Barclays Banking Reviews: Is Barclays a Good Bank?

By Peter Vanderbuild

January 12, 2024 • Fact checked by Dumb Little Man

There is no exaggeration in saying that Barclays online banking is an excellent choice for CD accounts and savings in the market with highly innovative rates. The oldest and the most significant bank in the UK, Barclays has its roots in the late 17th century.

Barclays has been gaining popularity for over 50 years for its ideal credit cards. Barclays is not as popular in the US as compared to other parts of the world. But if you look today, you will be surprised to see Barclays as one of the top online banks with commendable reviews.

It is strictly an online financial institution that delivers high-end, attractive options such as online payments, Barclays CDs, student loans, and no minimum balances with fixed CD rates. It is one of the best financial services companies that provides exclusive customer service lines and credit unions.

What else the Barclays bank offers? It has multiple features for account holders to enjoy, from minimum balance requirements and different savings products with guaranteed favorable reviews for increased user experience. Let's get right into the details!

What is Barclays?

Barclays bank has its foundation in the United Kingdom since 1690, with its growing branches worldwide. In 40 countries around the globe, there are more than 48 million Barclays customers. Due to its vast geographical status, Barclay's bank offers several online websites.

Safety and security are top priorities for any online bank, and Barclays ensures that these crucial features are fully valued. SSL technology is used for data encryption with firewalls and many other technologies to protect the customer's personal information and account details. To prevent unauthorized use, Barclays includes monitor equipment. It has an automatic logout feature in the mobile app and online access after long periods of inactivity.

Are you searching for multiple investment banking features, Barclays savings account, decent wealth management, and annual percentage yield? It fulfills the federal regulation d and offer competitive rates while focusing on cutting fees and high-end exceptional customer experiences with reasonable purchase assurance.

Moreover, the Barclays savings accounts and network partners with an effective price protection method that's no more an exception. You can accrue additional money in interest. It has zero minimum balance with the least fees.

How do Barclays Accounts work?

Barclays Bank is an online-only bank focusing only on savings and CD accounts. It also includes credit cards and personal loans, but it does not offer different checking accounts or other lending options.

- Savings account

- CDs

- Credit cards

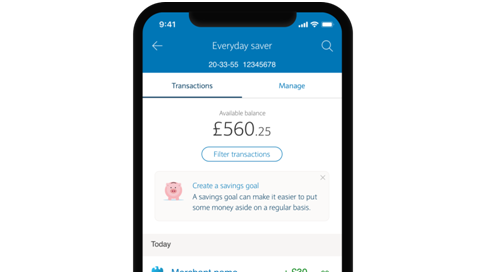

Savings Account

The high-yield online savings accounts offer a competitive and high-grade 0.50% APY, that's higher than many other banks and the national average. This financial institution has an adequate credit score with zero minimum deposit requirement and no monthly service fees. It allows you to transfer money from other banks or to other banks online by setting up a direct deposit in the account.

The plus point is that you don't require any minimum balance to open a Barclays savings account, and it will not cost you monthly maintenance fees. It offers excellent contact customer service by a specific service provider and up-to-date credit card options.

CDs

Do you know Barclays incorporates online CD options from three months to almost five years? It is one of the ideal financial institutions where CD will renew within the current available interest. The CD rates offer minimum deposit amounts with no fees. You will get an email alert a month before the CD matures. That's a reminder. It will provide you with a 14-days grace period to add or withdraw your funds without additional fees.

When you withdraw the CD before maturity, it will cost you. For instance, it will add a penalty of 90 days interest under the 24 monthly CD. When going for more than 24 months, the penalty increases up to 180 days interest. When the penalty enhances with interest earned, the remaining option will get deducted. That's how it functions without monthly fees and a large ATM network.

Credit Cards

Barclays features a unique credit card option associated with different lifestyle and travel brands to provide credit card services and promotions while telling you the credit score. It includes other airline cards used to transfer funds conveniently. Some standard cards include:

- JetBlue card

- Hawaiian Airlines world Mastercard

- JetBlue plus card

- Frontier Airlines World Mastercard

- Hawaiian Airlines World Elite Mastercard

- AAdvantage Aviator Red World Elite Mastercard

The hotel card options include:

- RCI Elite Rewards Mastercard

- Diamond Resorts World Mastercard

Different travel credit cards options include:

- Princess Cruises Rewards effective Visa Card

- Carnival World Mastercard

- Holland America Line Rewards Visa Card

Lastly, consider the following lifestyle credit card options for better reliability. The cards include:

- NFL Extra Points

- Upromise Mastercard

What are the Features of Barclays Banking?

