Surge Mastercard Reviews: Card For Building Credit?

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Bad credit might make it difficult to get a credit card, but the Surge Mastercard gives qualifying applicants an unsecured credit card without a large security deposit. However, the hefty costs and lack of incentives may make it beneficial to investigate other solutions.

Celtic Bank offers the Surge Mastercard credit card, meant for people with a poor credit history or none at all. Moreover, anyone who wishes to establish or rebuild their credit will also find it beneficial. In less than a minute, you may check the status of your Surge credit card application. You can check whether qualified or not.

Although this unsecured credit card does not need collateral, it does come with a hefty annual charge. If it restricts credit card alternatives, a Surge Mastercard payment plan might help you improve your credit score via responsible use. Let's consider the Surge Credit Card review!

Overview: Surge Mastercard Credit Card Review

| Card | Best For | Fee & Credit | More Details |

|---|---|---|---|

| Best For Credit Building | Annual Fee: $75 - $99 • APR: 25.9% - 29.99% variable • Benefits: Free Monthly Credit Score |  |

What is Surge Mastercard Credit Card?

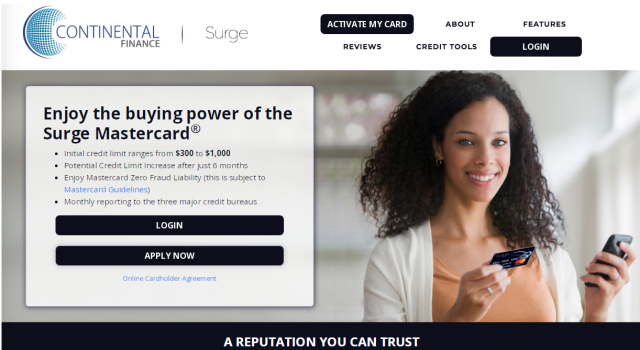

The Celtic Bank Surge Mastercard® Credit Card, managed by Continental Finance, is an unsecured credit card for people with bad or no credit. The card comes along with its annual fee and a minimum credit limit of $300. You can increase it in as short as six months.

Because the issuer sends your monthly payments to the three main credit agencies, the card may be a useful instrument for building credit. However, because there are no points or other benefits, this is not a card to maintain after your credit increases, and you are eligible for better deals.

The Surge Mastercard® is a credit card for those with bad or no credit. The card's provider, Celtic Bank, considers applicants with bad credit. However, you won't find it as a secured card with an upfront deposit required upon acceptance, unlike other cards geared at the subprime market.

Continental Finance, the card's servicer, provides your payment history to all three credit agencies (Experian, TransUnion, and Equifax), allowing responsible customers to establish credit.

How does Surge Mastercard work?

The Surge Mastercard® intends to assist people in establishing credit. If you're new to credit and want to repair your credit, this card should be on your list.

However, it's critical to comprehend the card's expenses, particularly when compared to alternative possibilities.

Use It to Build or Improve Your Credit

The Surge Mastercard® intends to assist you in establishing a solid history. Continental Finance, the card's servicer, transmits your account activity to all three credit agencies. The categories include Experian, TransUnion, and Equifax ensuring that it records timely payments are recorded.

Most major credit cards report to all three credit agencies, and this function is rather straightforward. Some credit cards for those with bad credit, on the other hand, do not. It's a must-have feature if you're searching for a card to help you establish credit.

Online and Mobile App Account Capabilities

Generally, it's easy to manage Surge Mastercard® accounts online or through the Continental Finance mobile app. It's also available for Apple and Android smartphones.

You may use the card servicer's mobile app to check current and previous transactions, make payments, update your contact information, and report a lost or stolen card. Your VantageScore® credit score is also available for free with the card. You'll get your updated score every month when you sign up for online statements.

Click Here to Get Started With Surge Mastercard Credit Card.

What are the Features of Surge Mastercard?

Let's consider the features in detail!

Current sign-up bonus/welcome offer

This card does not come with a sign-up bonus or a welcome offer. The rapid prequalification offer is the key introduction advantage. The application procedure is quick once you know whether pre-qualified or not. You can start working on your credit nearly immediately.

Benefits

The Surge Mastercard is a credit card for anyone with all types of credit. It's a fantastic option for folks who can't get an unsecured credit card and don't want to pay the deposit that secured credit cards require.

When you use the card, you will report your Surge credit card activity to all three main credit agencies — TransUnion, Experian, and Equifax. Assuming you make on-time installments, maintain your credit card usage modestly, and use it properly, you may increase your credit rating and ultimately be eligible for a higher credit card.

Anyone entitled to a credit card limit adjustment after six months of paying the required minimum monthly payments will get benefits. This can help you reduce your credit usage, which is another factor that might help you boost your credit score.

