Currency Correlation: Overview, Formula, And How To Trade

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

If you have been trading for a while, you may have noticed that when a specific currency pair rises, the other pair falls. For example, if EUR/USD is going up, USD/CHF is going down. Have you also noticed that when one currency pair is going up or down very fast, the other currency pair does the same thing but in the opposite direction?

This is called currency correlation, which refers to a statistical measure of how two currency pairs move in relation to each other. Whenever the currency pair value rises, a positive correlation is formed. On the other hand, a negative correlation is said to be present when one currency pair falls as the further increases.

As a trader, you need to understand and monitor currency correlation as it strongly affects trades and significant risk in your portfolio. For example, if you hold two pairs with a strong positive correlation and both start to move against you, your losses will be magnified.

We’ve got Ezekiel Chew, an experienced trader with over 20 years of experience and educator at Asia Forex Mentor, to share his take on Currency correlation and how traders should trade them. We will share his POV on calculating correlation, trading pairs, tools that can be used to track correlation, and more.

What is Currency Correlation?

In the trading world, correlation measures how two currency pairs move in relation to each other. Currency correlation is a measure of how closely two currency pairs move up or down at the same time. The aim is to establish whether two currency pairs move in the same direction (positive correlation), in opposite directions (negative correlation), or are random.

All the stock pairs that show the random movements without any unconnected relationship do not correlate. So, what does it depict? It means that the changes in one will not affect or influence the other. On the other hand, if two currency pairs have a perfect positive correlation, they will move in the same direction. Most traders may ignore the perfect positive correlation as it rarely exists; however, it can affect the trading results.

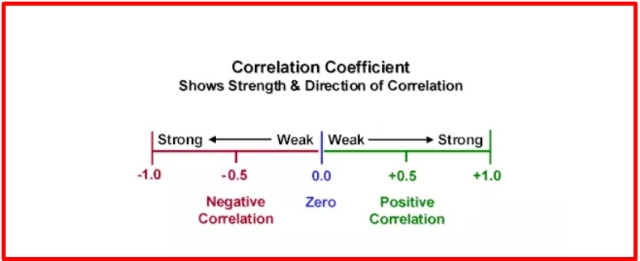

Mathematically, correlation is represented using a Correlation Coefficient formula that ranges from -1 to +1 or -100 to +100. A coefficient of +1 indicates perfect positive correlation, while a coefficient of -1 indicates perfect negative correlation.

When a stock pair's value is in the positive range of 1000, the assets move in nearly the same direction. If it is above -100, forex pairs move in almost identical but opposite directions. However, a currency pair with a coefficient close to 0 generally means that the relationship between the two currency pairs is small and not worth worrying about.

Correlation Coefficient Formula

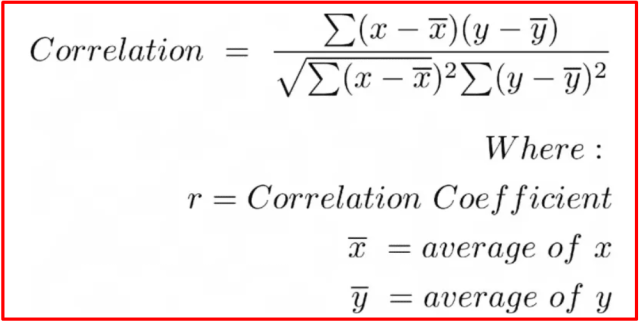

The correlation coefficient rate is generally calculated by using the below formula.

You may feel the correlation coefficient formula is complicated, but that's not the case. The overall idea is that it compares data points representing two pairs (X & Y) to the average reading in each pair. As a result, the bottom equation component represents the standard deviation, while the top component represents covariance.

Forex Correlation Pairs

Currency correlation is not exclusive to just two currency pairs. However, it can be measured for a group of currency pairs, especially when you have multiple positions open simultaneously.

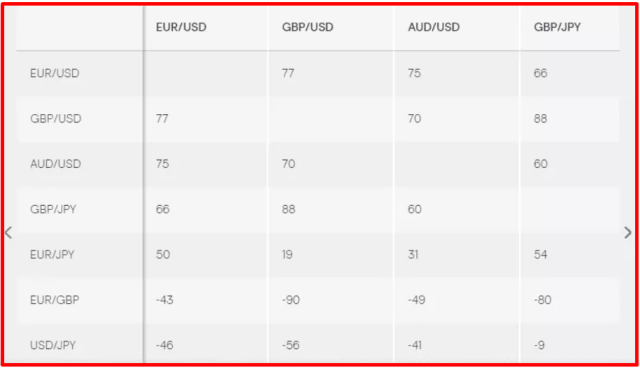

The table below compares the forex link between the world's most widely traded currency pairs. It will be more helpful to compare the currencies on the x-axis to those on the y-axis to see how they are connected. For instance, the correlation between GBP|USD and EUR|USD is 77, which is pretty high.

Forex Correlation Table

Although the Forex correlation pairs may not move in the same direction, they move together. On the other hand, the EUR|GBP, and GBP|USD from a strong negative correlation is at -90.

According to the above statement, most move in opposing directions. Currency correlations must be monitored since even the tiniest currency pair table may contain several significant ties.

