TTM Squeeze Indicator – Complete Expert’s Guide (2024)

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

A popular safeway for investors is the TTM-squeeze indicator; it utilizes a zero line and momentum indicators to highlight the changes in asset price over time. It can help you ascertain your trading decisions and avoid buying a declining share. Do you wish to know more about this fantastic strategy?

Well, the blog is the perfect fit for you; we have Ezekiel Chew on board with us to share his take on the TTM squeeze indicator. We shall describe the ideal strategies for traders to maximize their returns using the TTM indicator and how you can master the art.

Ezekiel Chew is a world-renowned mentor among financial students; he has helped thousands of students achieve their trading dreams with his expertise. Let's use his knowledge to succeed in the investment world.

What is TTM Squeeze Indicator

TTM squeeze indicator has been a popular choice amongst traders to detect market volatility and generate target entry and exit points. It has become a dependable tool for traders to magnify investment returns and bring more profits.

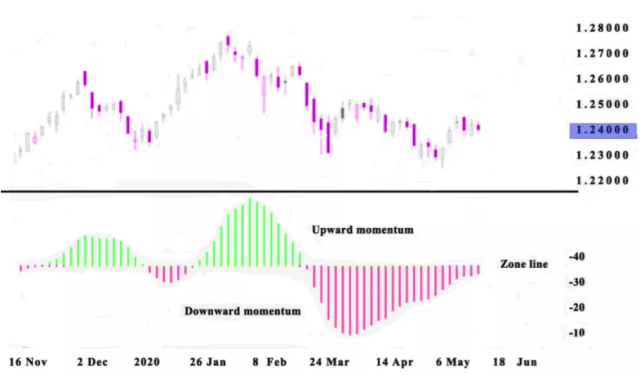

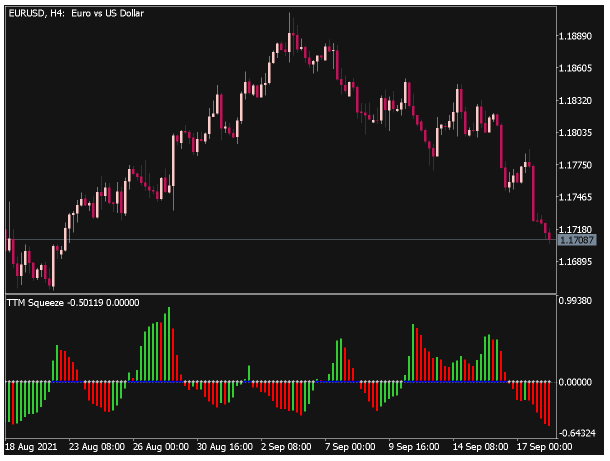

The question in your mind would be how the technical indicator works; a TTM squeeze indicator has a zero line based on the average security price; it stays constant at its position, and histogram bars are extended at either side to highlight the price movement.

The bar length indicates the rise in share prices, and their size represents the change in direction. A bar above the zero line shows positive magnitude, and below the zero line shows a decline in values. We talk more about momentum indications in the next section.

What does TTM Indicator do?

The momentum oscillator is a critical aspect of the TTM squeeze, and it can help us detect the entry and exit points of the trade. A momentum indicator above the zero line shows a possibility of rising, represented by green dots, and indicates a profitable purchase.

A histogram below the zero line indicates a possible decline in values represented by red dots and is a shorting opportunity for investors.

It is vital for investors to know when is the right time to enter the market; the information can be obtained by monitoring the squeeze in the histogram. Let's consider a zero line with multiple red dots; it shows a consolidating market that waits for a rising opportunity.

Once the green dots appear, it signals an upcoming rising trend that provides an opportunity for investors. The increasing trend continues until the histogram starts to squeeze; the bars get close together, and on some platforms, the color of the bars intensifies.

It signals an end to the trend, and a trend reversal may be upcoming. However, the TTM indicator isn't always safe from false signals and you may end up making some wrong decisions if you use the TTM indicator as the sole volatility and momentum indicator.

You should use it alongside relevant risk factors to optimize your decisions and make profits.

