Fed on Hold, 2025 Policy Outlook Unchanged – Gold & US Dollar on the Move

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

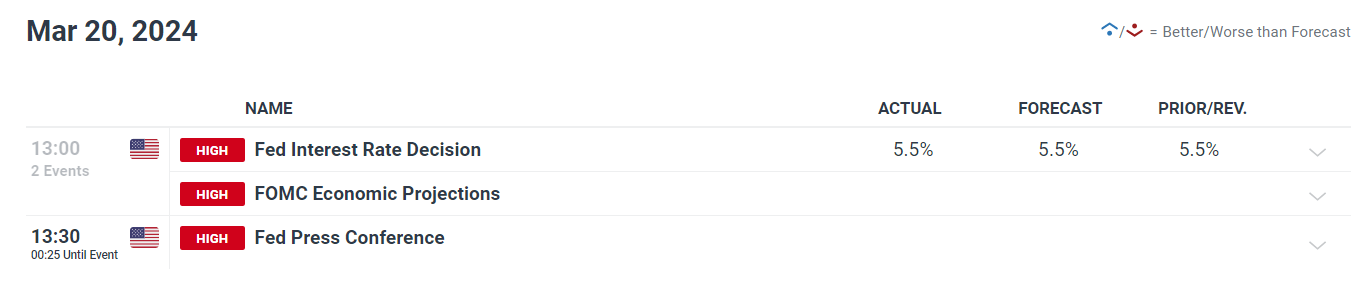

The Federal Reserve decided to maintain its benchmark interest rate at a level that would remain between 5.25% and 5.50% following its March policy meeting on Wednesday, a decision expected by analysts and investors.

The Federal Reserve has demonstrated its commitment to monetary policy stability by not adjusting borrowing costs for the fifth straight meeting. In addition, according to market expectations, officials decided to maintain their current quantitative tightening program without making any changes.

Economic Assessment and Forward Guidance

In its accompanying statement, the Federal Open Market Committee (FOMC) reaffirmed its bullish assessment of the economy, pointing out that macroeconomic indicators are still consistent with strong gains.

The declaration made clear that although the unemployment rate is still at historically low levels, economic activity has been growing steadily. Despite its continued concerns about pricing pressures, the Fed acknowledged that inflation has eased over the past year but remains elevated.

Regarding forward guidance, the FOMC reiterated its position that until it is more certain that inflation is steadily approaching its 2.0% target, it will not contemplate lifting policy restraint.

According to this statement and previous discussions, officials are holding off on taking a more accommodative monetary policy stance until they have additional proof of a persistent lower trend in inflation.

Insights from Economic Projections

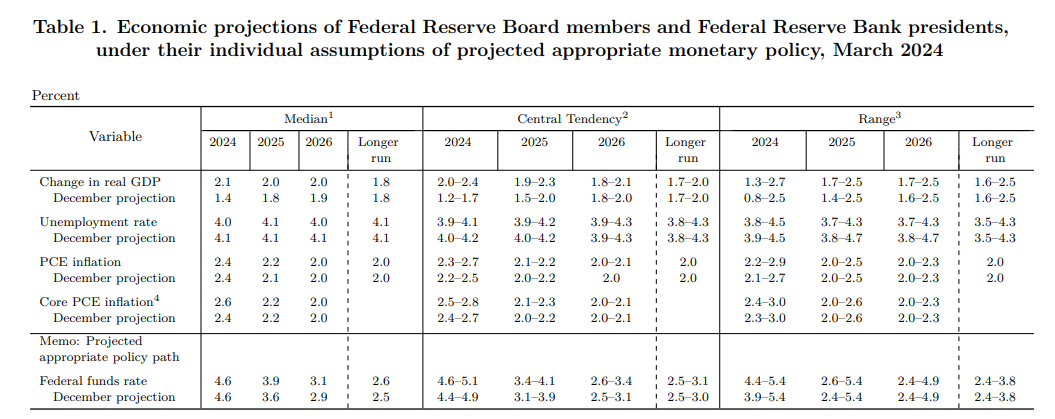

The release of the March Summary of Economic Projections provided additional insights into the Fed's outlook for key economic indicators.

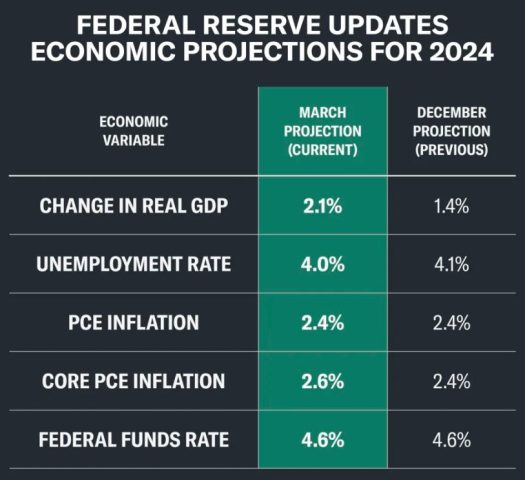

Notably, the economy's ability to weather challenges and maintain growing momentum was seen in the revision of GDP growth estimates for 2024, which went from 1.4% to 2.1%.

A further indication of the persistence of an optimistic assessment of the labor market's resiliency was the revision of the unemployment rate outlook downward to 4.0%.

Inflation expectations also saw upward revisions, with the Fed now forecasting a core PCE deflator of 2.6% for 2025, up from the previous estimate of 2.4%.

