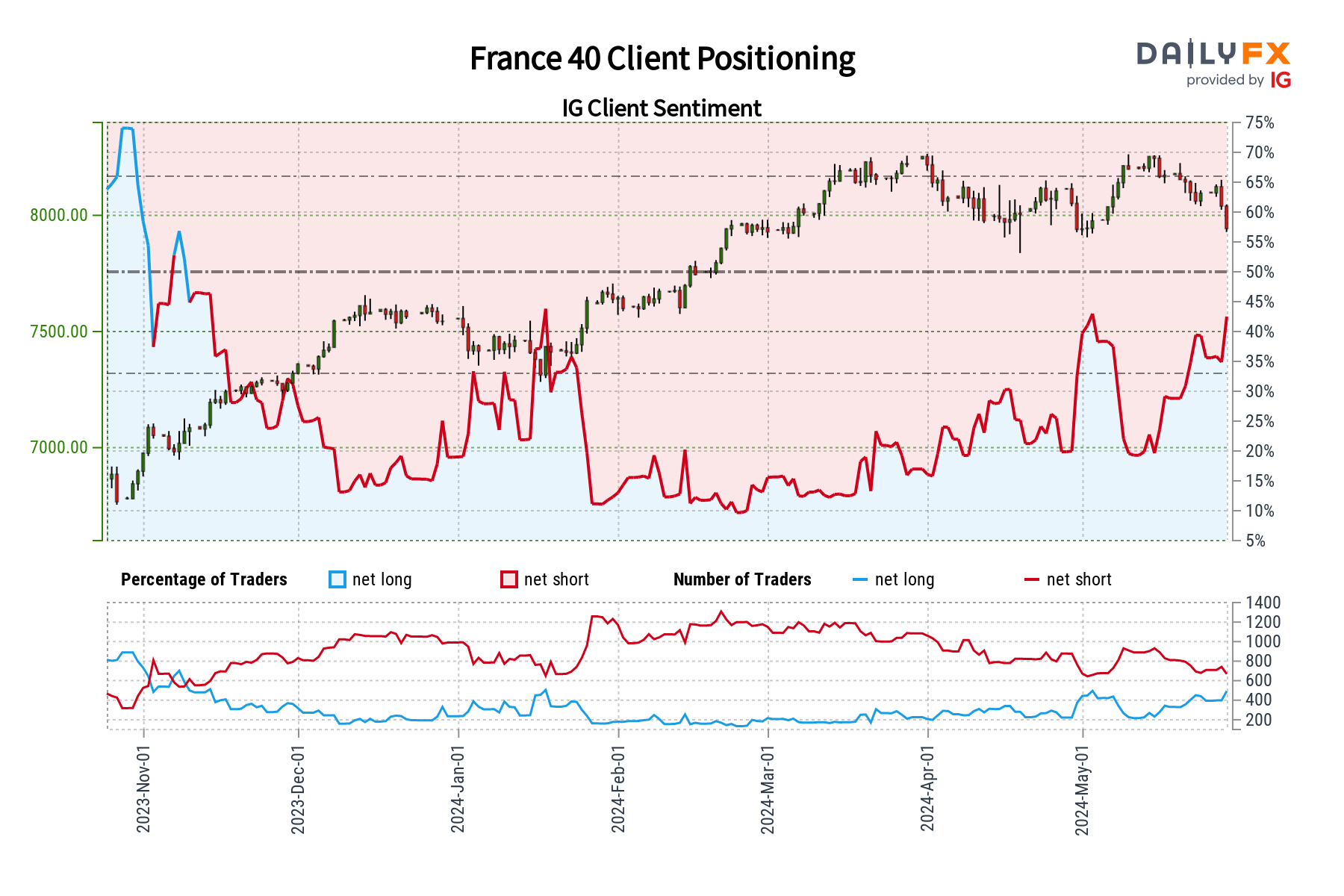

Retail trader data indicates that 52.21% of traders are now net-long on France 40, with the long-to-short ratio standing at 1.09 to 1. Since November 13, when France 40 was priced near 7,094.20, traders have maintained a net-long position.

Since that date, the index has appreciated by 11.93%. The proportion of traders net-long has surged by 27.54% since yesterday and 33.68% over the past week. Conversely, the number of traders net-short has decreased by 16.67% since yesterday and 19.97% since last week.

Traditionally adopting a contrarian stance to market sentiment, our analysis suggests that with traders predominantly net-long, there may be potential for a downward trend in France 40 prices.

Our latest data reveals traders have been net-long on France 40 since November 13, 2023, marking the first occasion since that date. The increase in net-long positions compared to yesterday and last week, combined with prevailing sentiment, points to a stronger bearish contrarian trading bias for France 40.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.