Forex Sentiment Analysis: EUR/USD, USD/JPY, USD/CAD

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Trading Strategies: Contrarian Insights

In the fast-paced world of trading, there's a tendency to follow the crowd. Yet, experienced traders often exploit the benefits of contrarian strategies. This approach entails going against prevailing market sentiment to potentially reap significant rewards.

Contrarian trading is more than just opposition; it involves recognizing when the majority may be wrong and capitalizing on these opportunities. Tools like IG client sentiment provide insights into excessive optimism or pessimism, acting as a crucial counterbalance to mainstream market views.

However, these strategies are not guaranteed and work best when combined with robust technical and fundamental analyses. This blend offers a well-rounded understanding of market dynamics, which can be missed by those simply following the crowd.

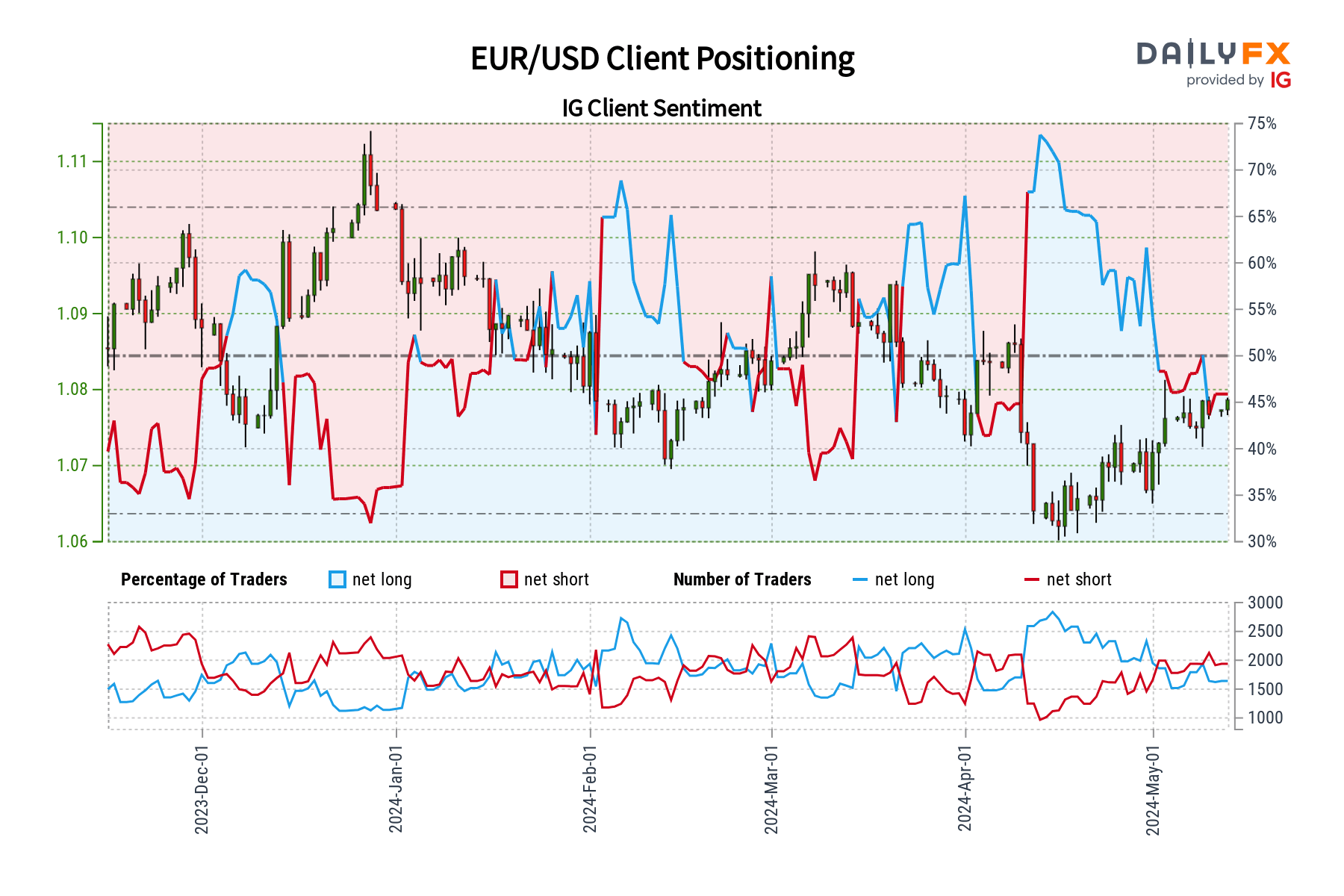

EUR/USD Outlook – Market Sentiment

IG data shows that 55.27% of traders are bearish on EUR/USD, with a short-to-long ratio of 1.24 to 1. An increase in bearish positions suggests a possible rise in EUR/USD prices shortly. This bullish contrarian signal is reinforced by recent trading patterns.

