How To Trade VIX – Expert Insights and Strategies Unveiled 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Market volatility provides movements for traders to capitalize and generate better returns. However, sometimes, the fluctuations may get uncontrollable and cause significant losses. Learning ‘How to Trade VIX' will allow you to hedge your funds against market volatility.

The S&P 500 has been a popular index to judge the overall market's performance, but it doesn't provide insights about future market movements. A trader can't rely entirely on the S&P 500 movements to decide their trades; any price movements could cause the price to go in an unfavorable direction.

The VIX index is an efficient tool to understand market volatility and predict index values using short-term options. Are you new to the trading world? If yes, then this blog is for you. We shall discuss everything you need to know about the VIX index.

We have Ezekiel Chew with us to share his take on the subject; he is a renowned investment mentor and has trained thousands of students worldwide. His expertise has earned a positive reputation worldwide, and let's use his knowledge for our benefit.

What is a VIX

VIX index was launched in 1993 by the CBOE options exchange and is maintained by CBOE global markets; it was their first breakthrough index, and several other fundamental indicators followed after it. VIX stands for volatility index, a fluctuation-based indicator that monitors the fluctuations and volatility of S&P 500 stocks.

The VIX uses fluctuations in near-term options- expiring within 30 days- to evaluate the possible volatility changes of the NYSE stocks. It is also called the fear index, and its value provides traders with insights into market sentiments, investor confidence, and future volatility.

As options are derived assets, any fluctuation in the underlying asset is magnified onto options. Hence, when an option's premium varies due to S&P 500 changes, the VIX monitors the price change and calculates it to provide a view of market volatility. Initially, the CBOE used specific options from the CBOE exchange to calculate the index value.

However, as its efficiency improved and it became popular, the VIX started including a wider range of options that provided better insights into the market. VIX has become an important index to measure implied volatility for the short-term future and determine investor sentiment in the market.

VIX index value changes as market volatility alters; a political crisis is bound to increase market fluctuations that will increase the VIX value. The VIX index stays low when the market is stable in rising periods. Experts consider a VIX value above 30 a highly-volatile market with high fear.

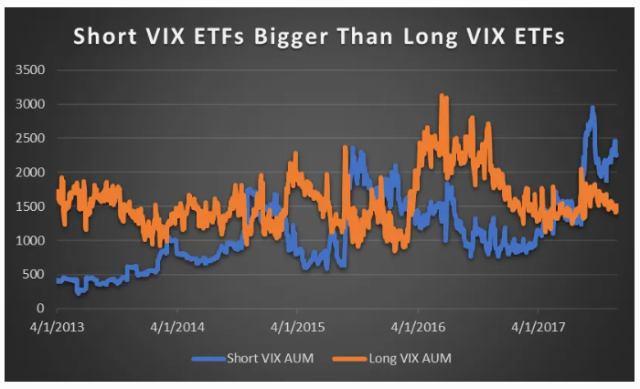

Today, various ETFs have been developed associated with VIX value; their value moves in correspondence with the index's value. Traders buy these ETFs to safeguard against a declining future market.

Measuring Market Volatility

Market volatility can make you profits in a low-potential market but can also lead to significant losses in quick successions. It is usually measured using two methods. The first approach is a historical average approach, with the goal of evaluating market volatility from past data.

Experts use different measures such as mean, variance, and standard deviation to determine the volatility of the stock; they carry the procedure for every stock in an index, and later the values are totaled based on their weights. However, the process is complex and requires specifically developed software to get accurate answers.

The drawback of a backward-looking approach is the assumption of market repetition; the calculated analytics are heavily dependent on previous statistics and are taken under the assumption that the market would repeat similar patterns.

However, it isn't often the case. The volatility may be influenced by several factors, such as political and economic changes that make the results inaccurate, and the effort goes in vain. The other choice involves a forward-looking approach through the use of options.

The underlying asset's volatility drives option premiums; if an asset is highly volatile, the option will have rapid changes in its value before reaching expiration. Options prices change as the expectation of an option achieving its strike price alerts; if traders expect a put option to achieve its strike price in a short period, they may opt to buy it.

Experts analyze the option's fluctuations to predict the volatility of an asset in the short run. It involves complex calculations that use the weighted average of options to comprehend market volatility. However, the forward-looking approach isn't perfect either; an option isn't the exact replicant of the stock market volatility and may sometimes provide inaccurate results.

How to Calculate VIX

VIX index monitors real-time fluctuation in options prices to determine the market volatility of the S&P 500 index. It has become a highly valuable index amongst users and is also used as a yardstick for certain ETFs. The VIX futures market deals with significant volume highlighting traders' interest. VIX futures contracts are highly volatile and may require investors with a higher risk appetite.

VIX index is calculated through a complex set of calculations that considers the price changes of short-term options; the index uses options maturing between 23 days to 37 days, and any options expiring later or earlier aren't used for index calculation. The CBOE volatility index is calculated by monitoring the SPX options retiring within the period mentioned earlier.

The calculation includes the standard CBOE options that retire on the third Friday of the month and the weekly CBOE options that mature every other week; these options are valued according to the S&P 500 index, and any variations in their value highlight the change in volatility of the stock market.

