Analyzing Market Sentiments & Predictions: Gold, Silver, Oil, S&P 500, and EUR/USD

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Understanding market sentiments is crucial for predicting the direction of key assets. This analysis delves into the current trends and sentiments surrounding gold, silver, oil, the S&P 500, and EUR/USD, offering insights for informed investment decisions.

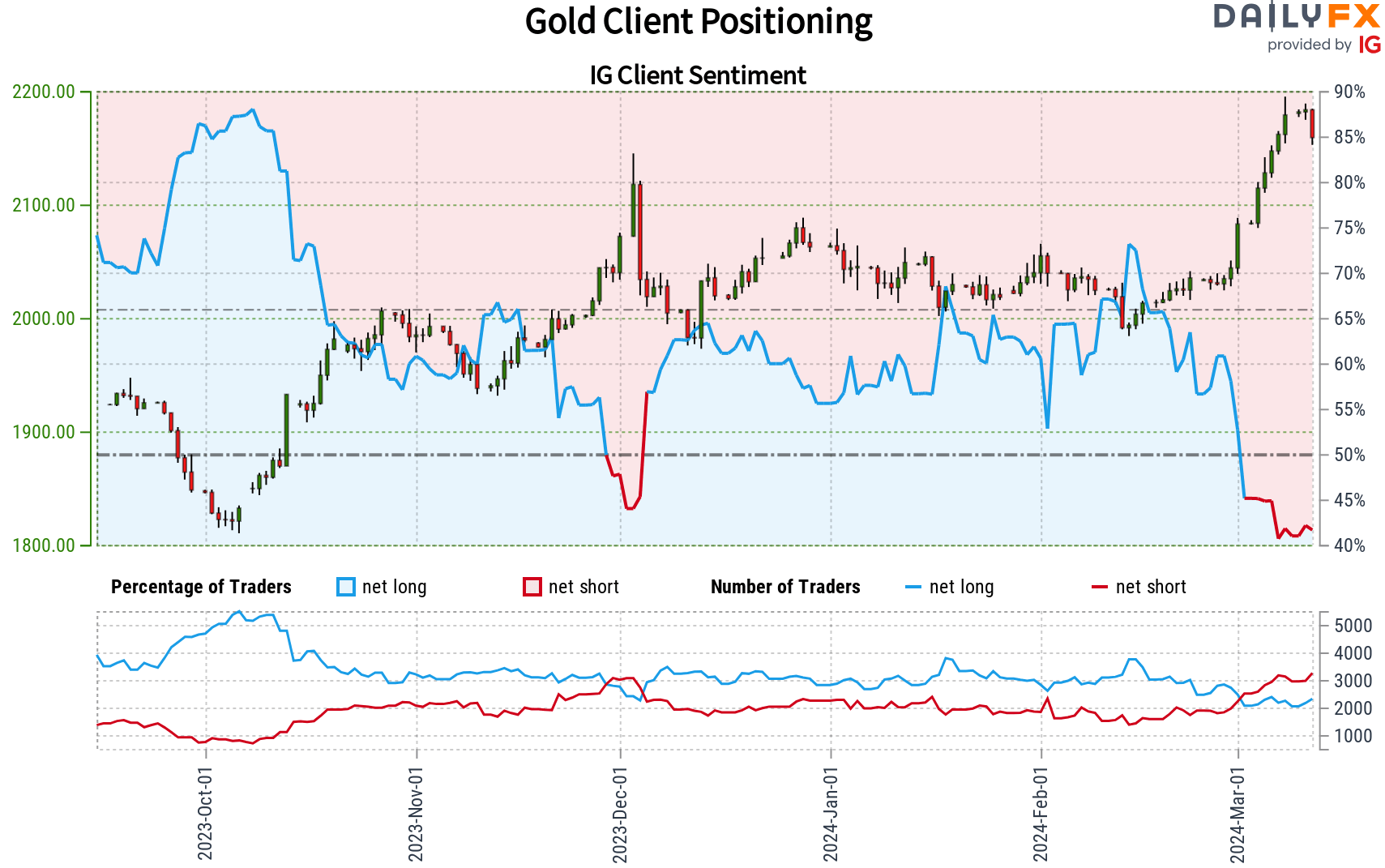

Gold Price Outlook

Retail trading data indicates a net-short bias in gold, with bearish positions outnumbering bullish ones at a 1.47 to 1 ratio as of Tuesday afternoon.

Collectively, bullish positions on gold have decreased by 9.67% since yesterday and are 12.80% lower than last week. Conversely, bearish positions have slightly fallen by 0.31% from the previous day and increased by 13.15% over the past week.