No security deposit

With the Surge credit card, you may acquire a credit limit of $300 to $1,000 with no deposit. Are you authorized? You may get cash right away without having to put up any of your own money. The credit limit of up to $1,000 doub to $2,000! (All you have to do is pay your first six-monthly minimum payments on time.)

Security Features

This card comes with conventional security measures, including restricted responsibility for illegal transactions, card replacement in the event of loss or theft, and encryption technology.

What is the Credit Score Requirement of Surge Mastercard?

Generally, Surge Mastercard offers a free monthly credit score for the credit card issuer for better credit utilization. Moreover, the initial limit starts from $300 to almost $1,000 credit limit doubles for different credit types.

The starting credit limit increase when you make six on-time monthly payments and helps potential credit limit increase. With the least monthly fees and the Subprime credit card market, you can get free access to fraud liability protection and higher credit line.

Whether it's limited or poor credit, look for the credit profile as it helps you know about monthly reporting and other credit building cards. Therefore, the applicants' credit approval option offer cash advances and own proprietary website rules, and a refundable deposit for assistance. It helps build credit reliably.

How much does Surge Mastercard Cost?

Let's take a look at the annual fees and costs! The Surge card includes an annual fee of $75 to $99 that aids in building a free credit score with assistance. It's a credit-building credit card with fewer foreign transaction fees.

However, it will cost you a monthly fee of $10. There is an additional card fee of almost $30 with a cash advance fee of 5%, that's greater. It's an accepted MasterCard with a foreign transaction fee of almost 3%. There are monthly maintenance fees and an annual fee for creditworthiness. The APR features a 24.99- 29.99% variable rate making it a beneficial option.

Click Here to Get Started With Surge Mastercard Credit Card.

Who is Surge Unsecured Credit Card Best For?

As per the Experian, one of the three main card agencies, 33% of Americans have a FICO score that falls between 300 and 669, putting them in the “extremely low” to “fair” category.

If your credit score falls into one of these areas, you may have trouble getting accepted for a credit card. Moreover, you may only be able to receive a secured card.

Hundreds of dollars in security deposits are essential for secured cards. The Surge Mastercard may be an option if you don't want to deposit.

You might be able to get this card without a deposit if your credit is good enough, providing you access to an unsecured line of credit.

Best for people with a short-term credit limit

The Surge Mastercard is only a viable option for persons who want to use it as a short-term credit-building instrument because of these downsides. You can terminate your account whenever you qualify for a credit card with lower costs.

The Surge Mastercard® Credit Card can assist you in achieving your history improvement goal, but it will come at a cost. The card may come with a significant annual cost depending on your creditworthiness.

Best credit scores

The card comes with a monthly maintenance cost beginning with your second year as a cardholder, in addition to the potentially hefty annual price. Authorized users, cash advance purchases, and international transaction fees incur additional charges.

However, there are a lot of costs associated with this card. Unlike the security deposit on a secured card, these costs aren't refundable.

Surge Mastercard Pros and Cons

| 👍 PROS |

|---|

► Access to Unsecured Cards If you have less or no credit, you may need to start with a secured card, which requires a deposit. However, you may be eligible for an unsecured card with a credit line of $300 to $1,000 if you apply for the Surge Mastercard. ► Reports to the Three Biggest Credit Reporting Agencies: Each month, the three main credit bureaus—Experian, Equifax, and TransUnion—report payments on your Surge Mastercard account. Using the Surge Mastercard to make all of your payments on time will help you steadily improve your credit score. The major credit bureaus fast and help get reports from most, but not all, credit card issuers. Check to see if a card targeted for those with weak credit would record your payment behavior before applying. ► Additional Card Details Because the Surge Credit Card offers features for those with weak credit or no credit history. It doesn't come with many perks other than monthly credit reporting to the three major credit agencies. You do not have to put down a cash deposit as you would with a secured credit card because of an unsecured factor. This is useful if you know you'll be able to make on-time payments each month but do not have the payments to put down a deposit. |

| 👎 CONS |

|---|

► Security Deposit may apply Applicants who do not meet the requirements for the Surge Mastercard without a security deposit must pay a refundable security deposit. Your creditworthiness determines the amount you receive. The Surge Mastercard's key advantage is an unsecured alternative for persons with bad credit. This card's value negates if you don't qualify for it without a security deposit. In this situation, the Milestone Gold card could be a better option. It has expensive costs, but it is secure for all approved customers. ► Higher-than-Average APR The Surge Mastercard's APR on purchases is 29.99 percent, much higher than the national average for all interest-bearing credit cards. While many cards for bad credit applicants have high-interest rates, holding a load with such a high APR might lead your balance to rise over time. Attempt to pay off your account balance in whole each month to prevent hefty interest charges. Look for a credit card with a lower APR if you plan to carry a balance. |

Surge Mastercard Compared to other Cards

| Credit Card | Annual Fee | Credit Requirement | Welcome Bonus |

|---|---|---|---|

| Surge Mastercard Credit Card | $75 - $99 | No Credit Requirement | Not Specified |

| Chase Freedom Unlimited | $0 | 690 - 850 | $200 |

| Capital One QuickSilver | $0 | 700 - 850 | $200 |

| Petal 1 Credit Card | $0 | None | $50 |

Click Here to Get Started With Surge Mastercard Credit Card.