The calculating software measures a weighted index of various put and call SPX options within the time frame; it weighs the fluctuations in their premium, and only non-zero bid options are considered. The method allows investors to attain a fair market view without adding anomalies.

The actual calculation of VIX involves using technical algebra and complex functions that aren't necessary to succeed in the trading world. Hence, we don't discuss it here, but the calculation procedure is similar to the details mentioned previously.

Choosing to go Long or Short in VIX

Although VIX futures are highly volatile, you can short or long the futures contract to generate significant profits. These contracts are based on the volatility of the S&P 500, so if the stock market is stable, the volatility would be low, leading to a lower VIX.

A trader needs to have clear knowledge about when to opt for a long or short trade. When trading VIX, a trader can opt for a long position if the equity market volatility is on the rise. For instance, a political figure's controversial comment hits market participants, and they may withdraw investments.

The political crisis increases volatility, leading to a higher VIX. Any trader with VIX contracts can benefit from the increased volatility by a longing position.

However, the volatility adjustments may sometimes be negligible to create a VIX difference, so a profit might be challenging to capitalize on. Shorting VIX is a better option in a stabilizing market; businesses usually flourish when an economy experiences growth with a low-interest rate and market sentiment is positive.

It causes a lack of volatility, and the VIX stays low, meaning a VIX futures contract may decline in value. If a trader chooses to short the position, they can generate a good profit. However, shorting has a higher risk, and if the volatility index rises, you may incur significant losses.

What is the Precision when trading the VIX Index

The Chicago Board Options Exchange launched the Volatility index in 1993, and it has had various improvements and adjustments throughout the years. It has become a valuable tool for traders, and the values are updated daily. However, VIX short-term futures are prone to high volatility and can lead to significant losses if necessary precautions aren't taken.

Every trader of VIX ETFs should master the stop-loss and take-profit tool as they will help you avoid emotional decisions and incur losses. Market volatility can vary significantly over a period, and it can take time to anticipate the value of the VIX. Hence, you should set the buy and sell orders at fixed positions to avoid missing out on profits.

Secondly, you should also focus on diversification and market research. Every stock market asset has a beta that shows the relation between the market index and the stock; investors tend to buy a mix of shares with a positive and negative beta to reduce their risks.

VIX has a negative beta, and it moves against the market; investors must diversify their portfolio to benefit whether the market rises or falls. You should add multiple assets to your portfolio to avoid over-dependence on a single stock or market.

Best Stocks and Forex Trading Course

VIX is an effective tool to predict market changes in the upcoming future and plan for them beforehand; it allows traders to analyze market volatility and investor sentiment, which can help them avoid entering the market at the wrong time.

Investment education can be handy in generating good results; however, newbies are often curious about the best courses to prepare for their trading journey. Asia Forex Mentor by Ezekiel Chew is our choice.

The course goes with the motive of helping you make big money and be financially free. It takes you through a detailed five-step procedure of the forex market that discusses market queries and helps every trading segment. Experts regard the course as a unique approach to simplifying the complex forex trading structure.

Ezekiel Chew explained a secret five-step procedure in the course he had developed over the last two decades. He is the man behind thousands of forex students and institutions; his students can reliably make six figures per trade. DBP- the second largest bank in the Philippines- was also trained by him.

You can log onto his website to see a short snippet of what the course offers. It involves various indicators and comprehensive information that helps circulate any barriers in your trading journey.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

4 Best Stock Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Traders Read Review | securely through Tradestation website |

| Intuitive Platforms Read Review | securely through Tradier website |

| Powerful Services at a Low Cost | securely through Tradezero website |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Conclusion: How to Trade VIX

The stock market is based on various factors, and any news or rumor can impact its performance. Changes in politics, economy, and society will influence the market, causing it to adjust. However, market fluctuations are not always friendly for all traders, and many incur losses during declines.

VIX helps traders anticipate the ongoing market sentiment and plan their trading decision; likewise, it summarizes the market's implied volatility by calculating the weighted averages of short-term options of the S&p 500 index. The value usually hovers between 20-30 but may occasionally rise into triple digits.

VIX is an index and can't be traded directly; however, it has various connected ETFs and ETNs that can be bought for a diversified portfolio. Investors must educate themselves about VIX and how it can enhance their results.

How to Trade VIX FAQs

Can you trade VIX directly?

VIX stands for volatility index, launched by the Chicago board options exchange in 1992. You can't trade the VIX as it is an index; however, it has multiple ETFs and futures that are linked to the index. These assets change their values based on VIX changes, and you can trade them for profit.

How do you trade with VIX?

VIX highlights the volatility of the stock market as per the S&P 500. Its values usually lie between 20-30; experts deem values above 30 highly volatile. You can purchase ETFs and ETNs connected with VIX; it allows you to generate profits as market volatility increases.

How do you buy VIX calls?

Traders have used VIX call options to hedge their funds against declines in the S&P 500. As VIX is negatively correlated with the market index, a declining market would mean a rising VIX ETF; hence, investors can generate profit from an undesirable position.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.