Our analysis typically takes a contrarian view of crowd sentiment. The current net-short positioning hints at potential short-term upward movement in gold prices.

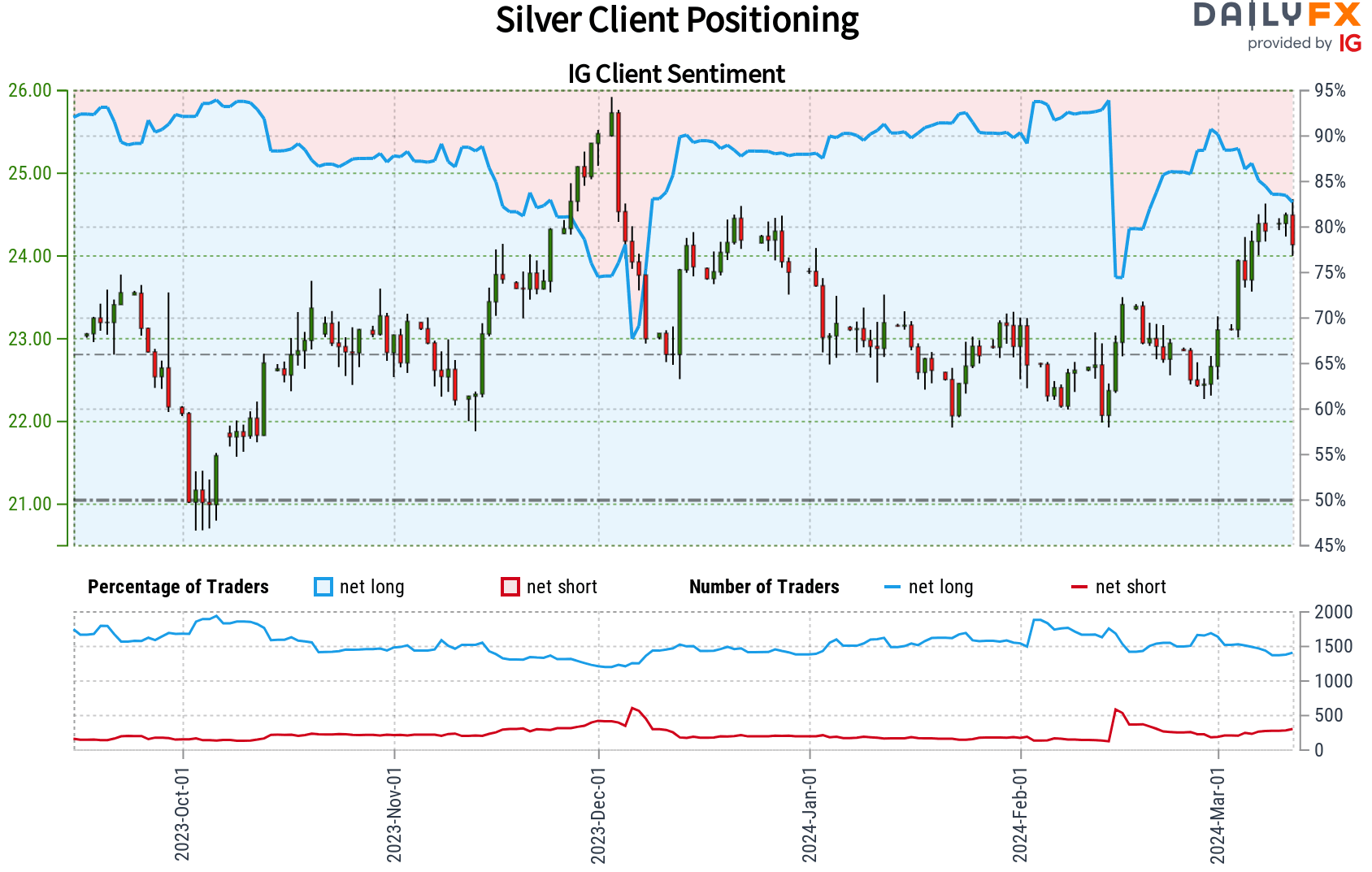

Silver Price Outlook

Retail trader metrics show 81.60% of traders are net-long on silver, with a long-to-short ratio of 4.44 to 1.

The proportion of traders net-long on silver has decreased by 7.08% since yesterday and 12.23% from last week. On the other hand, net-short traders have increased by 6.86% since yesterday and 21.81% from last week.

Adopting a contrarian perspective to crowd sentiment, the predominantly bullish stance among retail investors suggests that silver prices might face a downward correction soon.

