EUR/USD, USD/JPY, GBP/USD – Trading Insights and Forecasts

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

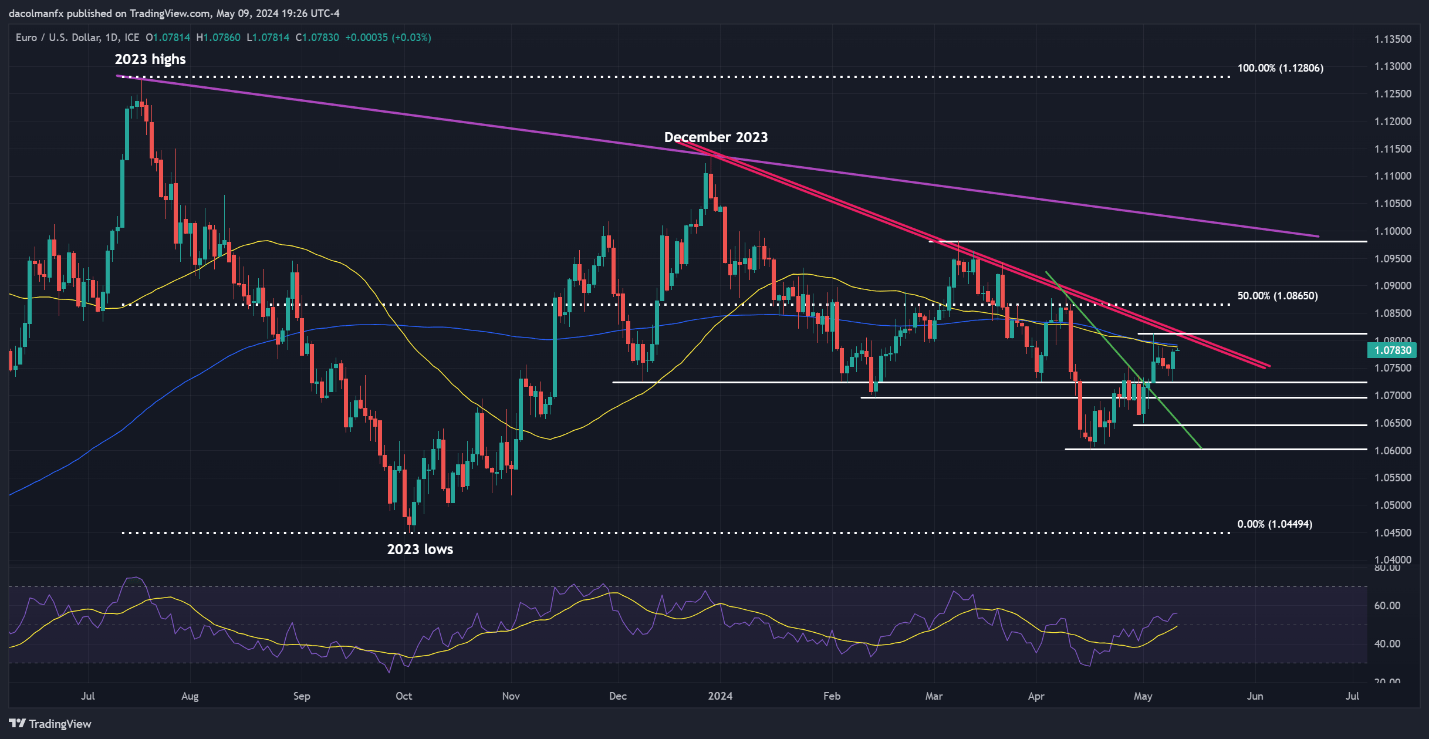

EUR/USD Outlook – Advanced Technical Review

EUR/USD experienced an upward trajectory on Thursday, starting from a critical support level at 1.0725 and pressing against a significant resistance at 1.0790—where the 50-day and 200-day simple moving averages converge. Breaching this resistance could lead to an encounter with the trendline at 1.0810, potentially extending gains toward the crucial Fibonacci level at 1.0865.

In contrast, a reversal could see the currency pair retract to initial support at 1.0725, and if the downtrend persists, the next support is at 1.0695. A failure to uphold these levels might trigger a further decline to 1.0645, with a possible test of the April lows at 1.0600.

