Earnings and Economic Insights This Week

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

This week will be one of the busiest of the year, filled with earnings reports, a Federal Reserve meeting, substantial economic data, and a Treasury Quarterly Refunding announcement.

Although there are mixed opinions about the impact of the Quarterly Refunding Announcement, it's likely to end up as a non-event. Details will start to surface on Monday afternoon, with the official announcements set for Wednesday morning.

There's some speculation on social media that the Treasury General Account (TGA) will be significantly reduced, potentially releasing a wave of liquidity into the markets.

While a reduction from the current $900 billion to about $750 billion is possible, it’s improbable that it will decrease to $100 billion.

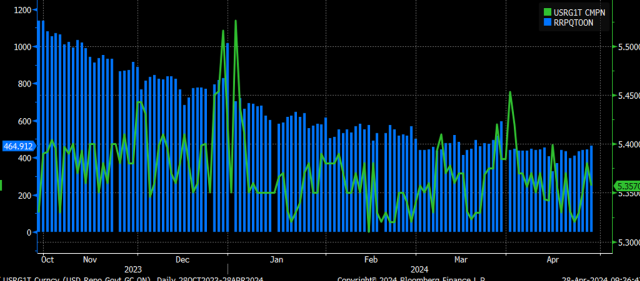

If the Treasury reduces bill issuance, some of the funds that have moved out of the reverse repo facility in recent months might start to flow back. If there's an excess of cash in the overnight funding markets, overnight rates could drop to the reverse repo rate of 5.3%.

If rates fall too low, the money will likely find its way back into the Reverse Repo Program (RRP), which could help drain liquidity from the system, especially if the reverse repo facility increases faster than the TGA decreases.

Since the end of March, the overnight rate has generally been trending lower, and the cash in the repo facility has been generally trending higher. So, the details we get in the next few days could be crucial, especially if bill issuance is net negative.

This week’s Federal Reserve meeting is probably more important for credit spreads than anything else. Financial conditions eased significantly when the Fed pivoted and indicated potential rate cuts in December.

That process began in November when Powell suggested that rate hikes were nearly over. Will this meeting serve as the catalyst to start tightening those conditions again if Powell suggests that the number of rate cuts anticipated in March might be reduced, with the June meeting possibly taking them all away? It's a possibility.

So far, the lowest point for spreads was right around the March FOMC meeting.

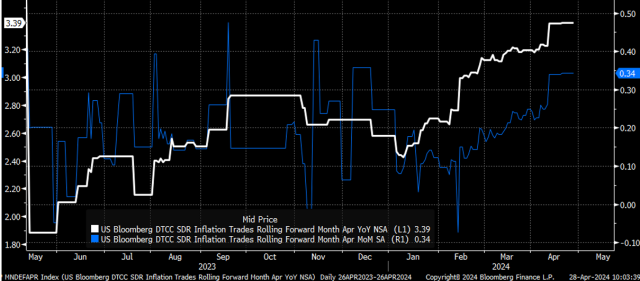

One reason the Fed may eliminate all rate cuts by June is that the April CPI swaps are expected to show an increase of 0.34% month-over-month and by 3.4% year-over-year. Let’s face it: 0.34% is just 0.01% away from 0.35%, which then rounds up to 0.4%. If the CPI reports another 0.4% in April for the third consecutive month, it will not bode well for the rate cut outlook.

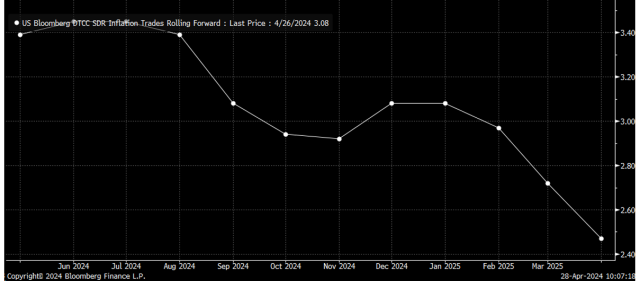

Based on the current CPI pricing, it will be challenging to see rates below 3.0% until February 2025. So, if the Fed is hoping for a series of favorable reports before starting to cut rates, they might have to wait until May 2025—at least if the current trend continues and swap pricing is accurate.

This suggests that the 2-year Treasury rates will continue to rise and push through the bull flag.

US 2-Year Yield-Daily Chart

The 10-year is also likely to climb higher and reach around 5% after breaking above resistance at 4.65% at the end of last week.

This is probably why the dollar should also continue to strengthen, push higher, and break out of its bull flag.

Meanwhile, the S&P 500 rose this week to reach the 20-day moving average, is very close to the 50-day moving average, and is approaching the downtrend line. So, this week will be pivotal in determining whether the downtrend in the SPX should persist.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.