Fast Capital 360 Reviews: Business Term Loans for Small Businesses

By Peter Vanderbuild

January 12, 2024 • Fact checked by Dumb Little Man

Access to capital helps drive your small business economy and gear up to achieve the business goal. However, financing always remains challenging for small businesses especially, if they try to loan at large banks.

So, here Fast Capital 360 comes to fill the gap in the marketplace with quick and hassle-free application. Besides, borrowers can get funding advice that helps you move through your business options from industry-leading groups.

Terms and conditions are simple and you can get the fund quickly, even in 1 day in most cases. Let's dive into the review to know more about Fast Capital 360.

Overview: Fast Capital 360 Loans Review

| Lender | Best For | Fee & Credit | More Details |

|---|---|---|---|

| Best For Small Business Loans with Low APR | Loan Amount: Up to $5 million • Loan Term: 3 months to 25 years • APR: 6.25% - 10% |  |

What is Fast Capital 360?

Fast Capital 360 is a U.S.-based finance institution that offers multiple loans ranging from $1000 to $5,000,000 to businesses. Capital 360 is available in 50 states in the US.

Since 2013, the company has been providing access to capital to customers claiming that it has served 35,000+ businesses successfully.

Being a direct lender and online lending platform, Fast Capital 360 works with all credit-type business owners. But you need to have at least 500 FICO and $72,000 annual revenue to qualify.

The borrowers can compare the offers from Fast Capital and other lenders in the network by completing a one-minute online form. As a result, they can prequalify in a few minutes and get the funds in their bank account in 24 hours.

What are the Types of Loans Offered by Fast Capital 360?

Fast Capital 360 is a great company that offers short-term and long-term business loans.

Business Term Loans

A Business Term Loan offers up to $250,000 capital to business owners with starting 7% interest rate. It includes loan term ranging from 1 to 5 years and provides the fund in 24 hours.

Short-Term Loans

Short-term loans can be useful in business emergencies and Fast Capital 360 offers the fund up to $500,000. However, it may be expensive for borrowers to loan starting APR of 10%.

Short-term loans extend the term ranging from 3 months to 18 months at Fast Capital 360.

SBA Loans

SBA Loans offer up to $5 million to small business owners exclusively from participating banks and alternative lenders. SBA Loan is a long-term loan so it extends from 5 years to 25 years at starting 6.25% APR.

The fund may take seven days to reach a borrower's account. Small business owners with good credit can leverage this loan for their capital-intensive projects.

Merchant Cash Advances

Merchant Cash Advances (MCAs) allow businesses to borrow funds against their future profits. MCAs are available up to $500,000 at Fast Capital 360 with a starting factor rate of 1.10.

With the fund transfer on the same day of application, the company extends loan maturity from 3 to 24 months. The MCAs can be good for business owners to fill temporary cash-flow gaps and improve their credit.

Equipment Financing

Borrowers can buy or lease business machinery, vehicles, and equipment through equipment financing. An equipment loan is available up to 100% of equipment value with a starting interest rate of 8% at Fast Capital 360.

The loan can extend from 1 year to 5 years term and borrowers can receive the fund in 2 business days.

Business Lines of Credit

The business lines of credit allow borrowers access to a pool of fund that they can withdraw when they need it. Borrowers can apply for up to $250,000 with the interest rate starting from 8% at Fast Capital 360.

The credit line loan is a short-term finance product that extends from 6 months to 2 years. It can be helpful in cash-flow gaps, business emergencies, and short-term projects.

Accounts Receivable Financing

Accounts Receivable Financing (ARF) allows business owners to sell accounts receivable balance and receive an advance of the invoice’s face value. to 80% of the invoice value. Fast Capital 360 offers ARF up to 80% of invoice value at a starting factor rate of 1.02.

The borrowers can get the fund on the same day of application and repay until the customers pay their invoices.

Working Capital Loans

Working capital loans can help in maintaining the business economy with medium-term policy. Fast Capital 360 offers working capital loans up to $500,000 with a starting interest rate of 7%.

Borrowers can get the loan on the same day of application and repay the loan in the medium term ranging from 3 months to 5 years.

Commercial Loans

Commercial loans are long-term loans that offer up to $5 million at Fast Capital 360 with a starting APR of 6.25%. Borrowers can receive the loan on the same day of application and repay the loan between 3 months and 25 years.

This type of loan can be best for longer-term investments including equipment purchases, building enhancements, and business expansion.

