Dow and Nasdaq 100 Still Close to Highs, and Hang Seng Continues to Rally

By Peter Vanderbuild

February 27, 2024 • Fact checked by Dumb Little Man

According to a recent analysis, traders all around the world have been paying attention to the divergent trends in market performances across the Nasdaq 100, Hang Seng Index, and Dow Jones Industrial Average.

The movement of each indicator provides distinct insights into the dynamics of the global financial system by reflecting wider economic signals, technology developments, and geopolitical factors.

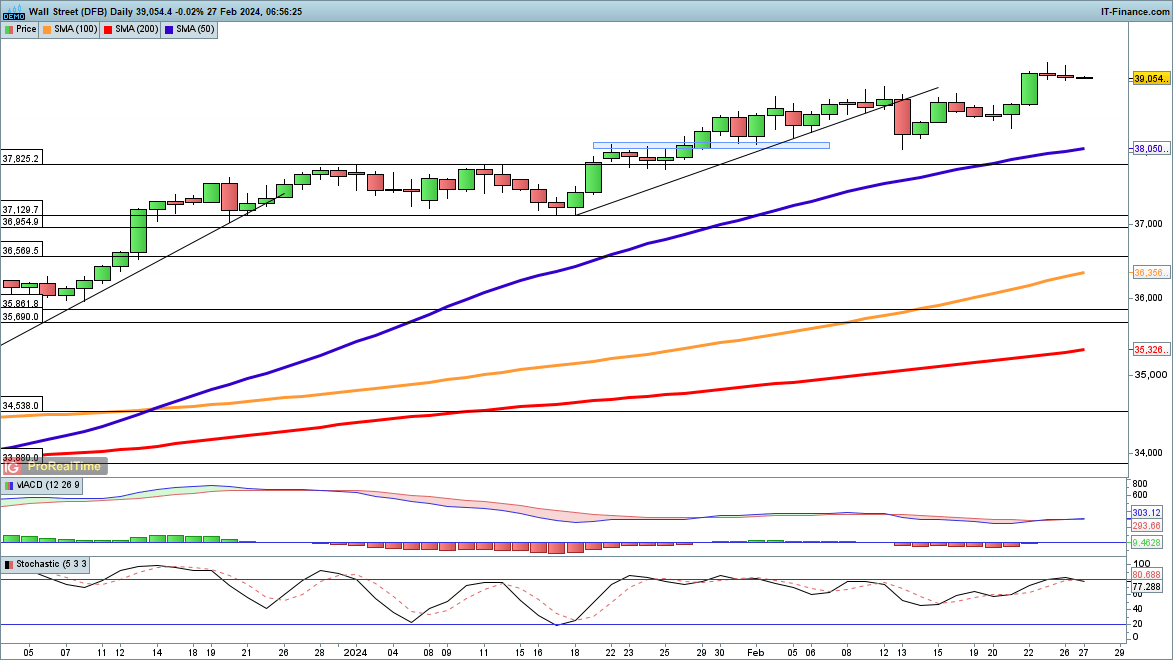

The Dow Jones Industrial Average

Source: DailyFX

The Dow Jones had a minor decline from the all-time high it hit on Friday, and Monday's trading struggled to hold onto gains while remaining near the peak.

There are worries since a possible decline below the low from the previous Wednesday would indicate a trend in the direction of the 50-day simple moving average (SMA). This is a critical milestone since a decline below it might challenge more support, indicating a cautious outlook for the Dow in the near future.

The Dow's resiliency in the face of a recent session that saw a drop of nearly 100 points is indicative of the cautious optimism of the broader market and the erratic nature of investor sentiment.

