AUD Up as Inflation Beats Forecasts, Rate Cuts Unlikely

By Daniel M.

April 25, 2024 • Fact checked by Dumb Little Man

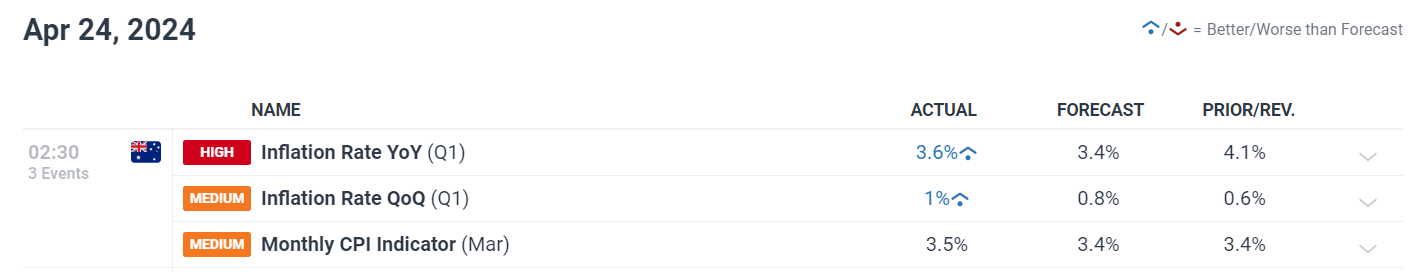

Australian inflation rates surpassed estimates in the first quarter of 2024, with the Consumer Price Index (CPI) rising to 1.0% quarterly and 3.5% annually, compared to forecasts of 0.8% and 3.4%, respectively.

This increase highlights continued inflationary pressures, notably in the service sector, which may impact the Reserve Bank of Australia’s (RBA) monetary policy.

Market Reactions and Monetary Policy Outlook

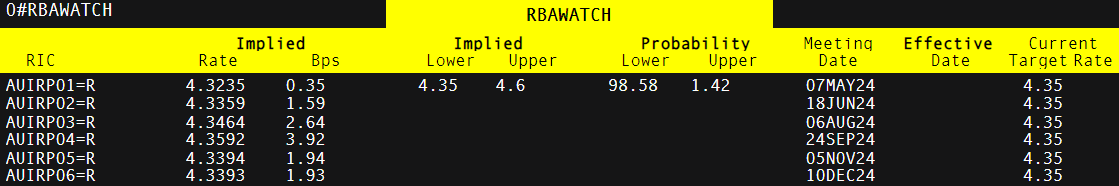

The unexpected inflation estimates have lowered expectations for rate cuts this year, as markets now expect interest rates to remain high for longer than originally thought.

This shift is reflected in the implied basis point moves, which are all positive. A healthy job market, which boosts consumer spending, reinforces this expectation, making it difficult for inflation to quickly fall below the RBA’s objective.