Surge Mastercard vs. Chase Freedom Unlimited

The Surge card includes an annual fee of $75 to $99 that aids in building a free credit score with assistance. It's a credit-building credit card with fewer foreign transaction fees. However, the Chase Freedom Unlimited® is a good option for those searching for an all-around workhorse card.

The Surge Mastercard is only a viable option for persons who want to use it as a short-term credit-building instrument because of these downsides. Besides this, Chase Freedom Unlimited is for consumers who desire a straightforward rewards program with good returns and exciting new bonus earning opportunities.

>> Full Article: Chase Freedom Unlimited Review: Huge Cash Back and Bonus?

Surge Mastercard vs. Capital One Quicksilver

The Surge Mastercard is designed for those with weak credit or no credit history; it doesn't have perks other than monthly credit reporting to the three major credit agencies. However, the Capital Quicksilver credit card includes no annual fee with few benefits like auto rental damage insurance, accident insurance, and warranty protection.

Generally, Surge Mastercard offers a free monthly credit score for the credit card issuer for better credit utilization. But wait! Capital bank's secure site offers credit utilization and is a Platinum Secured credit card with a credit line limit and recommended credit score record.

>> Full Article: Capital One Quicksilver Review: Cash Rewards Credit Card

Surge Mastercard vs. Petal 1 Credit Card

Let's compare Surge MasterCard with Petal 1 Credit Card! The credit card includes a $1000 credit limit that works well with $2000, whereas Petal 1 card comes with $500 to $5000 limits to offer different benefits.

The surge credit card also provides all credit types, but Petal 1 helps get a credit limit increase option. Besides this, a Surge credit card also includes a foreign transaction fee, whereas there are no fees on the Petal 1 card.

The Surge Card includes an effortless application process with online account access. However, Petal 1 has 2-10% cash-back factors on selective merchants with no deposits requirements.

>> Related Article: Petal 2 Visa Credit Card Reviews: Cash Back No Fees

Conclusion: Is Surge Mastercard Worth it?

Continental Finance and Bank provide the Surge Mastercard® Credit Card, an unsecured card for clients with bad credit or limited history. You won't have to deposit because it's an unsecured card. However, the significant continuing costs associated with this card might rapidly pile up.

You should emphasize prudent credit use with any card for credit building. The three credit bureaus get monthly reports on your Surge Credit Card usage and on-time payments, which can help you improve your credit score over time. There is also a monthly maintenance fee for assistance.

The Bank Surge Mastercard has several features that may appeal to people looking for a second opportunity at building credit, but the costs significantly exceed the advantages. It includes a prequalification procedure, the possibility of a larger credit limit, and payment reporting to all three main credit agencies.

>> Related Topic: Best Chase Credit Cards • Compare Top Chase Credit Card of 2024

Surge Mastercard FAQs

What is the highest credit limit for Surge Mastercard?

Unsecured credit cards offer different options to build your credit by being prudent with your money. You can get a credit card limit of up to $1,000 without putting down a security deposit. After six months of use, you may be eligible for a higher credit limit.

With an initial credit limit of $300 to $1,000 on the Surge Credit Card, you'll need to be particularly careful with your spending to rebuild your credit.

Does Surge Mastercard report to the three major credit bureaus?

Reports to the Three Biggest Credit Reporting Agencies: Each month, the three main credit bureaus—Experian, Equifax, and TransUnion—report payments on your Surge Mastercard account. Check to see if a card targeted for those with weak credit would record your payment behavior before applying.

The Surge Mastercard® Credit Card is not a scam; it is a legitimate credit card for persons with terrible credit. It sends monthly credit reports to the three main credit bureaus, allowing cardholders to improve credit by paying on time and only utilizing a part of their credit limit.

Is Surge Mastercard good for building credit?

To begin, use Credit Karma to compare offers for credit cards for those with bad credit or secured credit cards. If you're still not convinced after looking into your other alternatives, the Surge Mastercard® could be worth considering because it can help you develop credit quickly.

An unsecured card comes with the possibility of increasing your credit limit. The Surge Mastercard® has an initial credit limit of $300 to $1,000. If you make your first six monthly payments on time, you may be eligible for a credit limit increase.

Click Here to Get Started With Surge Mastercard Credit Card.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.