Key Point: While insightful, contrarian indicators should be part of a broader strategy that includes other analytical methods to guide EUR/USD trading.

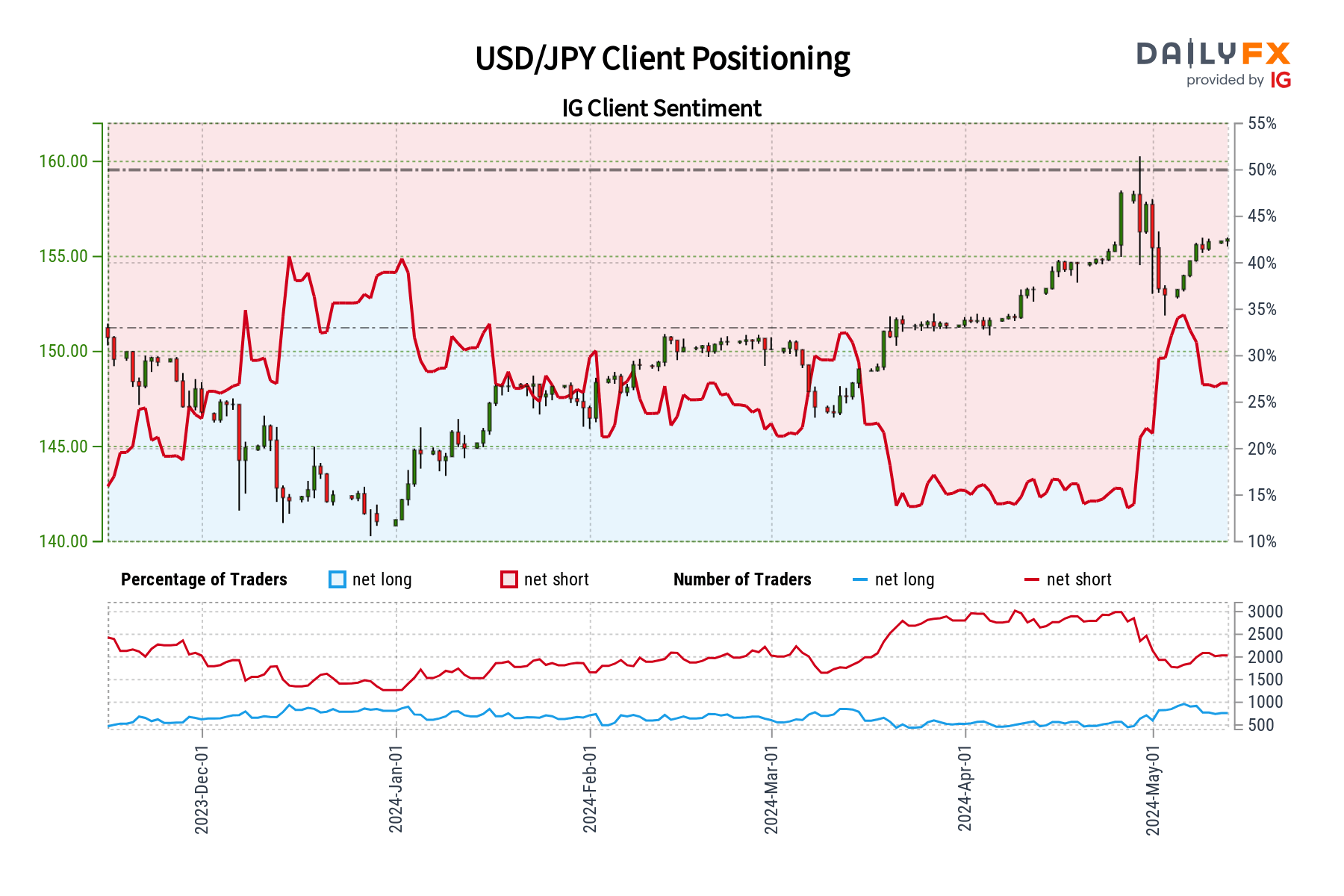

USD/JPY Outlook – Market Sentiment

According to IG, 72.13% of traders are short on USD/JPY, indicating a bearish sentiment. Despite a slight decrease in bearish sentiment from yesterday, the mixed signals require a cautious approach to using contrarian strategies alone.

