Reducing The Complexity Of Healthcare Payments

By Brian Wallace

January 10, 2024 • Fact checked by Dumb Little Man

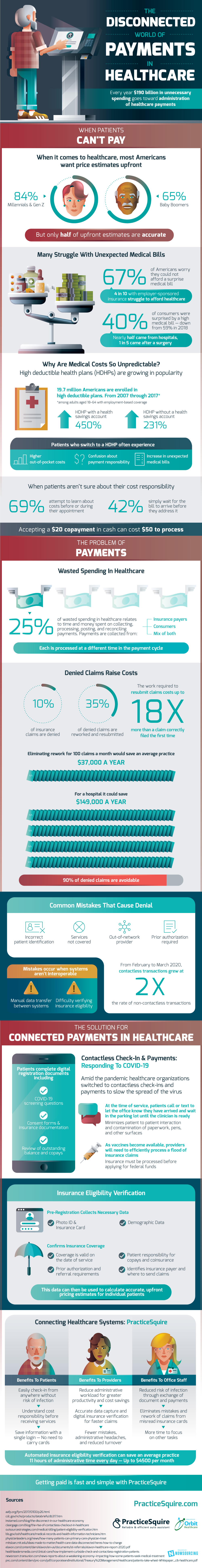

As the world of healthcare payments becomes increasingly complex during the pandemic, a lot of people have faced the difficulties due to unexpected medical bills. The majority of adults want price estimates upfront when it comes to healthcare.

The need for payment transparency spans generations; 84% of Millennials and Gen Z and 65% of Baby Boomers want price estimates upfront for medical services, yet only half of these estimates are accurate.

In 2019, 40% of consumers were surprised by a high medical bill. Nearly half of these surprise medical bills came from hospitals, and 20% came from surgeries. The majority fear that they would not be able to afford a surprise medical bill. Even with employer-sponsored insurance, this fear persists, and 4 in 10 struggle to afford healthcare.

So, why are medical costs so unpredictable? The growth in popularity of high deductible plans can account for payment confusion. They have risen 450% with a health savings account and 231% without a health savings account within the past decades.

Almost 20 million American adults with employer-sponsored insurance were enrolled in a high deductible plan from 2007-2017. 69% of patients are proactive about payment responsibility and attempt to learn about costs before or during their appointment.

However, patients who transfer to these high deductible health plans frequently struggle with higher out-of-pocket fees, confusion over payment accountability, and an increase in unforeseen medical bills.

Another consideration within the healthcare industry is wasted spending. Time is a big factor as one quarter of this spending is related to the time and money needed to collect, process, post, and record payments. This complexity is due to the different areas that payments are collected – both on the insurance and consumer side.

All of the procedures involved here are processed at separate times in the payment cycle, which makes it hard to manage. For example, accepting just a $20 copayment in cash can cost up to $50 to process.

Another way healthcare facilities lose currency is through denied claims. One-tenth of insurance claims are denied, and of that amount, 35 percent undergo reprocessing and resubmission. Reworking and resubmitting a claim that's already been denied can pile up cost-wise, up to 18 times more than a claim that was properly filed from the beginning.

That being said, 90 percent of the denied claims can be avoided. Reducing the amount of denied claims could save medical practices tens of thousands of dollars annually. Denied claims typically stem from simple errors that could otherwise be easily avoided.

Human error can typically catch patient information such as prior authorization and out-of-network providers. That said, other mistakes occur through manual data transfer between different systems.

Payment issues in healthcare insurance eligibility verification are a headache to all involved. That's why contactless check-in and payments, and connecting healthcare systems are a game changer. An average medical practice could save 11 hours of administrative time per day and up to $4,500 monthly by employing automated insurance eligibility verification.

Pre-registration collects the patient’s photo ID and insurance card, as well as their demographic data. This confirms if coverage is valid on the date of service, confirms patient responsibility for copays and coinsurance, and identifies the insurance payer and where to send claims.

A switch to contactless check-ins and payments during the global pandemic was a welcome switch to paperwork and helping stop the spread of infection. This minimized the time it takes to check in and inputting of paperwork, all while minimizing patient to patient interaction. Using this improved check-in process, patients have been able to complete coronavirus screening, consent forms, and fill in insurance documentation.

Connecting healthcare systems in a way that is beneficial to all parties involved in the management of healthcare payments has become increasingly important. Patients can easily check in and save their information with a single login.

Office staff reduced their risk of infection through the exchange of documents and payments and eliminated denied claims from misread insurance cards. Insurance providers, meanwhile, experienced decreased administrative workload, resulting in higher productivity and lower costs. Insurance companies were also less likely to encounter lapses, administrative troubles, and even experienced a decrease in turnover.

Learn more about the disconnected world of healthcare payments in the visuals below:

Brian Wallace

Brian Wallace is the Founder and President of NowSourcing, an industry leading infographic design agency based in Louisville, KY and Cincinnati, OH which works with companies that range from startups to Fortune 500s. Brian also runs #LinkedInLocal events nationwide, and hosts the Next Action Podcast. Brian has been named a Google Small Business Advisor for 2016-present and joined the SXSW Advisory Board in 2019.