Here we go with the exclusive features! This Barclays bank review will let you know the maximum about how the account works with multiple exclusive features and details. The bank incorporates the following features for effectiveness.

Barclays doesn't include other banking products and services except for personal loans. It has excellent credit score options, credit cards, CDs, and saving options. The bank comes with different features to meet customer requirements and needs.

Barclays Bank Customer Service

When we talk about bank accounts, customer service is the most compelling feature you need to consider. You will get customer service at 1-877-523-0478 for seven days a week or 24 hours. It also offers you multiple ways to secure online messages or use the mobile app. You will get two different mobile apps depending on the product type with Barclays Bank versus credit cards.

Features and Services

You will come through Barclays Bank's website to complete the banking process using the mobile app. You can search for the mobile app with Barclays US Savings on the Google Play store. It has a 4.2 rating in the Apple App Store. It offers excellent services to the customers.

The app lets the user deposit checks within the account simply by taking multiple options and verifying the amount in reliability and performance. The deposit accounts include different features for functioning. Furthermore, the check maximum limit is $5,000, with the daily account limit being $10,000. It helps you deposit ten checks for a day.

You can also effectively complete one-time transfers from different external accounts. The website enables the user to deposit funds and transfer them with the accounts. You can enjoy a five-day hold for multiple checks, and the funds are available after three to five business days. You will also get various features to withdraw and deposit money through the Barclays Online Savings account.

Deposit options

Do you know Barclays cannot accept cash deposits, third-party checks, money orders, or even different wire transfers? It is mainly for only one person whose name isn't mentioned in the check front. The bank helps you get multiple options for better functioning. You can deposit the funds into the Barclays Online Savings account in various ways such as:

- Direct deposit

- Mailed check

- Mobile deposit

- Electronic funds transfer

Withdrawal options

Generally, it takes about two to three business days to get into the external bank account from the Barclays account. The process occurs through only online transfer options. Whenever you desire to withdraw money from the Barclays Online Savings account, you can effectively consider the following options:

- A mailed check from Barclays

- Electronic funds transfer

How much does Barclays Cost?

| Barclays Bank Accounts Types | Monthly Fees | Waiver Criteria | Minimum Deposit Amount |

|---|---|---|---|

| Online Savings Account | $0 | N/A | $0 |

| Standard Savings | $0 | N/A | $25 |

| Reserve Account | $0 | N/A | $0 |

| Growth Account | $0 | N/A | $0 |

Who is Barclays Best For?

To be honest, Barclay's bank suits all those clients who desire to get an online-only bank account that features competitive interest rates. Moreover, the bank includes no monthly fees or bad credit, making it one of the best options available. It works great for the following people:

People that don't require a checking account

Are you looking for only a saving account that offers different financial products services? Or does it includes multiple phone numbers options? It works ideally for people who don't require any checking account feature to work. Moreover, it is ideal for anyone who doesn't want to visit branches every day. YES! The plus point is that they don't worry about the monthly fees and offer personal loans services to the customers.

Want to get competitive rates

Anyone who desires to get competitive and highly performing interest rates on the CDs and savings can benefit from the following options. It is an excellent option for anyone who wants to open an account with no opening deposit funds. Furthermore, it allows people to get interested and rewards from the cards. Sounds great, right?

Barclays Bank Pros and Cons

| ✅ PROS |

|---|

▶ Competitive interest rates The most significant benefit is for people looking for incredible interest rates on the savings accounts, and multiple certificates of deposit will enjoy using Barclay with exclusive benefits and options. Therefore, Barclay's bank is far more effective than other banks in offering premium competitive interest rates, making it a considerable choice.