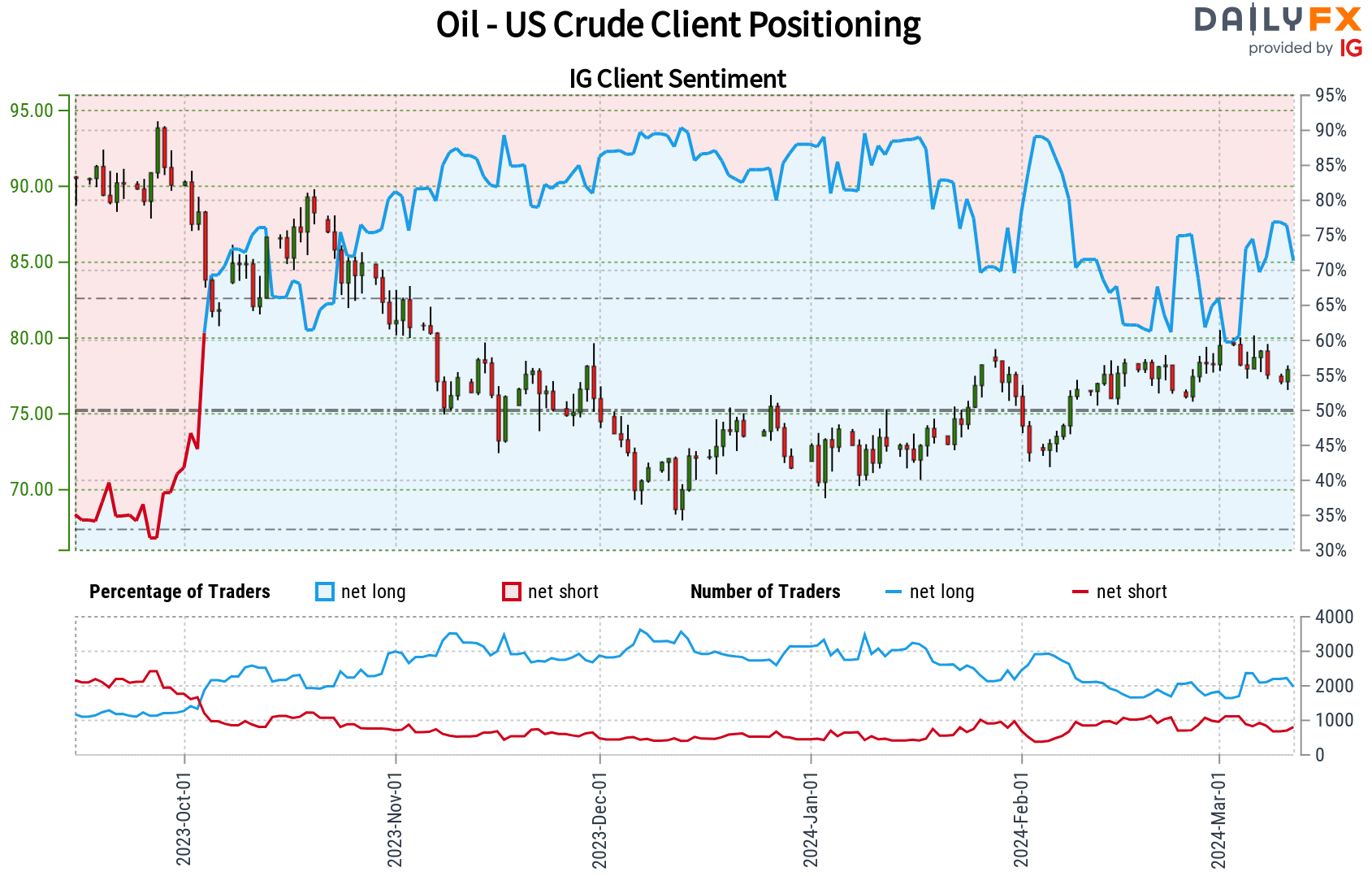

US Crude Oil Price Outlook

Today’s data from IG shows that 69.87% of retail investors are net-long on US crude oil, with a bullish-to-bearish ratio of 2.32 to 1.

Analysis reveals a 8.58% drop in net-long traders since yesterday and a 17.45% reduction from last week. Net-short positions have risen by 17.58% from the previous session but have slightly declined by 0.48% from last week.

