Without a doubt, Interactive Brokers are the institutional investors that promote commission-free trading while providing the most accessible brokerage services for decades. This sophisticated publicly-traded company has got the top rankings for the best online brokers for stock and ETF. However, some people find it a little intimidating initially, but when they get used to the web options and other mobile features, the interactive brokers stands become excellent.

Besides this, Interactive Brokers have one of the most effective market offerings available till now. This ideal stock trading app will help diversify foreign stocks and investment portfolios on exchange commission with inactivity fees.

The interactive brokers will allow you to invest in different stock shares such as bitcoin cash, stock and ETF, and many other international exchanges when we talk about investment portfolios. Isn't the margin rates a significant advantage? YES!

Anyone can invest fractional shares that help them meet the trading objectives conveniently with diversified portfolios, whether it's a beginner or advanced trader. Before making any assumptions, let us take you deeper into the details of what interactive brokers offer!

What Is Interactive Brokers?

Interactive brokers is an exclusive U.S-based trading platform , maintained by financial industry regulatory authority, including the United Kingdom's financial authority and a part of NYSE FINRA SIPC.

Moreover, the United States exchange and securities commission, Hong Kong futures and securities commission, commodity futures trading commission are also a part of these free trading platforms.

One of the ideal, the Interactive Brokers trading platforms was founded in 1993. Interactive Brokers has an aerodynamic reach to compensation service that centers on low costs, superior trade execution, and broad market access.

The IBKR lite customers are available to trade forex, options, stocks, bonds, funds, and options on up to 135 markets, not more than one trade accounts. for the convenience of the customers to easily evaluate assets among the socially responsible investing lens

Interactive brokers offers the customers global as well as US-based trading. The two plans that the company thought about are IBKR Pro and IBKR Lite.

The IBKR Lite does not offer any trading fees or commissions. For all the experienced active traders who need a wide variety of investments, interactive brokers are the best choice making them the best online broker.

How does Interactive Brokers app work?

Do you know what these online brokers offer? It has significant trade value, exchange, and regulatory fees within the global markets. The interactive brokers offer the following factors. Described below:

Interest on cash

Like all the online brokers, IBKR also produces interest earnings with the difference between what it earns on the customer's cash backs and what it pays on their idle cash.

Furthermore, in April 2021, the clients of IBKR do not earn interest on cash backs, whereas other few brokers often pass part of incomes that are on customers.

Payment for order pass

The company also offers market research. Like most, the brokers produce income when they accept payment from the market makers to direct orders to the trade venues. That is known as the payment for the order flow.

According to the interactive brokers, the most recent date is 12 December 2019, on which the IBKR got an average per share in the payment for order pass in the United States exchange is 0.016 dollars. While on per contract, the IBKR earned an average of 0.3612 dollars.

Stock loan programs

When the stocks held in the client's account are lent to other hedge funds or traders, the stock loan program produces revenue for interactive trading brokers.

From all the loan shares, the company provides 50% of the total income that it receives to the client. A mobile app is available for the customers who are approved for cash account or margin account with 50000 dollars. The trading interactive brokers offers exclusive benefits.

Price improvement

The IBKR attains almost 0.47 dollars as an average per 100 shares that are traded, and price improvement is attained by smart order router.

Portfolio margining

The overall risk calculated may be within lower margin rates with the help of the customers who are eligible for applying portfolio margining. The clients who trade imitative offset the risk, and it works ideally for clients in their equity positions. However, Eligible IBKR traders and customers can utilize portfolio margining.

It's all about how the interactive brokers work to provide traders a beneficial online platform with the right investment advice and exchange and regulatory fees depending on the trading values.

What are the Features of Interactive Brokers app?

Here are the exclusive features ensured by interactive brokers!

Security and Reliability

The interactive brokers are proficient enough to exceed security values within the global markets. It includes:

- The mobile app feature fully secured characteristics as you can only log in with fingerprint or biometric recognition.

- The client portal includes two-factor authentication.

- The interactive brokers LLC protects the client security accounts through Securities Investor Protection Corporation incorporating a cash limit of $500,000

- The interactive broker's sweep program allows the clients to effectively promote $250,000 SIPC of FDIC insurance on different cash balances.

