EUR/USD, USD/JPY, USD/CAD: Forex Market Sentiment and Outlook

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

In the ever-evolving landscape of trading, there's a constant tug-of-war between following the crowd and charting one's own path. While conventional wisdom often leads traders to ride the wave of popular sentiment, seasoned investors recognize the power of contrarian strategies. These tactics involve going against the grain of prevailing market sentiment, offering potential rewards for those willing to swim against the tide.

Understanding Contrarian Trading

Contrarian trading isn't about blind rebellion but rather about spotting opportunities where the majority may be misguided. Tools like IG client sentiment provide invaluable insights into market sentiment, highlighting moments when optimism or pessimism may be overstated. These signals offer a fresh perspective often overlooked by mainstream analysis.

However, it's essential to note that contrarian signals alone aren't a foolproof strategy. They work best when combined with comprehensive technical and fundamental analysis, providing a holistic view of market dynamics that can elude those who blindly follow the herd.

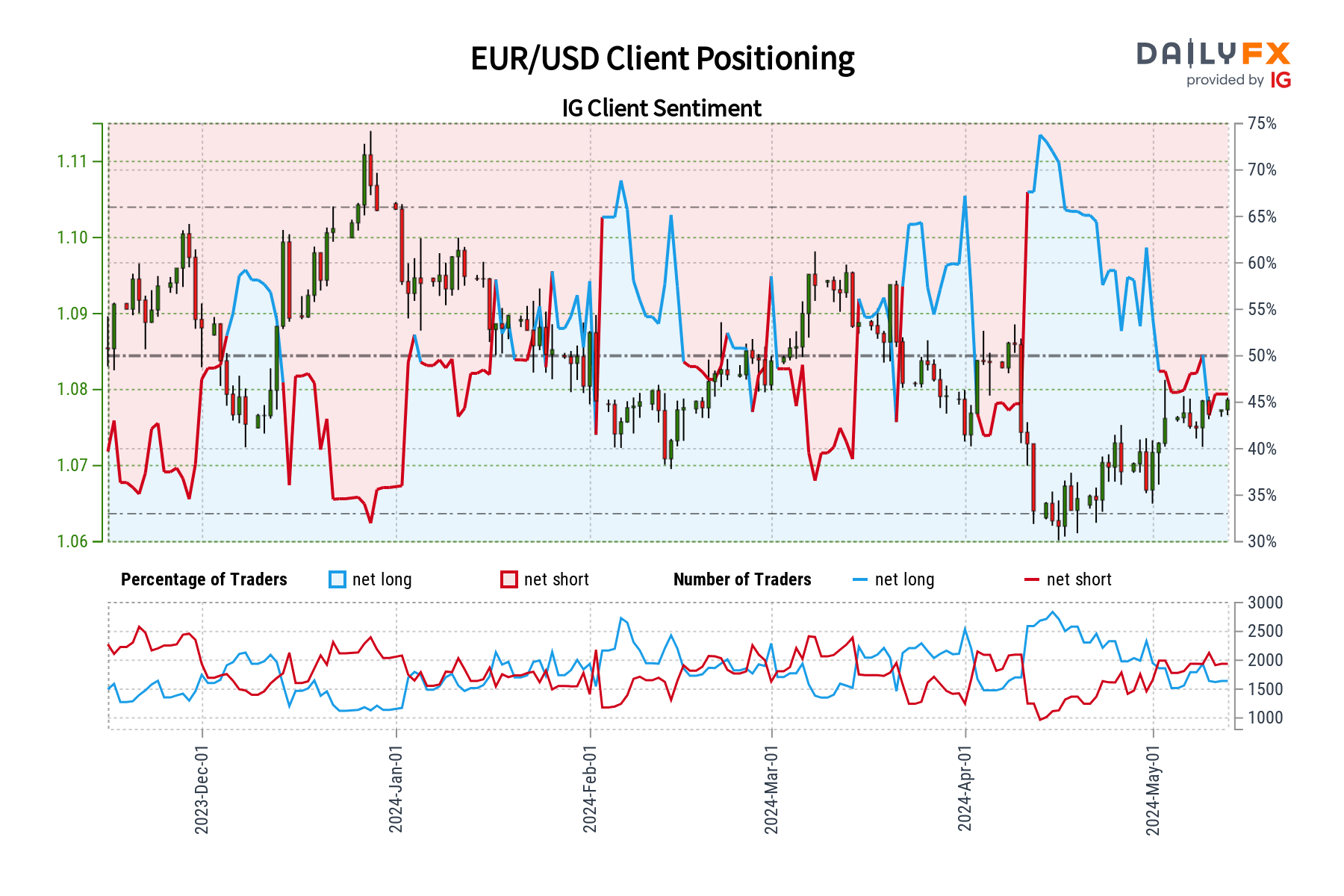

EUR/USD: Contrarian Insights

According to IG data, a majority of traders anticipate weakness in EUR/USD, with net-short positions on the rise. However, our contrarian approach suggests potential upside for the pair, supported by recent shifts in sentiment favoring long positions.