Timeframes play another vital role in TTM squeeze findings, and it is challenging to achieve your desired objectives without focusing on them. Certain investments, such as options trading, are usually short-term, and you may have to modify your charts to a smaller time frame.

On the contrary, stock investment tends to last longer comparatively, and a bigger timeline for the TTM squeeze would be a better choice.

Reading the Bollinger Bands and Keltner Channels

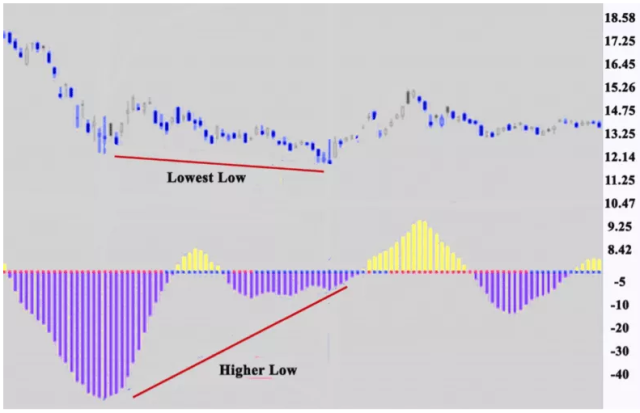

TTM squeeze is based on recognizing the volatility and momentum of the asset's prices; the dots on the zero line indicate the share's volatility, while the histogram bars indicate the asset's momentum.

Both details are essential to making the best decisions and utilizing the trading tools. Different platforms use multiple colored dots to identify asset volatility, but red and green dots are commonly used. A red dot indicates low share volatility and presents a waiting time before your entry.

Once the volatility increases, you will see the Bollinger bands expanding their range, and the candle movement will move past the Keltner channels indicating high volatility. The red dots will turn green at the instant, showing squeeze activation.

Experts suggest the perfect point to enter a trade is after a green dot has appeared at the zero line; it ensures high volatility and presents a chance to earn profits. If the share is in positive momentum, you should make the purchase; otherwise, shorting would be a better option.

The same momentum usually goes on for about ten dots, and once you see a prominent squeeze, it might be time to exit the trade. Experts suggest traders wait for about two red dots to appear before making an exit decision.

Every share follows a cyclic pattern; you would note the dot sequence to repeat once the momentum changes.

The lifetime of a cycle may differ, and sometimes, the magnitude of the negative charge may be higher than a positive change and vice versa. The color of the dots highlights the intensity of the change, and you can use it to base your decision's horizon.

Traders often use the TTM indicator in multiple timeframes to confirm their insights; if both timeframes show the first green dot, it may be a strong signal, and traders can look to capitalize on it.

Trading the TTM Squeeze Indicator

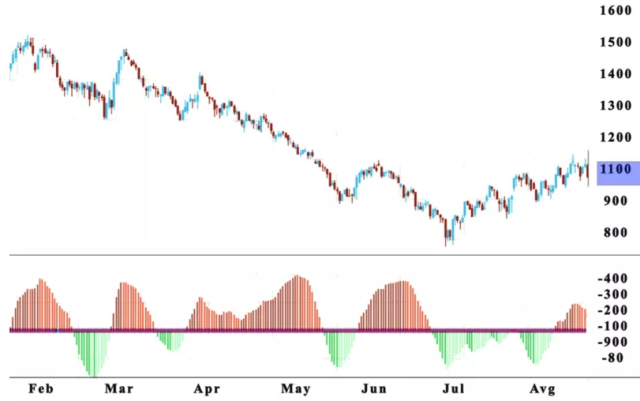

We have finally reached the most crucial section of the blog, and it is time to learn how to make profitable deals using the TTM indicator. We have understood how the indicator works and its characteristics; the dots represent the volatility, and the histogram represents the momentum.

Our goal is to enter a trade once the squeeze is activated and exit it as soon as the red dots reappear.

TTM squeeze indicator alerts you about the correct entry and exit points of trade through the positioning of a dot; your primary focus should be on the dots along the zero line; a red dot indicates low volatility and less profitable opportunities. Therefore, you must wait until the volatility increases and green dots appear.

