Euro Dips as ECB Holds Rates; EUR/USD, EUR/GBP Affected

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Impact on EUR/USD and EUR/GBP Amid Monetary Policy Divergence

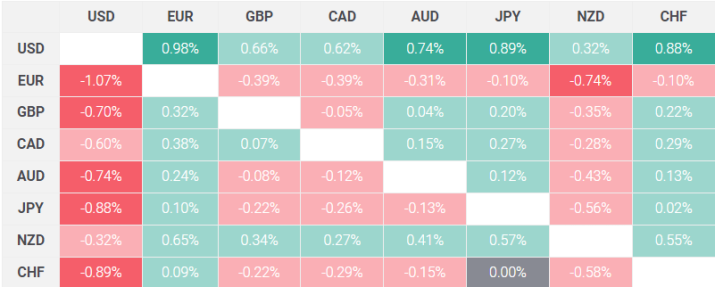

The euro fell against major currencies, including the US dollar and the British pound, after the European Central Bank (ECB) decided to keep interest rates unchanged at their April meeting.

EUR/USD lost 0.2%, closing at 1.0725, while EUR/GBP fell 0.3%, falling through its 50-day simple moving average to end at 0.8542.

ECB's Dovish Stance Signals Potential Rate Cuts

During the press conference, ECB President Christine Lagarde emphasized the bank's shift to a more dovish monetary policy, implying a rate cut as early as June. This move is due to greater confidence in the ongoing disinflation process and a worse economic outlook.

Lagarde stated that the recovery would be underpinned by a gradual improvement in real incomes and an increase in exports, however, she noted that growth risks remain on the downside.

Comparative Central Bank Policies

The ECB's projected easing comes ahead of comparable steps by the Federal Reserve and the Bank of England, which will influence the euro's performance against those currencies.

The Fed's chances of cutting rates have decreased as a result of recent robust inflation and labor market data, in contrast to the ECB's upcoming easing measures.

In contrast, the Bank of England may begin lowering borrowing costs by August, but at a slower pace than the ECB's predicted 75 basis points of easing.

Technical Analysis: EUR/USD and EUR/GBP

EUR/USD Outlook

Following a strong loss, technical indicators indicate that if the euro's depreciation continues, the next support levels to watch are around February's lows of 1.0695, with more downside potential to 1.0640 and 1.0450.

However, a reversal might cause the EUR/USD to seek the 50-day and 200-day simple moving averages at about 1.0825, with a possible extension to 1.08.65.

EUR/GBP Outlook

EUR/GBP faces similar difficulties, having lately retreated from trendline resistance at 0.8585. If the euro falls further, support may develop at 0.8285, with a considerable danger of dropping to year lows.

On the upside, a recovery would face resistance near the 50-day simple moving average at 0.8550, and breaking through a longer-term descending trendline at 0.8575 might imply a larger rebound.

Market Response and Final Thoughts

The market's reaction to the ECB's news was mild, with the euro displaying modest bearish trends shortly after the decision.

The ECB's sustained dovish stance indicates that, while currency devaluation has immediate consequences, the longer-term focus is on managing inflation and supporting economic recovery inside the eurozone.

Finally, traders can expect more volatility in EUR/USD and EUR/GBP pairs as the ECB begins to implement rate decreases.

The monetary policy divergence between the ECB, Fed, and BoE is anticipated to have a significant impact on the trading dynamics of these currencies in the coming months.

Keeping a watch on impending economic data releases and central bank statements will be critical for successfully navigating these markets.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.