British Pound Trading Analysis: GBP/USD, EUR/GBP, GBP/JPY

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Trading often resembles a game of follow-the-leader, with participants reacting to market movements by following established trends. However, experienced traders leverage contrarian strategies, which can uncover significant opportunities by opposing mainstream market sentiment.

IG client sentiment tools provide insights into market moods, identifying potential shifts indicated by extreme bullish or bearish sentiment. These insights can challenge the prevailing market narrative.

While these contrarian indicators are insightful, they are most effective when integrated with technical and fundamental analyses. This blend enhances traders’ understanding of market dynamics, which might be overlooked by the majority.

We will explore the implications of IG client sentiment on three significant British pound pairs: GBP/USD, EUR/GBP, and GBP/JPY.

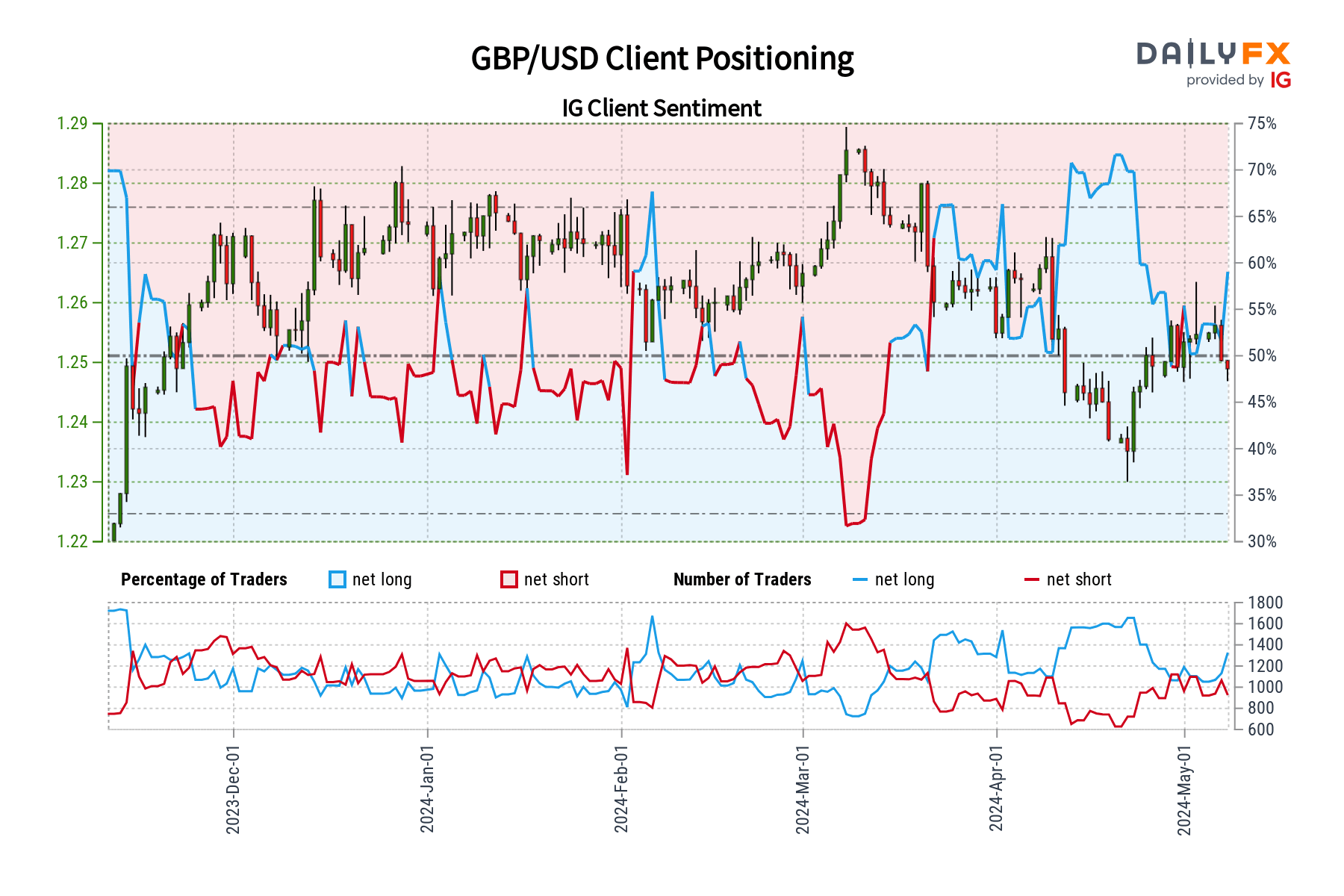

GBP/USD Forecast – Market Sentiment

IG data shows a significant majority of traders (62.47%) hold net-long positions on GBP/USD, with a long-to-short ratio of 1.66 to 1. This bullish sentiment, increased by 25.35% since yesterday and 18.04% from last week, suggests potential for the continuation of the pair's recent pullback.

