Crude Oil Prices Struggle As China Growth Plans Fail to Convince Amid OPEC+ Production Cuts

By Daniel M.

March 5, 2024 • Fact checked by Dumb Little Man

Crude oil prices plummeted Tuesday, reflecting investors’ distrust of China’s economic rescue efforts. However, they managed to recover some ground as the European morning progressed.

As the second-largest economy suffers from a slow post-pandemic recovery, persistent concerns about China’s energy consumption put pressure on oil prices. The modest 5% growth target for 2024 underscores China’s slower pace compared to past success, despite Beijing’s efforts to overhaul its economic model and remove overcapacity.

Production cutbacks have been extended by the Organization of Petroleum Exporting Countries (OPEC) and its allies, including the group known as “OPEC Plus”, into the second quarter of this year. Despite being widely expected, this action had little effect on prices.

Ample supply from non-OPEC suppliers and hazy demand outlooks continue to divide the market, especially as developed economies struggle with weak growth or recessionary pressures. Citing possible production limits in nations like the United States and Guyana, several economists predict a tighter supply in the upcoming year.

However, geopolitical concerns in areas like the Middle East and Ukraine continue to drive prices upward in the interim. Notably, the US crude price trend is still generally rising despite market pessimism.

US economic data came in a flurry this week, led by Friday’s non-farm payrolls. Positive US economic numbers could boost the oil market if rates are cut. Wednesday traders also expect the Energy Information Administration oil stock data from the previous week.

US Crude Oil Technical Analysis

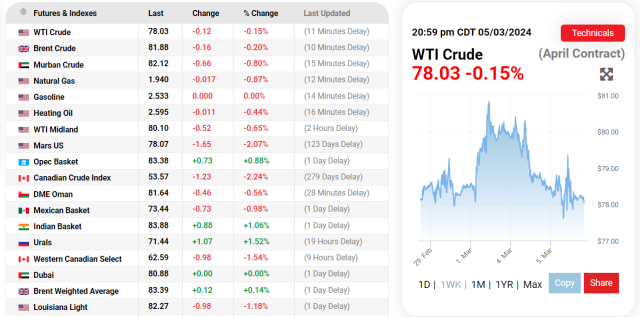

The US West Texas Intermediate Benchmark is approaching a trading range from late October and early November 2023, making it hard to reach earlier highs. Recent price changes suggest a narrowing despite economic event risks, while resistance at $80.21 and support at $74.23 suggest a big rising range. Positive trend may be maintained with $77.76 retracement support.

IG’s sentiment data shows 74% of traders remain upbeat amid uncertainties, suggesting a contrarian opportunity. China’s economic ambitions and OPEC+’s sustained production cuts lowered crude oil futures. The April West Texas Intermediate finished at $78.15 and the May Brent futures at $82.04.

The 5% growth objective set by China for 2024, the issue of “ultra-long” special treasury notes, and the prolongation of the output cut by OPEC+ underscore persistent concerns about supply and demand. US oil prices are holding steady despite various obstacles, including geopolitical concerns and economic data releases.

Final Thoughts

All things considered, the oil market is facing several difficulties resulting from concerns surrounding China’s energy consumption and more general economic recovery initiatives. Beijing has taken steps to boost growth and tackle structural problems like overcapacity.

However, the modest growth target of 5% for 2024 highlights how slowly China’s post-pandemic economic recovery is still progressing. These elements cloud the oil markets, causing persistent volatility and uneasiness among investors. It is because of this unpredictable environment that market players are keeping a careful eye on sentiment data and technical indications.

The market dynamics are further complicated by the upcoming release of important US economic data, such as the non-farm payrolls report. Because of this, traders are still in a position to take advantage of chances and maneuver through the complex workings of the oil market.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.