Want to jump straight to the answer? The best Stock Brokers are Tradestation and Tradier

The #1 Stocks and Forex Trading Course is Asia Forex Mentor

Do you know what a credit spread is? Perhaps you’ve heard the term used in conversation by your fellow investors, or maybe you’ve seen it referenced in financial news articles. Would you want to learn how much money you could make and whether or not it was worth taking the risk by placing an options trade? If yes, then the credit spread is what you’re looking for!

If you are wondering what credit spread is, the simple answer is “a strategy used in options trading where the trader seeks to profit from a decline in the price of the underlying asset.” But there’s more to it than that! That’s why we have got Ezekiel Chew to share his take on credit spread. He is the founder and CEO of Asia Forex Mentor, one of Asia’s largest options trading firms. He is a highly sought-after speaker and trainer and has been known for his ability to make complicated concepts easy to understand.

In this guide, we will discuss credit spread basics, its movements, risks, and much more. So without further ado, let’s get started!

What is Credit Spread?

A credit spread is an options trading strategy that involves buying and selling two options contracts with different strike prices but with the same expiration date. The options bought are typically out-of-the-money while the options sold are at-the-money or in-the-money. The name “credit spread” comes from the fact that you collect a credit when entering the trade.

The purpose of a credit spread is to profit from a decline in the underlying asset’s price. If the stock drops significantly, the value of the options sold will decline more than the value bought options, and you will keep the difference as profit. On the other hand, If the stock rises significantly, you will incur a loss.

For example, let’s say you expect the stock price of ABC Company to fall in the next month. You could enter a credit spread by buying a put option with a strike price of $50 and selling a put option with a strike price of $55. If the stock price falls to $49 at expiration, the put option you bought will increase in value to $1, while the put option you sold will decline to $0. The result is a net credit of $1 per share or $100 for the entire trade.

Understanding Credit Spreads (Bonds and Options)

A credit spread is the simultaneous purchase of one security and sale of another security, usually with different maturities, for a net credit. The credit is the difference between the sale proceeds and the purchase price.

Bond Credit Spread

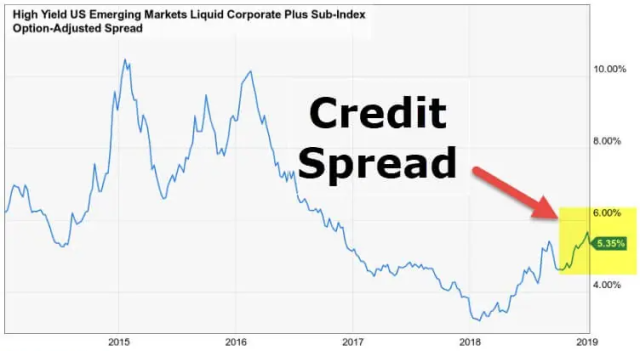

The spread is between bonds with similar maturities but different credit ratings. One of the most common types of a credit spread is the bond yield spread, which is the difference in yield between two bonds.

In the United States, there are two main types of corporate bonds i-e treasury bond yield and corporate bond. Treasury bonds have a low likelihood of default as opposed to corporate bonds. This is because the government guarantees them. However, corporate bonds are quite risky as independent corporations back them.

On the other hand, corporate bond spreads are still a good investment as it offers higher yields than a Treasury bond. You can buy corporate, and treasury bond credit spreads to diversify your portfolio and reduce risk.

Suppose the government bond with a ten-year maturity sells for 5.5 percent, and the corporate bond with a ten-year maturity sells for 8.5 percent. The two bonds have the same maturity but varying credit quality. If an investor puts his credit spread in both of these issues, it would be 3%. The 5.5% difference between the two bonds would be subtracted from the 8.5% price premium offered on the corporate bond compared to a 10-year government bond.

Credit Spread Options Strategy

In the context of options strategy, a credit spread (vertical spread) is a simultaneous purchase and sale of two different options with the same expiration but varying strike prices. It’s also known as a net credit spread. It’s a type of options trading technique in which the trader receives more money than they paid for, hence the name “net credit.” The credit spreads strategy aids investors in reducing their risk while maximizing their profit on put and call trades.

As a trader, you can use this strategy to calculate the amount of money you can put at risk when opening a new position. There are two types of options trading, i-e, credit call spread, and credit pull spread.