The Fed has made this adjustment to better reflect its commitment to closely monitoring inflation dynamics and its recognition of ongoing price pressures.

Dot Plot Insights and Market Reaction

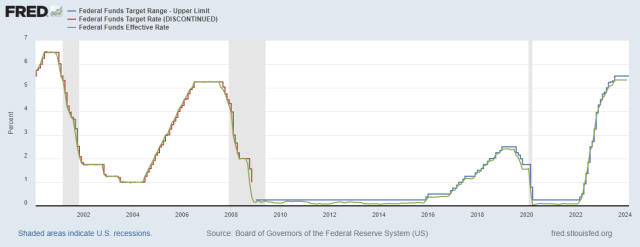

The dot plot, which shows the trajectory of interest rates as anticipated by Federal Reserve officials, did not significantly vary from earlier projections.

Policymakers continue to anticipate three quarter-point rate cuts in 2025, with rates expected to end the year at 4.6%. By 2025, rates should have gradually decreased to 3.9%, according to the estimate.

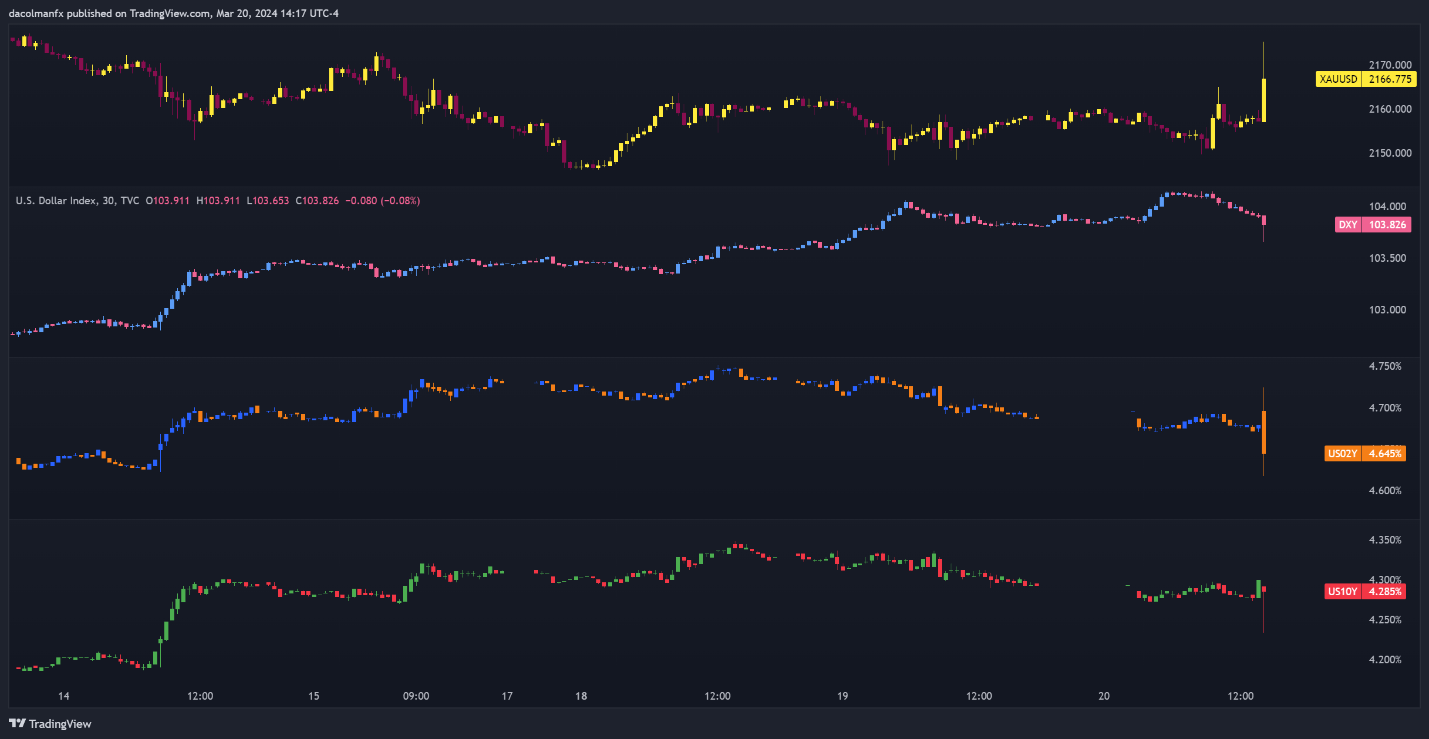

Following the Fed's statement, financial markets reacted accordingly, the U.S. dollar and bond yields dropped, and gold prices gradually increased.

A sign that rate cuts will continue until 2025 put bearish pressure on the dollar and demonstrated how sensitive the market is to signals from the monetary policy.

Final Thoughts

A cautious approach to managing economic risks is reflected in the Federal Reserve's decision to maintain interest rates and policy outlook. Prioritizing sustainable economic growth, the central bank remains vigilant about inflationary pressures.

With the market pricing in line with the Fed's estimates, investors will probably be keeping a close eye on incoming data and the remarks made by policymakers for any indications regarding the direction of future monetary policy.

A major factor influencing market sentiment and asset price fluctuations will continue to be the Fed's dedication to making data-driven decisions, even as global economic conditions change.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.