Our contrarian view to crowd sentiment suggests the current net-long positioning may indicate an upcoming decline in oil prices. This highlights the importance of leveraging market insights for strategic trading.

image3.png

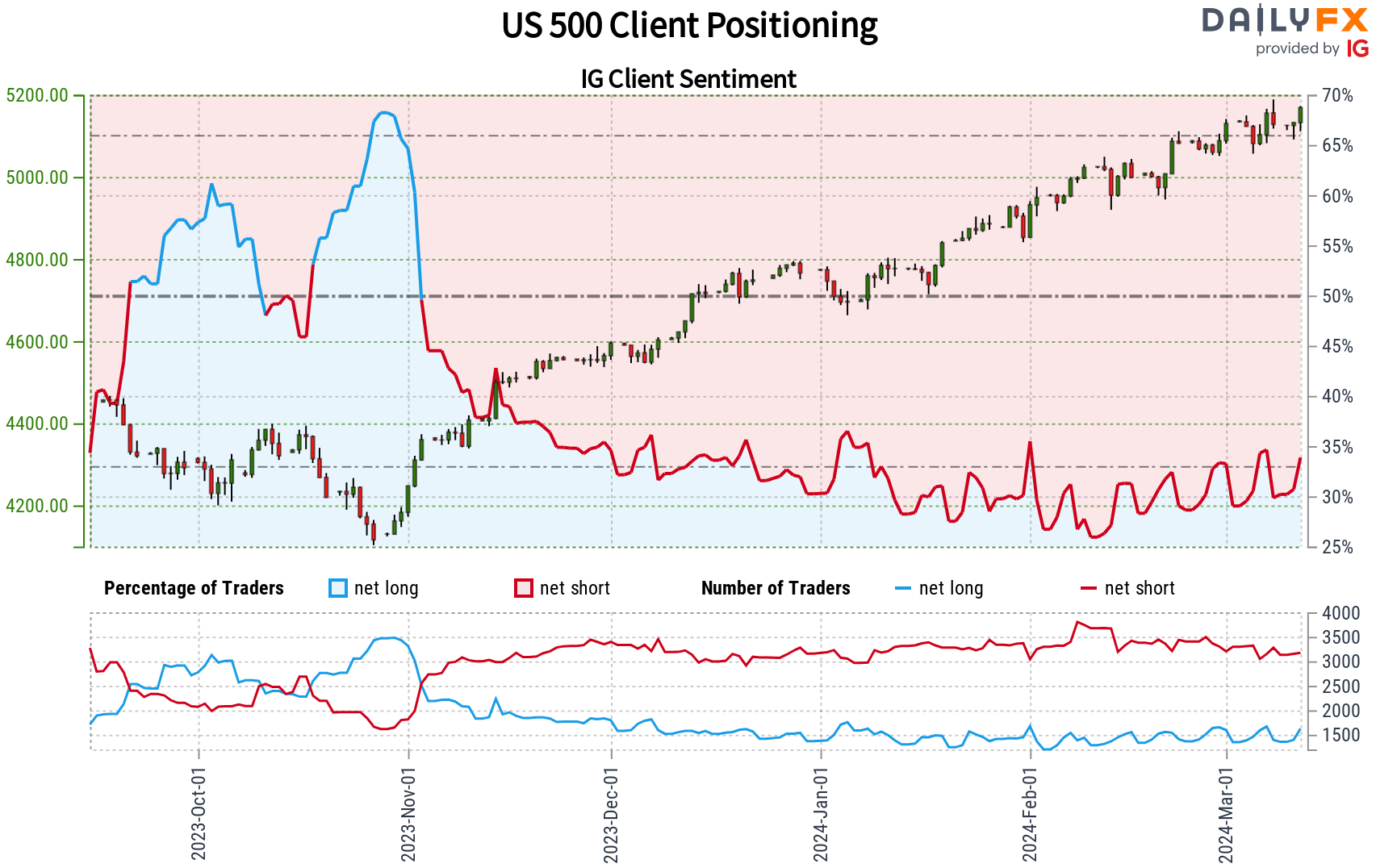

S&P 500 Outlook

Retail trader data reveals 33.09% of traders are net-short on the S&P 500, giving a bearish to bullish ratio of 2.02 to 1. Net-short traders have seen a 4.42% increase since yesterday, with a minimal decrease of 0.03% from last week.

In contrast, net-long traders have grown by 2.89% since yesterday and 4.76% from the previous week.

Taking a contrarian stance on the prevalent sentiment, the current net-short positioning among traders suggests potential for the S&P 500 to maintain its upward momentum.

