EUR/USD and EUR/GBP Face Key Levels Amid Market Moves

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Despite anticipation that the European Central Bank (ECB) will lower interest rates in June, the Euro has displayed resilience, rising versus both the US Dollar and the British Pound.

The US dollar has weakened, but incoming US economic data may support the case for continuing higher interest rates.

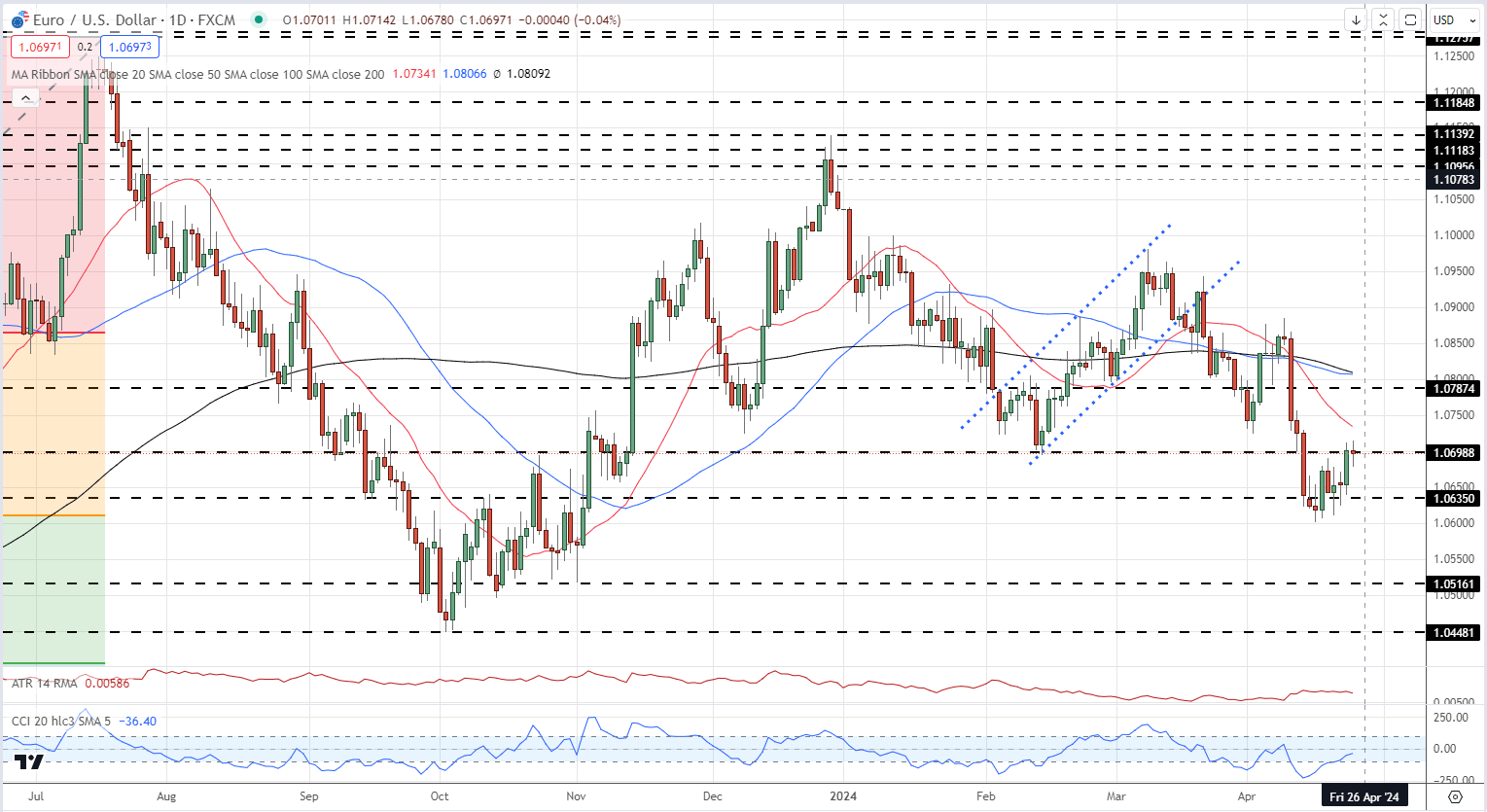

EUR/USD Analysis

EUR/USD has been trading near 1.0700, recovering from a recent low of 1.0600. Despite a short-term rally, the daily chart shows a negative trend, with the currency pair making lower highs and lower lows since last year.

Technical resistance is currently at 1.0787, and a dip below 1.0600 might result in further drops to 1.0561 and possibly 1.0448.

According to sentiment data, 59.30% of traders are net-long on EUR/USD, although a shift toward more short positions signals that prices may fall. However, shifts in trader sentiment suggest that the present decline may reverse.