Key Point: A combination of contrarian views, technical data, and fundamental insights is essential for a nuanced understanding of USD/JPY.

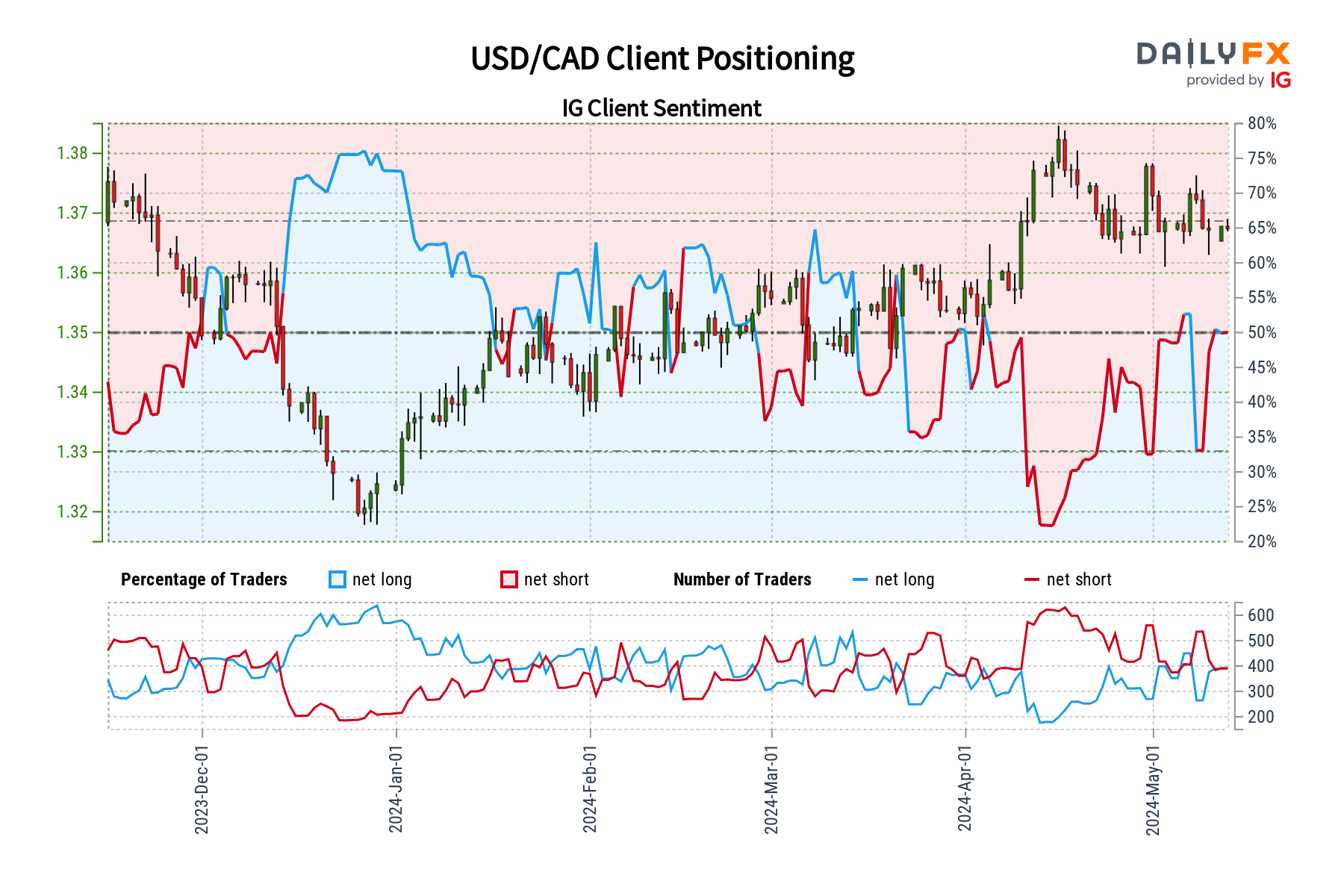

USD/CAD Outlook – Market Sentiment

The sentiment towards USD/CAD is predominantly bearish with 53.41% of traders holding short positions. An increase in these positions from yesterday suggests potential upward movement in the currency pair.

Key Point: Contrarian perspectives are valuable, but they must be evaluated within the context of comprehensive market analysis to effectively trade USD/CAD.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.