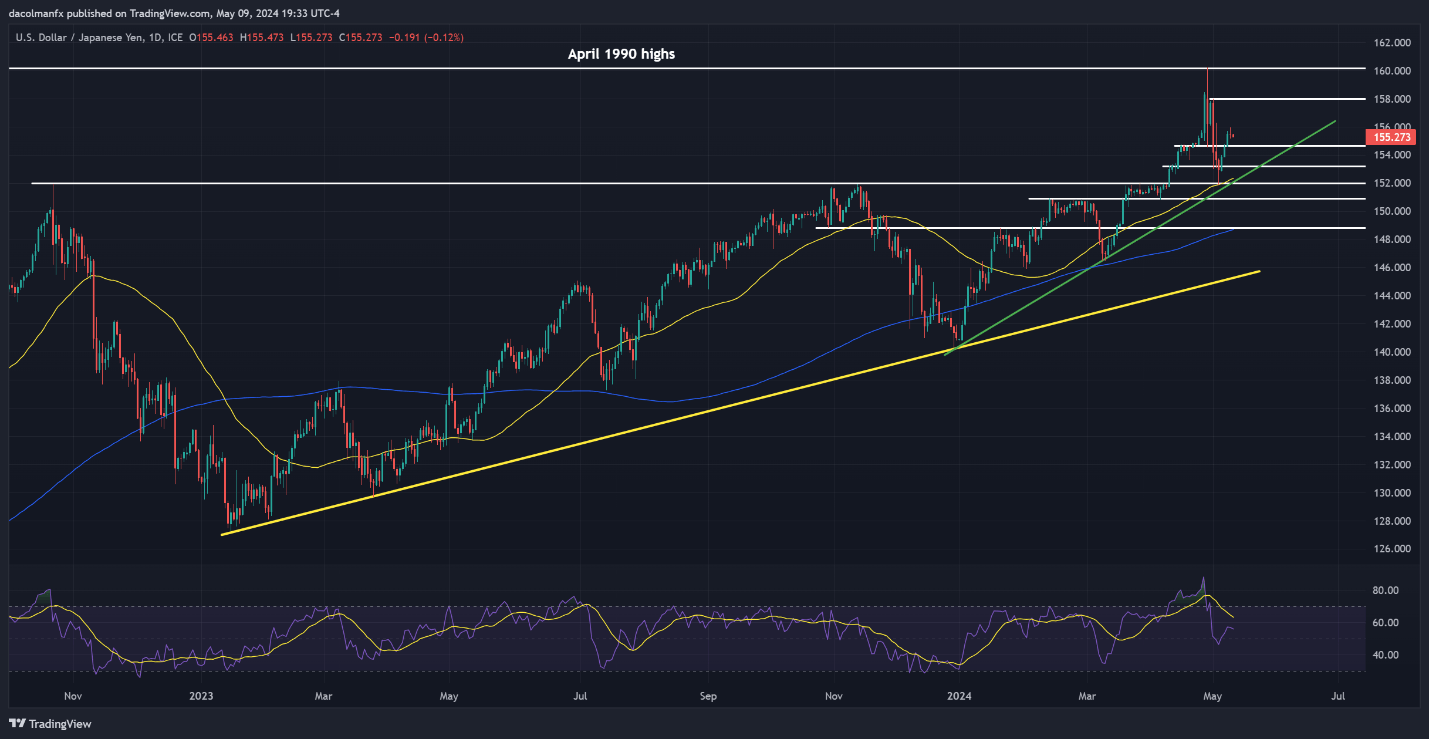

USD/JPY Market Analysis

After a notable surge earlier this week, USD/JPY stabilized on Thursday, showcasing resilience by holding above 155.00. A continuation of this rally might challenge resistance points at 158.00 and 160.00. However, traders should remain vigilant as potential interventions by Tokyo to bolster the yen could lead to a rapid pullback.

On the downside, should the uptrend falter, the initial support to monitor is 154.65. A further weakening could bring the focus to 153.15, potentially the 152.30-152.00 range, where the 50-day simple moving average meets a key ascending trendline.