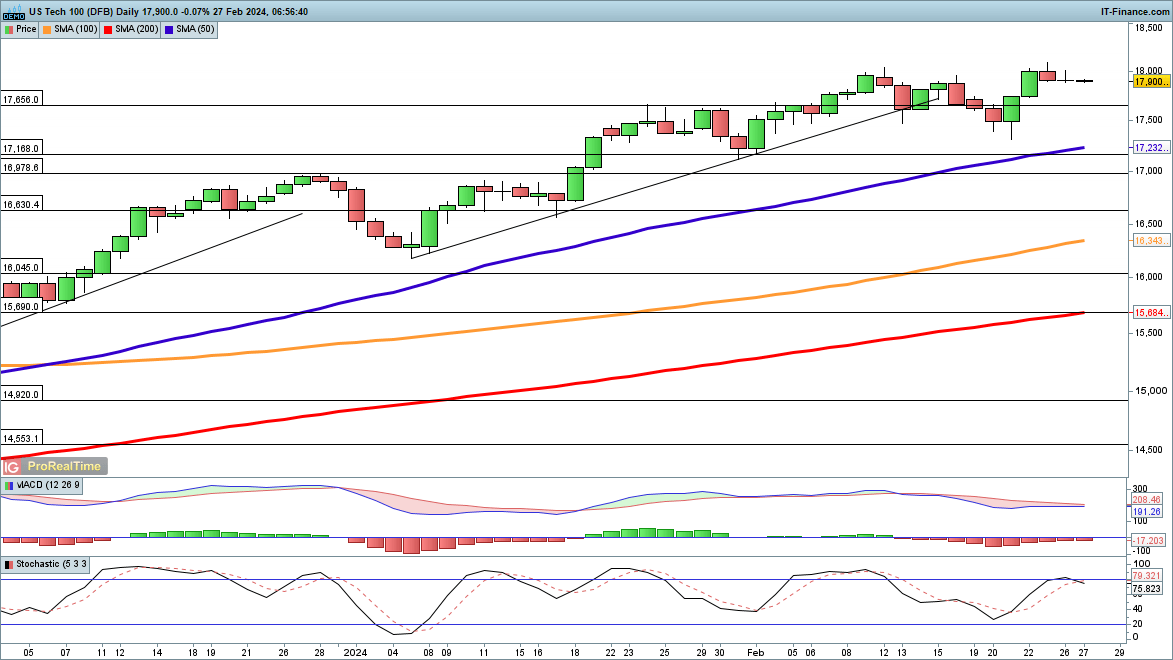

NASDAQ 100

Source: DailyFX

Similar to the Dow's performance, the Nasdaq 100 saw a decline after hitting a nearly all-time high. A failed attempt at a rally suggests a possible retest of the 50-day SMA and the bottom from last week.

The performance of this index shows how sensitive the tech-heavy market is to general economic indices and how important digital assets are becoming.

Tech stocks are very dynamic and have a big influence on market mood. This is demonstrated by the Nasdaq's resiliency, which was recently demonstrated by a 0.4% increase in one session.

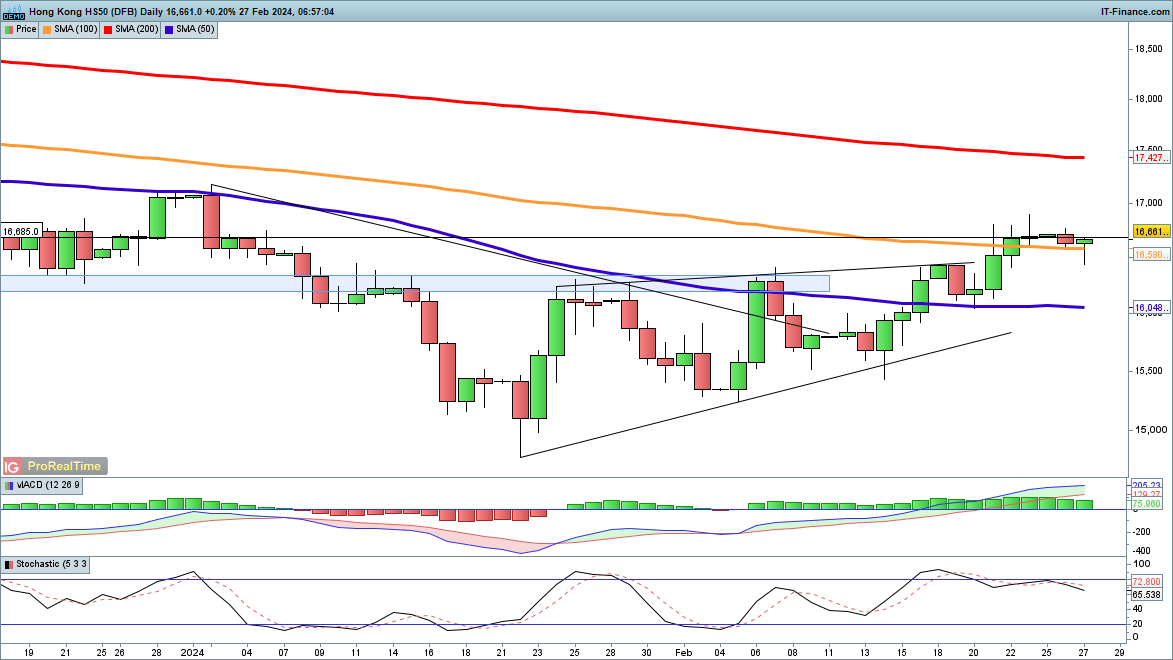

The Hang Seng Index

Source: DailyFX

Remarkably resilient, the Hang Seng Index rose over the 100-day SMA for the first time since mid-November. The index's performance indicates a cautious optimism among investors towards Asian markets, even as the gains are starting to taper off.

The Hang Seng's capacity to hold above important technical levels, along with notable increases in the Hang Seng Tech Index and the Hang Seng China Enterprises Index, highlight the potential for economic development and recovery in the area.

To reverse the bearish picture, however, a negative MACD crossover and the requirement to overcome earlier lower highs are still critical.

Final Thoughts

The recent trading sessions brought to light the interdependence of the world's markets as well as the regional differences in investor attitude. The surge in Bitcoin and its impact on cryptocurrency stocks highlight the increasing desire for riskier investments, even in the face of caution brought up by fresh economic data.

The performance of the global markets, which includes increases in the Hang Seng Index and the CSI 300 in China and Hong Kong, contrasts with the uneven outcomes in the European and Japanese markets, illuminating the intricate dynamics influencing investor choices.

Future economic indicators, such as inflation data, are eagerly anticipated by traders as they navigate through these unpredictable times in search of additional insights into market trends.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.