- Moreover, the company had significant European systems problems that led to outages and long-in issues for almost 90 minutes on Trader Workstation. The whole mobile app was down at that time.

- Do you know the service claims automatically and files a claim against securities resulting within the interactive brokers? Whenever it occurs, the service claims the administrators to seek funds recovery on compensation through IBKR mobile services. If they feature any recovered amounts, you will get the amount in the account with a 20% contingency fee.

Customer Service

Interactive brokers offer excellent customer service through the mobile app and improve their overall reputation when talking about customer service. The IBot service works with an artificial intelligence engine that answers all exclusive questions asked in English.

IBot is available on the overall website and aids in finding answers without requiring the users to wait for extended times.

You will get Toll-free and reliable support 24 hours a day within six days a week. Moreover, the callback service will help you call back mainly when you don't want to lose the place within the line.

It also includes an online chat you will get within the website and platform. Do you know it also contains secure message centers? YES! You heard that right. The IBot directs within the client portal to provide AI-powered resources.

Portfolio Analysis

Undoubtedly, the Portfolio Analyst is beneficial to track, analyze and let you complete the performance reliably through such trading platforms.

The fees interactive brokers you can effortlessly connect the savings, checking, corporate political spending, incentive plan, investments, and other credit card options to aid you in getting an overall financial situation view when planning the future.

The plus point is that it's a free tool for everyone to use. Still, the clients will only get access to the advanced features offered by PortfolioAnalyst while including the overall portfolio updates. Isn't it great? All the power calculations, balances fully feature real-time options and help you calculate the internal return rate.

What's more? The interactive brokers include a Tax Optimizer tool so you can set a default and versatile method to aid you in overriding certain symbols whenever desired.

If you want to maximize the options and tax efficiency, the optimizer provides a complete overview of P and L for each matching technique.

The interactive brokers offers traders a journal feature that helps you save different trading notes and record the ideas.

It also saves screenshots as a note or links the notes to specific trades while configuring both executed trades and other orders. It is one of the comprehensive options in traders academy with efficiency from interactive brokers.

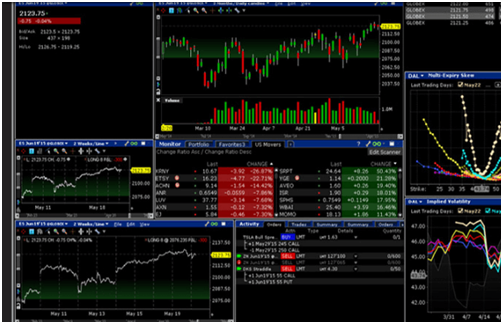

Trading Technology

Here we thoroughly explained the advertiser disclosure interactive brokers review. It includes SmartRouting technology with sequential order and spray methodologies designed to work on particular market and order situations.

The third-party service provider analysis illustrates that interactive brokers include a U.S. dollar price improvement measuring $0.62 for almost 100 shares better than the trading industry.

Moreover, the interactive brokers full-order working engine that reroutes the order part within the options strategy lab to optimize price improvement and execution while maximizing potential rebates.

With various trading tools on block orders and significant volume that helps you benefit from institutional order flow, interactive brokers include eight dark pools. SmartRouting is great for active traders, and shows spread orders independently by ensuring the best possible venue.

How much are Interactive Brokers Commissions and Fees?

| 1 | 2 |

|---|---|

| Stocks and EFTs | $0 for IBKR Lite Accounts |

| Mutual Funds | Access to thousands of no-fee mutual funds. Other funds $14.95 per trade or 3% of your purchase volume. Learn more about its no-load mutual fund marketplace. |

| Options | $0.15 to $0.65 per contract depending on your trading volume |

| Forex | 0.08 to 0.20 base points plus trade value depending on your regular trading volume. Interactive Brokers doesn't markup its spread. |

| Futures | $0.15 to $0.85 depending on the asset you're buying, plus clearing and regulatory fees. |

| Bonds | Corporate, Municipal, Treasury bonds and CDs available. Fees range from 0.0125% to 0.01% of the face value of the security. |

| Account Minimum | $0 for all accounts |

You will find the pricing scheme for interactive brokers a bit complicated. That's because it includes three different types of commissions named fixed, tiered, and lite programs. Firstly, let's talk about stocks and ETFs. It costs $0 for IBKR lite accounts and ranges from $0.005 to $0.0035 per share for at least 300,000 shares per month or a minimum of $0.35 per trade.

