Euro Trade Setups Ahead of ECB Decision – EUR/USD, EUR/GBP and EUR/JPY

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

EUR/USD, EUR/GBP, EUR/JPY Prices and Analysis

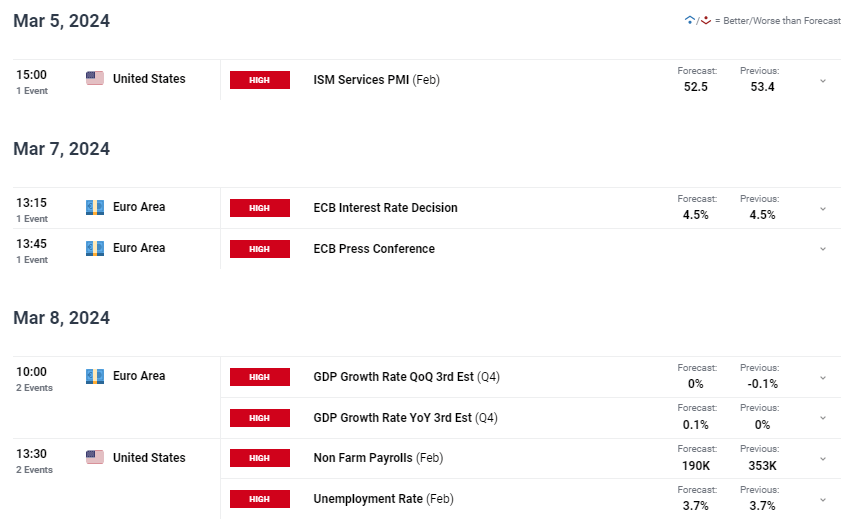

Next week, the financial calendar features several key releases and events. The spotlight will be on the ECB policy meeting and the US Nonfarm Payrolls. Expectations are set for the ECB to maintain current policy settings, yet hints about the timing of future rate cuts are highly anticipated. Market anticipation leans towards a 25 basis point rate cut by the ECB in June. Observers will closely watch for any commentary from ECB President Lagarde or voting members that may counter these expectations.

The upcoming US Jobs Report on Friday forecasts an addition of +190k jobs. Given the previous month's impressive 353k jobs created, adjustments to these figures could influence market directions.