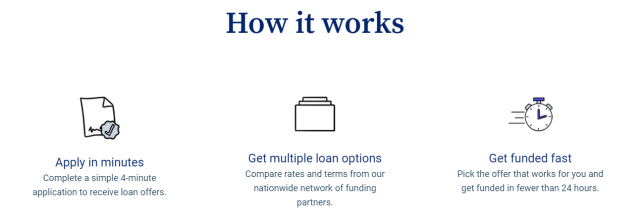

How does Fast Capital 360 work?

Capital 360 offers multiple loan options ranging from $1000 to $5,000,000. For this, you need to fill out a quick online application.

The official site has only mentioned that the interest rates start at 6.25%. So, it can vary according to the offer type and term. You will know once your application is approved and an offer is made.

Once approved, you receive the fund on the same day of application but depends on your loan type. You will also get the payment routine according to the term you have signed.

When it comes to repayment, it can vary depending on your loan type. For example, business term loans can be paid off in weekly or monthly installments.

On the other hand, borrowers can repay short-term loans in weekly or biweekly payments. But if the loan is long-term like SBA loans, borrowers need to repay in monthly payments.

Click Here to Get Started With Fast Capital 360 Loans.

What are the Features of Fast Capital 360?

With the diversified offers and loans, Capital 360 has several considerable hallmarks.

Quick Online Application: Applying for Capital 360 loans does not consume much time. Customers can fill out the form in a few minutes.

Fast Funding: After an application approves, the funding process is swift Capital 360. In most cases, the borrowers receive the fund on the same day of application. The longer time to receive the fund from the lenders at Capital 360 is seven days.

Multiple Loan Types: Capital 360 provides multiple loan options for small businesses. This helps borrower meet their financial need in a single place.

Multiple Offers: Applicants receive multiple offers from several lenders at Capital 360. So they have options to compare offers and choose the best one. Also, they can qualify for multiple loans through a single application.

No Need for Good or Excellent Credit Score: Capital 360 expects the minimum 500 FICO credit score to qualify for the loans. However, if you have a good or excellent credit score, you can win reasonable offers for your business.

Fast Capital 360 Requirement?

To leverage the Fast Capital 360 products, you need the following requirements.

Credit Score: You will need at least a 500 FICO credit score to start with Fast Capital 360 products. However, you may hit some expensive offers through this credit score. So, instead, a Good or Excellent credit score can help you qualify for better offers.

Time in Business: Generally, lenders at Fast Capital 360 seek small businesses that are in operation for 2 years or more. However, the borrowers in the business for 6 months are eligible to qualify for Fast Capital services.

Annual Revenue: The business revenue also matters to qualify for loans at this platform. Small businesses with a minimum of $10,000 monthly income or $72,000 annual income can qualify for Fast Capital 360 loans.

To apply for Capital 360 products, you will need to submit the following requirements:

- Contact information

- Business EIN number

- Social Security number

- Financial statements

- Past bank statements

- Business license

- Tax returns (personal and business)

- Other legal documents (e.g., articles of incorporation)

- Proof of collateral

How to Apply for Fast Capital 360?

The below steps will guide you to apply for and qualify for Fast Capital 360 offers.

Step 1: Showcase Your Need

After visiting the official website, you need to enter the amount you need. Along with that, time in business and annual revenue will also be filled out.

Step 2: Enter Your Business Details

The next step will be exposing your business details. For this, first, you need to mention your name, company name, email address, and phone number. Then, they will ask for your business address and contact details, the date of starting a business, annual revenue, and EIN number.

Step 3: Upload the Required Documents and Submit

You need to enter your bank account information or the 4 most recent bank statements in this step. After that, you need to submit all details and wait for what comes next.

Step 4: Check What Offer You Have Qualify for

Once you finish submitting, Fast Capital 360 will show up with the best matching offers. You can compare the offers and decide to choose which one you need.

Step 5: Allow Hard Credit Check

If you feel the offers are comfortable, you can continue applying for the loan. In this step, you need to allow the company for hard credit pull.

Step 6: E-sign and Get the Fund

Once officially approved, you can e-sign the loan agreement and receive the fund. In most cases, the fund is delivered in 24 hours.

How much does Fast Capital 360 Cost?

As Capital 360 has multiple loan offers, the cost also varies depending on the type of loan and amount. Below are charging rates in offers of each category.

- Business Term Loans- starting 7% APR

- Short-Term Loans- starting 10% APR

- SBA Loans- starting 6.25% APR

- Merchant Cash Advances- starting 1.10 Factor Rate

- Equipment Financing- starting 8% APR

- Business Lines of Credit- starting 8% APR

- Accounts Receivable Financing- starting 1.02 Factor Rate

- Working Capital Loans- starting 7% APR

- Commercial Loans- starting 6.25% APR

Click Here to Get Started With Fast Capital 360 Loans.