For example, if you are a trader, you can buy GBP|USD, vend the EUR|GBP, and expect to represent two different forex markets. Pairs, on the other hand, have a strong negative correlation, indicating that they move in opposing directions. As a result, the trader may lose or win money on them because the two teams and not fully independent currency trades are linked.

Currency Correlation Hedging Approach

A forex correlation strategy can be used to hedge risk. When you utilize a hedging strategy, you essentially take two different trades correlated to offset the risk in your portfolio. For example, forex traders can hedge stock market positions by taking trades in correlated pairs that move in the same direction.

As a trader, you can attain a currency hedge if you lose from one currency trade. So, it can be a result-driven strategy for a trader who does not want to exit a particular position but merely intends to minimize or offset their loss when the pair retreats.

Remember that hedging with correlated currency pairs is not always easy. The forex market moves quickly, and managing two trades in different directions can be very difficult.

Commodity Forex Correlation

Different commodities and raw materials feature correlation currencies. The table below compares the link between some of the world's most widely traded commodity currency pairs.

The above table showcase that XAU|USD (gold) shows little correlation with other currency pairs. However, it is highly correlated with XAG|USD (silver), which is not surprising given that both precious metals tend to move together. The table also shows the strong positive currency correlation of gold which is 81 with XAG|USD (silver). If you are trading with gold or any other major currencies, you can use such analysis to take long- or short-term positions in various currencies.

Pairs Trading

Pairs trading is a strategy forex traders use to take advantage of the relationship between two currency pairs. Forex traders can sell the pairs that are moving up and buy the pairs that are moving down. In order to do this, the trader must have a strong understanding of forex correlation. The idea of pair trading allows the currency to move up as they share a high correlation history. Therefore, it can be the best possible approach for better conversions.

Despite that, it is possible that the pair may not go up again. This is because most forex trades set up a stop-loss order on the positions to eliminate risk to manage losses. Remember that a profit can be earned on one trade by offsetting a loss on another, even if the pairs return to their initial correlation. To put it another way, the sold position may fall while the purchased position rises when the pair's mean-revert trend is resumed. This condition results in both sides making money.

You need to understand trading pairs better and invest in a position to manage risk using a currency correlation approach. Moreover, opt for the small percentage to trade based on where you want to place the stop loss. For example, if the stop loss is set at 30 pips within the EUR/USD exchange rates, it implies a risk of about $3. To match a 1% value in the account, the forex trader must have a minimum balance of at least $300. As a result, they can assist in limiting performance and trade risk

How To Trade Currency Correlation Pairs

Several approaches can be used to trade currency correlation pairs. It includes techniques like commodity correlation, hedging, and pair trading. The steps that are essential for trading and making profits has:

#1. Open A Live Account

When you are ready to start trading, the first step is to open a live account with a broker, or you can use virtual fund practices.

#2. Research Market

You should not step into the market without prior knowledge. So, always take your time to research the market and learn currency pairs like interest rates, inflation, and economic data.

#3. Choose a Currency correlation strategy

After doing your homework, the next step is to decide which currency correlation strategy you want to use.

#4. Risk Management

The most crucial thing in trading is risk management. You should always set stop-loss and take-profit orders to minimize your losses in volatile markets. However, remember that these tools don't protect your investment slippage.

#5. Open a trade

When you have chosen your strategy and set your orders, it's time to open a trade. Always monitor your positions and ensure that your stop-loss orders are in place. Moreover, determine the entry and exit points.

Best Forex Trading Course

The best Forex trading course is the One Core Program from Asia Forex Mentor by Ezekiel Chew. While trading skills are lucrative, it may take you so long to grasp what works and what doesn't. It builds your skills from the viewpoint of a new trader with fear into an advanced trader working with strategies.

Your best option is a great course. Trainers and mentors are aware of what will help you conquer the markets. Fumbling alone can waste your chance at a lifetime career in trading. A course helps you fast-track on a tried and tested model.

Many traders make a final stop at the One Core Program. Which is among the top ten credible courses you can bank on? Traders go on to hit six-figure trades following a proven model. It's a course that has helped retail and institutional traders transform their trading careers.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Currency Correlation

Currency correlation pairs are a great way to diversify your portfolio and limit risk. You can use hedging, pair trading, and commodity correlation strategies to trade these pairs. However, it's important to understand how they work before you start trading for better risk management. Moreover, always research the market, set stop-loss orders, and use risk management strategies to protect your initial investment.

Currency Correlation FAQs

How do currency pairs affect each other?

Currency pairs affect each other because they are inversely correlated. Whenever the two different currency pairs increase in value, the positive correlation is said to be strengthened, and when they decrease in value, the negative correlation is said to be weakened.

How do you use currency correlation?

You can use currency correlation to trade multiple currency pairs at the same time. By looking at the correlation coefficients, you can see which pairs are moving in the same direction and which pairs are moving in opposite directions. Always learn before applying the currency correlation techniques such as economic data, interest rates, etc. When the reading is under -70 and greater than 70, the movements of the two pairs are mirrored each other. When readings are between -70 and 70, it indicates less correlation between the pairs.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.