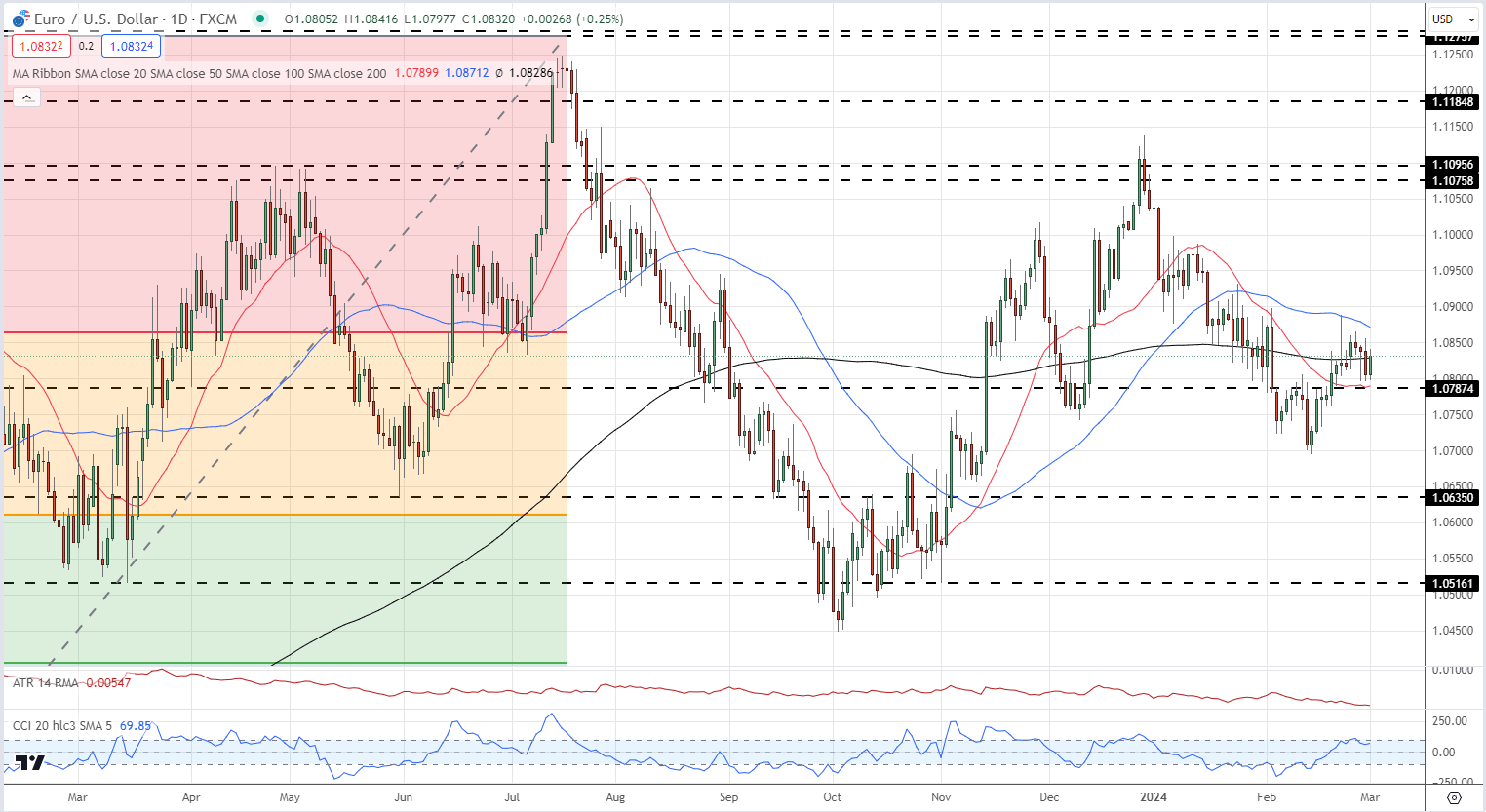

EUR/USD is trading near the 200-day simple moving average (SMA), with the upcoming week's events expected to provide directional clarity. Support is identified between 1.0787 and 1.0800, marking this week's lows and the 20-day SMA. A breach here could target the February 14th low at 1.0695. Conversely, a break above the 200-day SMA could refocus attention on the 1.0850/60 zone, highlighted by recent highs and the 23.6% Fibonacci retracement.