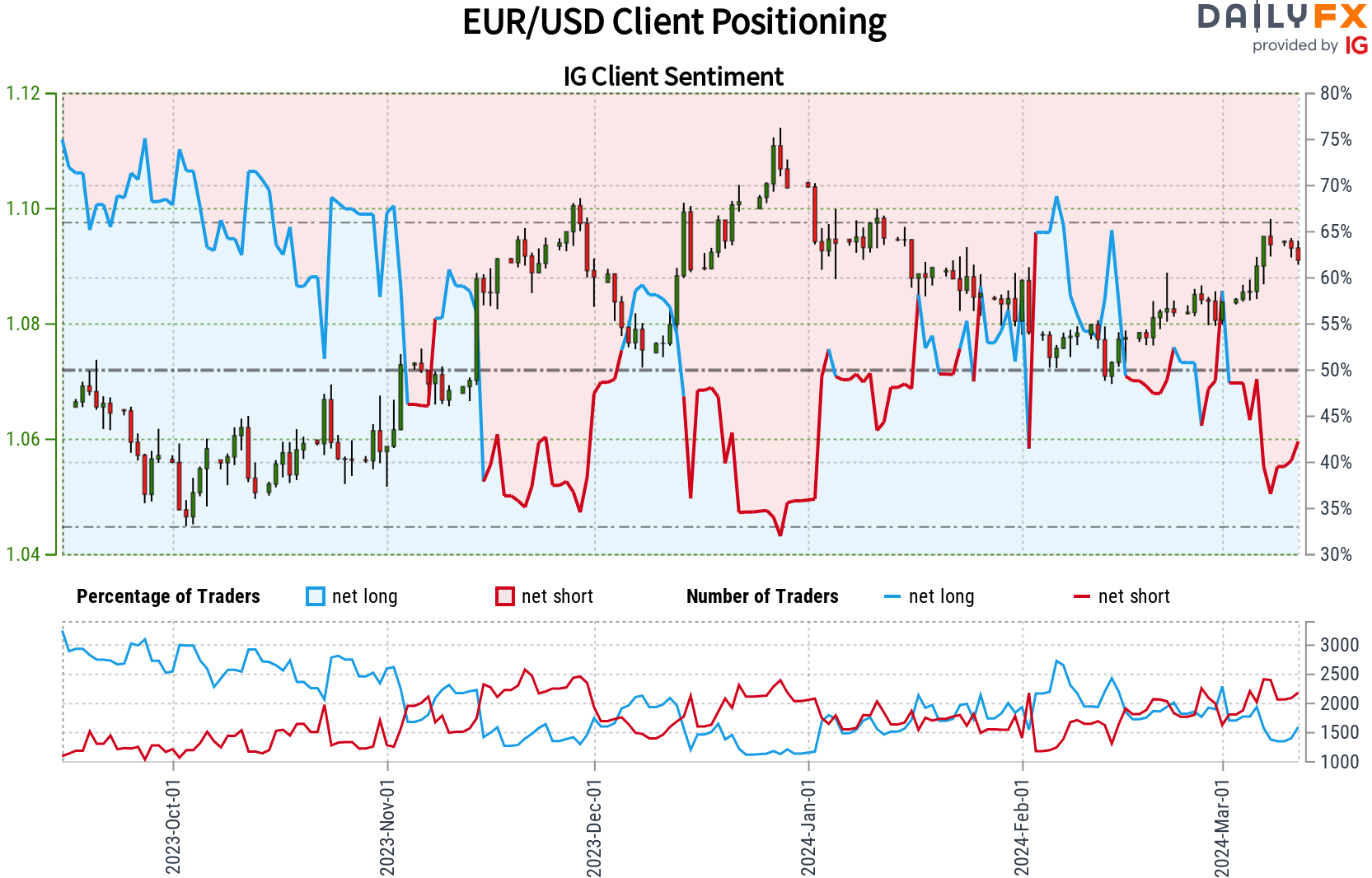

EUR/USD Outlook

IG’s retail client data today indicates 43.27% of traders are net-short on EUR/USD, with a bullish-to-bearish ratio of 1.31 to 1.

Overall, bullish bets have dropped by 0.73% since yesterday and 19.44% from last week. Meanwhile, the amount of traders net-short has decreased by 2.10% since yesterday, with a slight increase of 0.28% from last week.

Our approach often diverges from the crowd sentiment. The current net-short positioning suggests that EUR/USD might face limited resistance in moving higher.

Final Thoughts

As market dynamics continue to evolve, staying ahead requires a keen eye on sentiment indicators and trends. By leveraging the insights provided, investors can navigate the complexities of the market with greater confidence and strategic foresight.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.