Contrarian insights hint at a bearish outlook for GBP/USD, given the overwhelming optimism.

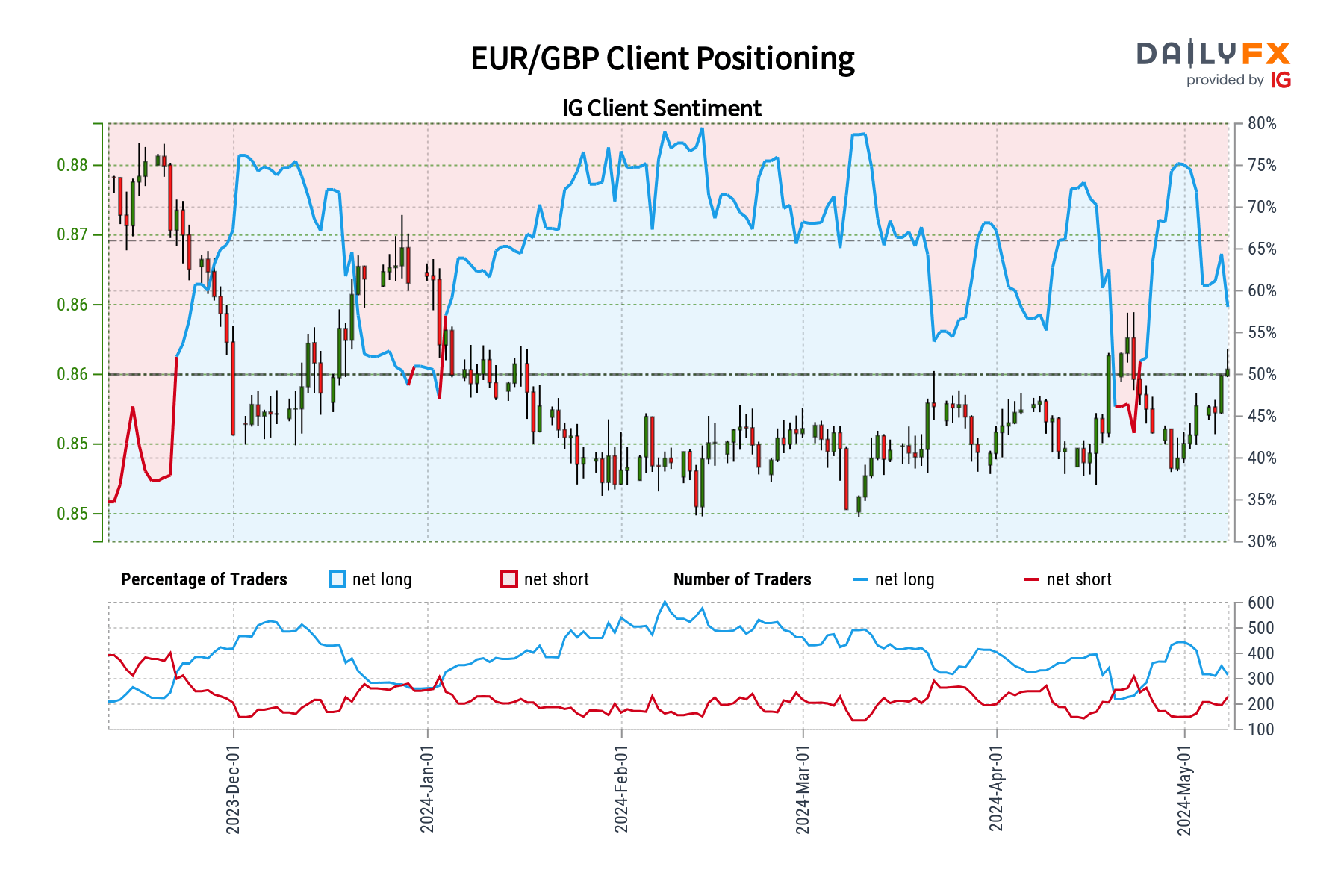

EUR/GBP Forecast – Market Sentiment

IG data indicates a shift with 51.54% of traders now net-short on EUR/GBP—the first such occurrence since April 24. With the short-to-long ratio at 1.06 to 1 and a 27.14% increase in net-shorts since yesterday, sentiment is leaning bearishly.