Moreover, depending on the trade volume, the commissions are $0.15 to $0.65 per contract. When trading 15 contracts, it will cost 32.50. Mutual funds are lessening than 3% of total trade value costing $14.95 for funds. When we talk about the future trades, it costs $0.85 per contract with additional regulatory and exchange fees.

What's more? Let's consider Forex trading! They will cost an introductory price between 0.20 and 0.08 basis points. That's because all this depends on the trade volume. And you know what? Interactive Brokers will not markup the spread. The bonds are different, and the fee ranges differently, with a minimum account fee of $0 for all the accounts. That's how the costing works!

Who are Interactive Brokers Best For?

Let us tell you something exciting! People desire of getting the latest and advanced trading platform with extended asset classes and different trading costs and exchanges that result in interactive brokers as the best-in-class platform to find interactive brokers,

The interactive broker attempts to widen the appeal by creating new services and products aimed at less active investors. For instance, foreign exchanges work as a professional-level platform to promote less-experienced investors. The trader workstation is proficient enough to accept customers from almost 220 countries that support 135 markets using 23 currencies.

Interactive brokers maintain a fully extensive lineup for trading products such as funds, bonds, futures on different marketplaces within a limited time.

In addition to this, it offers perfect access to different marketplaces, global exchanges and maintains a massive inventory of income, including Euro-denominated government and other corporate bonds.

The SmartRouting software claims to give customers the ideal price with IBKR mobile app options and excellent combination prices with firm stock whenever you place an order and immediately seek to execute the order. The IBKR comes with a net improvement price of effectiveness and mutual funds. It is perfect for people who desire:

- Advanced traders and beginners

- Option trading

- Data and research

- Reliable investors

- Margin accounts.

Interactive Brokers Pros and Cons

The interactive brokers include multiple trading platforms, web, mobile options, desktop versions available on iOS and Android devices. The app works with the same functionality as other web platforms.

Pros

- Low fees and commissions

- Impressive platform stacked with multiple features

- Incredibly decent and effective trade execution

- A broad range of investment features and offerings

Cons

- The platform is a bit intimidating, mainly for beginners

- It utilizes highly daunting tiered pricing plans

Interactive Brokers User Experience

Despite being an online option, interactive brokers work perfectly for beginners and professional investors by offering a plethora of services and features to meet their demands and requirements. Sounds impressive, right?

Moreover, the platform effectively provides access to different tradable assets and markets ranging from commission-free ETFs and multiple stocks to crypto features and forex trading. The plus point is that it's an effortless process to open an account. It will only take a few minutes to complete the process online. You will get a paper trading account within 24 hours after finishing the application.

Besides this, it helps you create a trader portfolio by penny stocks and different shares, allowing you to invest in multiple stock shares designed on the entire exchanges. That's a significantly valuable advantage to the trader, isn't it? Furthermore, paper trading is another helpful feature that allows investors to practice all their strategies peacefully and securely.

What's more? You can effectively generate the paper trading feature after opening and depositing funds in the interactive broker's account. And you know what? Once you get access to a demo account with this trading platform, you can begin with at least $1 million of paper trading to sell and buy assets in a risk-free environment that meets the market requirements.

Interactive Brokers vs Competitors

Here we will compare interactive brokers with the three most common competitors in the market. The following are the common comparisons you must know about:

Interactive Brokers vs. DEGIRO

Let's compare the interactive brokers with DEGIRO. Have you ever heard about DEGIRO? Consider it this way! Interactive Brokers is far more effective than DEGIRO because it provides more brilliant services and tools with multiple capabilities to professional traders.

