AUD/USD Weekly Forecast: Indications of a Bullish Surge Ahead

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

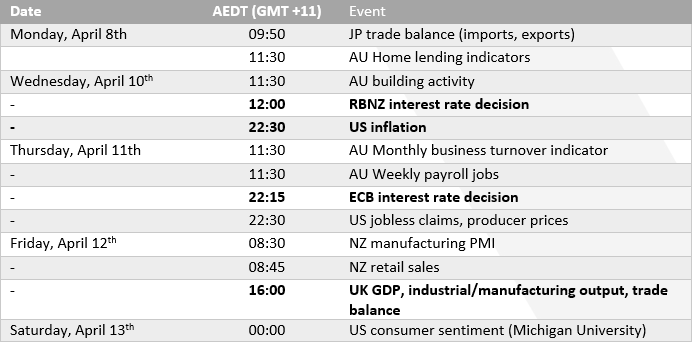

Economic Indicators: A Quiet Week with Potential Implications

This week may not be packed with significant Australian economic updates, yet indicators like home lending and business activity could stir interest among investors. Any signs of weakness here might fuel speculation among AUD skeptics, potentially influencing bets towards a rate cut. However, barring such developments, these datasets are expected to remain secondary in focus.

Global Dynamics: Middle Eastern Tensions and Market Impacts

Recent escalations in the Middle East have heightened worries about wider conflict implications, influencing US markets to retreat from their peaks. This development, highlighted by a bearish engulfing pattern in the S&P 500's performance, underscores the importance of considering headline risks and their potential to dampen sentiment—a factor that could negatively affect the AUD/USD pair, given its risk-sensitive nature.

Central Bank Perspectives: RBA's Stance Amid Global Easing Signals

The Reserve Bank of Australia (RBA)‘s recent minutes acknowledged slower growth and inflation but maintained that inflation was “too high”. This language suggests a rate cut may not be imminent.

Nevertheless, the unexpected rate cut by the Swiss National Bank (SNB) and anticipated adjustments by the Bank of England (BOE) hint at a possible shift towards easing by central banks, although the RBA's path is complicated by the Federal Reserve's stance against immediate rate cuts.

Attention is also directed towards the Reserve Bank of New Zealand (RBNZ), which, despite signaling a prolonged restrictive rate policy, might lean towards easing due to economic contractions, adding another layer to the central banking landscape.

Market Outlook for AUD/USD: Influences from Abroad

Key international events like US inflation data, producer prices, and the European Central Bank (ECB) meeting are set to dominate the scene. Softening US CPI figures could bolster expectations for a Fed rate cut in June, potentially easing pressures on the RBA.

Similarly, a decline in US producer prices could weaken the US dollar, favoring an AUD/USD uptick.

While the ECB's upcoming stance remains fixed, its reaction to recent soft inflation figures is keenly awaited. This global central banking atmosphere could indirectly shape the RBA's decision-making, possibly hastening a policy easing timeline.

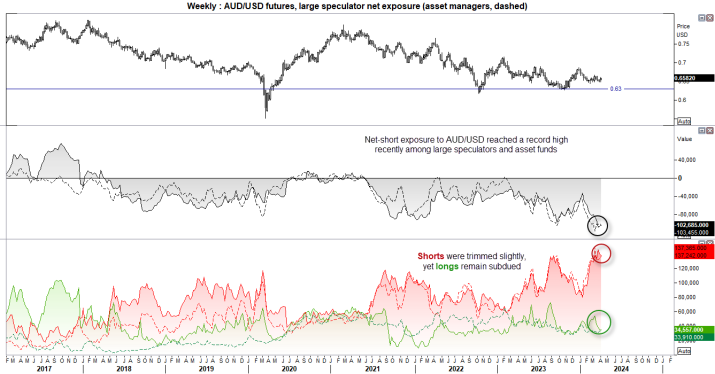

AUD/USD Futures – Market Sentiment from the COT Report:

Recent trends show a record net-short exposure in AUD/USD futures, signaling extreme bearish sentiment. Despite a slight reduction in short positions by large speculators, an increase by asset managers was noted.

The subdued long positions hint at limited upside potential, although the current bearish extremity warrants caution against forecasting prolonged declines without significant disruptive events.

A bullish outside week on the AUD/USD weekly chart suggests a potential for a three-week bullish reversal, possibly influenced by softer US inflation numbers, aligning with seasonal tendencies favoring AUD/USD.

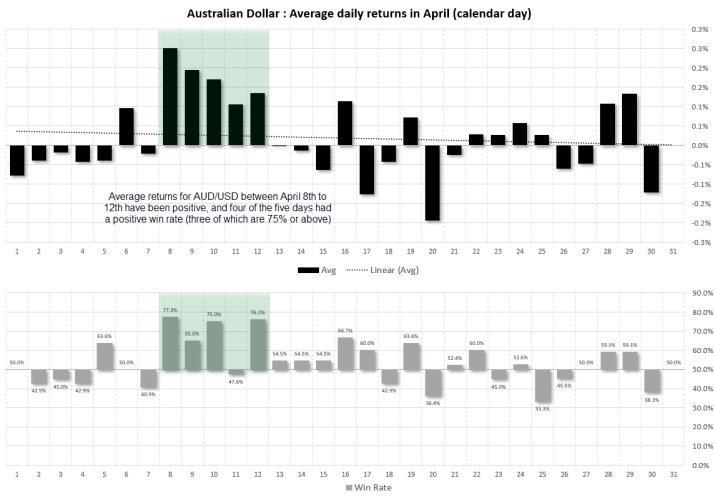

AUD/USD Seasonality in April:

Historical analysis since 1976 shows April as a generally positive month for AUD/USD, with an average return of 0.48%, a median of 0.82%, and a 55.8% win rate.

Specifically, the period from April 8th to 12th showcases consistently positive daily returns, aligning with a traditionally weaker performance in US markets during the same timeframe.

While seasonality is not a guaranteed predictor, favorable conditions could lead to a bullish week for AUD/USD, supporting its seasonal trend.

AUD/USD Technical Analysis:

The Australian dollar has recently demonstrated resilience, bouncing back from a false break below 75c. Despite a momentary pause indicated by Friday's hanging man candle, the currency's position above its 200-day EMA suggests limited downside risk.

This positioning, combined with seasonal trends favoring an uptick, positions AUD/USD as a candidate for bullish consideration, especially on dips, in the week ahead.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.