Do You Know What To Do In A Ride Sharing Accident?

By Brian Wallace

July 19, 2017 • Fact checked by Dumb Little Man

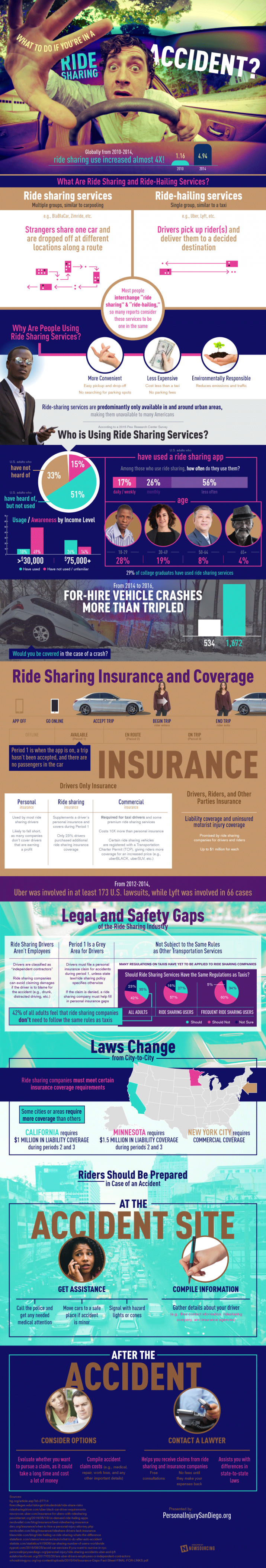

Ride sharing and ride hailing are often lumped together, but the two services are completely different. One is more like a taxi while the other is more like a bus. What’s not different about the two is that there is still a lot of confusion about who is legally responsible if there is an accident.

Because drivers don’t usually need commercial insurances even though they are performing a duty for which they are getting paid, insurance companies are often reluctant to pay up in the event of an accident.

To clear things up, here’s what you need to know.

Ride hailing is common

Over half of adults in the United States have heard of a ridge hailing or ride sharing app, but only about 15% have used one. This brings a lot of confusion about what it is, what the legal ramifications are as well as its regulations.

Most people who use these services are affluent and between the ages of 18 and 49. 29% of college graduates have used these services as well.

A little over a third of all adults believe that ride sharing services should be treated like commercial taxi services, while about the same percentage of frequent ride sharing users believe the same thing. Even though the liability is the same, most people don’t believe ride hailing drivers are no different from taxi drivers.

More states and municipalities are starting to realize the legal gaps that are occurring with these services and are making attempts at patching them up. It’s likely that more regulations will be passed in the future to protect both driver and passenger.

If you are a driver, you may not be covered

Driving for a ride sharing or ride hailing service can be risky if you don’t pay extra for commercial insurance. Unfortunately, this is a catch-22 because most companies pay so little that you would pay more for commercial insurance than you would end up making in fares.

Currently, New York City requires drivers to carry commercial insurance, which is as much to protect the drivers as it is to protect the riders. What if you are in an accident on your way to pick up a fare and your insurance doesn’t want to pay up? Or worse, if they do pay up and end up raising your rates for the next several years?

It’s definitely worth checking into your coverage before deciding to work a side hustle. The coverage provided by the ride sharing and ride hailing services might not be enough to protect you.

If you are a passenger, you might not be covered, either

Between 2014 and 2016, for-hire vehicle accidents more than tripled. As more and more people are using these services, there will understandably be more accidents.

A ride sharing insurance coverage can fill in the gaps when the driver’s insurance doesn’t want to pay out. However, as lawsuits involving these services are also on the rise, you could find yourself caught up in the middle.

If you are a ride sharing or ride hailing passenger and you are in an accident, here’s what you need to do:

- Get help at the scene

Getting a police report ensures that the facts won’t change after you leave the scene. Getting medical attention is the first step in documenting any injuries you may have.

- Get information from the driver

Again, gathering the facts at the scene is the best way to ensure they don’t change. Get as much information as possible, like contact information, insurance details and data on the ride hailing service you got.

- Have your injuries treated

You may think you are fine, but car accident injuries can become more serious over time, particularly if there’s no prompt treatment.

- Keep track of medical bills and expenses, including any lost work

From day one, write down any work you missed because of the accident and any bills you accrue. Keep receipts whenever possible as this will help you get reimbursements.

See Also: 5 Financial Emergencies Everyone Must Be Prepared For

- Decide whether you will need to hire a lawyer to recoup your costs

Sometimes, insurance companies are happy to pay up right away just to close the case. Other times, they may not be as willing and you’ll need help to get reimbursements for your expenses.

See Also: Timeline Of A Personal Injury Lawsuit

Coverage requirements vary based on location

From state to state and even from city to city, coverage requirements can vary widely.

The state of California requires an additional $1 million in liability coverage when drivers are en route and while they have passengers. Minnesota requires an additional $1.5 million in coverage for the same situation. In some places in the world, like France, ride hailing and ride sharing drivers need to be licensed professionals.

Knowing a little about the risks now, do you think these services should be treated like professional driving services or are you OK with taking the risk?

Learn more about what to do if you are involved in a ride sharing accident from the infographic below.

Brian Wallace

Brian Wallace is the Founder and President of NowSourcing, an industry leading infographic design agency based in Louisville, KY and Cincinnati, OH which works with companies that range from startups to Fortune 500s. Brian also runs #LinkedInLocal events nationwide, and hosts the Next Action Podcast. Brian has been named a Google Small Business Advisor for 2016-present and joined the SXSW Advisory Board in 2019.