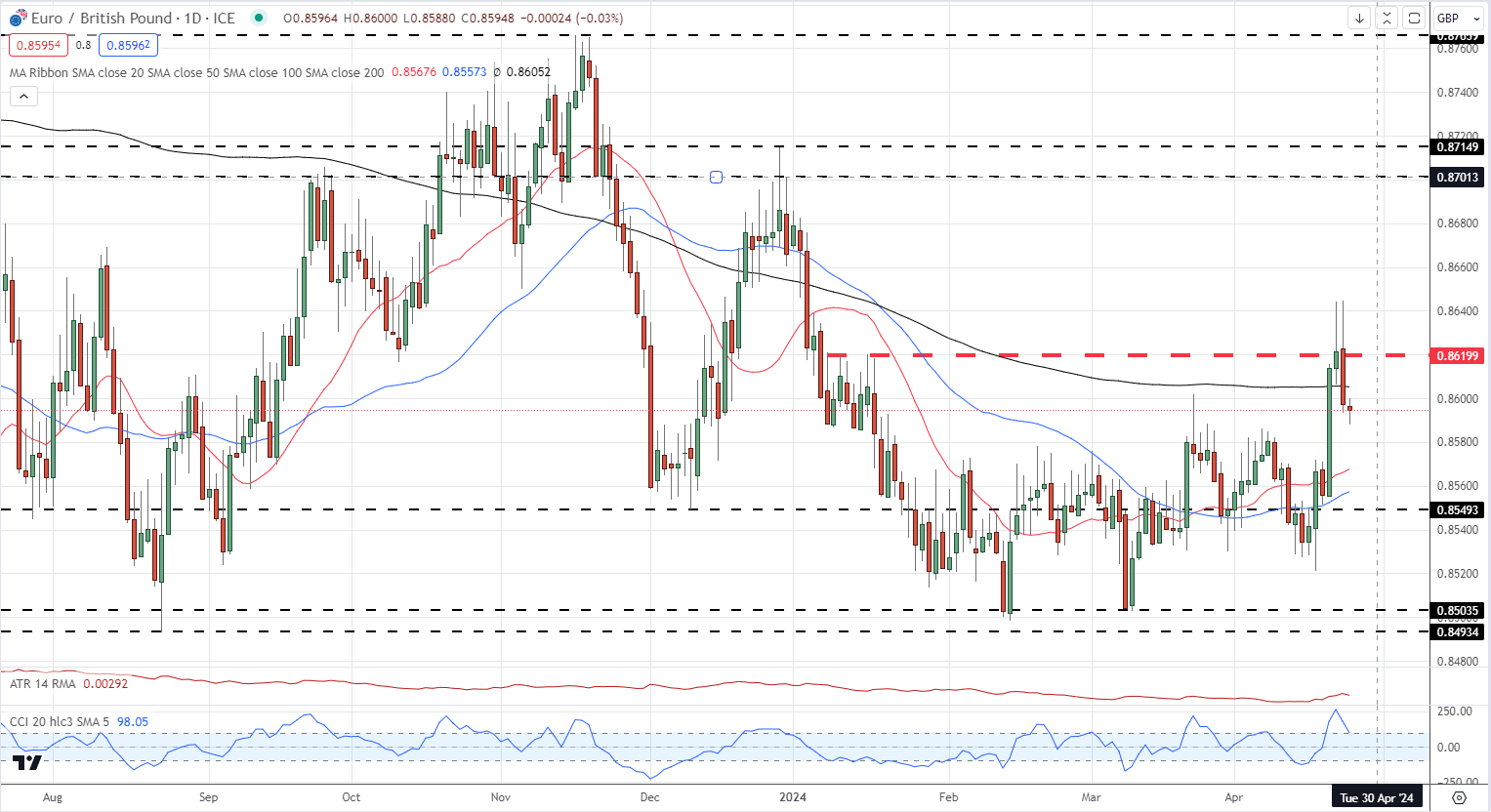

EUR/GBP Update

EUR/GBP has been volatile, reaching a multi-month high following comments from the Bank of England (BoE) indicating a slowing of UK inflation.

The pair has encountered resistance near the 0.8645 level, with current support located around 0.8590. According to sentiment data, 51.62% of traders are net-long, indicating a cautious market outlook.

Economic Indicators and Their Impact

The US economy remained strong, with durable goods orders rising 2.6% more than expected. The upcoming GDP data and the Core Personal Consumption Expenditures (PCE) Price Index will be critical in setting market expectations for future interest rate changes.

In Europe, the spotlight is on Germany's GfK Consumer Confidence, which is projected to improve and perhaps help the Euro.

Final Thoughts

The currency market is currently dealing with a combination of economic signals and central bank policy. Traders should keep a careful eye on upcoming data releases, particularly from the United States, as they may affect the Federal Reserve's interest rate decisions.

Maintaining levels above 1.0700 for EUR/USD could indicate a potential recovery, whereas, for EUR/GBP, the ability to hold above recent support levels may determine short-term direction.

The market sentiment, albeit mixed, reveals a wide divide among traders, suggesting an uncertain economic outlook.

Currency fluctuations are projected to become more volatile as central banks work to meet inflation and GDP targets, necessitating a cautious trading strategy.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.