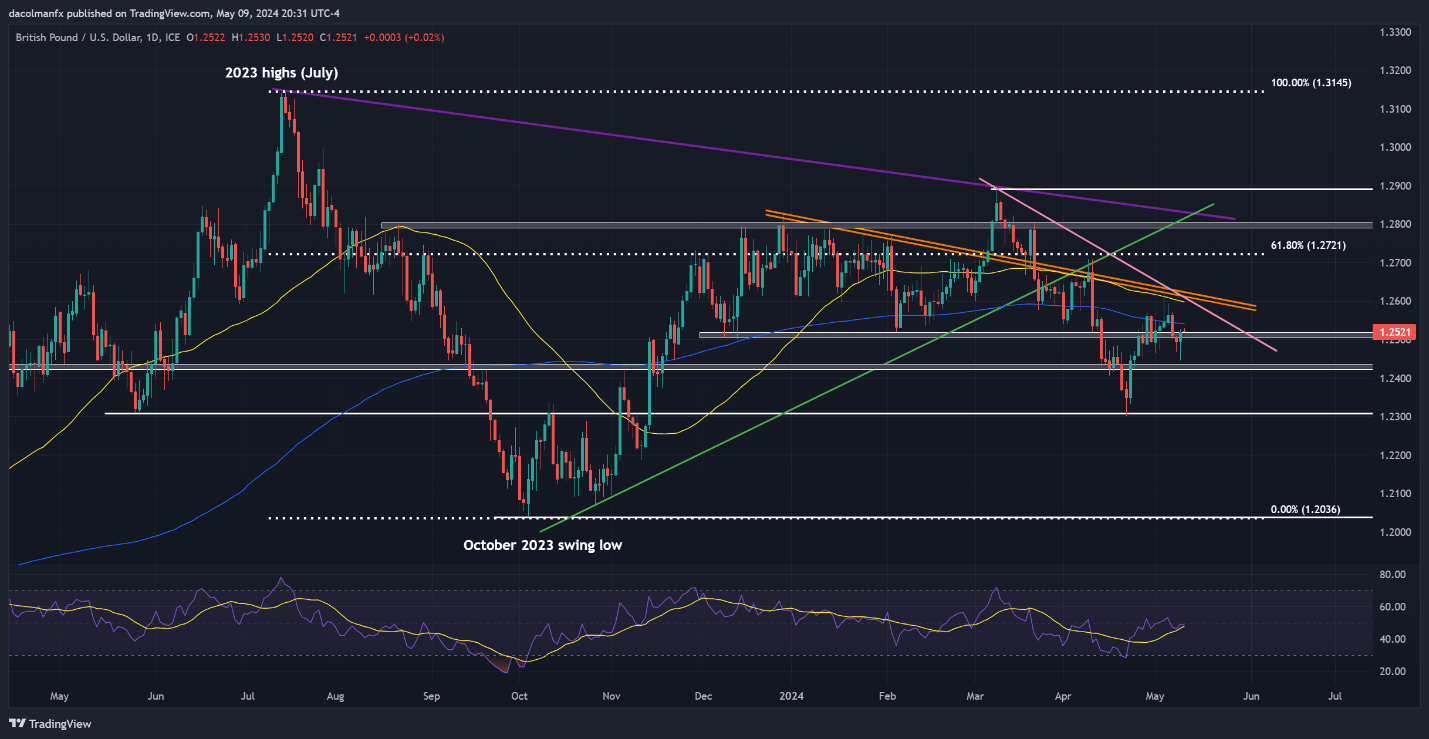

GBP/USD Technical Outlook

GBP/USD dipped following the Bank of England's dovish announcement during its May meeting, only to rebound and breach the 1.2500 threshold. A continued bullish trend could push the pair towards 1.2540, near the 200-day simple moving average. Beyond this, traders might eye the 1.2600-1.2620 range as the next target.

Conversely, a resurgence of selling pressure could pull the pair back to the support region around 1.2500, followed by 1.2430. A failure to defend this zone vigorously could amplify the selling drive, setting the stage for a potential retreat to the April lows at the psychologically significant level of 1.2300.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.