EUR/USD Daily Price Chart

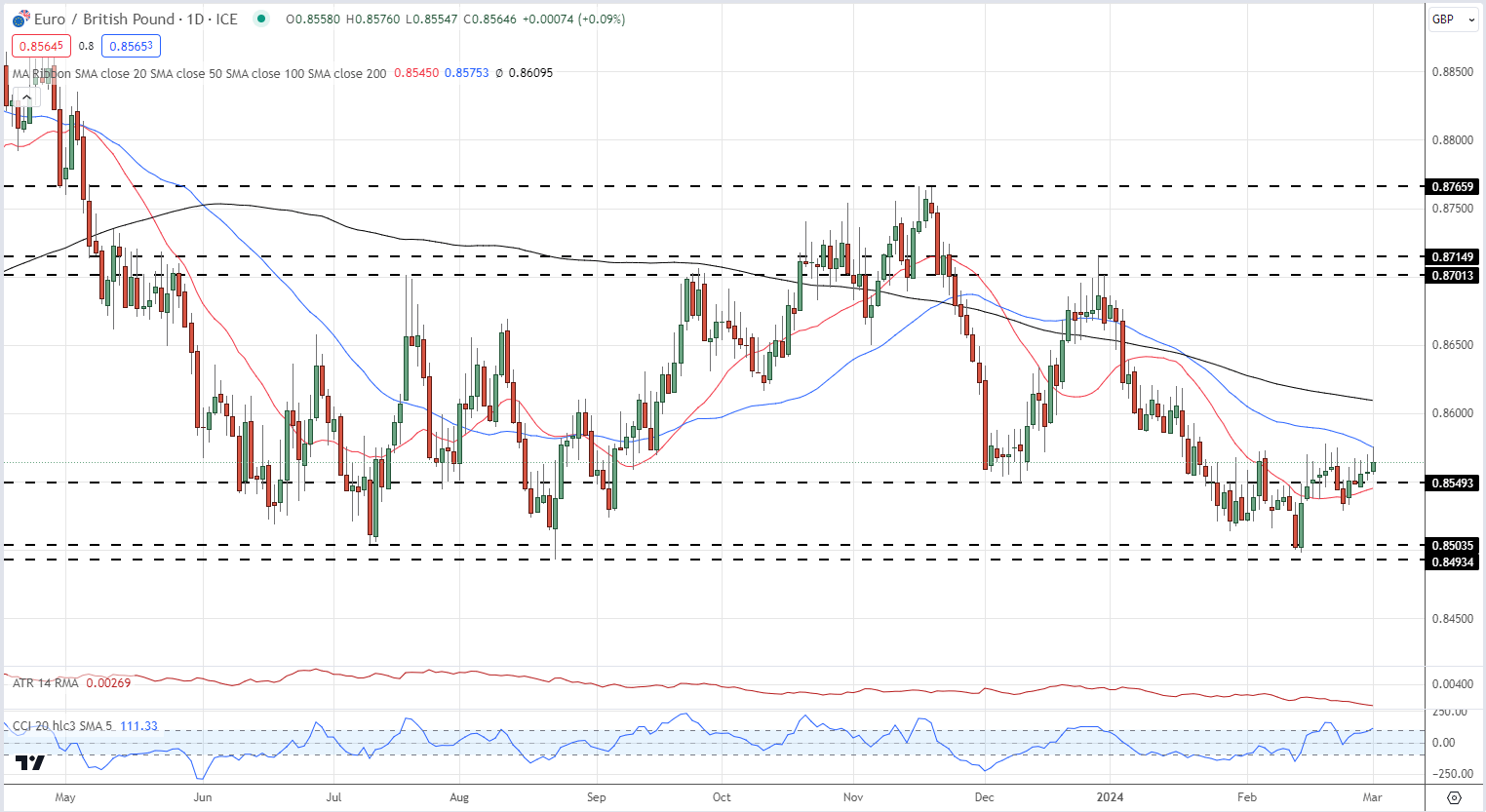

EUR/GBP has shown a steady increase, now trading at 0.8564 and above the 20-day SMA. The move has reopened focus on the 0.8578 to 0.8588 range, encompassing recent highs and the 50-day SMA. Further gains could challenge the 200-day SMA at 0.8610 and early to mid-January peaks around 0.8620.

EUR/GBP Daily Price Chart

Retail trading sentiment suggests a mixed outlook for EUR/GBP, with a majority holding long positions. The dynamic between current sentiment and recent changes hints at a potential further mixed trading bias.