You can double-check the indication by verifying it with Bollinger bands and kernel channels– if the Bollinger bands have an expanded range and candles have crossed the channels.

The signal is valid. The dark blue dots highlight the magnitude of the change, and the color lightens as the change reduces.

You can enter the trade at this point and hold with your decision until the red dots are visible. The red dots are an indication of slowing market volatility, and the trend reversal may be close. You should exit the trade as soon as the two new colored dots appear.

TTM squeeze indicator has been a regular partner for many traders, and they use it for regular investment advice. It is a profitable choice, and squeeze fires have helped various traders make the most of their investments.

Nonetheless, no trading tool is perfect, and they are prone to false signals; the TTM squeeze indicator has an accuracy rating of 70%, highlighting a 30% chance of the indication being false.

Hence, traders must use multiple trading indicators simultaneously to check and validate their insights. Market research and technical data help remove any wrong insights from your indicators and help you make informed decisions.

Best Forex Trading Course

Ezekiel Chew is a renowned forex trader, trainer, and industry expert. He has trained professional and retail forex traders as well as corporate finance players like bank traders, money managers, and asset investors. From his trading experience drawn from over 20 years of trading the forex markets, he has created a comprehensive forex trading course known as “the one core program”.

Ezekiel asserts that the one core program is designed for the ‘committed learner', so previous trading knowledge or experience is not required before you can enroll in the program. The program comprises over 60 video lessons that teach proprietary trading strategies that are backed by mathematical probability and technical analysis principles.

The one core program has been proven to be highly efficient as it has generated millions of US dollars for Ezekiel Chew and his students. There are numerous testimonials from students that have graduated from the program and are now making six-digit figures per trade just by applying the techniques learned from the program. The one core program is available on the Asia Forex Mentor website; which is a forex trading blog that has been existing for over a decade.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: TTM Squeeze Indicator

The blog discussed the main aspects of the TTM squeeze and how traders can use it to maximize their returns. The indicator has been a dependable choice amongst experienced traders who rely on its insights for their trade decisions.

It boasts a high success rate amongst other momentum indicators, and the simplicity makes it preferred for newbies.

The TTM Squeeze indicator was made by John Carter; it utilizes market volatility and trends to provide practical insights into price movements. The TTM squeeze histogram has been widely used to analyze the ongoing momentum, and traders use it to extend or limit their trading horizons.

Moreover, the zero line serves an important role in highlighting the entry and exit points for traders.

Despite its remarkable accuracy, TTM squeeze isn't free of false signals, and there may be instances where the findings may lead to false signals.

Experienced traders always use multiple indicators to analyze the expectancy of profits before entering a market. A highly volatile market may delay account access for placing trade orders.

Digital investments are a new trend, but they have failed to see investors making massive profits partially due to reduced emphasis on education. Although investment gurus are helpful in your investment journey, they can never be the sole solution to generate profits, and over-reliance can be costly.

You should focus on attaining comprehensive education about preferred assets before putting your investment at stake.

TTM Squeeze Indicator FAQs

Is the TTM Squeeze a good indicator?

The TTM indicator was developed by John Carter and had a success rate of about 70%. The high accuracy signifies its efficacy in bringing valuable insights to the traders. It is often used alongside a smoothed momentum oscillator; the trading signals can be used to drive multiple details, including target entry and exit, relevant risks, and possible profits.

Wrong investment decisions can be costly in the long run; thus, it is wise to recheck and verify any signals using multiple indicators. Although TTM squeeze is a solid indicator, you shouldn't use its rulings directly in your portfolio; instead, start by verifying it using Bollinger bands, MACD and RSI.

What is the best timeframe for TTM Squeeze?

Investment markets are dynamic and are based on investors' energy; if high-volume investors are entering and exiting the market regularly, it would lead to higher volatility and better profit opportunities. TTM squeeze is designed to work based on your trading strategy, and it would provide valuable insights regardless of your timeframe.

You can alter the chart to focus on fixed timelines based on your objective. A directional momentum usually lasts for about ten dots, which may change as the volatility reduces and red dots appear. Hence, you can extend your investment timeframe to about 10x the bar timeline.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.