Credit Call Spread

A credit call spread is a bullish spread. Because you anticipate the same underlying security to appreciate, you sell an uncovered put option as part of this spread.

Credit call spread necessitates purchasing a premium at a higher strike price while selling a premium at a lower strike price. This way, you profit from the sale of the uncovered option while you wait for it to expire.

This strategy is risky as you can lose all your money before the options expire. However, if the stock price of the underlying security increases as you anticipated, your profit potential is unlimited.

Credit Put Spread

A credit put spread is a bearish strategy as you anticipate the underlying security and sell an uncovered call option as a part of this spread. The premium received from the sold option is greater than the premium paid for the purchased option, just like a credit call option. However, if the option doesn’t expire and you exit the position, you will still make money, but not as much as if it had expired.

This credit put spreads strategy is less risky as the maximum loss is limited to the difference between strike prices minus the net credit. However, if the stock price of the underlying security decreases as you anticipated, your profit potential is limited.

Both bond and options credit spreads are used to reduce risk while trading. As a result, investors use these strategies to make a profit while minimizing their risk.

Credit Spread Risks

Like any other investment, credit spreads come with risks that you should be aware of. The biggest risk is that the underlying asset’s price will move opposite your prediction. For example, if you are trading a credit spread to benefit from a decline in an asset’s price, you must be prepared for it to rise instead. At the same time, if you are trading a credit spread with the expectation of an upward movement, you must be prepared for it to fall instead.

Another risk with credit spreads is that their payout profiles have non-linear results compared to their linear forecasts. This means that even if the underlying asset’s price moves within your forecast range, there is a chance that the payout will be lower or higher than what you would have expected. Therefore, you must also be prepared for scenarios where you will lose your investment even though the prediction was correct.

A final risk to consider is that options are quite expensive, so the cost of entering into a credit spread can be quite high. This means that it may take a few months or even years before you can recoup your initial investment. Therefore, as a trader, you must be patient and have a long-term investment strategy to succeed. Moreover, you must be able to limit risk significantly.

Despite the risks, credit spreads can be a great way to make money despite the risks if you can correctly predict the underlying asset’s price movement. If you are new to trading, it is important to learn about all the different risks before you begin. This will help you make informed decisions and minimize your losses.

The Best Stock and Forex Trading Course

Bankers, hedge fund managers, prop traders, and others have all learned from Ezekiel Chew how to make money by trading forex, stocks, indices, commodities (including gold, silver, and cryptocurrencies), and everything else that can be traded.

In a short time, his course will reveal how to earn more money in a month than most individuals do in a year. His course will demonstrate how you may achieve the same financial success that his proprietary approach has brought him and many students. On the same day you sign up, you will have the option of making a real money deposit into your account.

His approach to teaching is built on the principle of return on investment, where you invest $1 and get $3 back. It’s not about gimmicky tactics or spectacular methods. He has a trustworthy system that banks and experienced traders employ.

He is responsible for many banks’ achievements, notably DBP, the second-largest state-owned bank in the Philippines with more than $13 billion in assets. His course is simple enough for seven and eight-year-olds to understand. If they can understand it at such a young age, anyone can learn this technique if they put in the time and effort.

This strategy is so helpful that it has produced many full-time traders who were new to trading when they entered the program. Visit Asia Forex Mentor to learn more.

Featured Investing Broker of 2024

Conclusion: Credit Spread

Now that you know what a credit spread is and how it works, you can begin to trade them yourself. Just remember to take the time to learn about the risks before entering any trades. Also, you can use credit spreads to hedge your portfolio against market movements you are not expecting. By doing so, you can protect yourself from unforeseen losses and maximize your potential profits.

Start trading credit spreads today and see how they can help you achieve your financial goals. You can make a lot of money from the Forex market with the right strategy.

Credit Spread FAQs

Is credit spreads profitable?

Yes, credit spreads can be profitable if you correctly predict the underlying asset’s price movement. Also, its goal is to allow for the maximum profit in the short and long positions. However, risks are involved, so you should only trade credit spreads if you are comfortable with the risks.

Are Government Bonds risk-free?

No, government bonds are not risk-free investments. There is always the possibility that the issuing government will default on its corporate debt obligations or may also undergo a financial crisis. However, you can buy a government bond because of its stability and low-risk factor.