Asian Stocks Gain, Dollar Up as US Rate Cut Hopes Fade

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Mixed Signals from Global Markets

In an unexpected change of events, Asian markets have gained traction on the disclosure that US manufacturing rose for the first time in 18 months in March, with production and new orders growing significantly.

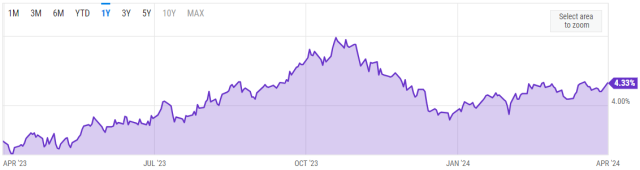

This strong economic indicator sent US Treasury yields skyrocketing, with two-year yields peaking at 4.726% and ten-year yields reaching 4.337%, the highest level in two weeks.

2-Year Yields

10-Year Yields

As a result, the dollar firmed, putting pressure on the yen, which stayed close to a 34-year low of 151.76 per dollar.

Yen Under Pressure

With the yen's value being keenly monitored, Japan's history of currency market interventions in 2022 looms large, particularly as the currency approaches the key 152-per-dollar level.

Meanwhile, European markets are set for a modest start, with futures indicating tiny increases across major indices: Eurostoxx 50 futures are up 0.10%, DAX futures by 0.02%, and FTSE futures by 0.07%.

Regional Market Highlights

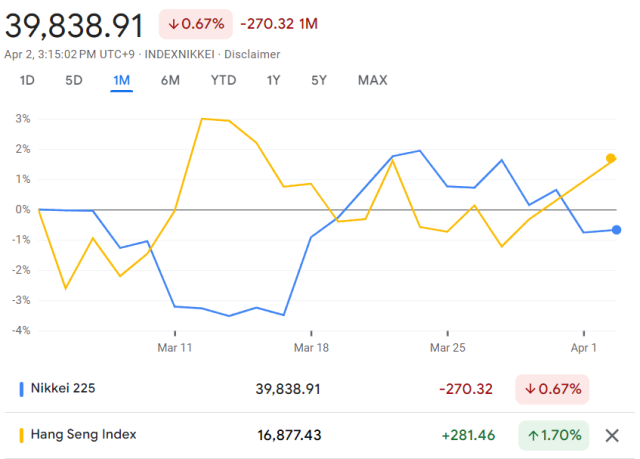

The Nikkei exhibited volatility, momentarily approaching 40,000 before stabilizing. In contrast, the Hang Seng Index outperformed, rising more than 2% as Hong Kong markets reopened after the holiday.

Despite a big rise the day before, Chinese stocks saw a moderate increase, owing to positive manufacturing activity data indicating a sustained economic recovery.

Global Outlook

European futures indicate a cautious start, with minor gains across major indices. Despite its best first-quarter performance in five years, the US S&P 500 is under pressure from higher Treasury yields, which are being driven by manufacturing statistics.

Market analysts are now adjusting the likelihood of a Fed rate cut in June based on the interaction of strong economic signs and Federal Reserve policy expectations.

Commodities and Currency

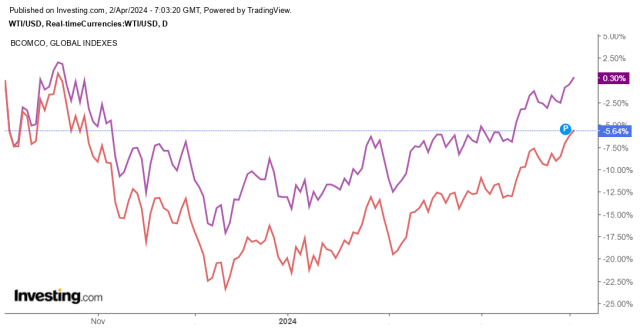

Oil prices have risen slightly, with US crude at $84.14 per barrel and Brent crude at $87.85, boosted by demand optimism and geopolitical worries. Gold continues to rise, adding to its gains after reaching an all-time high of $2,256.46 per ounce.

The dollar's strength, approaching a 4.5-month high of 105.5, is visible against a basket of currencies, pushing the euro and sterling lower.

Final Thoughts

This time of economic resiliency in the United States, as evidenced by robust manufacturing figures, has added a new level of complication for traders and policymakers alike.

The Asian stock market's reaction, combined with currency changes and commodity price movements, demonstrates the global interdependence of financial markets.

As traders navigate this changing landscape, strategic decision-making and risk management become increasingly important.

The recalibration of Fed rate cut expectations has an impact not only on investment strategies but also highlights the importance of closely watching economic indicators and geopolitical developments.

This volatile climate offers both difficulties and possibilities, with important implications for global markets and investment portfolios.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.