Who is Fast Capital 360 Best For?

Primary customers of Capital 360 are small business owners who have past 6 months in business and possess a minimum of 500 FICO.

The borrowers who need multiple financial loans in a single place can join Capital 360. Besides, they can qualify for multiple offers through a single application.

Also, those who need loans ranging from $1000 to $5,000,000 for business development can leverage Capital 360.

Fast Capital 360 Pros and Cons

| 👍 PROS |

|---|

► Quick Application and Funding: Unlike traditional loan companies, Fast Capital 360 has a short-online application form. As a result, borrowers need only a few minutes to complete. Once approved, the loan is deposited on the same day of application. ► Multiple Loan Types: The lending company offers altogether 9 finance loans for small businesses. This helps business owners meet all their financial loans in a single place. ► Customer Satisfaction: The company is a reputed lending platform with positive Fast Capital 360 reviews. Based on employee reviews, customers claim that the representatives are helpful, knowledgeable, and quick. |

| 👎 CONS |

|---|

► Hard to Qualify: Capital 360 requires some additional requirements that kick the Startups out of the league. QuickBooks, PayPal, and Lendio can be the better options in this context. ► Non-Transparent Cost: The company has not included the interest rate (APR) or any fees on its official site. So, potential borrowers need to fill in all the required information to know the pricing. ► Available Online Only: Some customers need in-person meetings but Capital 360 is only online. Also, the company does not have mobile app access for customers. |

Fast Capital 360 Compare to other Lenders

| Lender | Est. APR | Loan Amount | Loan Term | Min. Credit Score |

|---|---|---|---|---|

| Fast Capital 360 | 6.25% - 10% | Up to 5 million | 3 months - 25 years | 500 |

| Fundera | 10% - 60% | Up to $1 million | 2 to 5 years | 640 to 700 |

| MainStreet Finance Group | 54.23% | $5,000 to $5,000,000 | Up to 25 years | 600 |

| BlueTrust | 472% to 841% | up to $1,500 | 6 - 12 months | Not specified |

Click Here to Get Started With Fast Capital 360 Loans.

Fast Capital 360 vs. Fundera

Capital 360 and Fundera are pretty similar in offering multiple loan types including SBA loans and Equipment Financing. They also offer similar loan terms, the credit score requirement, and a maximum borrowing amount.

However, borrowers can not borrow the amount below $2,500. Also, borrowers complain that some lenders have additional fees.

Unlike Fundera, Capital 360 has more loan options so, small business owners need not go anywhere for their financial needs.

Fast Capital 360 vs. Main Street Finance

Main Stree Finance Group offers three loan types; Business Cash Loan, Line of Credit, and SBA Loans.

However, it is hard to qualify for Main Stree Finance loans. The borrowers need to have 600 FICO, a $5,000 loan requirement, and $250,000 annual revenue.

Unlike Manin Street Finance, Capital 360 needs 500 FICO and $72,000 annual revenue to qualify for the loan. Borrowers can loan a minimum of $1000 for their financial needs.

Fast Capital 360 vs. Blue Trust Loans

Blue Trust Loans represents a tribal lender that offers small personal loans ranging from $100 to $3,000. However, they restrict the first-time borrower starting at $1200.

Though they do not consider credit scores to qualify for loans, they charge high APR. The interest rate can go up to 800%+ and loan maturity extends for only 10 months.

Unlike Blue Trust, Capital 360 offers multiple small business loans ranging from $1000 to $5,000,000. Besides, the interest rate is competitive like found in the market.

>> Full Article Review: Blue Trust Loans Reviews: Compare Top Lenders of 2024

Final Verdict

Fast Capital 360 is the lender and online lending platform available in 50 states in the US. The company offers multiple loans ranging from $1000 to $5,000,000 for small businesses to survive and grow.

Capital 360 has a quick form for an application and swift fund processing. So, if you are a business owner with 500 FICO and $10,000 monthly revenue can leverage Capital 360 loans.

Fast Capital 360 FAQs

What is the minimum credit score requirement for Fast Capital 360 Loans?

You'll need a minimum of a 500 FICO credit score to qualify for Fast Capital 360 loans.

Does Fast Capital 360 approve fast for business loans?

Yes. After approval, Capital 360 can load the fund to borrowers' accounts on the same day of application in most cases.

Is Fast Capital 360 legit?

Yes. Capital 360 has strong positive reviews from all around the 50 states in the US.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.