Saving For Retirement: 7 Reasons Why You May Have To Delay Contributions

By David

January 22, 2014 • Fact checked by Dumb Little Man

Thinking about retirement can be daunting when you’re wondering how much money you need saved and how you will earn that amount in the first place.

Saving for retirement is important and starting while you’re young is best.

Unfortunately, that isn’t always possible and life’s obstacles may decrease your retirement savings.

1. You Have Made An Investment In Your Career

Whether you’ve recently changed careers, decided to start your own business, or started to go back to school to make that leap into upper management, the financial toll of inconsistent income and continuing expenses can force you to stop saving for retirement.

2. You Are Trying To Save In Case of Emergency

We all know that anything can happen at any time and emergencies are so much more of a hardship if you have no money. It’s wise to be prepared by saving enough money to cover at least half a year’s expenses should anything go wrong. This should come before worrying about saving for retirement because short-term financial issues can spiral into huge long-term problems.

3. You Just Bought or Are Planning To Buy A House

If you are unable to start saving for retirement because of the expenses of owning a new home, assuming you didn’t overspend on the purchase, don’t worry. Buying a home is a wise move, because it brings about stability in more ways than one.

• When you own your own home you have a sense of security you wouldn’t have if you were simply renting. You know you aren’t going to be evicted for any reason and your money is going towards an investment that (as long as you continue making your payments) will likely be your largest asset.

• When you are renting, not only are you basically throwing your money away, your rent will likely increase in the future. However, if you own your own home, be sure to get a fixed-rate mortgage loan, especially nowadays.

• In many areas around the country, the prices of homes have stagnated after falling during the recession. This means that families and investors shopping for real estate may find value in underappreciated markets. Now is the best time to buy a house, because as the nation recovers financially and population grow continues, real estate will appreciate and rise back to pre-recession levels.

4. You Have Important Insurance Policies

It is a financial burden to have an accident that leaves you unable to work. This is why you must be prepared by having insurance. In order to keep from spending more than you have, affordable health and car insurance coverage are mandatory. And since car insurance is required by most state laws, consumers should learn how to get the best rates by researching the ins-and-outs of the industry. MyCarInsurance123.com is an excellent resource for learning everything about getting cheap car insurance.

Most importantly, buy a term life insurance policy when you are young and healthy. If you are the primary breadwinner in your family and have financial dependents, your death could mean significant adversity for them. Compare life insurance quotes to avoid overpaying for a long-term policy.

If you have to choose between paying for your insurance policy or making a contribution to a retirement fund, insurance is the way to go because your retirement won’t mean much if you are saddled with litigation or liability.

5. One of Your Children Is Disabled

When you have children, they are your first and foremost concern, and when you have a child with special needs, those concerns are heightened. Much planning is needed – from what type of school they will attend to how they will be cared for should anything happen to you. If you are a parent with a child who has a physical disability, check with a professional to make sure you are covering all your bases regarding tax laws and trust funds. There are plenty of government and private programs to help.

6. You’re A College Student

Generally speaking, the more education you have, the more money you will make. College graduates make at least $20,000 more per year than high school students and post-graduates with a master’s degree can make, on average, $20,000 more than college grads with a bachelor’s. Furthering your education is wise and definitely a legitimate reason to delay saving for retirement. A higher salary after graduation can more than compensate for a couple years lost in school.

7. Should You Pay For Your Child’s College Education?

College is expensive and tuitions are on the rise. Parents may feel it is their responsibility to pay for their child’s education, which means they will put off saving for retirement. However, there are ways your child can fund their own education without forcing you to delay saving for your retirement. There are plenty of public and private scholarships and grants available, and if your son or daughter works while attending school, their wages can go towards paying for books and other living expenses.

With the newly implemented government “Pay As You Earn” program, student loans are no longer as great a burden on graduates as they once were. Subsidized and unsubsidized Stafford Loans are available through schools and the government. Students just need to apply through the FAFSA website.

A student has many options to pay for their own education, but you don’t have all of the same opportunities to pay for your retirement. Let your child explore and take advantage of “free money” opportunities before you invest your hard-earned cash.

Saving For Retirement – Start Sooner Than Later

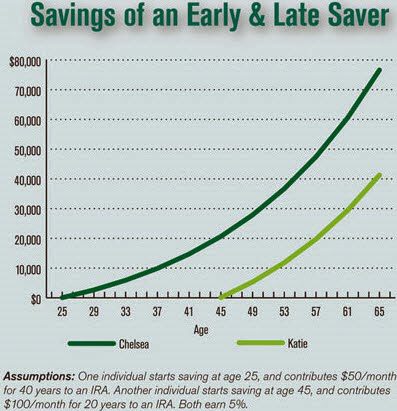

There are all kinds of reasons to delay saving for your retirement, and it’s stressful to think that you are waiting too long to start. The longer you wait, the less money you will accumulate. By protecting what you have today, you can build financial stability for your future. How you spend your later years depends on how you live now.

| Written on 1/22/2014 by Gary . Gary is a financial expert who started www.MyCarInsurance123.com to help U.S. consumers navigate the challenges of finding cheap car insurance coverage. Check out our articles to learn how to compare car insurance coverage, policies, companies, premiums and discounts via free quotes online. |