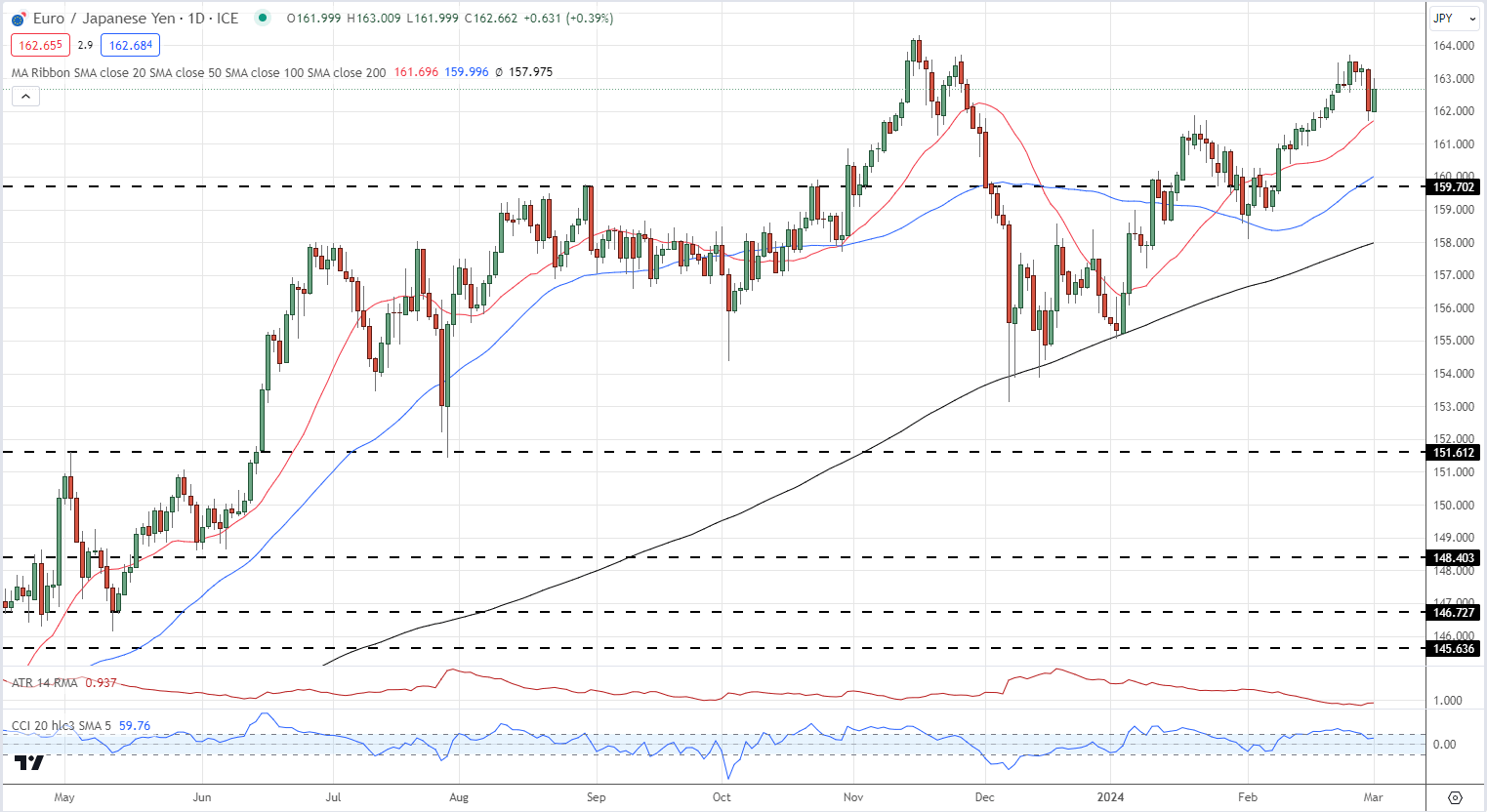

In contrast to the ECB's cautious stance, the Japanese Yen is currently influenced by the Bank of Japan (BoJ) and the Ministry of Finance, with market participants keen on any rate hike signals after prolonged low-rate policies.

Japanese Yen Grabs a Bid, Emboldened by Bank of Japan Talk

EUR/JPY faces a choppy outlook, influenced significantly by the Euro's performance. The pair's recent uptrend from February 7th appears halted, with the 20-day SMA at 161.70 now in jeopardy. Below this, the 161 zone and the 50-day SMA loom as critical supports, ahead of a solid base around 160.00. Any upward movement should consider the February 26th high at 163.72 as a potential resistance.

EUR/JPY Daily Price Chart

This week's retail trader data reflects a cautious stance on EUR/GBP, signaling a nuanced view towards market movements and highlighting the importance of sentiment analysis in trading strategies.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.