Crude Oil Prices Fluctuate Amid Red Sea Supply Concerns

By Peter Vanderbuild

February 27, 2024 • Fact checked by Dumb Little Man

Crude oil prices experienced early gains but fell back in the European morning, with the $77 support region becoming a focal point after being surpassed on Monday. Despite this dip, the overall uptrend remains intact, though West Texas Intermediate (WTI) crude appears more range-bound.

Supply Disruptions and Market Dynamics

Concerns in the market are rising as a result of worries about supply interruptions in the important Red Sea trade route. Attacks on shipping by the Iranian-backed Houthi militia, purportedly in aid of the Palestinian struggle in Gaza, continue, increasing travel times and expenses for the almost two billion metric tons of crude that are shipped by sea each year. U.S. Although it is unclear how a ceasefire between Israel and Hamas will affect Houthi activity, President Joe Biden made some allusions to it.

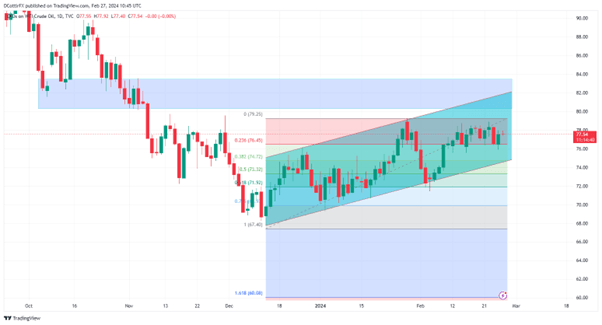

US Crude Oil Price and Technical Analysis

Source: Charts Using TradingView via DailyFX

Although persistent worries about China's energy consumption, crude oil prices have recently topped $77 per barrel, supported by indications of resilience in Chinese demand. The market is also anticipating that interest rates in industrial economies may remain high for an extended period of time, and it is closely monitoring upcoming U.S. data and central bank commentary.

Technically speaking, crude oil has been in an upward trend since December 14 but has been in a more defined range since February 8. Based on Fibonacci retracement, the range is denoted by a high of $79.25 and a low of $76.45. For bulls hoping to retest late-January highs, the market must consolidate above the key $78 threshold.

Recent Market Movements

Despite recent attacks on Red Sea shipping that have increased concerns about supply, oil prices have mainly held onto gains. While WTI crude slightly increased to $77.59 per barrel, Brent crude futures remained stable at $82.52 per barrel. The intricate relationship between supply concerns, Federal Reserve policies, and changing demand dynamics—particularly in China—is reflected in these changes.

Final Thoughts

The Energy Information Administration's inventory data is highly anticipated by market participants as it may offer additional insights into the levels of U.S. oil supplies. Analysts predict a surge in crude inventories, highlighting the oil markets' volatility in the face of economic data and geopolitical threats.

A volatile environment characterized by supply disruptions, geopolitical unpredictability, and economic considerations is affecting crude oil prices. Traders continue to be on the lookout for events that could influence market directions in the near term.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.