Another plus point is that Barclay doesn't require any minimum deposit whenever opening a CD or savings account. That's a significantly valuable advantage, no doubt. It will not cost any monthly service charges on a new savings account. And guess what? You don't have to worry about reaching any minimum balance requirement. Lastly, it offers multiple credit cards to offer customers exclusive rewards with cashback and financing promotions that are no more an exception. The bank meets the criteria by providing users unique benefits seriously. |

✖ Lacks brick-and-mortar branches What if you get into a problem? Or if you have any questions, then? You cannot ask any service provider in person. That's because it is an online bank and doesn't include any physical branch. You have to call the helpline or send an online message using the mobile app. Another thing that is lacking is checking accounts. If you are looking for a single bank for all banking needs, Barclays might not be the top pick. It doesn't have any checking account features you will find at traditional banks. Another thing is the personal loan features. However, the bank offers personal loans and a few lending options, but you cannot apply for any loan services until Barclay sends you an invitation.

🚫 CONS

✖ No checking accounts

✖ Personal loan by invitation only

Barclays Compare to other Banks

| Bank | Minimum Deposit | Monthly Fee | Savings APY | Overdraft | Number of Branches |

|---|---|---|---|---|---|

| Barclays | $0 | $0 | 0.40% | $0 | 4,750 worldwide |

| Chime | $0 | $0 | 0.50% | $34 | All financial services are digital |

| Chase | $0 | $12 | 0.01% | $34 | 5,100 |

Barclays vs. Chime

Let's compare Barclays with a chime. Both are online banks designed to offer exclusive financial services. But wait! Whose better than the other? Let's get into the details!

Barclays comes with high-interest rates than chime, mainly their savings, and CDs feature great interest. Chime includes a spending account, whereas Barclays features a saving assistance tool. Barclays doesn't have daily spending and withdrawal limited compared to chime.

Moreover, Barclays have different options to receive interest than chime that comes with low-interest rates. Barclays requires a few days to transfer money into the account, whereas chime has ATM features for functionality.

>>Read more About Chime Banking Reviews: Is Chime a Good Bank?

Barclays vs. Chase

The first thing that separates Barclays from chase bank is the account fees. Barclays requires no minimum deposit requirements or monthly maintenance charges, whereas chase has high opening account fees and requires high daily balances for working.

Barclays bank is practical and easy to use than chase that requires customers to meet balance requirements to waive the fees. Have you got that? Barclays have highly competitive interest rates and offer great savings options than chase, no doubt.

Barclays help you choose how you desire to transfer the money to get the exclusive benefits, whereas chase doesn't include such features. Both banks are different in their specific characteristics in offering excellent customer services and access.

Conclusion: Is Barclays a Good Bank?

Overall, the Barclays Online Savings account is an excellent option for low fees and a high annual percentage yield. It is also beneficial for people looking for in-person services at different branch locations. Clients can reap the rewards to enjoy high APY benefits and earn the maximum with this account. What does it offer? The lack of minimum balance requirement is a great deal.

However, if you plan CD APYs and are not very competitive, Barclays will suit you the best. Barclays might not be a reliable option at some points, but people who want to save money safely and securely will work the best for you. Barclays offers the most exclusive services with premium features and credits.

Quite simply, you will find Barclay as an online-only bank with no physical branch or ATM features. YES! You heard that right. It has no minimum balance requirements to open an account with no monthly maintenance fees. Do you know the customers are limited in the way they can withdraw funds? Therefore, you can enjoy saving money with no ATM access.

What's more? You will find Barclays' customer support accessible for 24 hours using phone or online through the mobile app. It won't be an issue for people who are comfortable with online banking. This Barclays bank review will let you know everything about the bank details and makes it an effortless option.

Barclays Bank FAQs

Is Barclays online savings account safe?

Don't worry, as Barclays is a Member FDIC and all its services are fully covered with FDIC insurance as many other traditional accounts like the Goldsmith bankers. It covers you for more than $250,000 per depositor even if the bank failure occurs, and that's a beneficial aspect, no doubt.

If you search for a fully online bank with excellent APYs and multiple options, Barclays is a top choice with secured and user-friendly services. Compared to any traditional bank, it is a member FDIC known for exclusive results and saving money by keeping an emergency fund.

Does Barclays offer personal loans?

YES! It offers some personal loans options. It will not cost you any charges for loan products, not even including an origination fee standard among different lenders. The bank also enables the user to change the payment date or pay the loan early with zero penalties.

That's how the feature works! Barclays bank helps people with excellent and reliable credit scores with low rates and services. The highest APR is 20.99% which is far more effective than many other lenders available. The bank is exclusive enough to promote better financial assistance to the customers.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.