AUD/USD Exchange Rate Dynamics

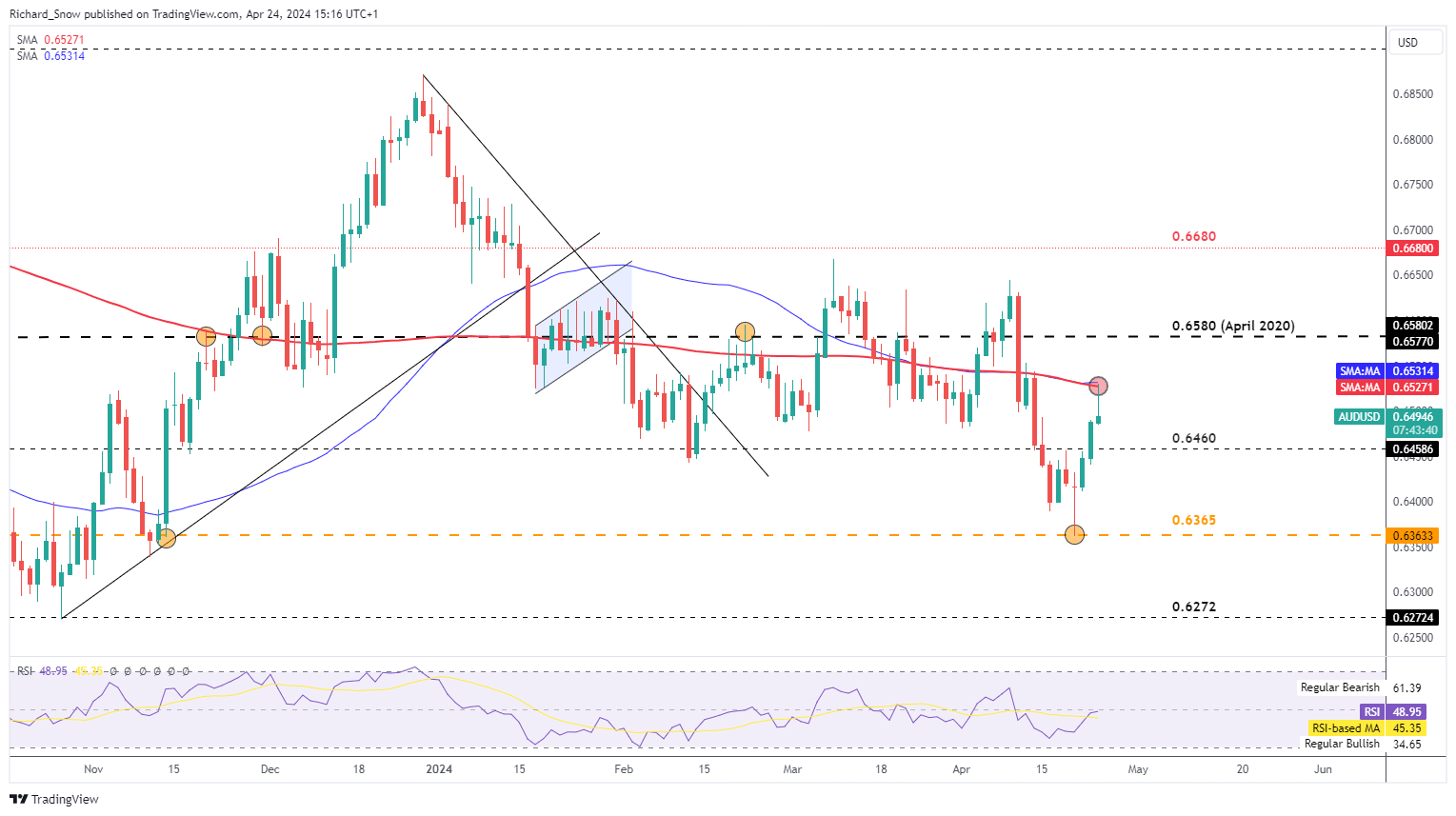

The Australian Dollar (AUD) has demonstrated resiliency by appreciating against the US Dollar. The AUD/USD pair recovered from a low of 0.6365 to break above 0.6460, boosted by lower geopolitical tensions and a return to riskier assets.

The US Dollar Index (DXY), which measures the US dollar against six major currencies, fell due to lower US Treasury yields and weaker-than-expected PMI data, bolstering the AUD’s surge.

