Euro FX Analysis: EUR/USD, EUR/CHF, EUR/GBP, EUR/JPY & Weekly Levels

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Market Outlook and Sentiment Analysis

In the dynamic realm of currency trading, adopting contrarian strategies can unveil hidden possibilities by deviating from conventional thinking.

IG client sentiment provides valuable insights into the market's sentiment, especially when analyzing the Euro FX pairs such as EUR/USD, EUR/CHF, EUR/GBP, and EUR/JPY.

When combined with technical and fundamental analysis, these insights offer traders a thorough understanding of the market.

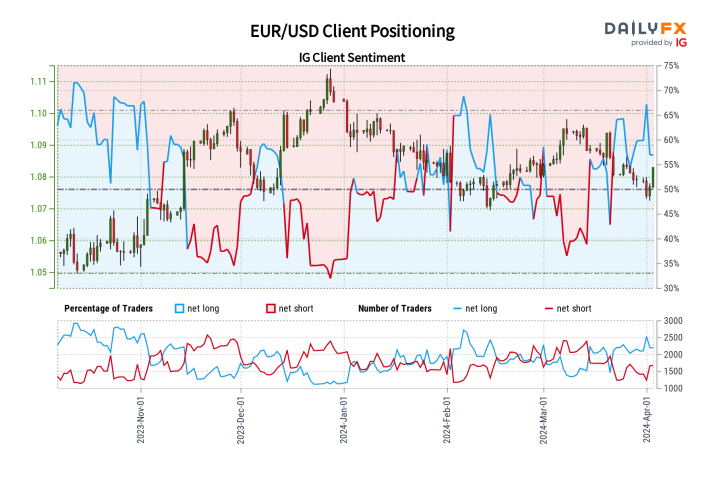

EUR/USD: A Mixed Sentiment Landscape

The sentiment surrounding the EUR/USD pair is quite nuanced, as most retail traders seem to have a slightly bullish leaning.

Nevertheless, a notable increase in bearish sentiment indicates the possibility of a positive shift. Traders should exercise caution and consider both sentiment and broader market analyses.

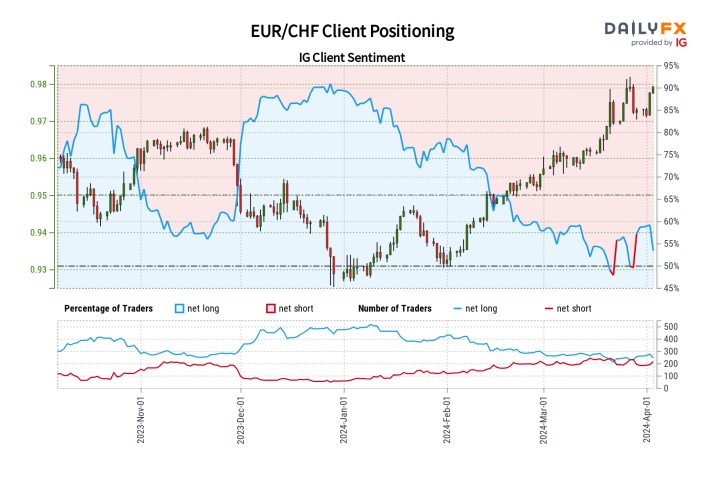

EUR/CHF: Bullish but Waning

Traders are currently expressing a positive outlook for EUR/CHF, although there are indications of a potential decline. There are conflicting indicators and a decline in optimistic positions that suggest the possibility of downward corrections.

The future movements of this pair require a careful approach, highlighting the significance of a comprehensive analysis strategy.

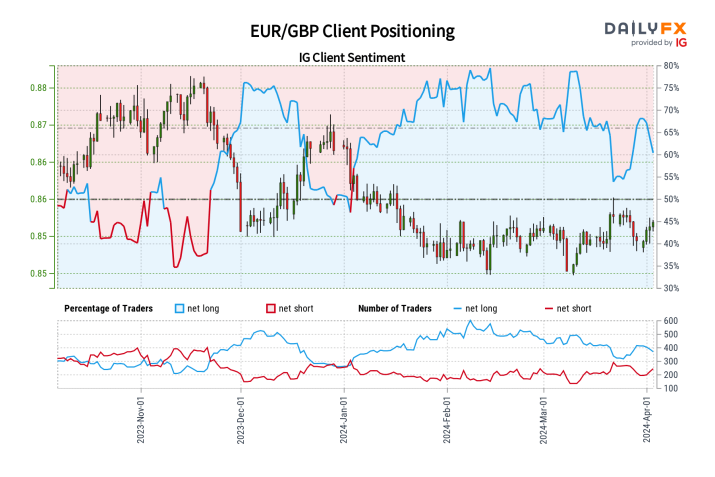

EUR/GBP: Optimism Faces Resistance

The EUR/GBP pair is currently experiencing a strong bullish sentiment, although recent changes indicate a more balanced market dynamic.

Considering the current market conditions, it is important to remain cautious and employ a balanced approach that combines both sentiment and technical analysis.

Although there are some predictions of a potential decline from contrarian perspectives, the overall long-term trend remains uncertain, emphasizing the need for careful observation and analysis.

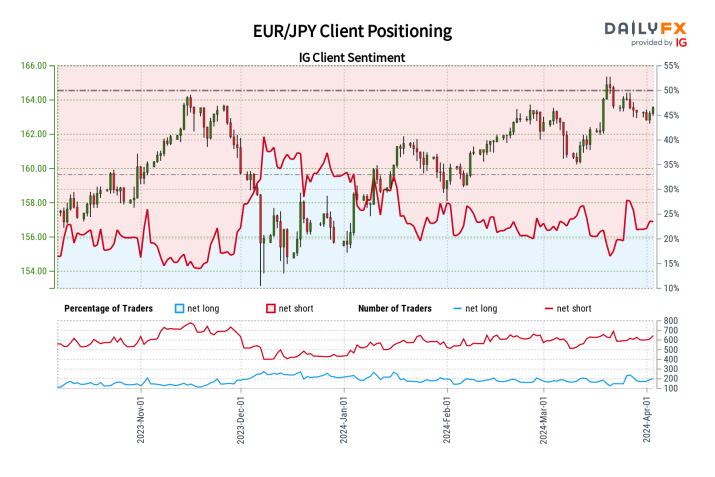

EUR/JPY: Bearish Bias with a Silver Lining

The EUR/JPY landscape is currently dominated by a strong bearish sentiment. However, the rise in long positions combined with a bearish weakening suggests the possibility of upward corrections.

It is important to closely track changes in sentiment and correlate them with technical indicators.

Technical Insights: EUR/USD and EUR/CHF

The EUR/USD is nearing important support levels, suggesting possible changes in price shortly. Traders should closely monitor any reactions occurring around the 1.0704/12 area. A potential breakdown in this region could indicate the possibility of additional declines.

There is a level of resistance near the 52-week moving average, and if it is broken, it could indicate a possible upward trend.

The EUR/CHF pair continues to show strength as it remains within an upward channel, even in the face of occasional bearish corrections.

Key economic indicators, such as the EU unemployment rate and inflation data, offer valuable insights into the currency pair, shedding light on the uncertainties at play.

Conclusion

The current state of the Euro FX market is characterized by a multitude of factors that influence both investor sentiment and technical indicators.

Traders are advised to adopt a market analyst mindset, incorporating contrarian perspectives and relying on thorough technical and fundamental analyses to make informed decisions.

Staying adaptable and well-informed will be the key to navigating the ever-changing market in these uncertain times.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.