It ensures a diverse and innovative selection, It also provides increased access to trading tools, bonds, stocks, ETFs, and much more, and has effective research than DEGIRO, with unlimited possibilities such as articles, exclusive reports, and much more.

For instance, if we talk about professional traders, Interactive brokers are more effective in offering cheaper foreign exchange services, mainly for swiss investors. Therefore, both options are different in their specific characteristics designed to provide additional trading services.

Interactive Brokers vs. TD Ameritrade

Here's something you need to know about Interactive Brokers and TD Ameritrade. Both platforms are fully-serviced and known for decades as the larges ones within the global market. However, Interactive Brokers offers low-cost, brilliant trading options and tools with superb trade execution and assets, whereas TD Ameritrade comes with an AI-powered experience developed by Charles Schwab.

Interactive brokers include a more powerful TWS with a technologically updated platform designed to enhance fractional shares and margin rates than TD Ameritrade. Moreover, the diversified portfolio and mutual fund feature in interactive brokers will enhance the overall user experience. In contrast, TD Ameritrade includes a trade bar on the bottom screen to use options effortlessly.

Interactive brokers offers extensive brokerage services within a limited range. However, TD Ameritrade doesn't include any fractional share trading compared to IBKR. Another plus point is that the Interactive Brokers introduced effective cryptocurrency coins within the tradable assets rather than only Bitcoin futures as in TD Ameritrade.

Conclusion: Is Interactive Brokers a Good App for investors and traders?

Overall, it's a thumb up for interactive brokers. Whether beginners are advanced traders who desire online trading, they found Interactive brokers the best bang for their buck with a broad range of assets and low commission services. Besides this, social trading is also a valuable aspect allowing users to interact with multiple traders to invest reliably through mutual fund features.

When we talk about the account types, interactive brokers keep things simple with specific savings and checking accounts while offering users a risk-free trading and simple environment. Have you got that? Well, if you desire to get a hands-off trading adventure, the interactive broker is an excellent tool designed to work perfectly.

Interactive brokers with commissions and fees are fully competitive, providing users an effective margin trading rates within the online broker space. The option also ensures a comprehensive menu for investment options while covering each asset class ensuring access to different international markets throughout 33 countries.

What's more? The interactive brokers offer attractive benefits to occasional traders and benefits. It provides multiple features to offer an approachable platform for people who needs commission-free trades within the US. Moreover, the mutual funds, US-based stocks exchange, and many simplified features, including exchange-traded funds, are also included in web and mobile platforms as explained in the verdict interactive brokers.

Interactive Brokers FAQs

Is my money safe with Interactive Brokers?

The foremost thing active traders consider is whether the trading platform is safe or not. The Interactive Brokers LLC works to protect customer securities through the Securities Investor Protection Corporation for a maximum deposit of $500,000.

Interactive brokers have excellent policies with specific features subject to a complete aggregate limit measuring $150 million. Besides this, the security options and coverage promotes high-end protection against broker-dealer and different market value losses regarding securities.

Is Mutual Funds a good investment?

Do you know this trader workstation has the most significant mutual funds investment advice available? YES! The mutual fund's marketplace with American Funds, PIMCO, Franklin Templeton, Allianz, and Fidelity. The plus point is that it has an entirely neutral marketplace with no interest conflict as this trader workstation offers mutual funds and not proprietary funds.

The range of offerings interactive brokers include are highly versatile and are available to people globally with more than $7,700, including no transaction fees. You can use 170 different variables with different mutual funds scanners available exclusively in Advanced Scanners while providing competent investment advice.

Is Interactive Brokers trading platform legitimate?

Have you accessed the interactive broker's review? It's one of the most professional and sophisticated active trading accounts where active investors take advantage of robust, powerful tools and total trade value to a broad range of assets. The professional traders include brilliant investment advice within the client portal to provide multiple benefits.

The interactive brokers offer high scores in trading with low-cost categories. Moreover, it has a diversified portfolio containing futures, bonds, and other stock options. When you get an interactive brokers account, it comes with an effective investment strategy for international trading and margin trading. It is a versatile option with a high-grade fundamental and completely technical client portal platform.