AUD/NZD Forex Movements

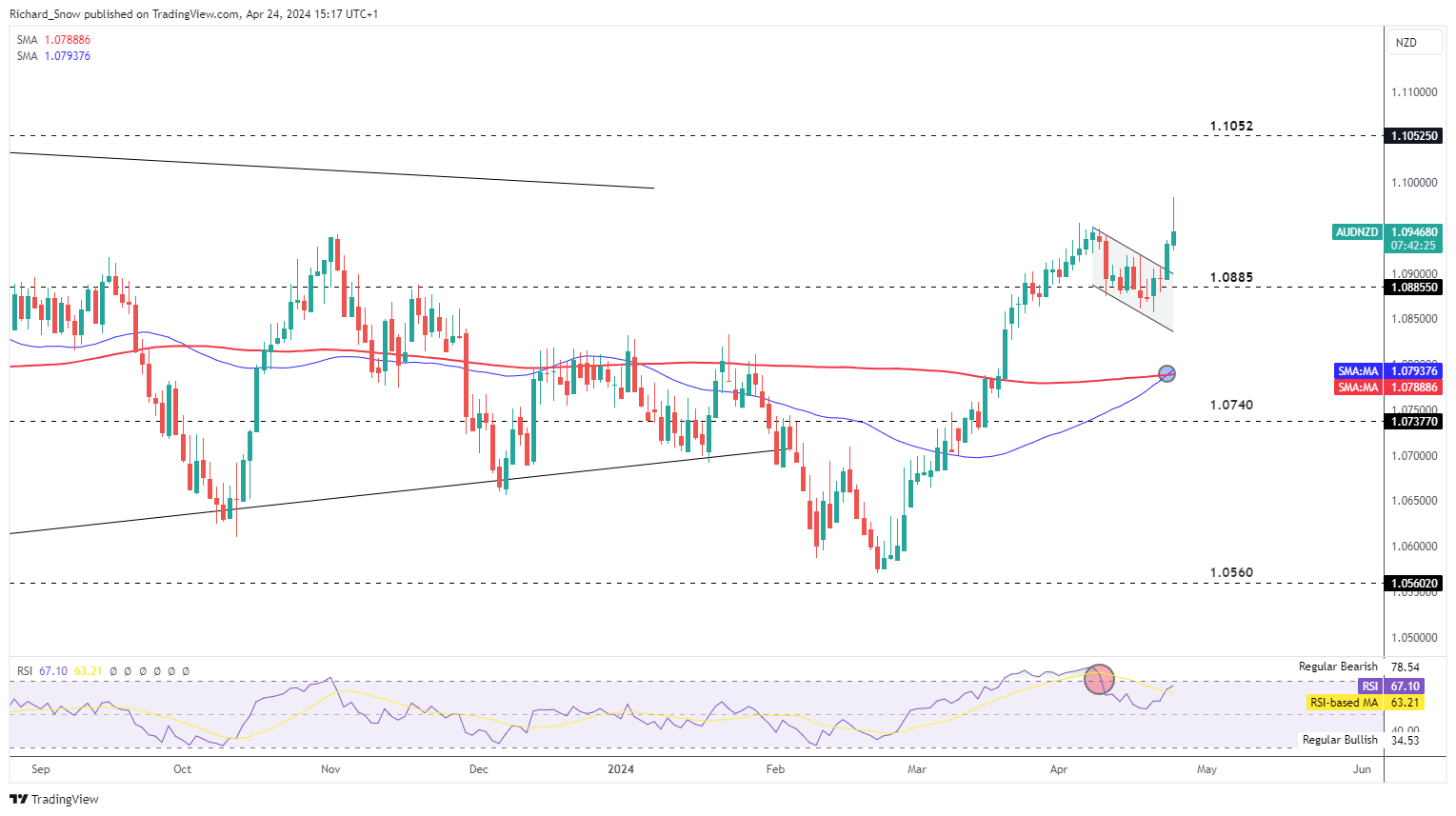

The AUD/NZD has shown a bullish continuation pattern, remaining above the important support level of 1.0885. Technical signs point to probable resistance at 1.1052, implying that the pair has room to rise if it continues on its current trajectory.

Global and Domestic Economic Indicators

The rise in the Australian dollar corresponds to increases in the ASX 200 index, which are impacted by good performances in the technology and healthcare sectors.

The AUD has also tracked upward fluctuations in global indices, indicating a stronger risk appetite. Domestically, Australia’s Judo Bank Composite Purchasing Managers Index hit a 24-month high of 53.6 in April, reflecting strong business activity.

Final Thoughts

The Australian Dollar’s rising trend appears to be continuing, aided by unexpectedly high inflation figures, which has dimmed the prospects for interest rate cuts.

Traders should be aware that the AUD/USD pair is trading around 0.6520, with psychological resistance at 0.6600 and the upper boundary of the symmetrical triangle near 0.6639.

As global and domestic economic conditions change, the strength of the Australian dollar will become increasingly important for traders, providing both possibilities and risks in the currency markets.

Upcoming US GDP and PCE statistics may add to volatility and influence the AUD’s short-term movement.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.