Asian Markets Exhibit Caution Ahead of Fed Meeting, While Nikkei Surges in Anticipation of BOJ Decision

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

With the focus on the Federal Reserve (Fed) and the Bank of Japan (BOJ), traders are anticipating a series of central bank decisions, which have most Asian stocks treading carefully.

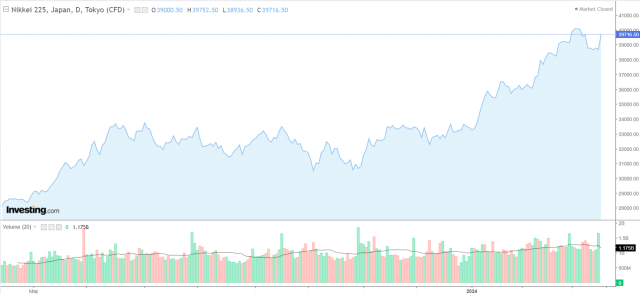

There is palpable anticipation surrounding these meetings, particularly given that the Nikkei 225 in Japan has spiked in response to possible policy changes by the BOJ.

Japanese Shares Surge as BOJ Policy Shift Looms

Despite conflicting economic statistics from China suggesting a battle with sluggish growth, Japanese stocks surpass their regional counterparts.

Backed by conjecture about the BOJ's possible departure from its ultra-dovish monetary policies, the Nikkei 225 and TOPIX index both saw notable increases.

The fact that Japanese unions were able to get large wage increases and are predicting a boost for the consumption-driven economy only serves to heighten this optimism.

Chinese Shares Make Modest Gains Despite Mixed Economic Indicators

Despite conflicting economic signals, Chinese markets remain resilient. A strong industrial output was reflected in the slight increase in the Shanghai Composite and Shanghai Shenzhen CSI 300 indexes.

China's chances of an economic rebound are clouded, meanwhile, by persistent worries about declining demand and an unanticipated increase in unemployment.

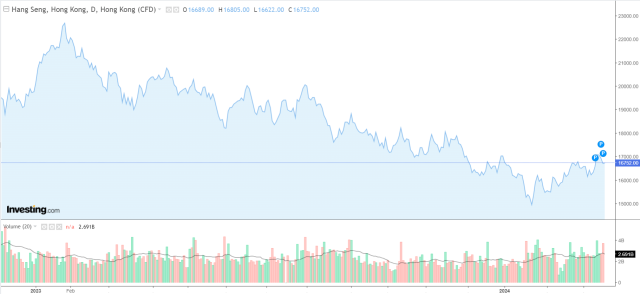

While the KOSPI in South Korea and the ASX 200 in Australia had mixed responses, the Hong Kong Hang Seng index experienced a minor decline in other regions of Asia.

The Reserve Bank of Australia is prepared to keep interest rates unchanged and will continue to have a hawkish outlook despite ongoing inflationary pressure.

US Market Influence and Global Central Bank Decisions

Asian markets are also responding to changes in the US market, closely monitoring the Federal Open Market Committee (FOMC) meeting that is coming up.

The cautious sentiment is heightened by the possibility of hawkish signals from the Fed in light of unexpected US inflation statistics.

This week is important because in addition to the Fed and BOJ, decisions are anticipated from the Reserve Bank of Australia, the Bank of England, and the Swiss National Bank.

Final Thoughts

The conclusion of the BOJ meeting is particularly important as traders navigate these uncertain times. A new phase for Japan's financial markets and economy could be approaching with the potential termination of its negative interest rate policy.

However, even in the event of a rate increase, the central bank's policy is anticipated to stay accommodative, indicating a cautious but positive prognosis for Japan's economy.

The complex relationship between central bank policies, market mood, and regional and worldwide economic data highlights the difficulties that traders encounter in the current climate.

With these central bank decisions ready to impact the trajectory of Asian markets and beyond, all eyes will be on them as the week goes on.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.