This pessimism might signal a contrarian bullish move for EUR/GBP in the near term, reinforced by the notable increase in bearish positions.

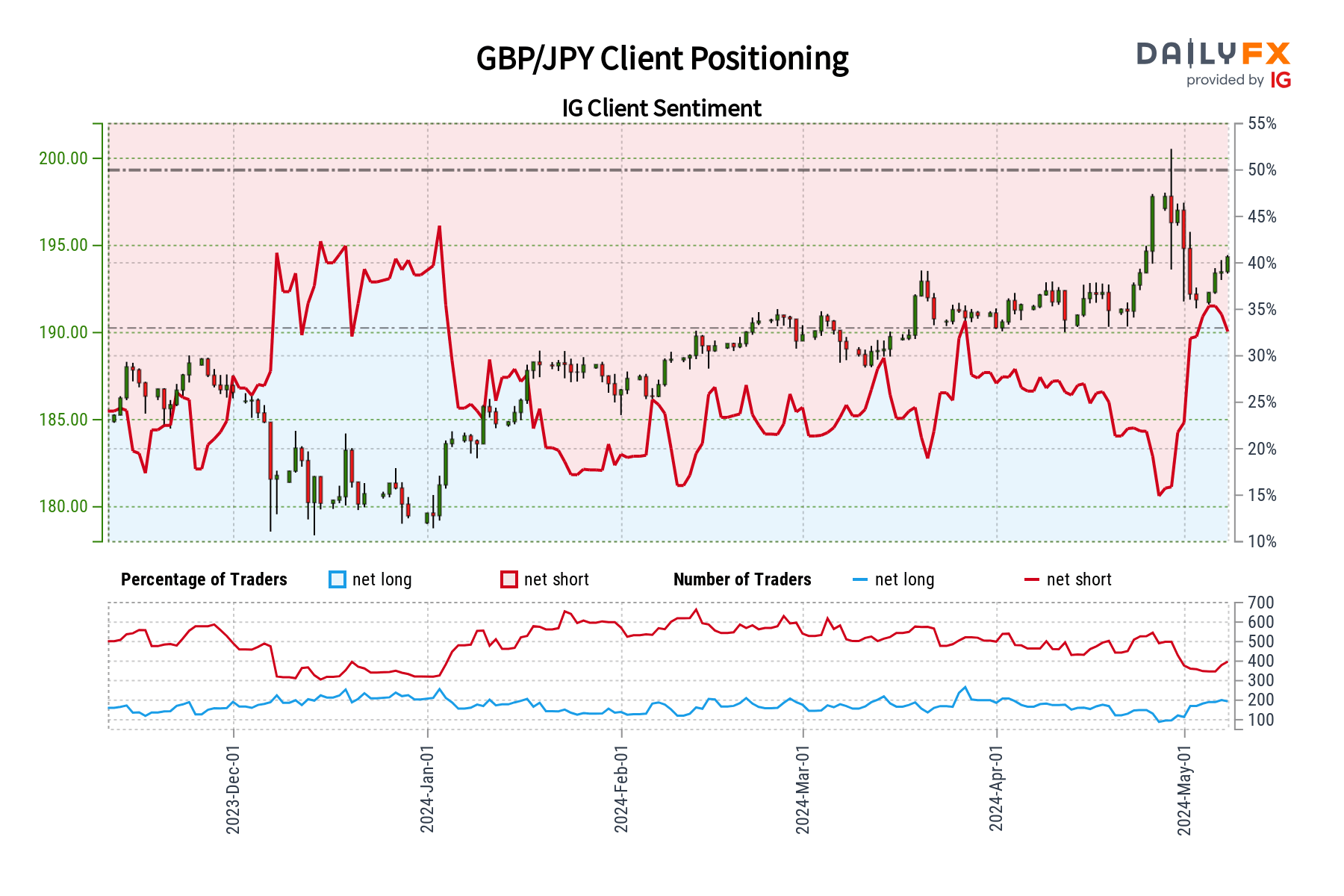

GBP/JPY Forecast – Market Sentiment

Currently, 63.19% of traders are selling GBP/JPY, which presents a short-to-long ratio of 1.72 to 1. The net-short positions have slightly increased by 3.19% since yesterday, though they have decreased by 16.74% from last week.

Contrarian views suggest GBP/JPY may continue its rise, despite recent decreases in selling pressure, which introduces some uncertainty about the continuation of the broader uptrend.

Key Reminder: While contrarian signals are valuable, they should not be the sole basis of trading decisions. A comprehensive strategy that includes detailed technical and fundamental analysis is crucial for informed trading in the forex market.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.