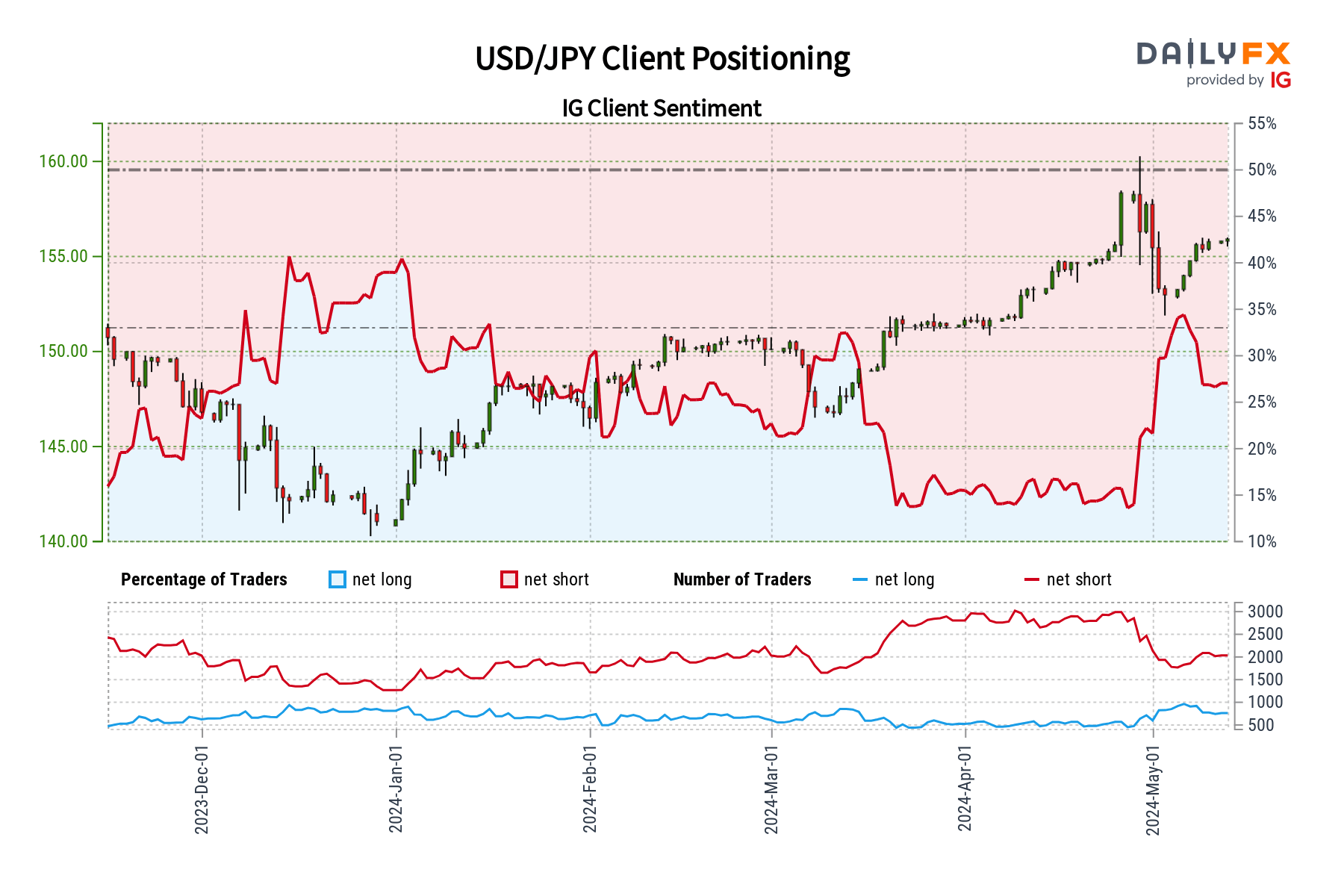

USD/JPY: Mixed Signals

While sentiment toward USD/JPY leans bearish, recent data shows a slight weakening in the bearish mood. This mixed outlook, with conflicting trends in net-short and net-long positions, calls for a cautious approach, blending contrarian insights with technical and fundamental analysis.

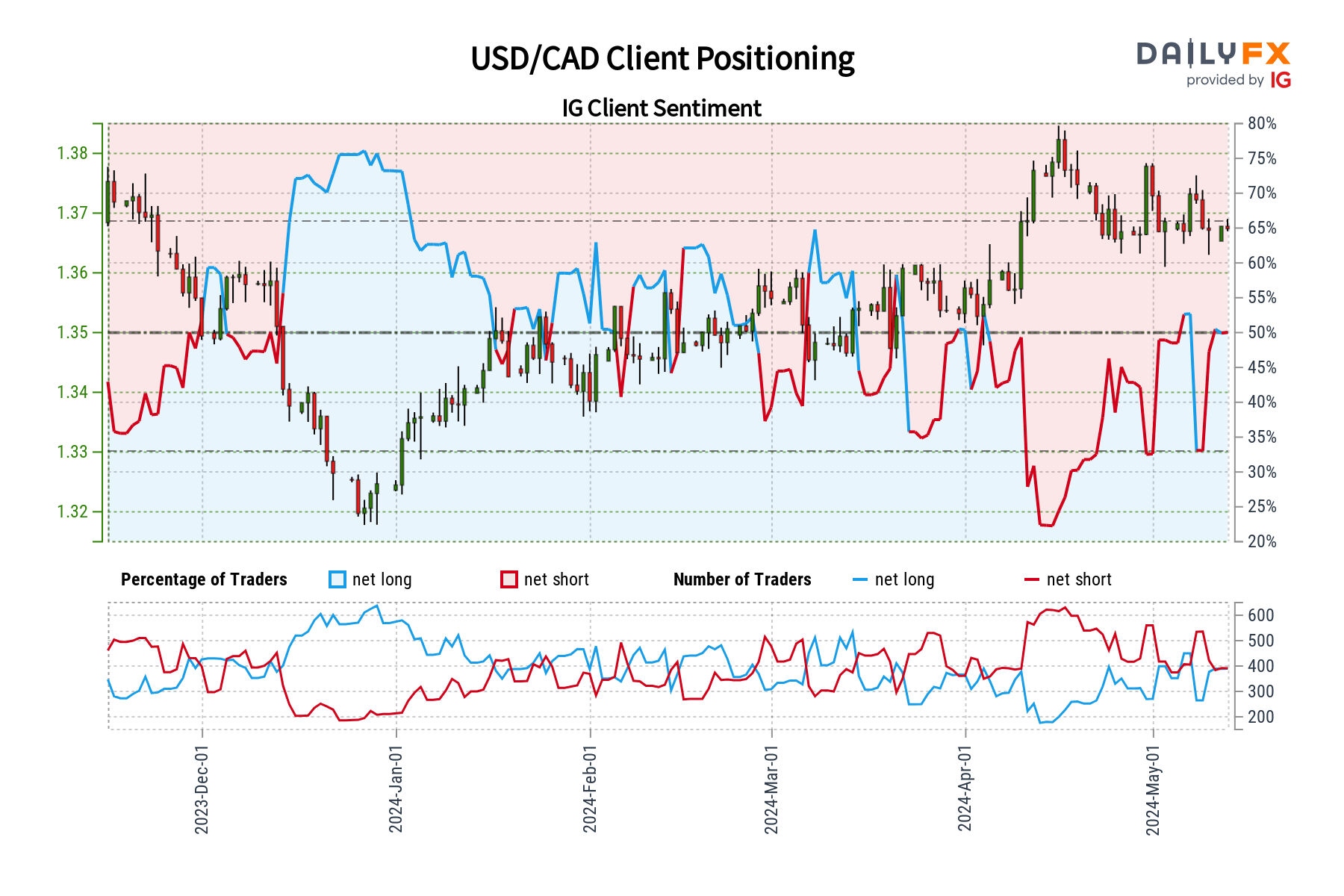

USD/CAD: Bearish Sentiment

Traders exhibit a bearish bias towards USD/CAD, with net-short positions increasing significantly. Despite this prevailing sentiment, our contrarian viewpoint suggests the potential for further upside, given the intensified bearishness and recent surge in net-short positions.

Key Takeaway

While contrarian signals offer alternative perspectives, they should be part of a broader analysis incorporating technical and fundamental factors. Integrating these insights enables traders to make informed decisions in the dynamic forex market.

Disclaimer: Trading involves risk and may not be suitable for all investors. Past performance is not indicative of future results.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.